Facts:

- Oil has already lost more than 22% YTD and 30% from its 2025 peak;

- Over the weekend, the US intercepted a Venezuelan oil tanker;

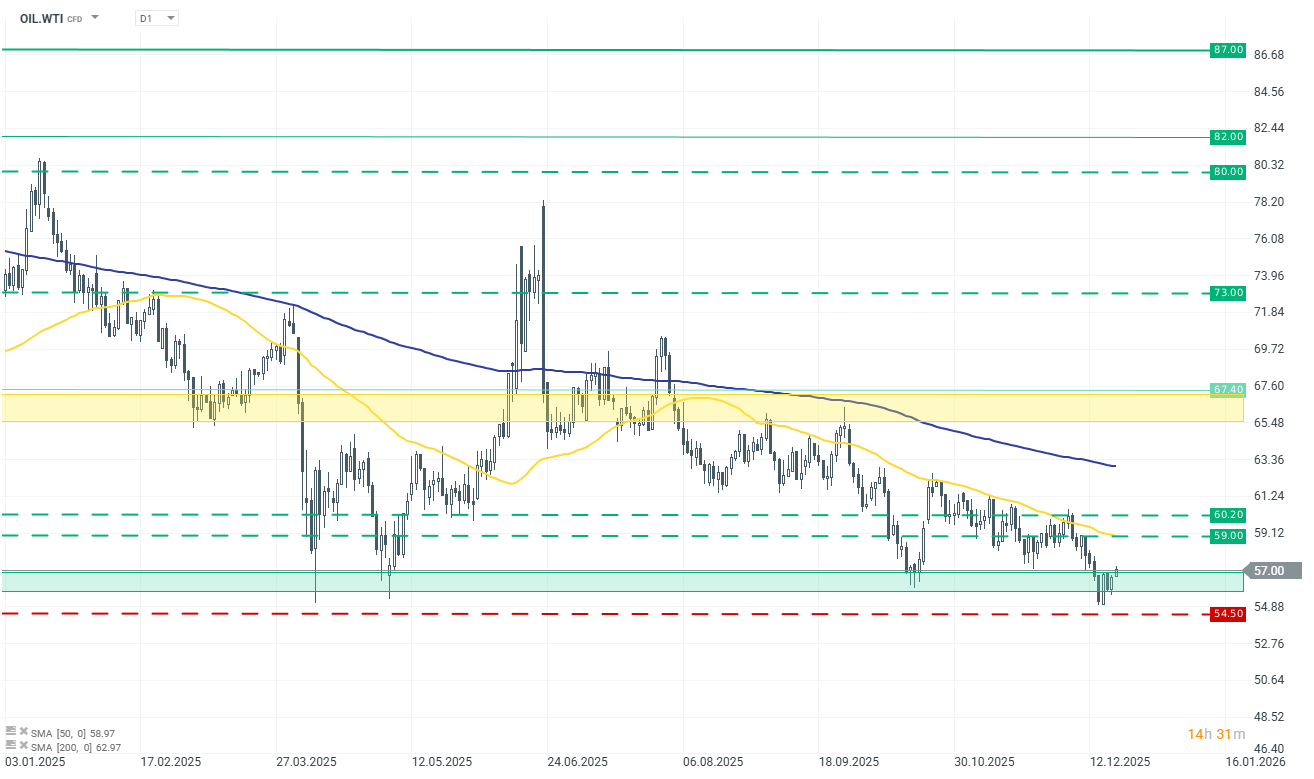

- OIL.WTI is defending key support in the 56–57 USD per barrel zone;

Recommendation:

Long position at market price

- TP1: 59.00 USD

- TP2: 60.20 USD

- SL: 54.50 USD

Opinion:

Tensions between the US and Venezuela are clearly escalating. The US Coast Guard has already intercepted two tankers and is pursuing another, accusing Caracas of using oil revenues to finance drug-related crime and operating a “dark fleet” designed to evade sanctions. Venezuela has responded with accusations of “theft and kidnapping” and plans to file a complaint with the UN. The dispute is intensifying at a time when the US is increasing its military presence in the Caribbean, conducting operations against alleged smugglers, and tightening sanctions on Maduro’s circle. Growing geopolitical tensions have begun to influence the oil market, which—after a steep selloff (WTI −21% YTD, −29% from the highs)—bounced off a major support zone.

Despite the short-term potential for a rebound from the strong technical support at 56–57 USD, the long-term outlook for the oil market remains neutral to bearish. Both the IEA and EIA forecast significant oversupply in 2026 — roughly 4 million and 2 million barrels per day respectively — which would mark the largest surplus in a decade. For this reason, geopolitical factors, while capable of generating short-lived upside moves, do not change the fundamental picture of excess supply.

Nevertheless, in the short term we expect a rebound in oil prices and therefore recommend taking a long position at market price. We additionally recommend setting a stop-loss order to minimise potential downside risk.