Chart of The Day – AUD/USD

AUDUSD continues its rally, adding another 0.3% amid broad dollar weakness and the newest GDP print for Australia. Data came in lower than expected, but it underlined constantly growing inflationary pressures, which reinforced market’s bets on hawkish RBA.

AUDUSD defended today the 50.0 Fibonacci level (around 0.656), currently approaching the test of the next resistance around 0.658-0.659, which coincides with 61.8 Fibonacci level. If the worries about further economic slowdown in China don’t outweigh the interest rate differentials, the pair should remain confidently above EMA100 (dark purple). Source: xStation5

What shapes AUDUSD today?

- Australia’s GDP grew 0.4% quarterly (2.1% y/y), led by strong private investment and household consumption. Public investment and government spending also supported growth. Offsetting factors included drawdowns in inventories and net trade, as imports rose faster than exports. Price pressures increased, driven by energy, rents, food, and labour costs. The reading came in lower than expected (Bloomberg consensus: 0.7% q/q), but the well pronounced inflationary development reaffirms market’s hawkish RBA expectations, with broad dollar weakness further contributing to the gains in the pair.

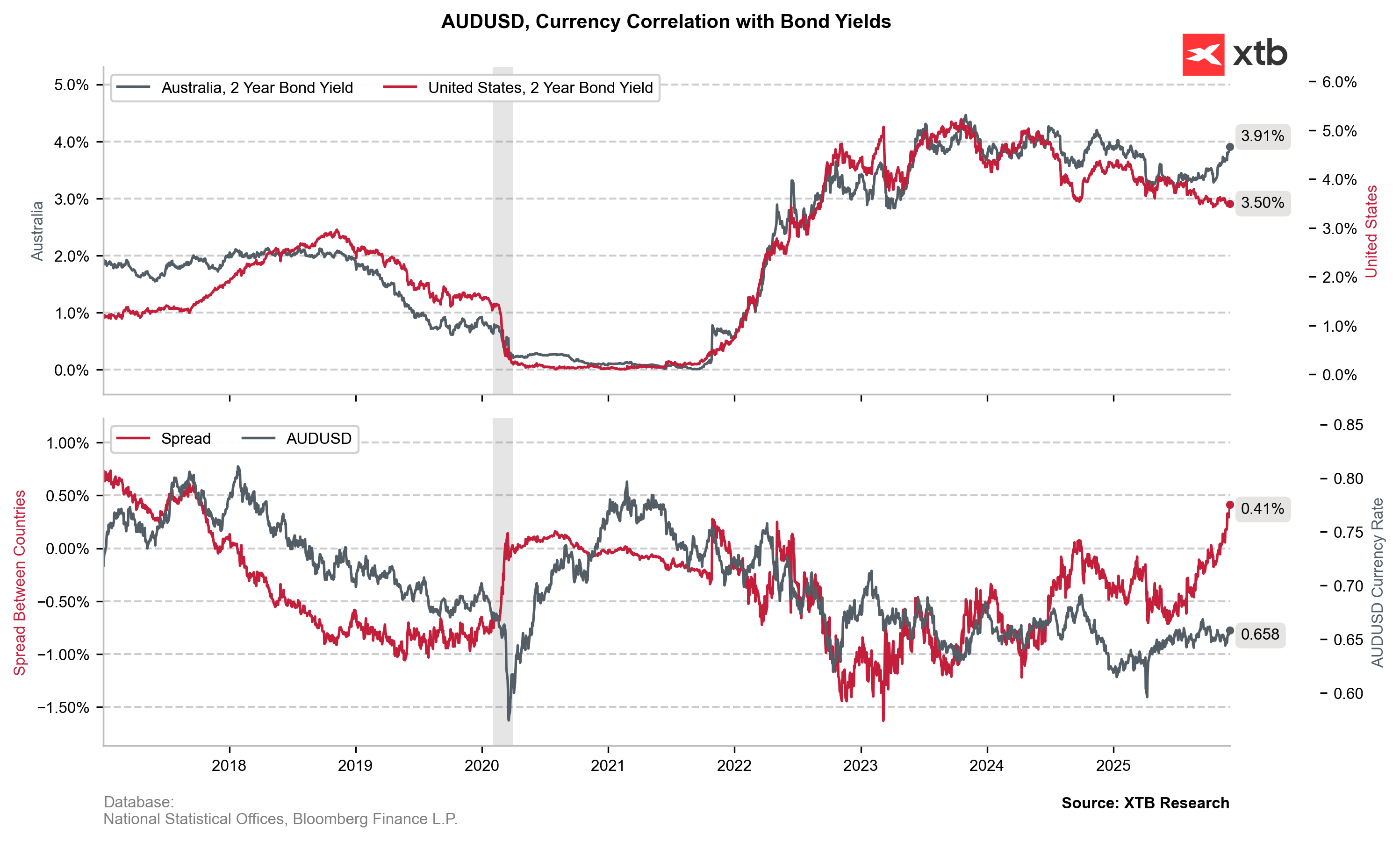

- The spread between 2-year Australian and US government bonds has reached its highest level since late 2017. The US monetary policy reflects both short-term expectations easing and a more dovish long-term outlook, driven by the anticipated succession of Jerome Powell by a Trump nominee, to be announced in early 2026. Overnight, President Trump referred to his chief economic adviser, Kevin Hassett, as a “potential Fed chair.” Markets view Hassett as one of the most pro-low-rate candidates on the unofficial shortlist, which is otherwise dominated by current or former Fed officials.

- AUD also got some additional support from higher than expected services PMI in China (52.1 vs 52 expected). The country’s services sector expanded in November, but growth slowed slightly (previously: 52,6). New orders and export demand improved, supported by easing Sino-US trade uncertainty, yet employment continued to contract and profit margins remained under pressure. Input costs rose for the ninth month, while firms’ future activity expectations weakened, highlighting ongoing challenges.

The spread between Australia and US 2-year bonds surged to its highest since late 2017 over last month. Source: XTB Research, Bloomberg Finance LP

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.