Last week, despite dovish signals from the Federal Reserve, which initiated technical quantitative easing (QE) and cut interest rates, proved disappointing for both the Nasdaq 100 and Bitcoin. The largest U.S. technology equity index fell by more than 2% over the past five sessions, while Bitcoin declined from above USD 94.5k following the Fed decision to around USD 87k over the weekend. On Monday morning, the price of the largest cryptocurrency is hovering near USD 89.5k.

- Spot Bitcoin trading volumes have been declining. At the same time, activity in derivatives markets is weakening including futures and, in particular, options (open interest). Altcoins remain unable to recover from the October 10 crash, while trading volumes in smaller projects point to ongoing bearish market conditions. Bitcoin is still trading roughly 30% below its October peak near USD 126k and continues to struggle to regain upward momentum.

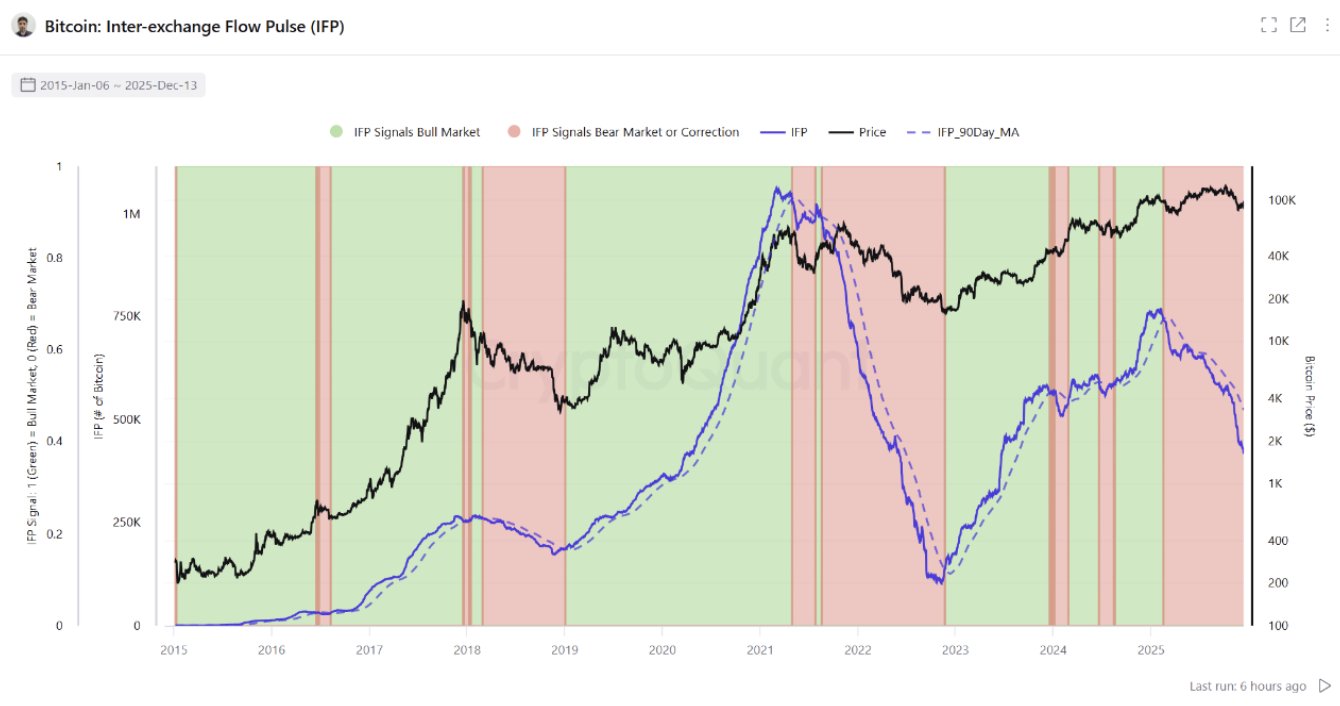

- On-chain data suggest elevated downside risk. A stronger price move is likely to follow several weeks of historically low volatility, reflecting a prolonged consolidation around the USD 90k level. The IFP (Inter-Exchange Flow Pulse) indicator, which measures on-chain Bitcoin activity between exchanges, has been consistently declining — a pattern that also preceded bear markets in 2018 and 2022. At the same time, Bitcoin inflows to Binance are at their lowest levels since 2018, suggesting a broad reluctance among investors to sell BTC at current price levels.

