Oil

- Crude oil remains pressured, as US and EU sanctions have yet to materially slow Russian seaborne exports. The Trump-Xi meeting omitted the Russian oil issue, suggesting purchases from this source will likely continue.

- OPEC+ decided on a 137,000 bpd production limit increase in December but paused further hikes for Q1 2026. Despite a moderate initial price reaction, the market surplus could still be the largest since 2020, even with a Q1 production cap.

- OPEC production rose by 400,000 bpd in September to over 29 million bpd, a near three-year high.

- Geopolitical risks include the potential for US action against Venezuela, a key concern given its large oil reserves. Venezuela’s output is currently 1.1 million bpd, down from 2.6 million bpd a decade ago, due to sanctions and underinvestment.

- The IEA projects a surplus of 4 million bpd, while the EIA estimates 2-3 million bpd. Russian seaborne exports are a key variable, recently falling to 1.88 million bpd, a three-year low.

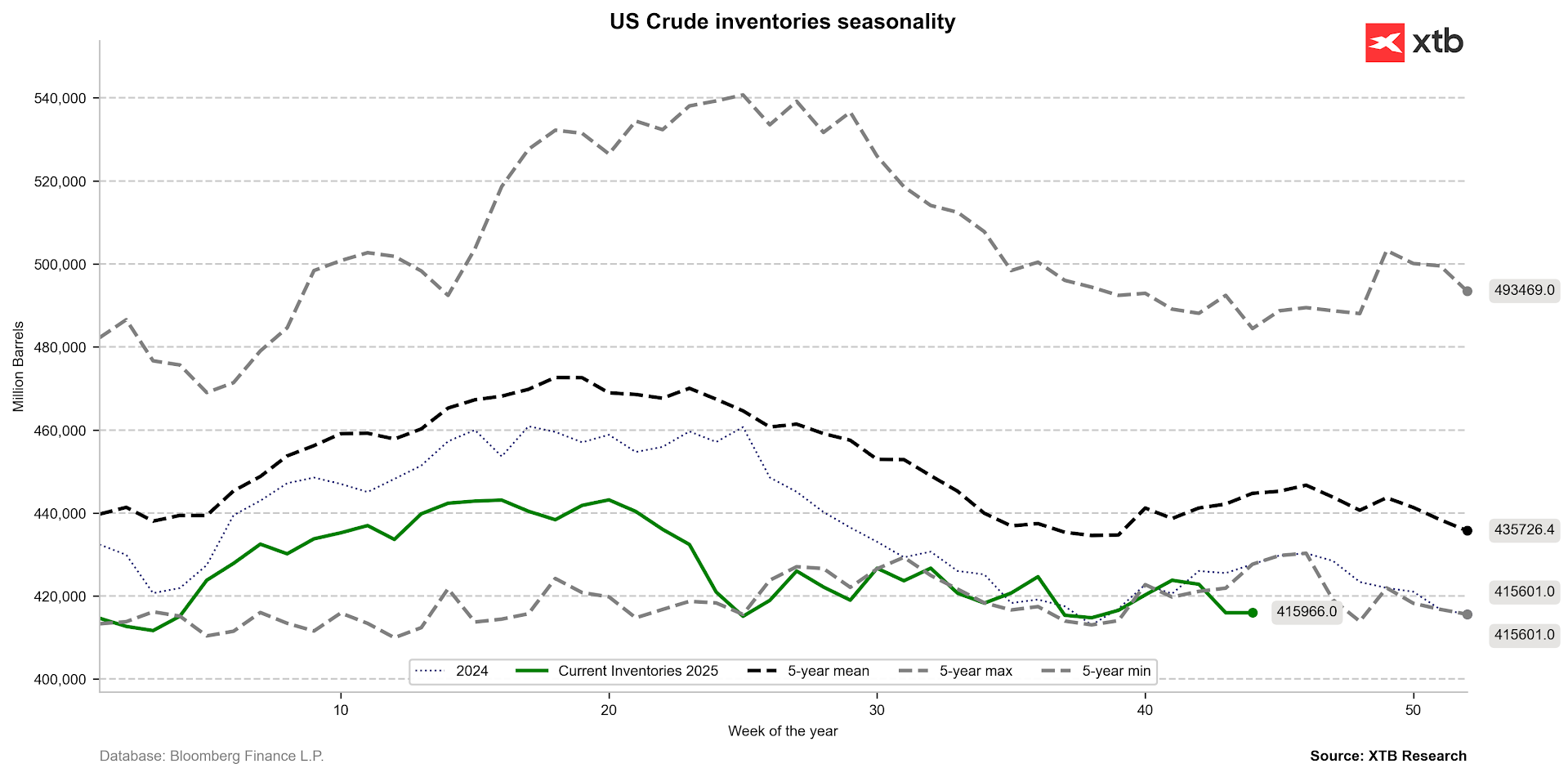

Oil inventories are markedly below last year’s levels and the five-year minimum. Weak US stocks, despite the global surplus, suggest high net exports, potentially narrowing the WTI/Brent spread. Source: Bloomberg Finance LP, XTB.

