Oil

- Crude oil remains under pressure due to expectations of a significant supply surplus in 2026. This surplus is forecast to reach up to 4 million barrels per day (bpd) according to the International Energy Agency (IEA), while the Energy Information Administration (EIA) projects an average surplus of 2 million bpd.

- Although forecasts vary, this anticipated oversupply would mark the largest market surplus since the pandemic.

- The EIA recently raised its 2026 forecast for Brent crude to $55 per barrel, though this remains a very low level relative to current year prices. This implies a price of around $51.5 per barrel for WTI crude.

- The EIA has indicated it will update its core models for forecasting key fundamentals and prices in the oil market next year, representing the first major modification in 25 years. Initial changes are scheduled for the spring, with full implementation of new models expected by 2027.

- One factor that could weigh on prices in the short term is renewed speculation regarding a potential peace deal in Ukraine, which could lead to reduced restrictions on Russian oil exports.

- The latest reports suggest Ukraine may waive its aspirations for NATO membership in exchange for security guarantees equivalent to those offered by the United States.

- Furthermore, recent data from the Chinese economy showed industrial production growth falling to a 15-month low. Retail sales recorded their slowest growth since December 2022. The weakness in Chinese data undermines the rationale for continued large-scale oil purchases by Beijing in the coming months.

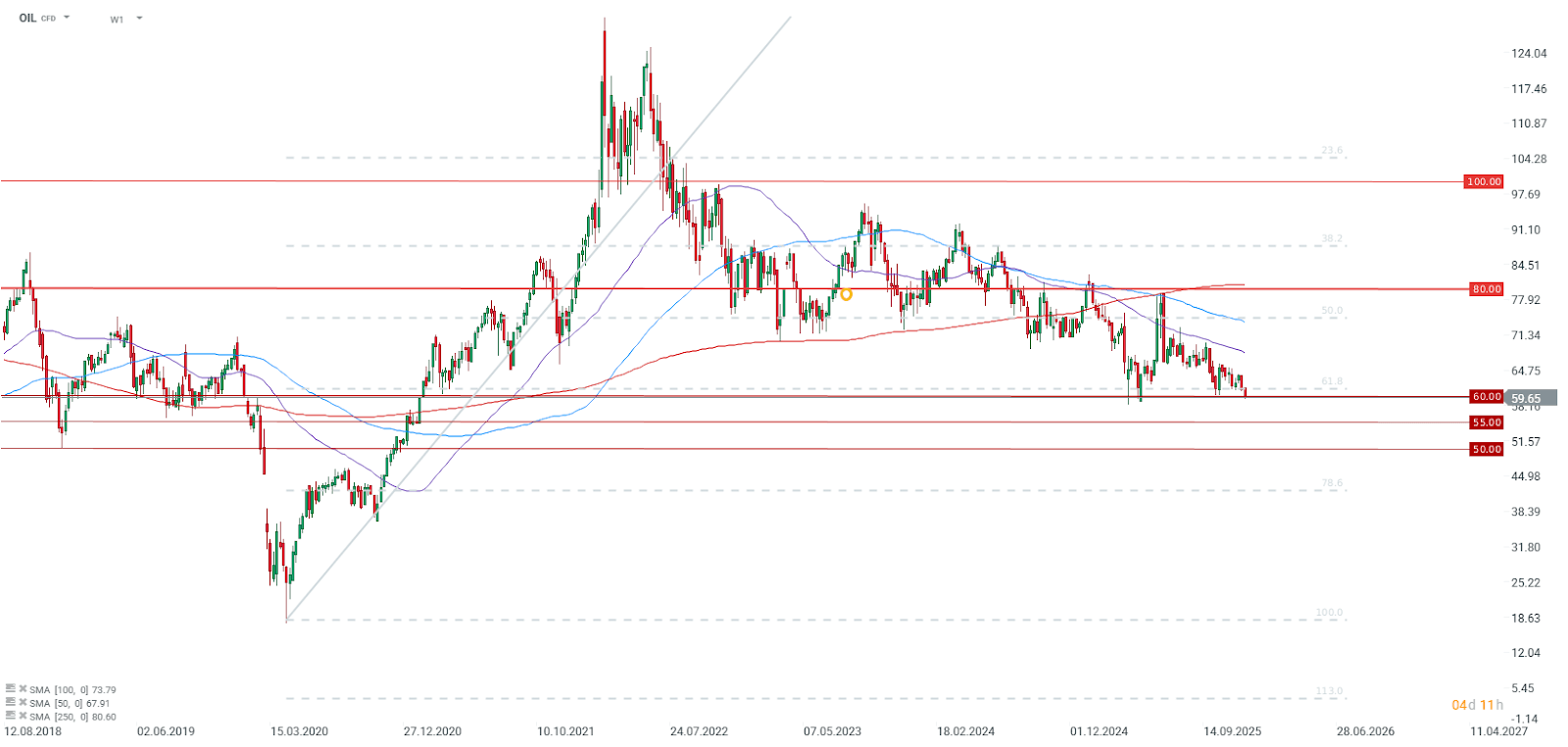

- In response to weak demand news and the potential for greater available supply, Brent crude has fallen below $60 per barrel for the first time since May.

