The Overbalance analysis aims to identify three financial instruments, analyzed exclusively on a four-hour interval (H4). The analysis uses only the Overbalance methodology, which allows you to determine where the trend may continue or where it may change.

Today’s analysis covers three instruments, evaluated exclusively in terms of the 1:1 correction structure.

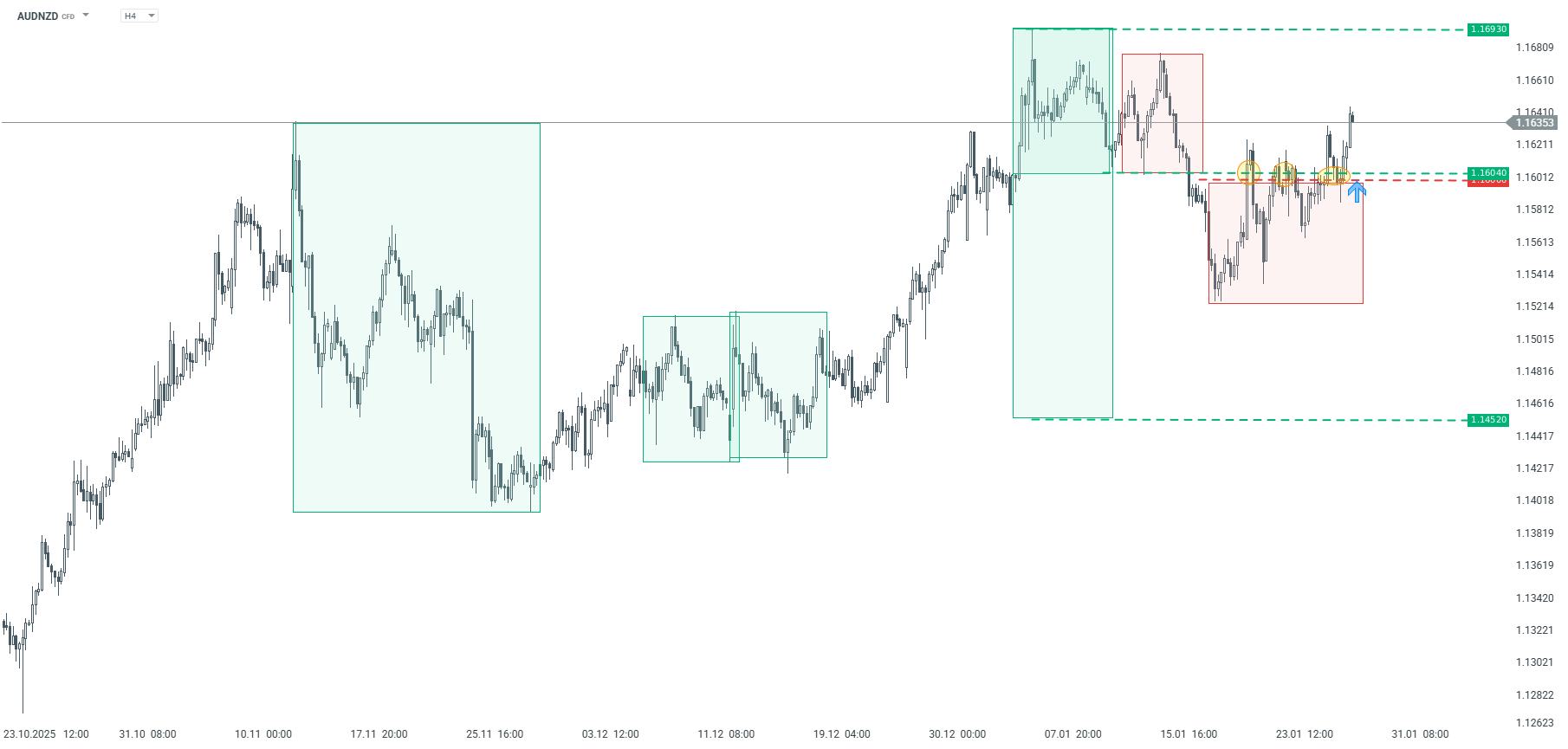

AUDNZD

The AUDNZD currency pair has recently been moving within a local consolidation range, but ultimately broke above the resistance level of 1.1600. It was then tested from above, followed by another local upward movement. This pattern may indicate a desire to retest the recent highs in the 1.1693 area. From the perspective of the Overbalance methodology, the upward scenario remains valid. Only a sustained return of the price below 1.1600 would open the way for a larger correction towards the lower limit of the 1:1 pattern at 1.1452.

AUDNZD – D1 interval | Source: xStation5

EURGBP

Since mid-November, the EURGBP currency pair has been moving in a downward trend, with the last two corrections having almost identical ranges. The rebound in the 0.8724 area was a reaction to the upper limit of the 1:1 geometry, which, according to the Overbalance methodology, suggests that the market is ready to continue its decline. In this scenario, the market appears to be aiming to establish a new low. Only a negation of the geometric pattern marked with a red rectangle could open the way for greater gains and a change in sentiment.

EURGBP – D1 interval | Source: xStation5

GBPUSD

The GBPUSD currency pair has been on an upward trend since November last year. The latest correction was slightly deeper and slightly breached the green 1:1 pattern, but its range did not exceed 127.2%, indicating that the main trend is still in place. In the event of another correction, the key support level remains at 1.3690, which is the lower limit of the significant Overbalance pattern. Only a break below this level could suggest a change in sentiment, which remains bullish at the moment.

GBPUSD – D1 interval | Source: xStation 5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.