Bitcoin Sell-Off Extends While Ethereum Falls Below Inportant Support Level

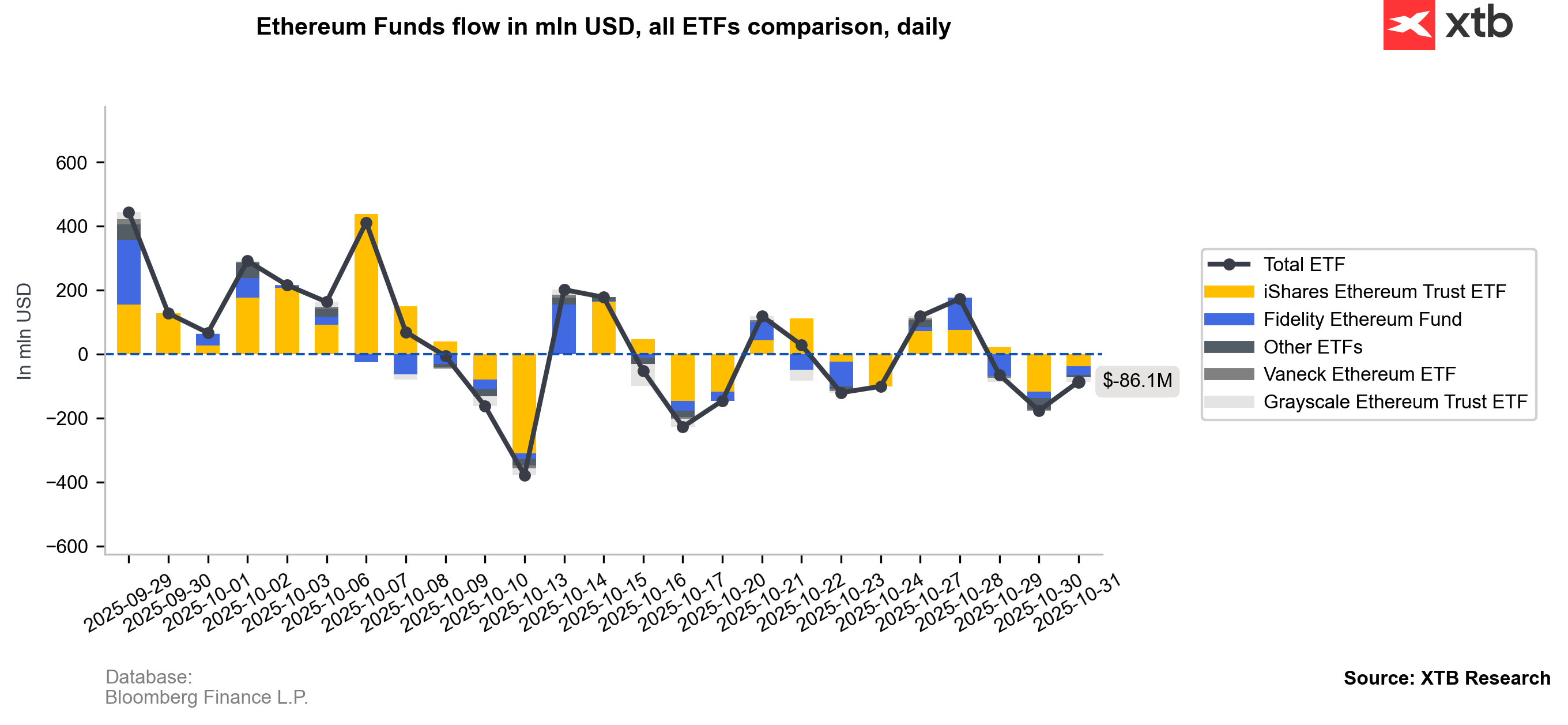

Cryptocurrencies remain largely dependent on stock market sentiment. According to Goldman Sachs data, the put-call skew in the Mag7 group (the seven largest tech companies) inverted for the first time since December 2024, meaning that the implied volatility of call options (betting on price increases) has exceeded that of puts (betting on declines). This phenomenon is rare and may signal that investors are potentially over-positioned for further equity market gains.However, weak technical conditions (also visible in Ethereum) and declining interest in U.S. spot ETF inflows are, to some extent, undermining the narrative of a strong autumn rally in the crypto market. As a result, the market may increasingly mirror the 2021 scenario, when the first half of November brought sharp declines in cryptocurrencies, triggering a bear market that lasted until around December 2022.