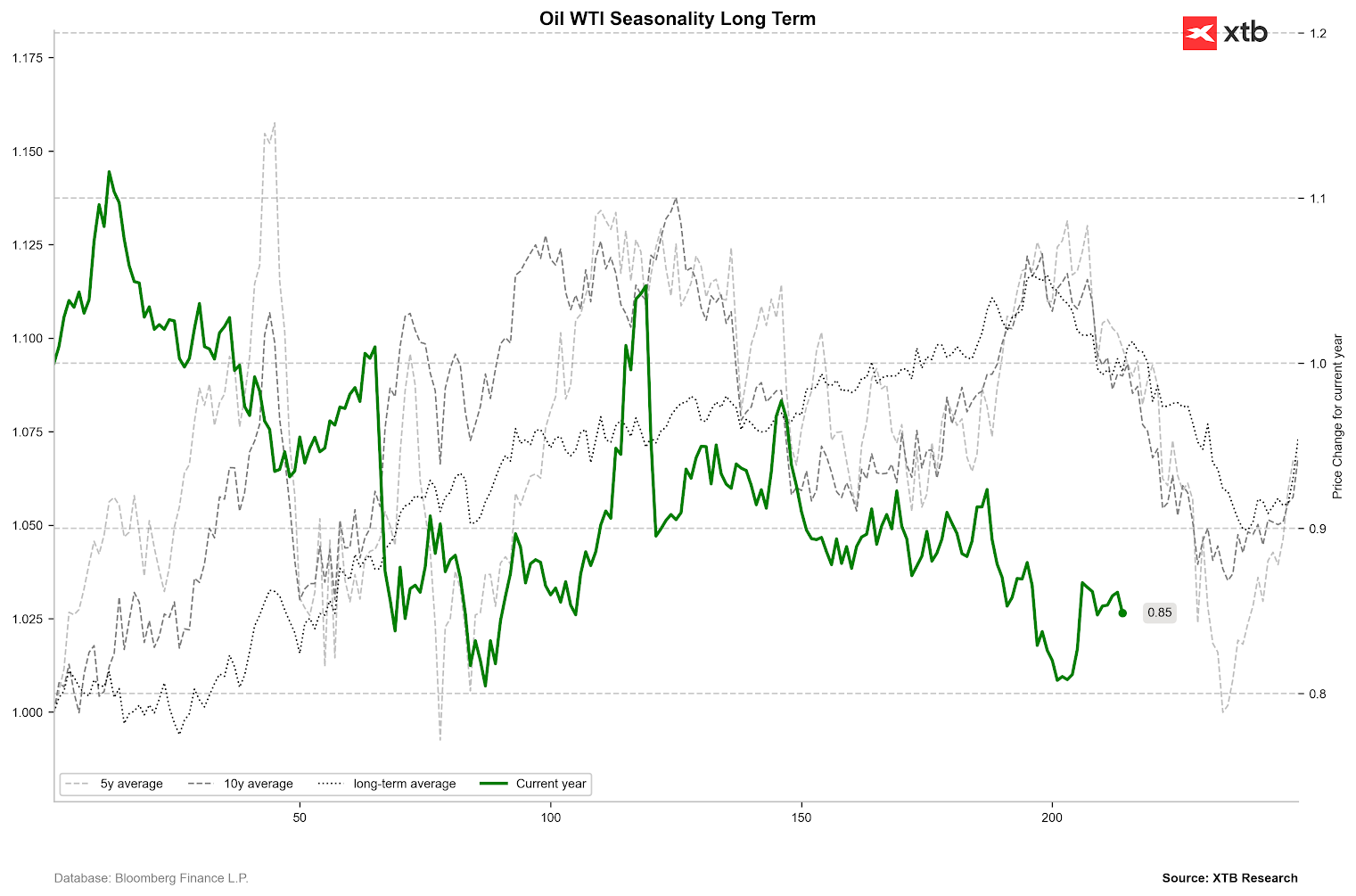

Seasonality indicates a local trough in the oil market in late November. Source: Bloomberg Finance LP, XTB.

Gold

- Gold is oscillating near $4,000 per ounce, less than 9% below its historical peak, maintaining a year-to-date gain exceeding 50%.