Should peace talks regarding Ukraine genuinely move towards a ceasefire or a formal resolution, Brent crude could drop below $58 per barrel, reaching its lowest level since 2021. The next key support levels would then be $55 and $50 per barrel. Source: xStation5

Should peace talks regarding Ukraine genuinely move towards a ceasefire or a formal resolution, Brent crude could drop below $58 per barrel, reaching its lowest level since 2021. The next key support levels would then be $55 and $50 per barrel. Source: xStation5

Natural Gas

- Natural gas prices are distinctly reacting to changing perspectives on consumption for the second half of December, with the price now trading below $4 per MMBTU.

- The EIA projects an average price of $3.9 per MMBTU for the current winter and an average of $4.0 per MMBTU for 2026, which would represent a 16% increase over 2025 prices. The EIA cites greater heating demand throughout 2026 and slightly tighter fundamental conditions.

- Considering the roll yield of futures contracts, gas remains one of the worst-performing commodities in 2025.

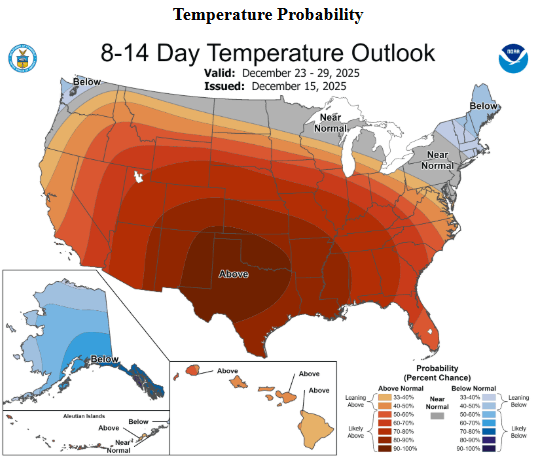

Temperatures in the second half of this month are expected to be significantly higher than normal. Source: NOAA

Temperatures in the second half of this month are expected to be significantly higher than normal. Source: NOAA