Bitcoin and Ethereum

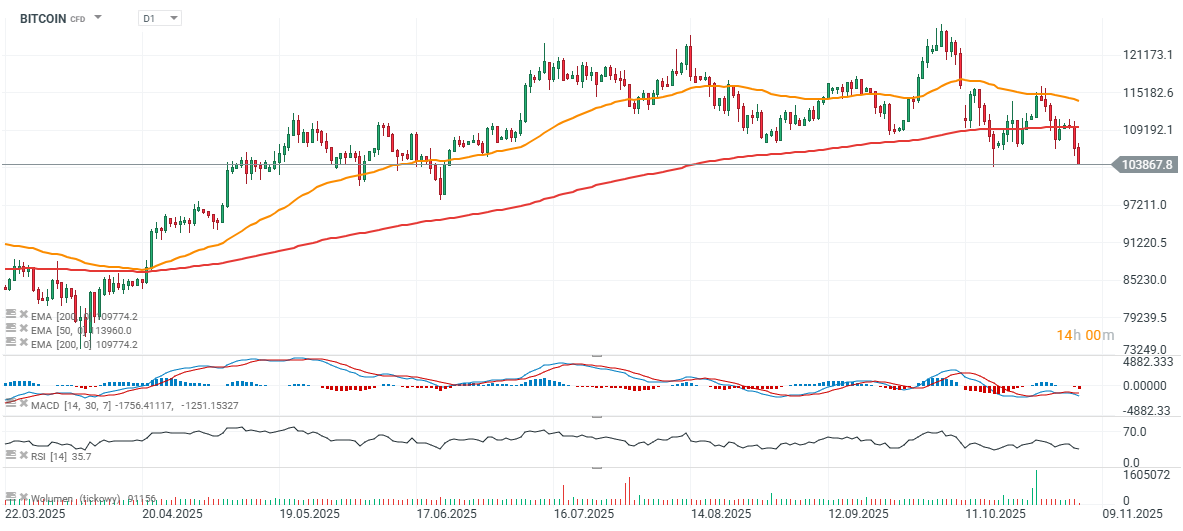

Bitcoin (BTC)

Key support levels for BTC remain the psychological $100,000 area and $94,000 (the retracement of this year’s entire advance). Should both levels be broken, we may cautiously assume that Bitcoin’s uptrend has ended. The current price is about 6% below the average cost basis for short-term holders, which indicates stress and potential loss realization within this group. Based on realized price metrics across all investor cohorts, a potential bear-market bottom would likely form in the $50,000–$55,000 range. Conversely, if Bitcoin finds solid support and resumes its rally, a breakout above $110,000 could open the way toward new all-time highs above $126,000.