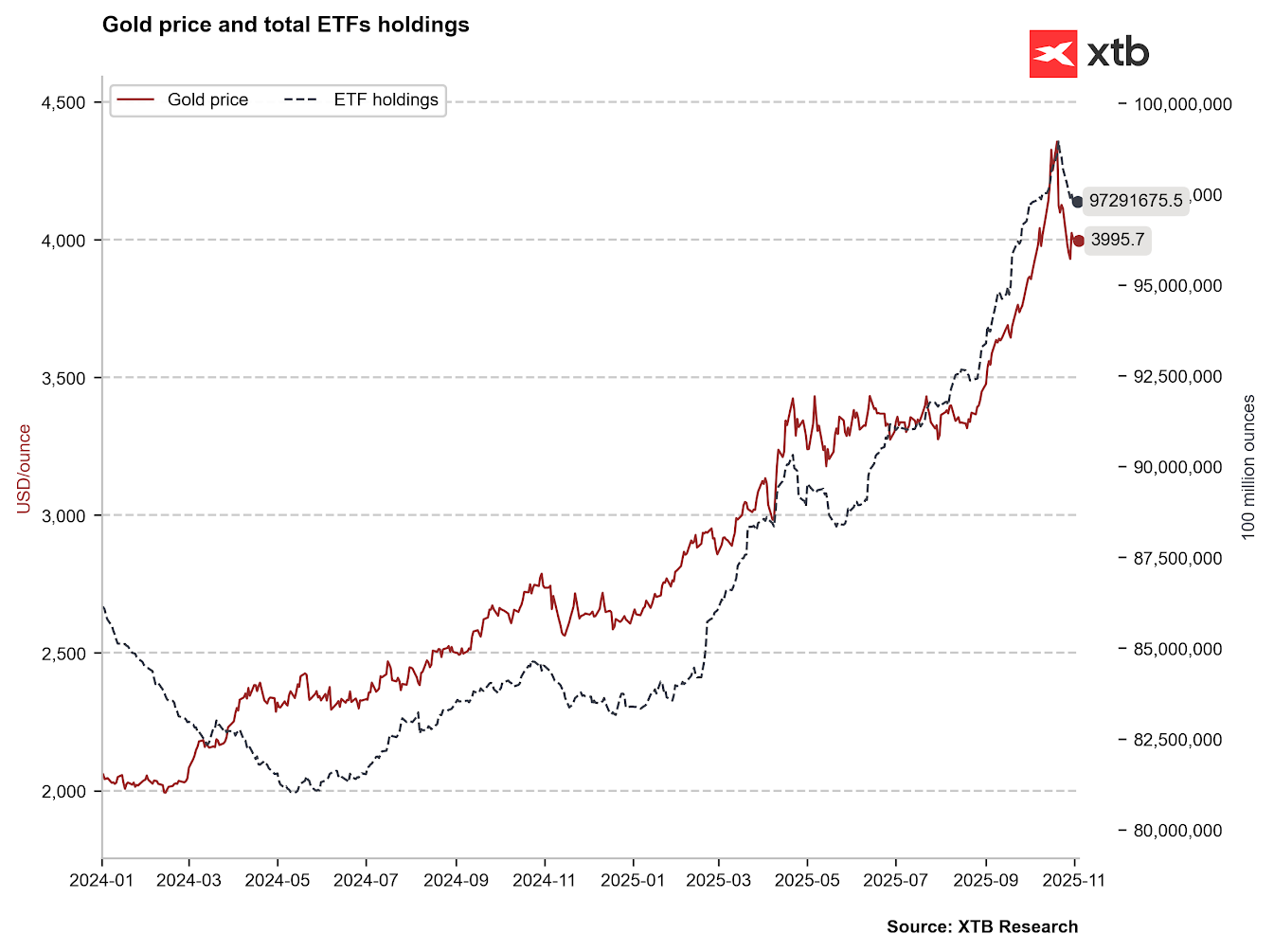

- Significant ETF gold reductions persist, although at a slower pace than in the preceding two weeks. Conversely, speculative long positions in China have ceased to decline.

- A negative factor is the end of tax relief for gold buyers in China; effective November 1, only investors registered on the Shanghai Gold Exchange or futures exchange can deduct VAT.

- This regulatory decision, aimed at market normalisation, may lead to a marked decrease in gold demand.

- The People’s Bank of China (PBoC) holds approximately 8% of its reserves in gold. Given the 20% global average, prospects for continued PBoC purchases in the coming years remain strong.

ETFs continue to sell gold, albeit at a slightly slower pace. Source: Bloomberg Finance LP, XTB.