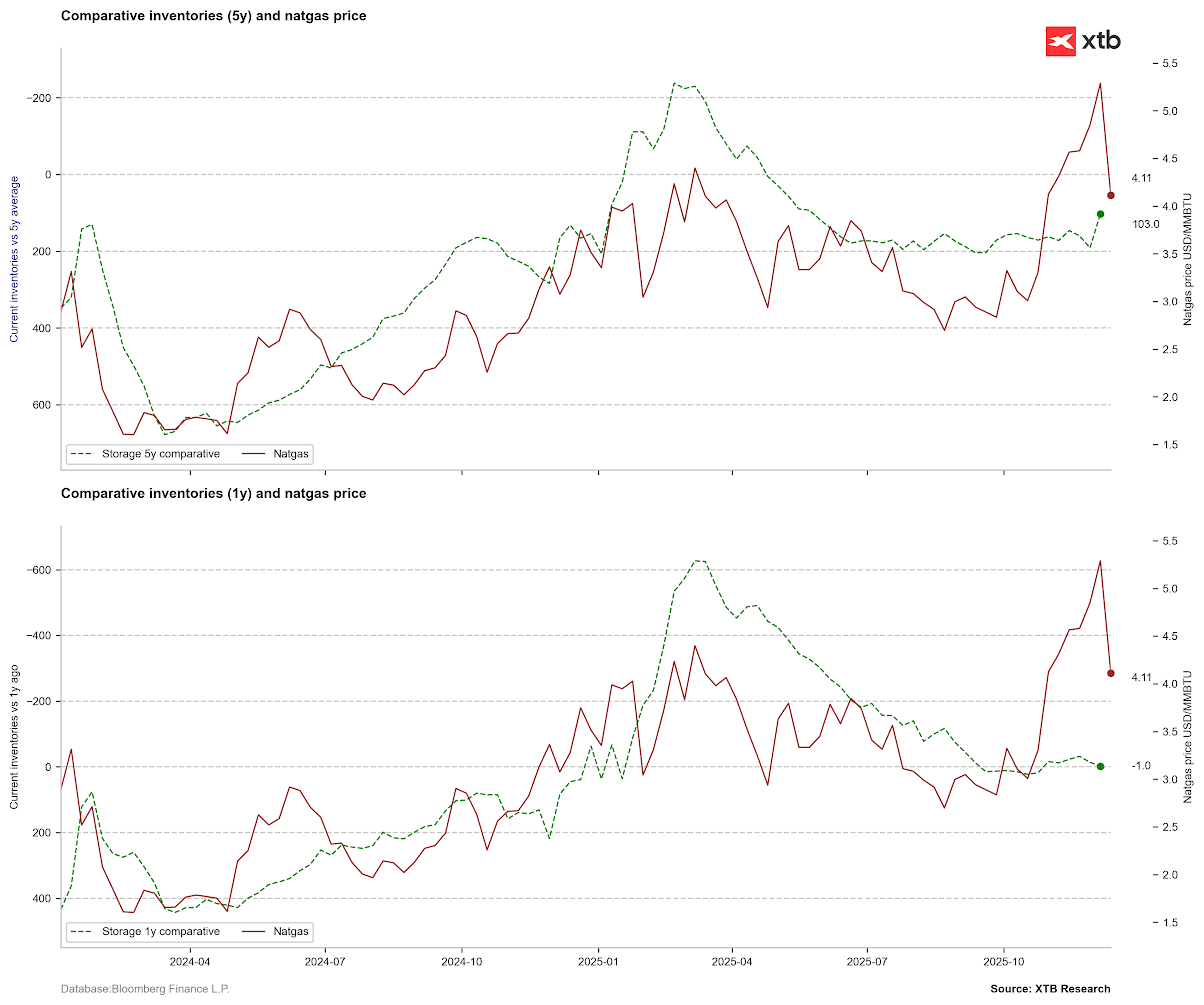

The price is undergoing a sharp correction. Comparative inventory levels did not suggest such a large price rebound, although inventories have marginally fallen compared to the 5-year average. In the coming weeks, we should observe distinctly lower demand, which ought to lead to a rebound in comparative inventories, marking a return to the trend that was present from April to August. Source: Bloomberg Finance LP, XTB

The price is undergoing a sharp correction. Comparative inventory levels did not suggest such a large price rebound, although inventories have marginally fallen compared to the 5-year average. In the coming weeks, we should observe distinctly lower demand, which ought to lead to a rebound in comparative inventories, marking a return to the trend that was present from April to August. Source: Bloomberg Finance LP, XTB

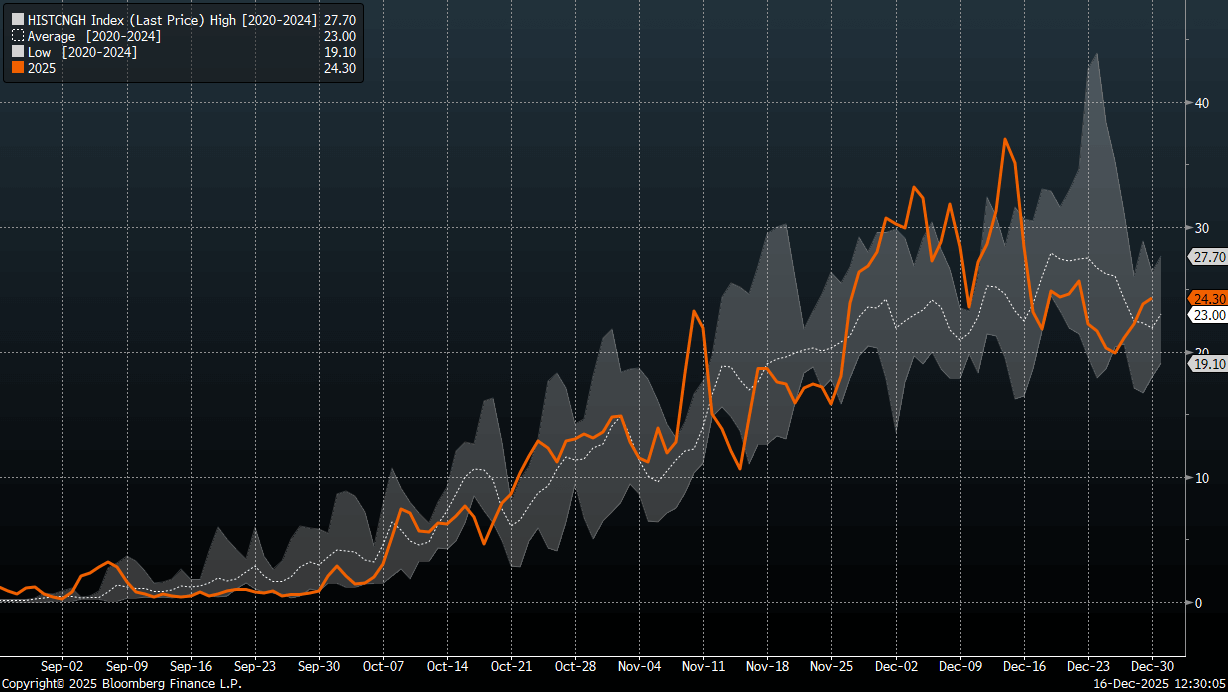

From December 17 to December 28, the number of heating degree days (HDD) is expected to be clearly below average. It is also apparent that, statistically, the number of HDDs sharply declines starting December 23. Source: Bloomberg Finance LP

From December 17 to December 28, the number of heating degree days (HDD) is expected to be clearly below average. It is also apparent that, statistically, the number of HDDs sharply declines starting December 23. Source: Bloomberg Finance LP

Cocoa

- Cocoa is undergoing a significant correction following news of the interventional purchase of 200,000 tonnes of cocoa by the regulator in Côte d’Ivoire.

- These purchases are related to exporters delaying purchases from farmers.

- Cocoa deliveries to Côte d’Ivoire ports have exceeded last year’s levels for the first time. Deliveries since the start of the season have reached 895.5 thousand tonnes, compared to 894 thousand tonnes last year.