Source: xStation5

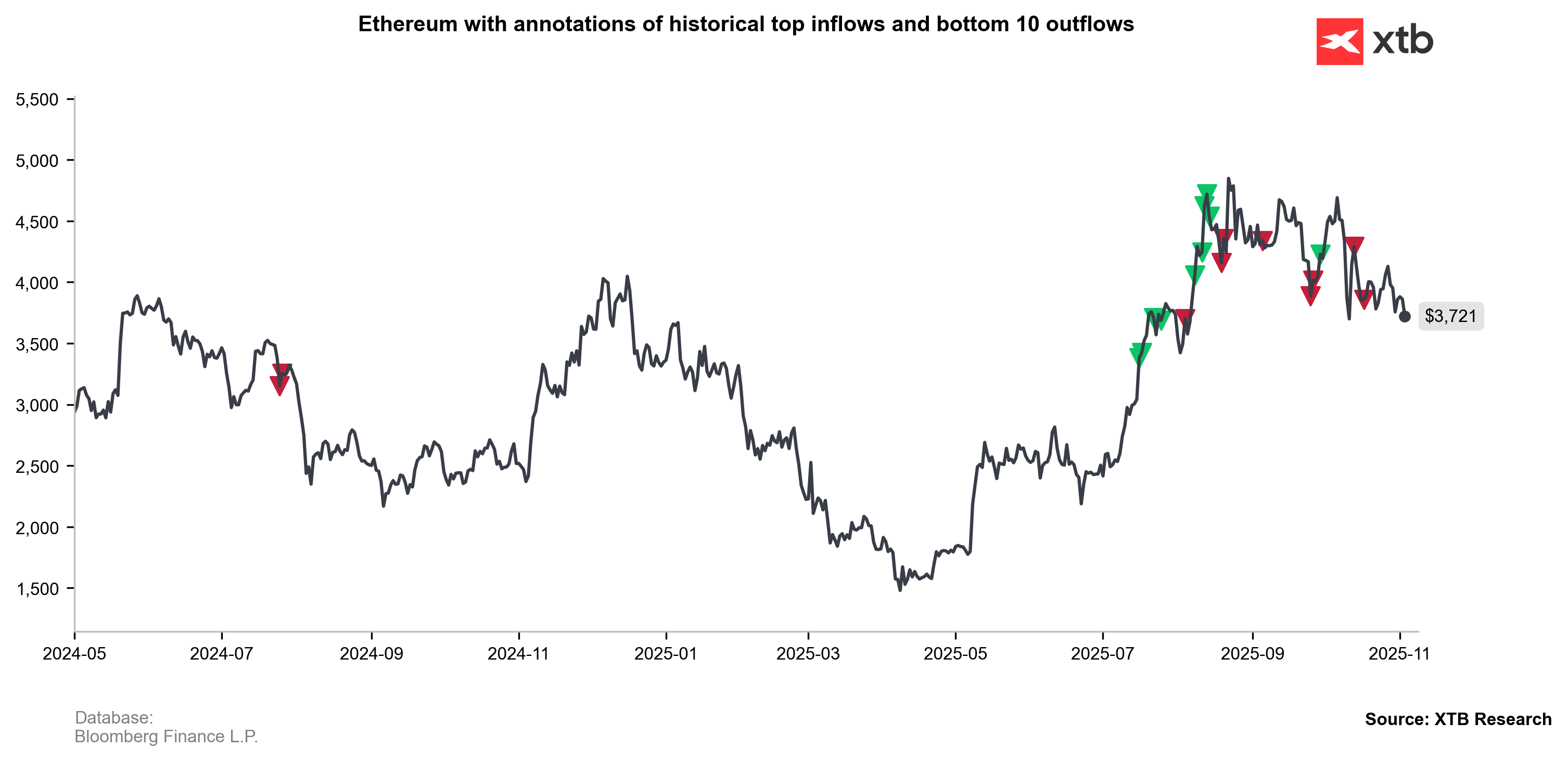

Ethereum (ETH)

Ethereum is currently under pressure, but based on historical price impulses, we can cautiously assume that market geometry supports at least a consolidation phase after the recent decline. Historically, however, drops below the 200-day EMA have almost always led to deeper sell-offs for ETH than the current one. To maintain a bullish trend, a quick rebound above $3,700 would be necessary. Otherwise, renewed pressure could push the price back toward $2,500, erasing this summer’s upward move.

Sources: xStation5

Source: xStation5

Bloomberg Finance L.P. , XTB Research

Bloomberg Finance L.P. , XTB Research

Source: Bloomberg Finane L.P. , XTB Research

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.