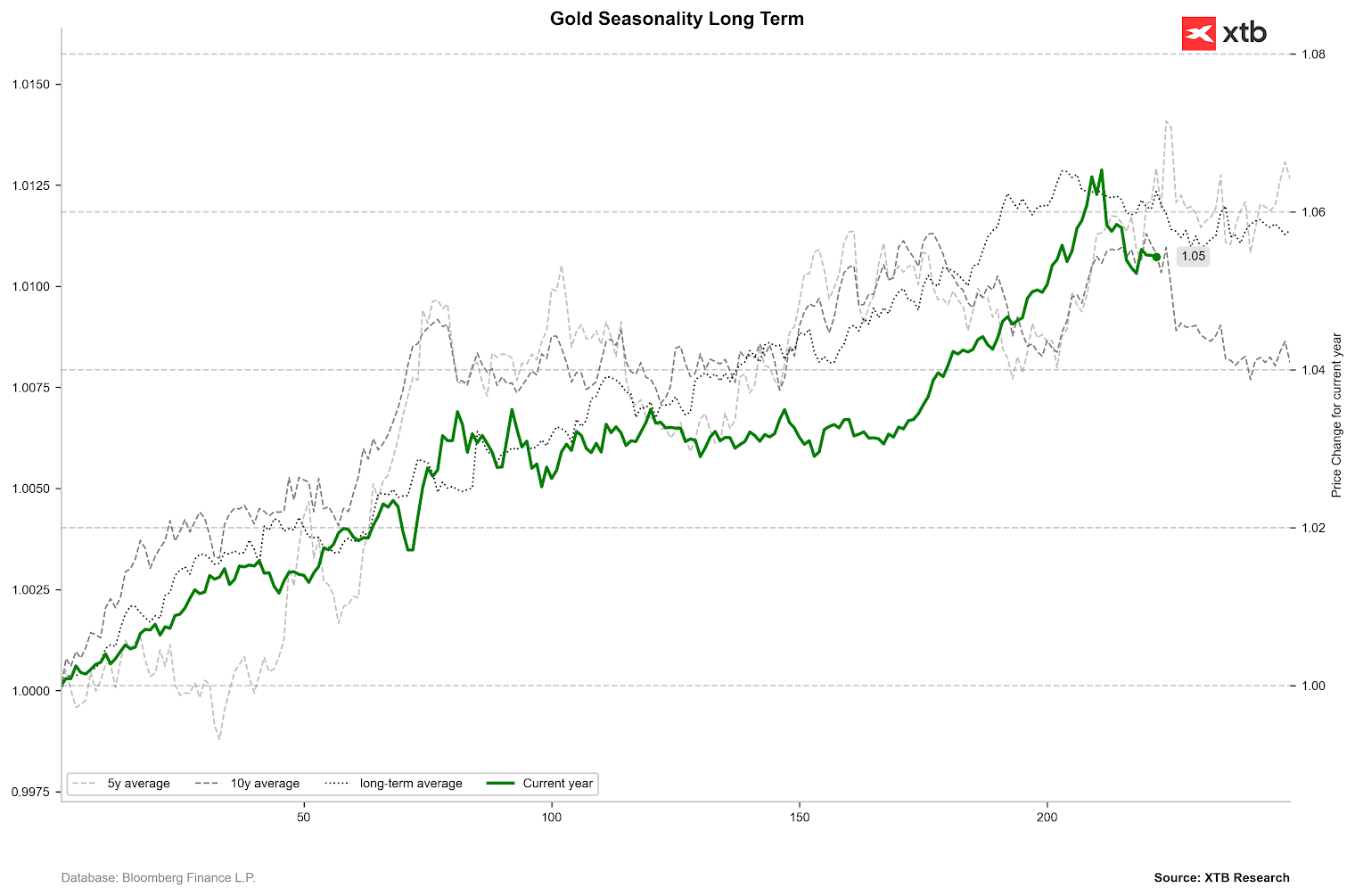

Seasonality suggests the year-end period for gold can be volatile. Source: Bloomberg Finance LP, XTB.

Natural Gas

- Natural gas prices are rising to near four-month highs due to forecasts of a sharp temperature drop in the Eastern United States mid-month.