- Another factor driving the price drop is a distinct improvement in weather outlooks. The seasonal Harmattan winds, which bring dry weather, are delayed this year. Furthermore, data indicates a suitably balanced amount of rainfall and sunshine.

- A factor supporting prices in late November and early December was the update of the 2024/25 surplus estimate, which was revised down from 142 thousand tonnes to 49 thousand tonnes. Additionally, Rabobank lowered its 2025/26 surplus forecast to 250 thousand tonnes from 328 thousand tonnes.

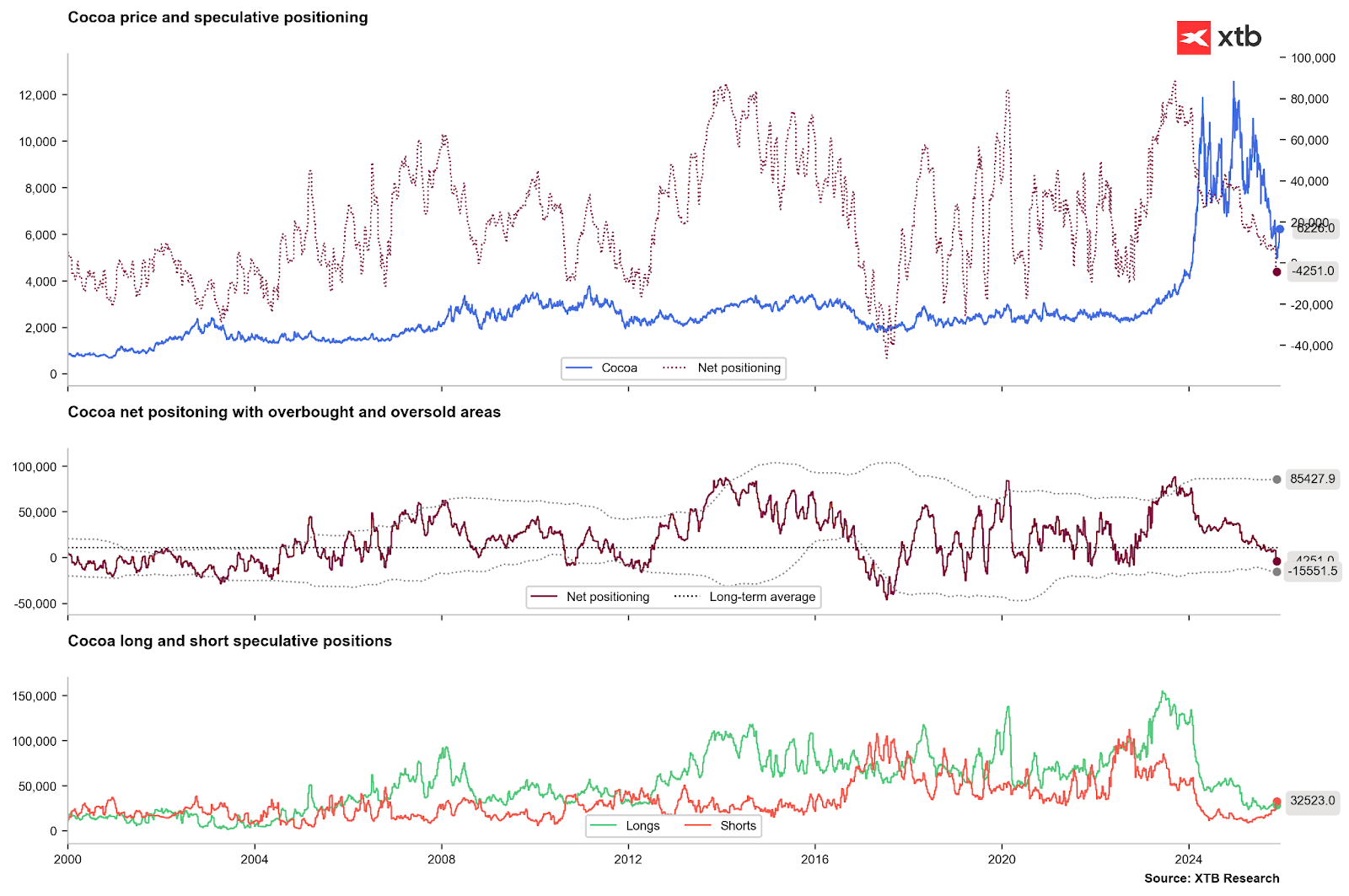

Net positioning in cocoa has fallen to negative territory for the first time since 2022. Although this was a contrarian signal back then, currently, there is no major buying activity observed. Short positions are rebounding from an extremely low level. Source: Bloomberg Finance LP, XTB

Net positioning in cocoa has fallen to negative territory for the first time since 2022. Although this was a contrarian signal back then, currently, there is no major buying activity observed. Short positions are rebounding from an extremely low level. Source: Bloomberg Finance LP, XTB

