The last session of the week brings a deepening of declines on the European market. Recent comments from the FOMC in the USA have dashed market hopes for rate cuts in December, which is reverberating across global markets. The leaders of declines in Europe are Poland and Germany. DAX40 contracts are losing over 1%. Slightly less, but also down by about 0.7%, are the prices of SPA35, ITA40, and UK100 contracts. The French stock market is doing better, with CAC40 down by about 0.4%. Switzerland is on a slight positive at the halfway point of the session.

Source: Bloomberg Finance Lp

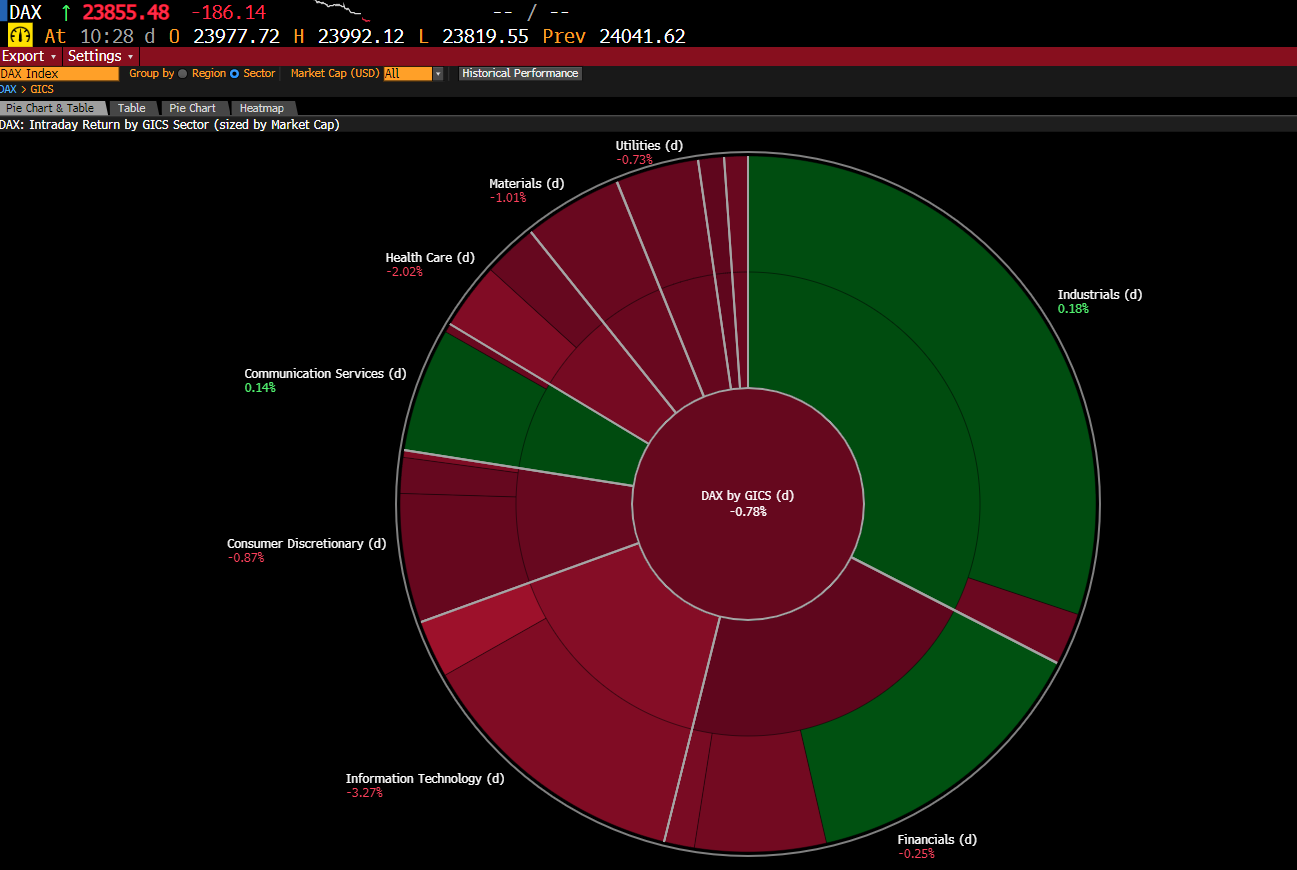

The market is under broad pressure. On the DAX index, the biggest declines are seen in technology and pharmaceutical companies. They are followed by retailers, services, and distributors. Industrial companies are currently on a slight positive.