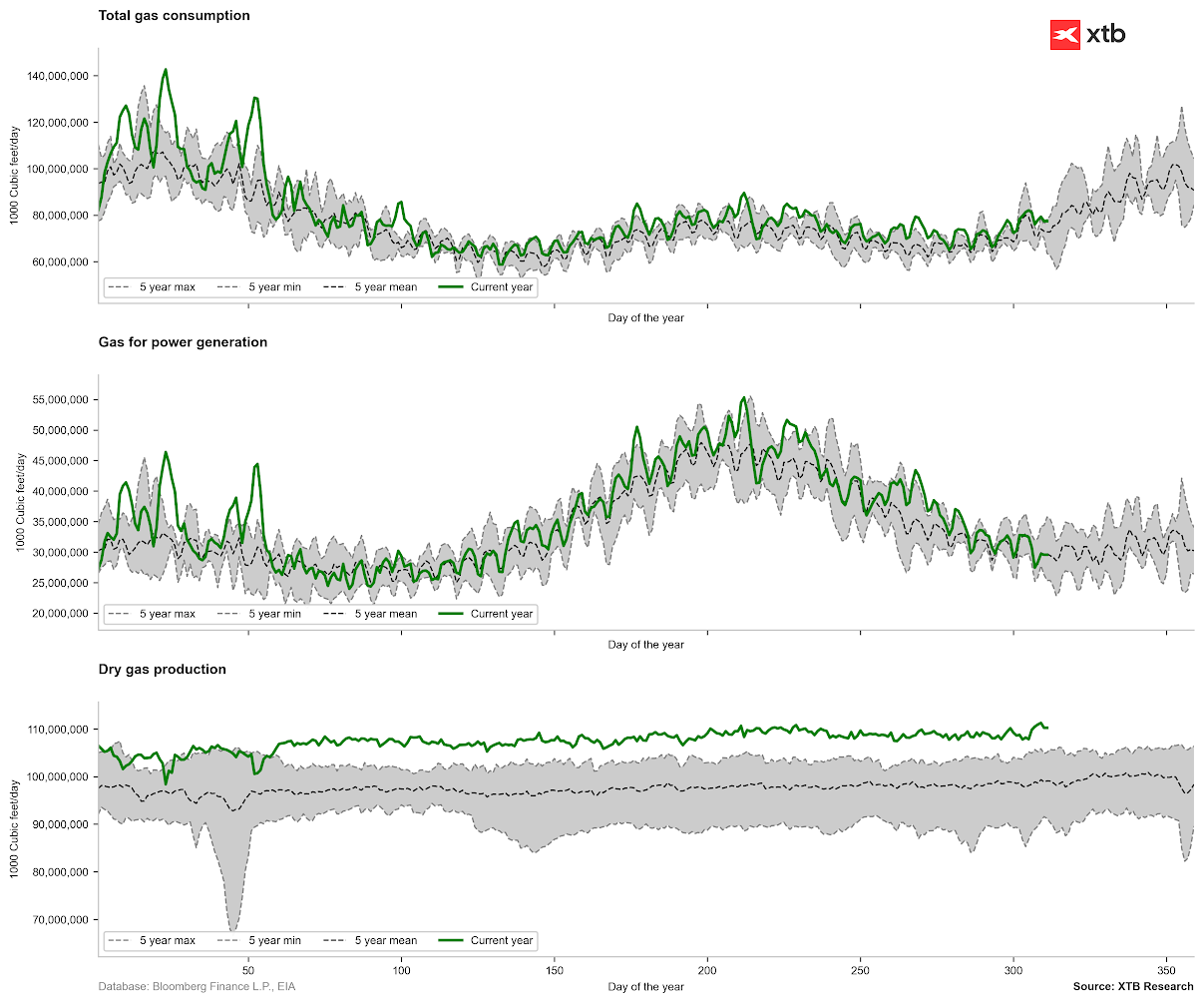

- US gas demand on Monday was 77.2 bcfd (+5.1% YoY), while production hit 110 bcfd (+6.6% YoY). LNG exports are also at record levels (16.8 bcfd).