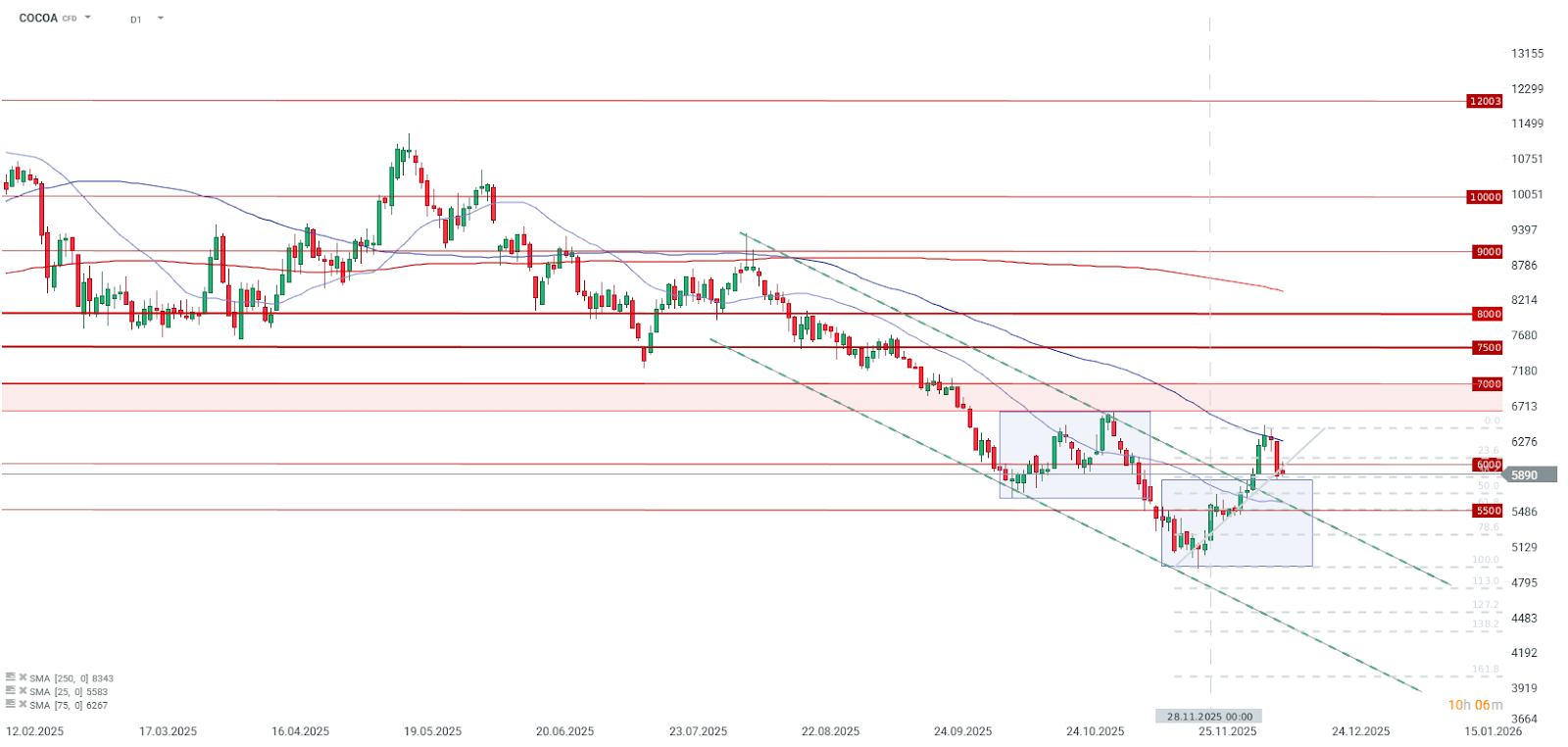

The price corrected after testing the 3-month moving average. Should no positive news emerge, and the price fail to return above $6,000 per tonne, a test of the 25-period moving average, slightly above $5,500 per tonne, can be anticipated. Source: xStation5

The price corrected after testing the 3-month moving average. Should no positive news emerge, and the price fail to return above $6,000 per tonne, a test of the 25-period moving average, slightly above $5,500 per tonne, can be anticipated. Source: xStation5

Soybeans

- China continues to purchase soybeans from the US, in line with the trade agreement provisions. However, these purchases are not compensating for the time lost since April, when China halted buying US soybeans.

- The latest grain inspection data shows that this season is lagging behind the previous marketing year.

- Cumulative soybean inspections this year reached 13.7 million tonnes, a figure that is 46% lower than last year.

- The most recent weekly inspection data indicates just under 800 thousand tonnes, a result that is 22% lower compared to the previous week and almost 60% lower than the same period last year.

- Soybeans showed clear technical overvaluation after strong gains in recent weeks.

