Yesterday’s session was not successful for buyers, as American indices clearly lost ground, and many commentators and analysts expected the declines to transfer to Europe after the market opened. European indices on the cash market opened with moderate declines, but futures contracts are already in growth territory. The SUI20 contracts are rising the most in the morning hours, by almost 1%. Smaller increases can be observed in the FRA40, ITA40, and UK100 contracts, where they are limited to 0.4-0.6%.

European markets will be pricing further direction today based on yesterday’s strong Wall Street movements, a solid dose of macroeconomic data from the old continent, and some comments from central bankers.

ECB bankers had their speeches today. The bank’s president, Christine Lagarde, strongly criticized the reluctance of European countries to implement key reforms and pointed out that the current level of interest rates allows for growth noticeably greater than what is being observed.

Macroeconomic Data:

- The situation in the United Kingdom continues to deteriorate. Retail sales fell month-to-month by -1.1% against expectations of 0%.

Mixed PMI readings from France, Germany, and the Eurozone were also published:

- In France, industrial PMI readings are significantly falling and remain in contraction territory (47.8). The composite PMI also remains in contraction (49.9), supported by a relatively good Services reading (50.8).

- The German reading remains ambivalent. The composite and industrial PMI falls more than expected but remains in growth territory (52.1 and 52.7). The industrial reading performs worse, with a decline to 48.4 against expectations of growth to around 49.8.

- In the Eurozone, services remain the strength of the economy with PMI rising above expectations to 53.1, but industry continues to disappoint, falling to 49.7.

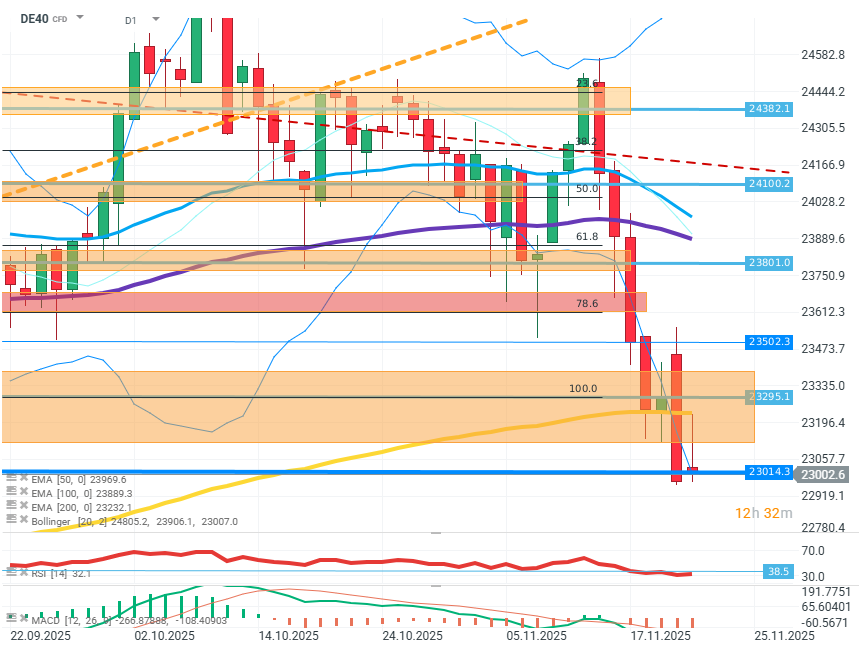

DE40 (D1)

Source: xStation5

The price on the index continues a strong downward movement, passing through the resistance zone around the FIBO 100 retracement and the EMA200 average. Buyers managed to halt the declines only at the level of 23000, the last minimum from May. The RSI’s transition into the oversold territory (38) and the lower limit of the Bollinger bands favor an attempt at a corrective increase.

Company News:

- The extremely unfavorable peace proposal for Ukraine recently proposed by the USA is negatively impacting the valuations of European defense companies. RENK (R3NK.DE), Hensoldt (HAG.DE) are losing about 3%. Rheinmetall AG (RHM.DE) is losing as much as 7%.

- The retreat from risk and shaken faith in the AI boom is putting pressure on the valuations of European tech companies. Infineon (IFX.DE) is losing 4%, ASML (ASML.NL) is down over 7%, Siemens (SIE.DE) is depreciating by 8%.

- Babcock (BAB.UK) – The producer of nuclear and military equipment published very good results, exceeding expectations and showing, among other things, a 27% profit increase. However, amid weak sentiment, the company is still losing over 2% of its capitalization.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.