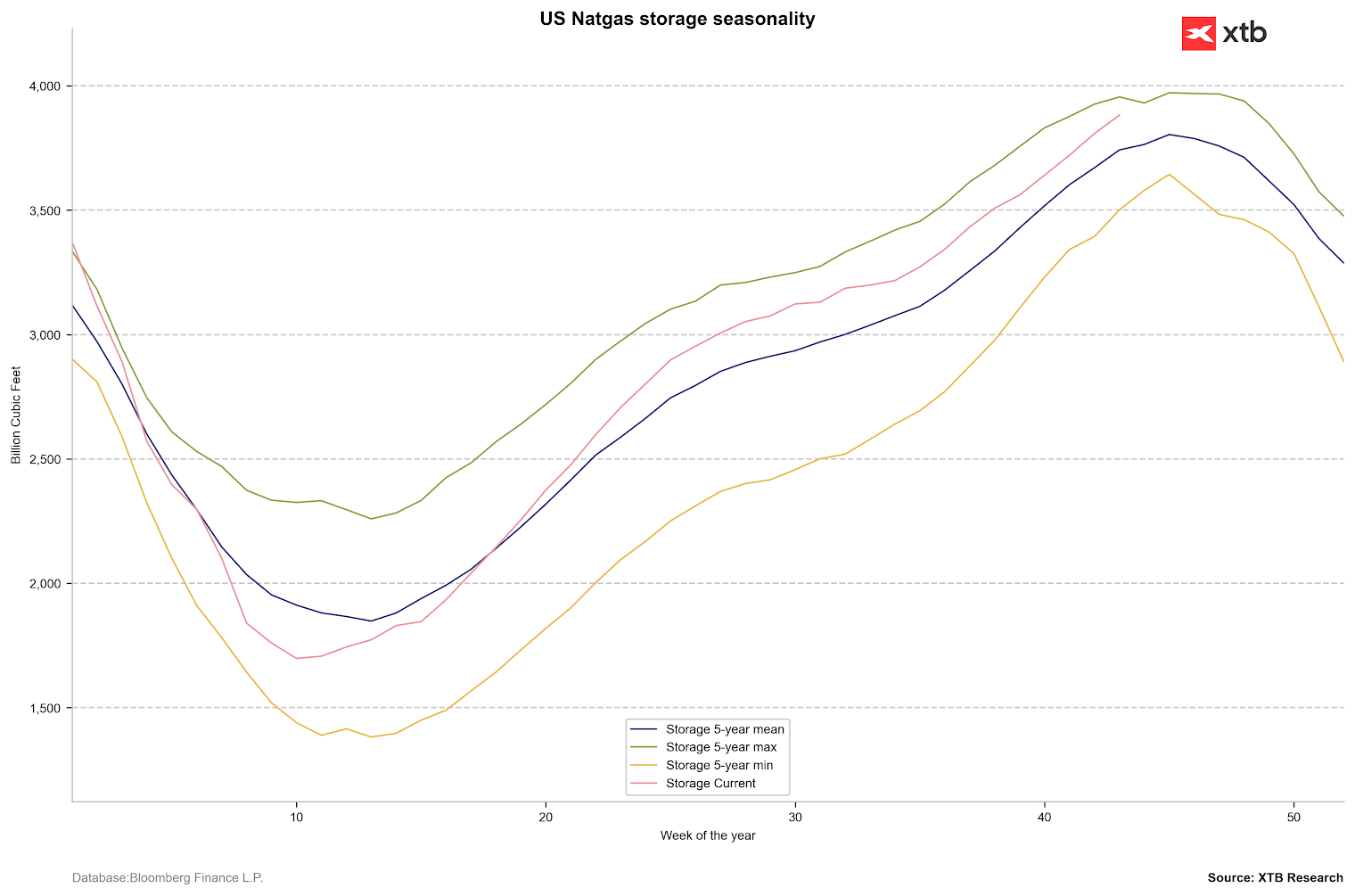

- US gas inventories are marginally above last year’s levels and about 5% above the five-year average. European stocks are significantly below average, but storage filling is ongoing.

Gas consumption remains above the five-year average, marking the start of the heating season, while production is at historical peaks. Source: Bloomberg Finance LP, XTB.

Inventory increases have recently outpaced the five-year average, driven by production growth rather than weak consumption. Source: Bloomberg Finance LP, XTB.