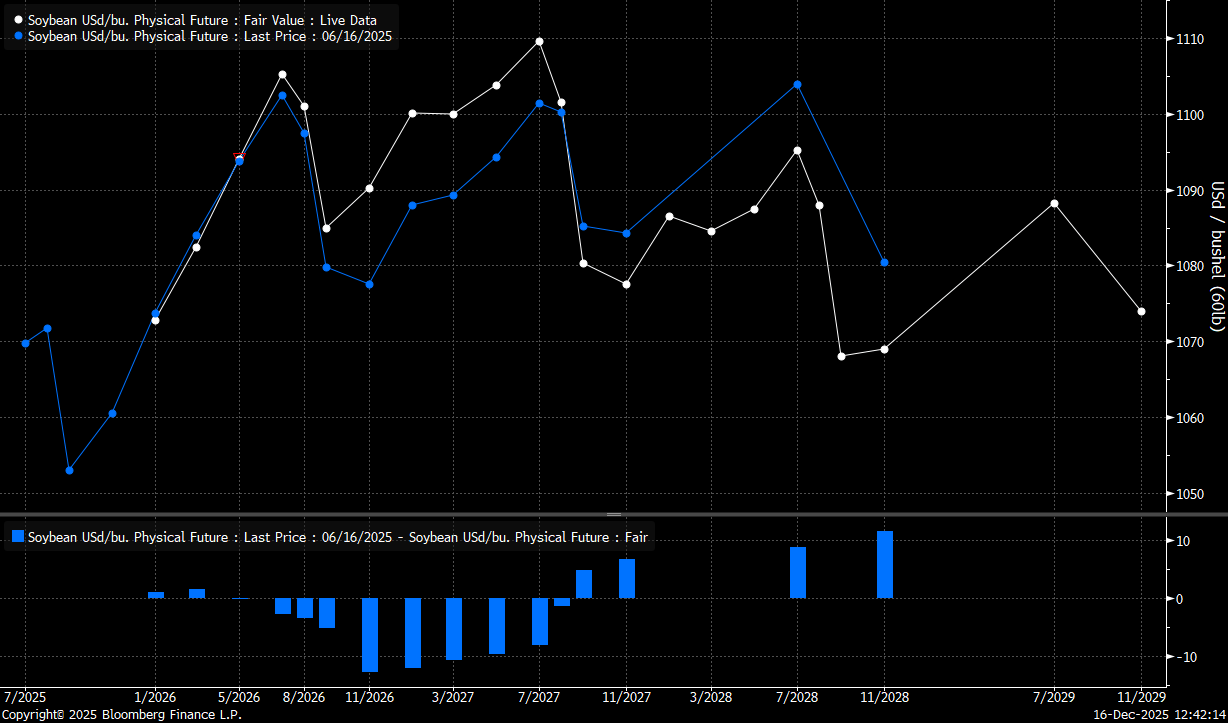

- The current soybean forward structure shows clear contango to the January contract, followed by short backwardation. The shape of the curve is starting to resemble the situation in the natural gas market, suggesting very large price movements in the short term and negative returns from holding soybean contracts long-term.

We are currently in contango in the soybean market. Long-term, the forward curve is beginning to resemble the natural gas market situation. Just a few years ago, we observed a distinct contango or backwardation structure. Currently, over the next two years, we have a mixed structure. Source: Bloomberg Finance LP

We are currently in contango in the soybean market. Long-term, the forward curve is beginning to resemble the natural gas market situation. Just a few years ago, we observed a distinct contango or backwardation structure. Currently, over the next two years, we have a mixed structure. Source: Bloomberg Finance LP