Bitcoin and Ethereum charts (H1)

Source: xStation5

Source: xStation5

Source: CryptoQuant

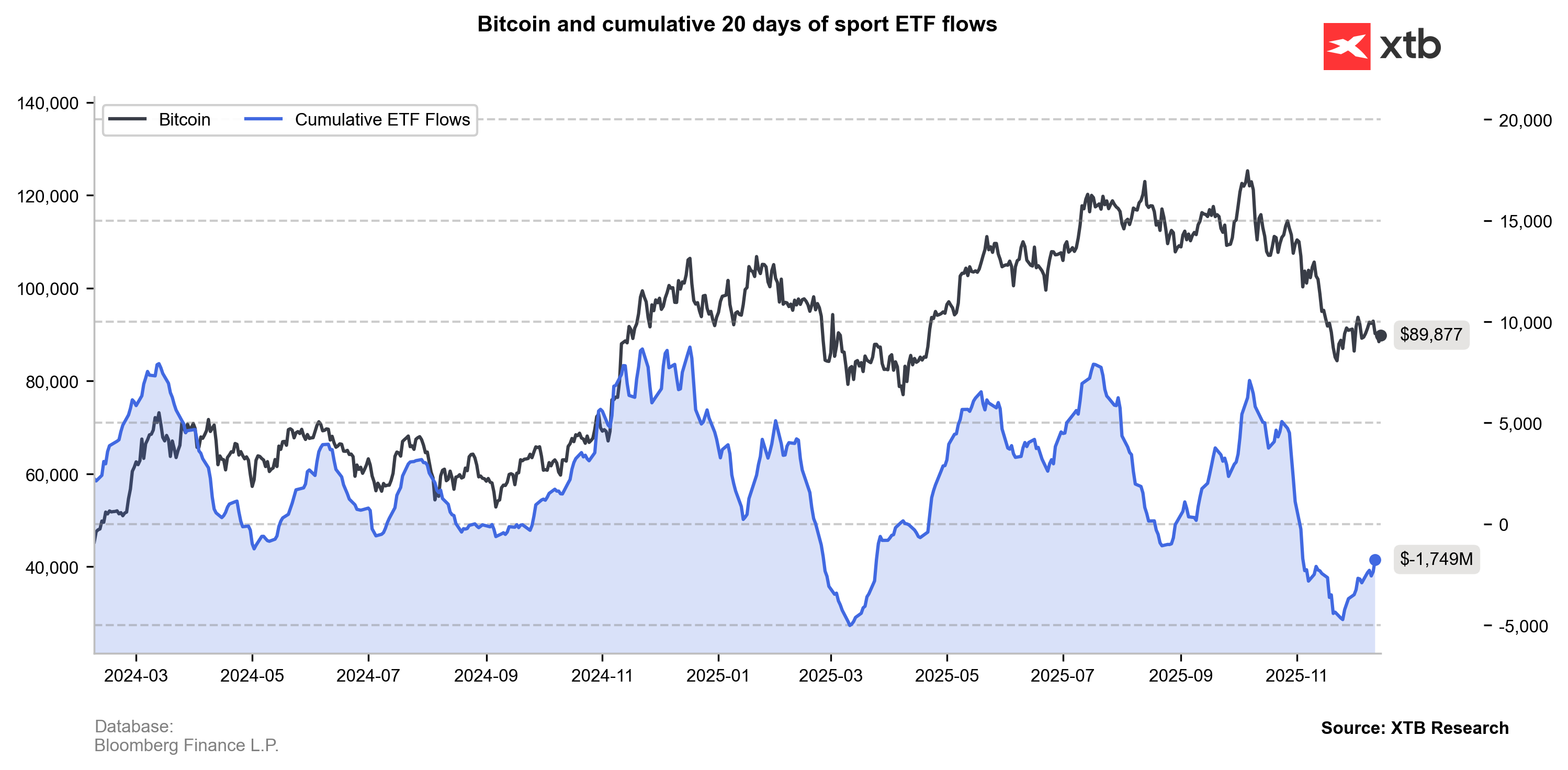

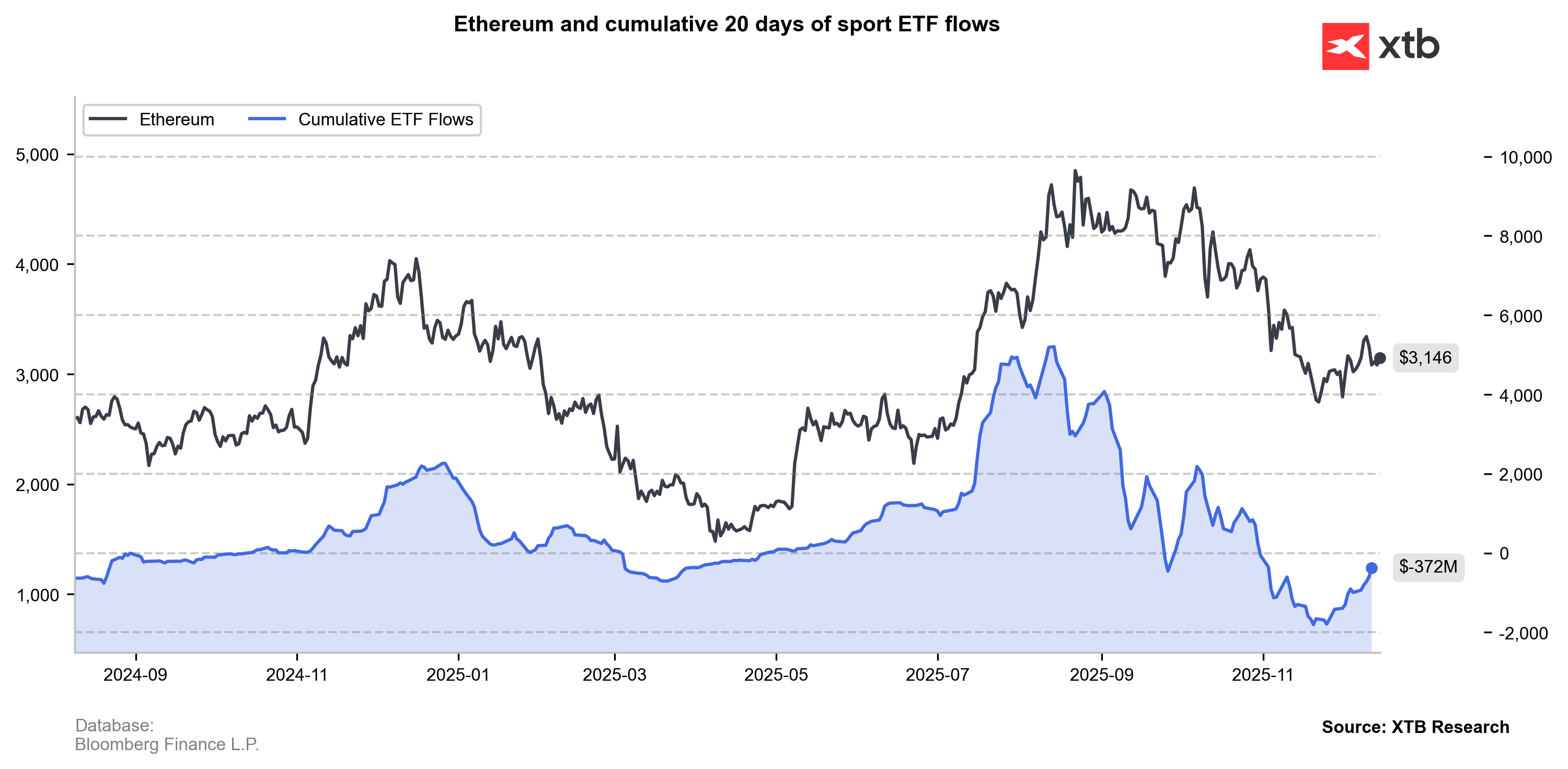

ETF Flows

Without a clear improvement in equity market sentiment and a meaningful rebound in trading activity across crypto markets, downside risks remain elevated despite solid fundamentals for the year ahead. These include an expected strong U.S. earnings season, the prospect of interest rate cuts in 2026, and a potentially broad, dovish shift in Federal Reserve policy. Recently, ETF funds have recorded only modest inflows during price increases, while experiencing sharp outflows during market declines.

Source: XTB Research, Bloomberg Finance L.P

Source: XTB Research, Bloomberg Finance L.P

Despite attempts to revive activity, overall sentiment within ETF funds points to caution and significantly reduced interest in Bitcoin and Ethereum investments. This resembles a state of market “fatigue” and demand exhaustion following years of strong gains. On the positive side, ETF funds focused on Bitcoin, Ethereum, and even Solana (SOL) recorded positive net inflows last week.

Source: XTB Research, Bloomberg Finance L.P

Source: XTB Research, Bloomberg Finance L.P

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.