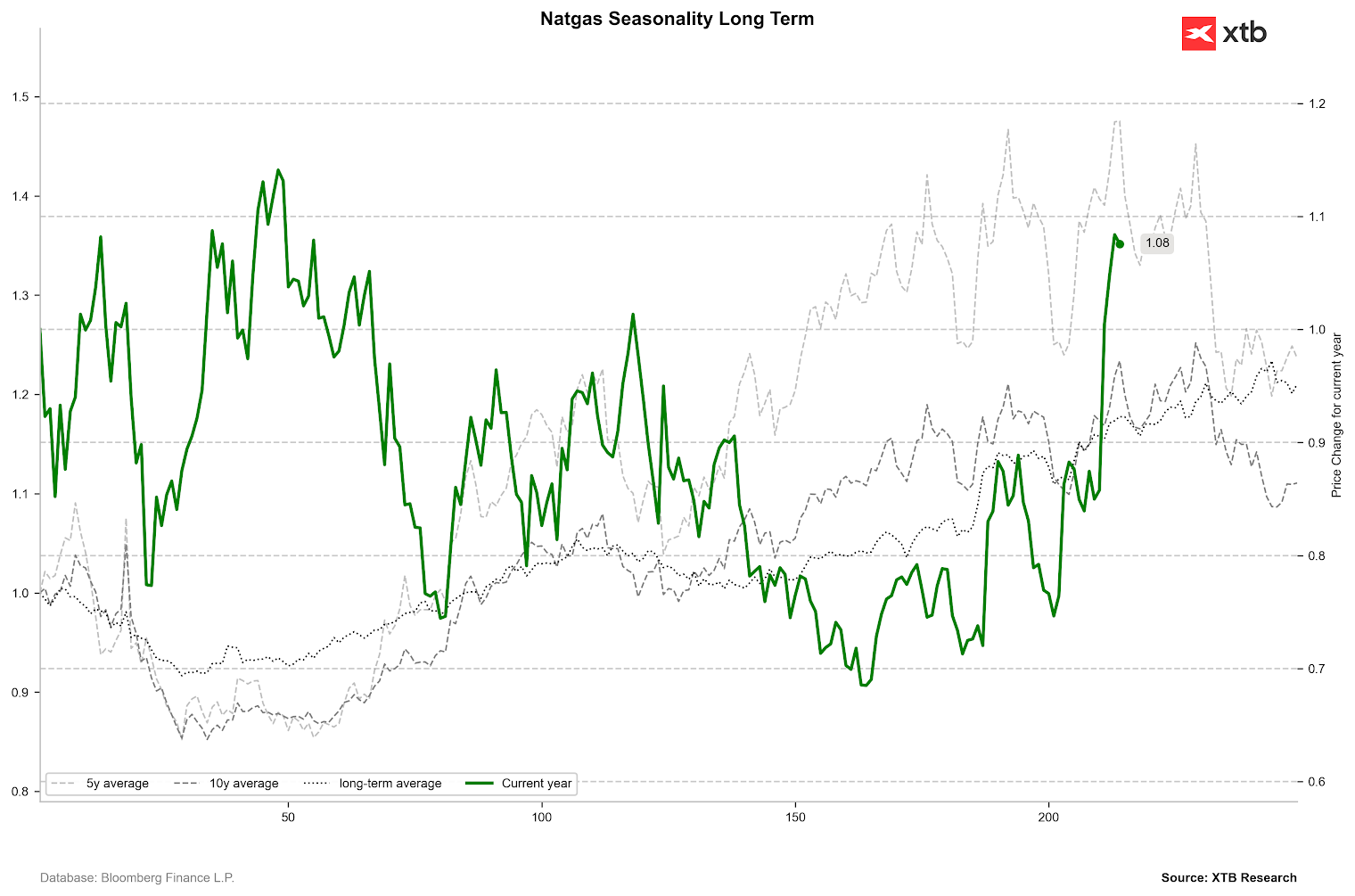

Long-term and 10-year averages indicate near-term price increases. Conversely, the 5 and 10-year averages suggest a local peak towards the end of November. Source: Bloomberg Finance LP, XTB.

Cocoa

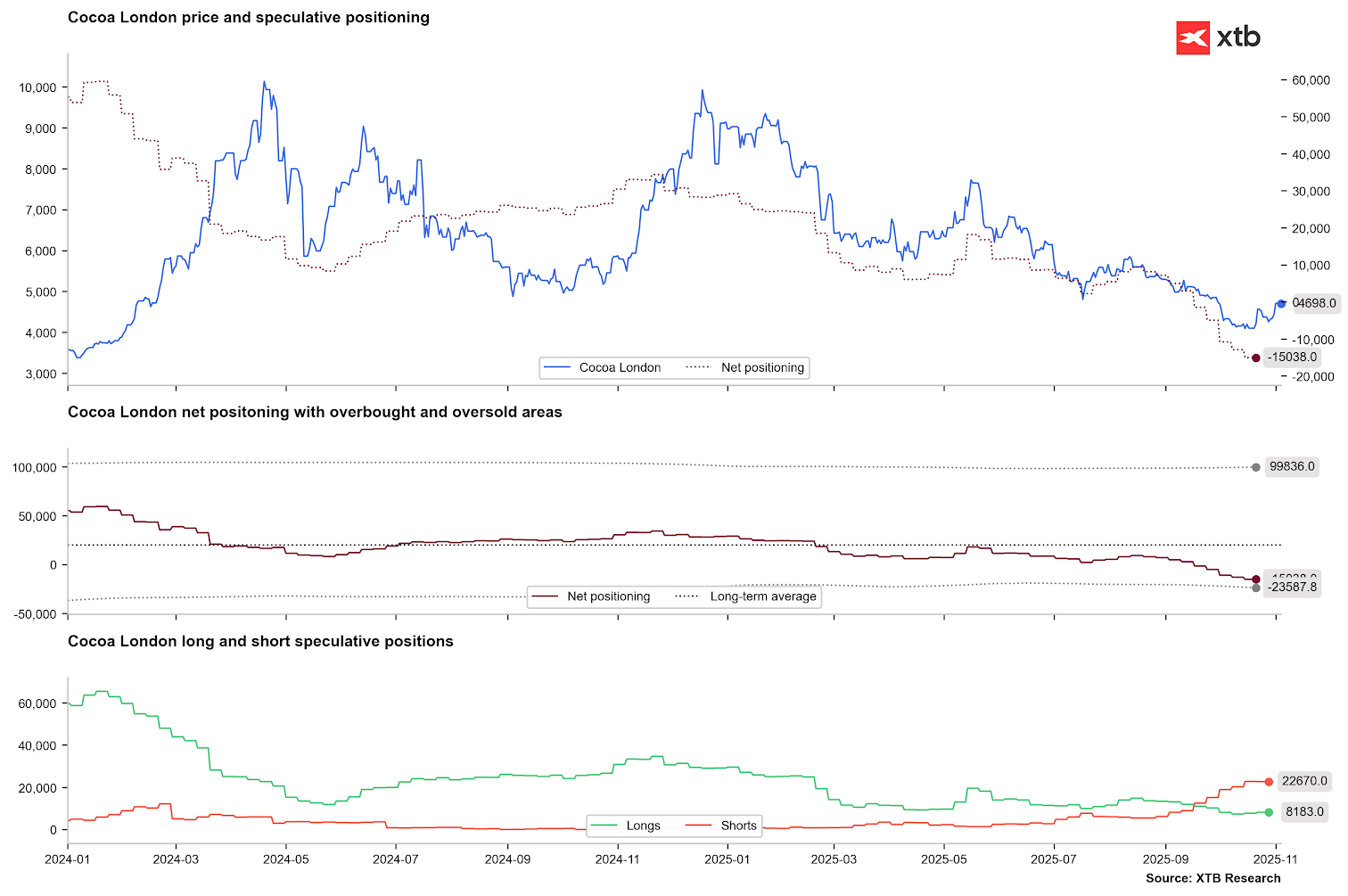

- Cocoa bean deliveries to Ivorian ports are 16% lower than last year (305k tonnes vs. 365k tonnes since October 1), mainly due to transportation issues. December deliveries, coinciding with the main harvest, will provide a clearer seasonal picture.