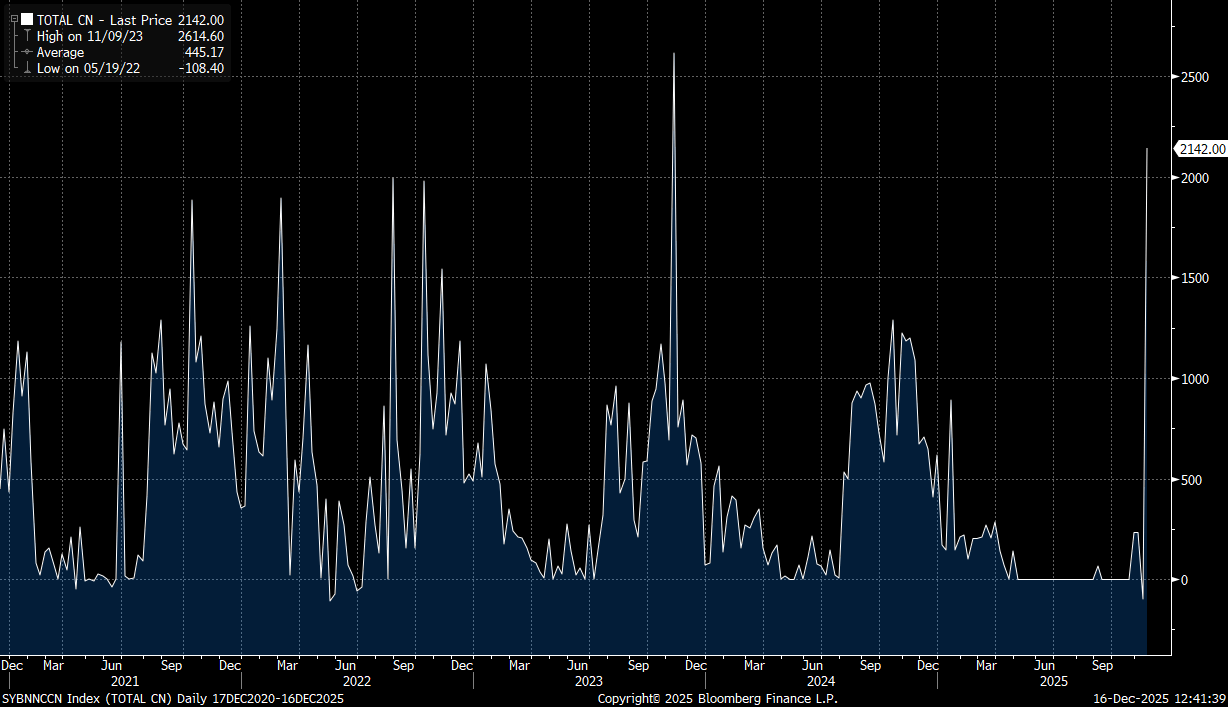

US soybean exports to China are seeing a clear rebound, though they remain below cumulative levels from previous years. Source: Bloomberg Finance LP

US soybean exports to China are seeing a clear rebound, though they remain below cumulative levels from previous years. Source: Bloomberg Finance LP

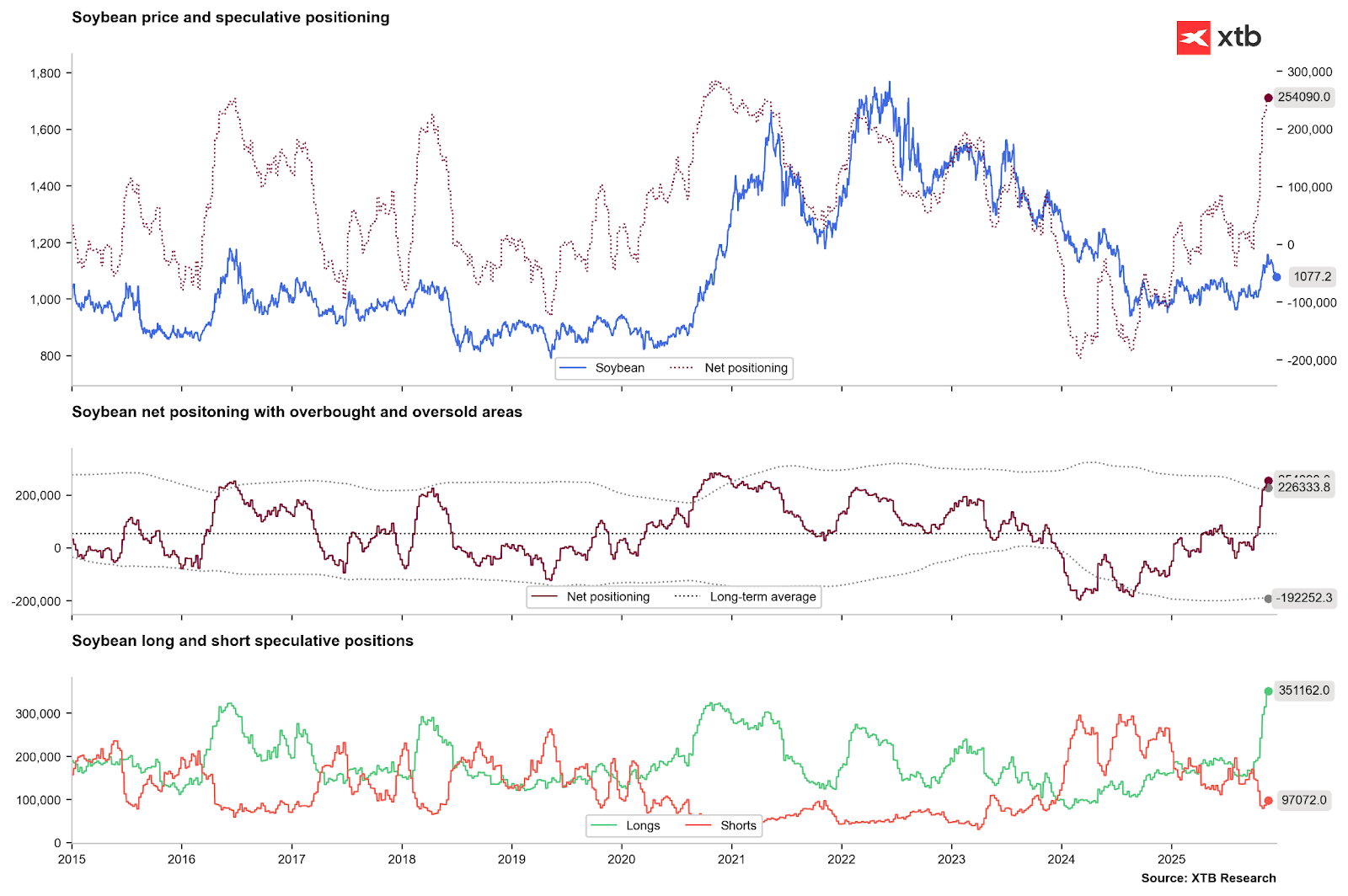

The latest positioning data (as of November 25) indicates extreme overbought conditions in soybeans among speculators. Net positions reached an overbought level. Conversely, we observe a huge divergence with the price. A similar situation occurred in 2016 and 2018. If buyers were to withdraw from the market, the price could fall as low as 900 cents per bushel. Source: Bloomberg Finance LP, XTB

