Chart of The Day – AUD/USD

October data from the Australian labour market turned out to be much stronger than expected, with the unemployment rate falling to 4.3% against a forecast of 4.4%. Even more impressive is the increase in jobs – 42,200 new positions, twice as many as the average forecast. The Reserve Bank of Australia would like to see fatigue in the labour market, which would justify interest rate cuts. Instead, it is getting a report that says one thing: the labour market is still hot, and the economy has less room for manoeuvre than we would like.

The structure of employment growth reveals a certain asymmetry – the entire increase comes from full-time jobs (+55,300), while temporary positions fell by 13,100. This suggests that employers are still investing in permanent staff, which in normal times would be a positive sign. However, in the context of monetary policy easing, this means that wage pressure may persist for longer. The labour force participation rate remained stable at 67%, and unemployment in the full sense fell to 5.7%.

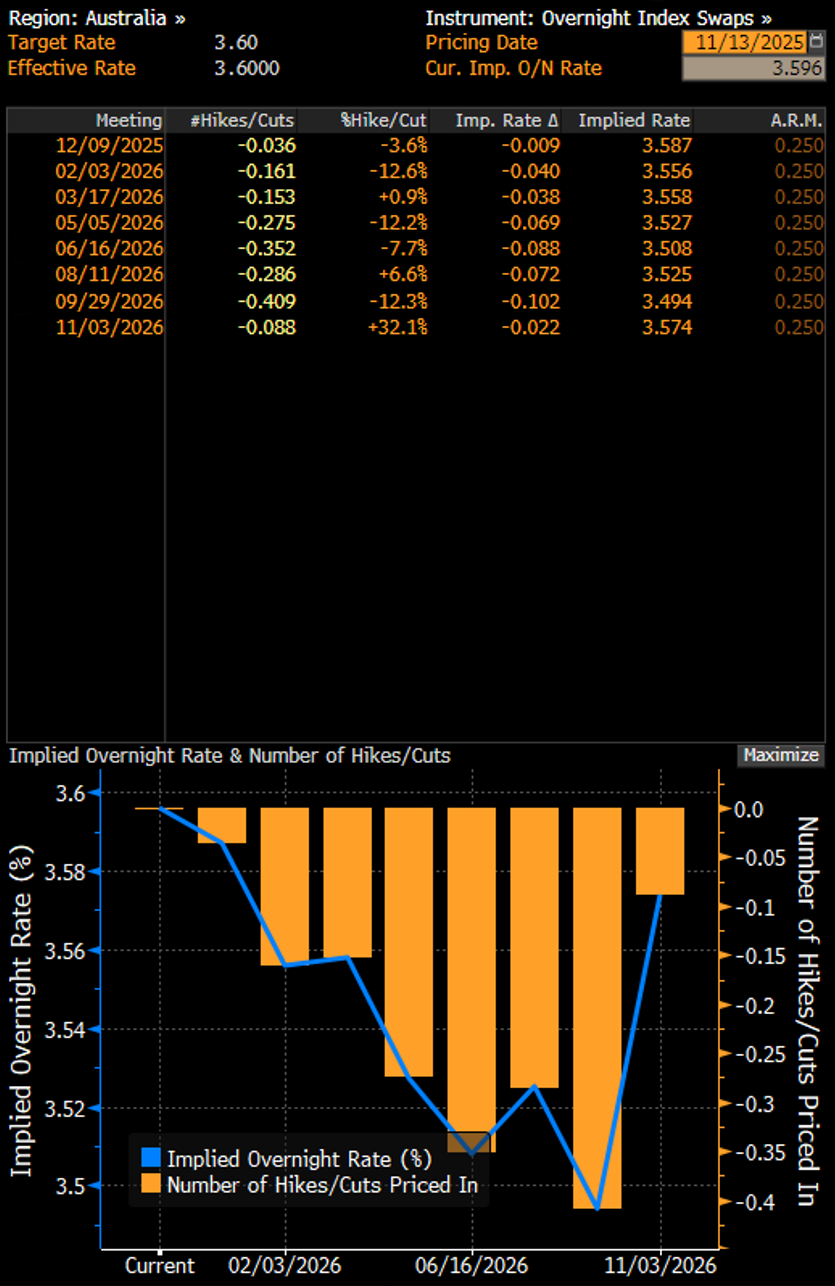

The implications for monetary policy are clear – investors have virtually closed the door on further rate cuts this year and, to a large extent, next year. The Australian dollar has accelerated and is currently trading at its highest levels against the US dollar since the end of October. The AUD/GBP pair is thus clearly breaking above the 50- and 100-day exponential moving averages, indicating an uptrend in the instrument. However, it is worth remembering that the dollar is losing significantly against almost all currencies today, so it cannot be unanimously concluded that the current movements are solely due to labour market issues. Source: Bloomberg Financial Lp

Source: xStation

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.