- Mondelez indicates cocoa pod count is 7% above the five-year average, pointing to a potentially good harvest. Global production increase is expected mainly from South America, as Ivory Coast and Ghana harvests are anticipated to be flat.

- Exchange inventories continue to fall, currently at just over 1.8 million bags, a seven-month low.

Net positions in London are still negative, but the lack of an increase in short positions over the past 2–3 weeks may be a potential contrarian signal. Source: Bloomberg Finance LP, XTB

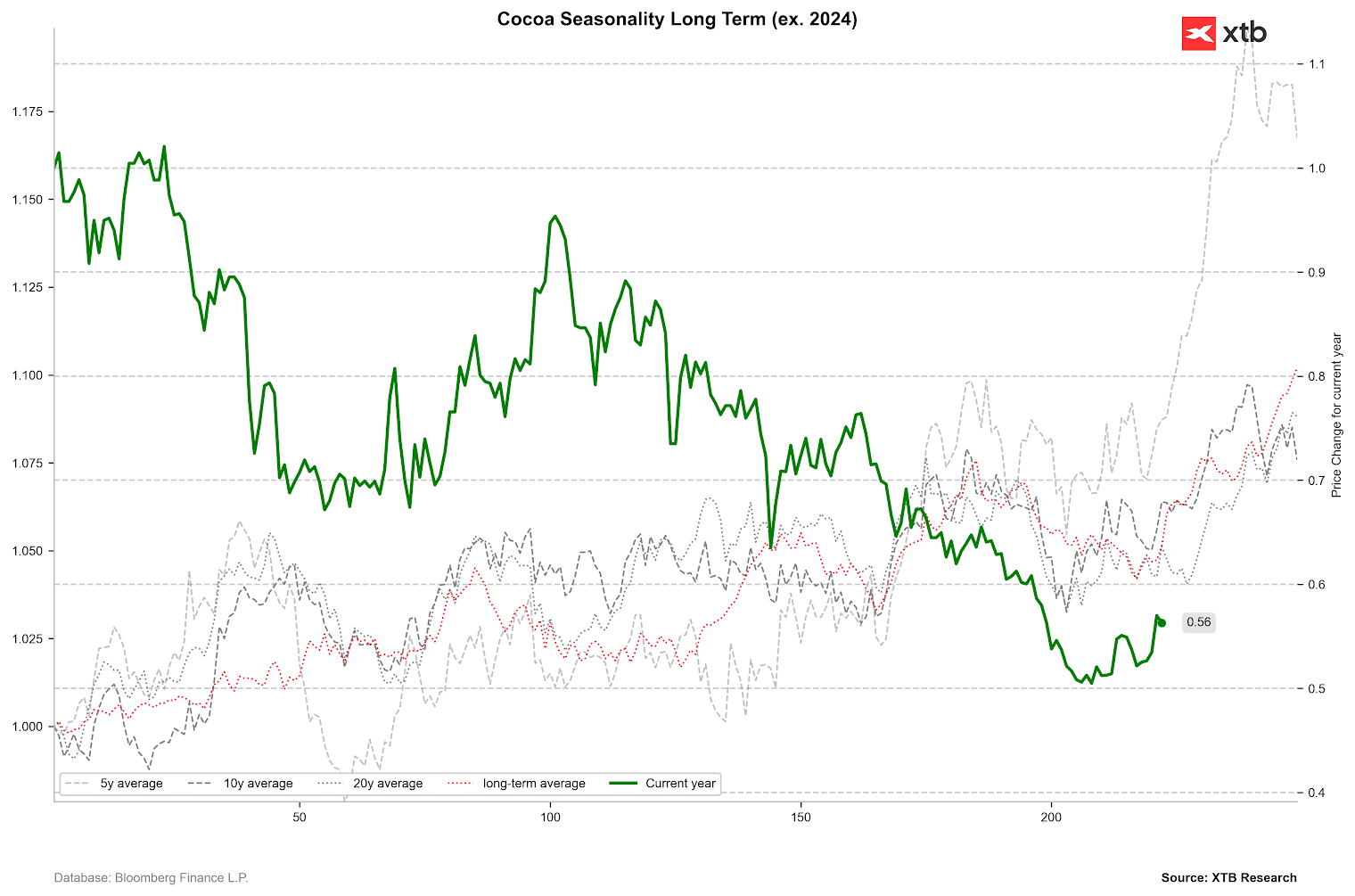

Cocoa prices are rebounding seasonally, with gains potentially lasting until late February/early March. Source: Bloomberg Finance LP, XTB

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.