Macroeconomic Data:

- The inflation reading from Spain still indicates a significant rise in prices. Prices increased monthly by 0.7%, and annual inflation rose to 3.1%.

- Economic growth from the European Union turned out to be slightly above expectations on an annual basis. Quarterly, the EU economy grew by 0.2%. The trade balance is also in an upward trend. After the session ends, ECB representative Philip Lane will speak on monetary policy.

- Outside Europe, the economic situation appears much weaker. China, one of Europe’s key trading partners, is experiencing weak industrial production growth, with its dynamics remaining in a downward trend.

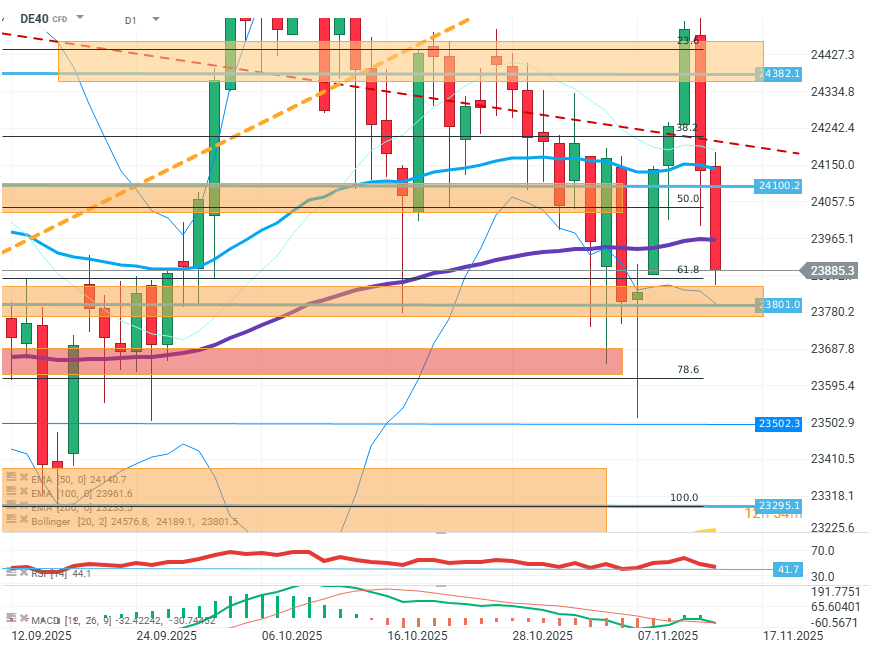

DE40 (D1)

Source: xStation5

The price extends yesterday’s declines and stops in the resistance zone around the FIBO 61.8 level of the last upward wave. The most important task for buyers will be to prevent the rate from exceeding 23,800 points to avoid deepening the correction. In case of failure, further declines may reach 23,500-23,300 where the next support zones are located. The base scenario is transitioning into consolidation and waiting for a price impulse in the 24,400-23,800 zone.

Company News:

- Siemens Energy (SIE.DE) – Part of the Siemens group responsible for power systems is rising by as much as 8% in today’s session. The increases are driven by excellent forecasts regarding wind turbines and demand from data centers.

- Bechtle (BC8.DE) — The German IT company published quarterly results that exceeded investor expectations regarding EBIT. The company’s valuation is rising by over 10%.

- Allianz (ALV.DE) – The financial group published very good results and also raised its year-end forecast. The company is up by over 1%.

- Richemont (CFR.CH) — The fashion company published very good results, including a 14% increase in quarterly sales. The company is up by as much as 6%.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.