The latest positioning data (as of November 25) indicates extreme overbought conditions in soybeans among speculators. Net positions reached an overbought level. Conversely, we observe a huge divergence with the price. A similar situation occurred in 2016 and 2018. If buyers were to withdraw from the market, the price could fall as low as 900 cents per bushel. Source: Bloomberg Finance LP, XTB

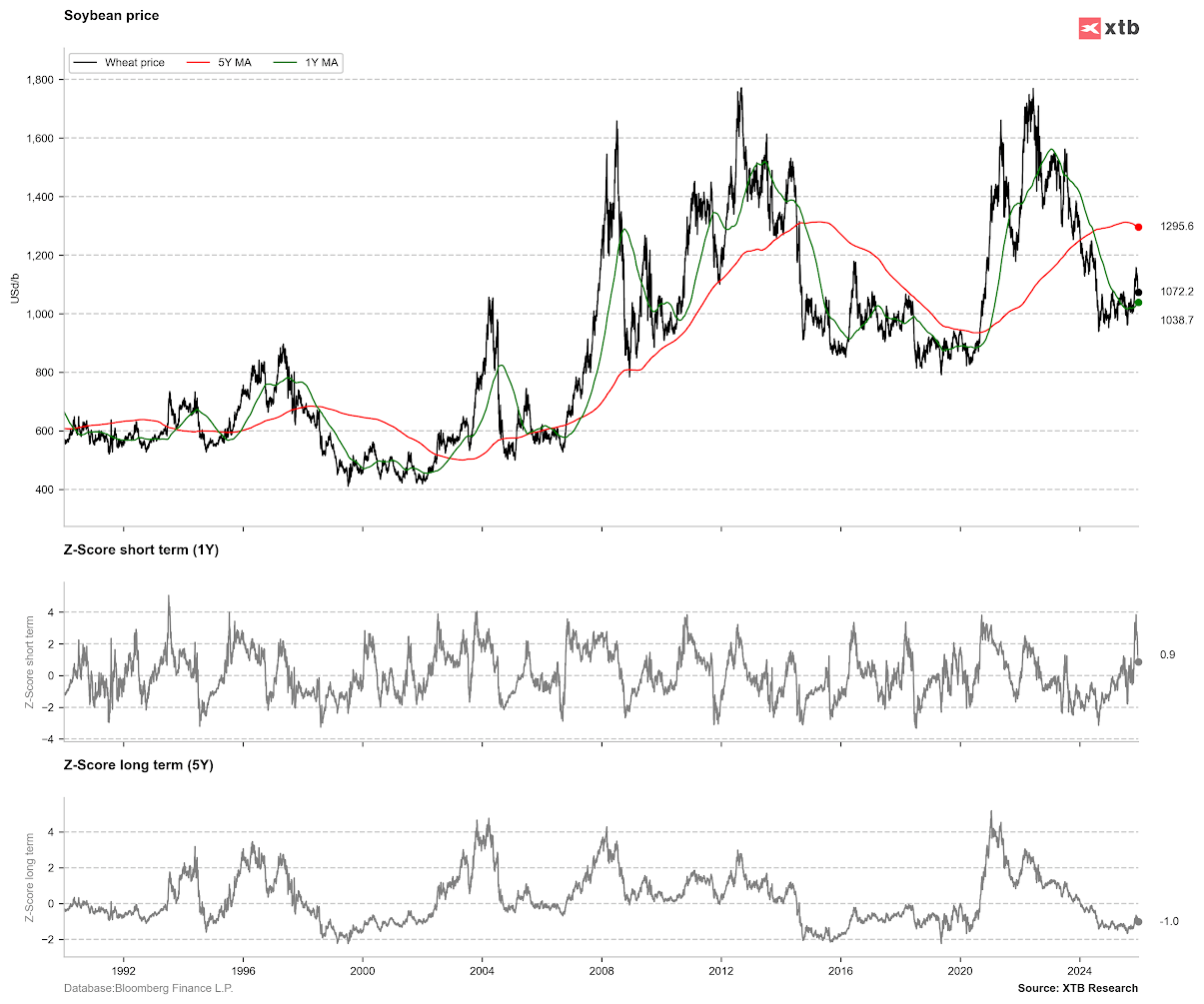

The price nearly reached a 4-standard deviation from the 1-year average, suggesting clear overvaluation. Although the 1-year average has distinctly reversed direction, a further decline in prices cannot be ruled out, with a revival only upon reaching a negative 2-standard deviation. Long-term, the price remains well below the averages. The current situation is beginning to resemble the short-term recovery seen in 2016, which was followed by further consolidation until 2020. Source: Bloomberg Finance LP

The price nearly reached a 4-standard deviation from the 1-year average, suggesting clear overvaluation. Although the 1-year average has distinctly reversed direction, a further decline in prices cannot be ruled out, with a revival only upon reaching a negative 2-standard deviation. Long-term, the price remains well below the averages. The current situation is beginning to resemble the short-term recovery seen in 2016, which was followed by further consolidation until 2020. Source: Bloomberg Finance LP

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.