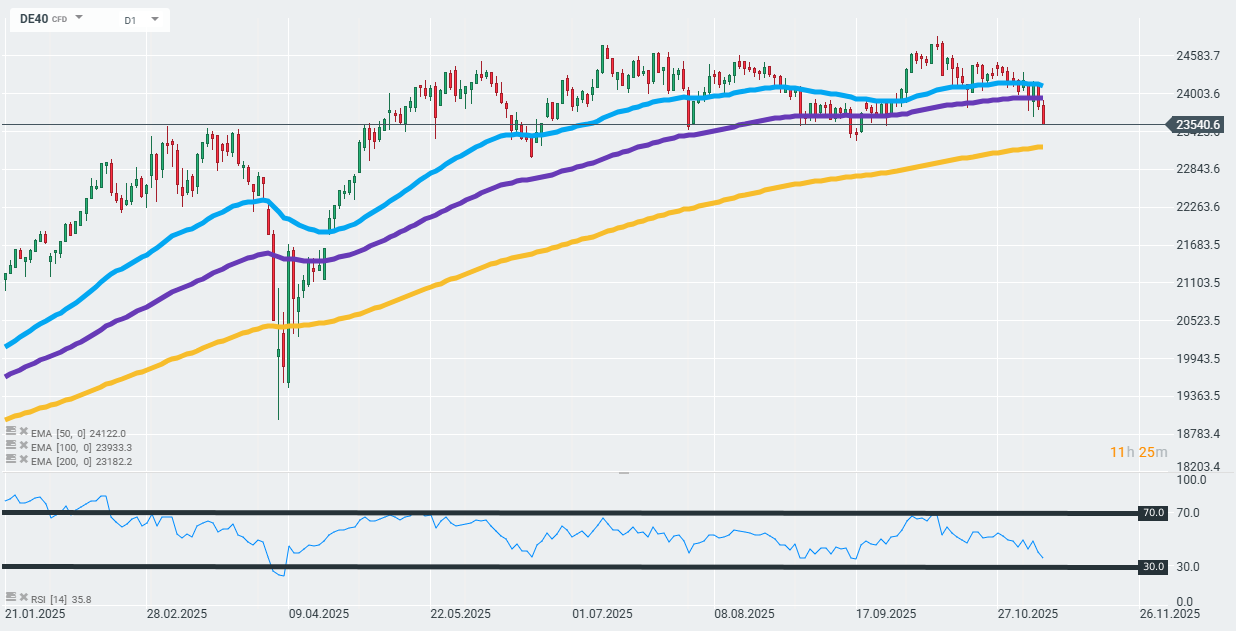

DAX40- German Index Below 100 Day EMA

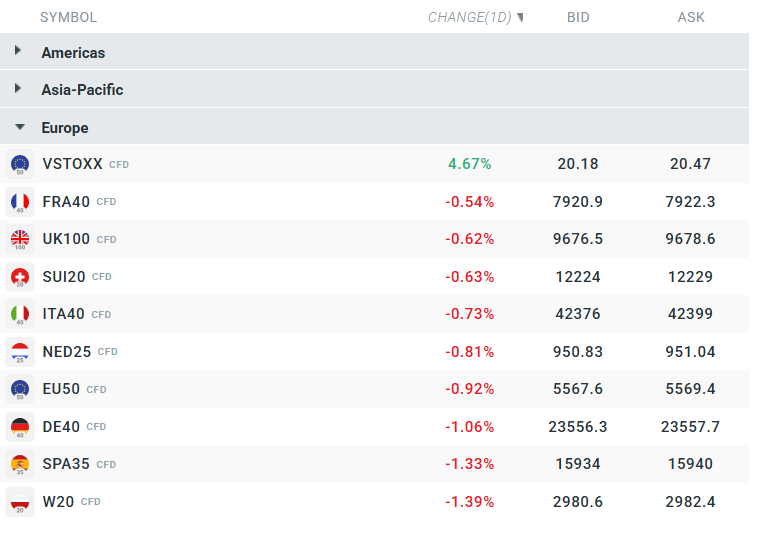

The first phase of this week’s final session on the European stock exchange brings significant declines in all local stock indices. The U50 contract is down 0.92%, while the DE40 is down 1.06%. Importantly, the German D40 is breaking below a key support zone, possibly paving the way for deeper sell-offs.

Source: xStation

Current volatility observed on the broader European market. Source: xStation

The DAX is clearly losing ground during Friday’s session and, crucially, is falling sharply below the 100-day exponential moving average (purple curve on the chart). This scenario causes the DE40 to negate the previous medium-term upward trend and creates the basis for further declines to around 200 -day EMA (gold curve), which was recently tested by the market during the biggest crash this year, namely in April, when we observed the peak of panic related to US customs policy. Source: xStation

Company news:

Hensoldt (HAG.DE) posted solid results for the first nine months of 2025, with adjusted EBITDA up 13% y/y to EUR 211 million. The company’s revenues increased by 12% y/y to €1.54 billion, and its order book grew by 9% to €7.1 billion. The company also boasts an increase in the value of new orders – €2.02 billion, which represents a decent increase of 8.7% y/y. The management expects an EBITDA margin of at least 18% for the year, with projected revenues of approximately EUR 2.5 billion. The company also confirmed its long-term goals and maintains a high book-to-bill ratio of 1.6-1.9x, which strengthens the outlook for the coming years. The company’s shares are currently up 4%.

Salzgitter (SZG.DE) gained nearly 3% on the latest move by JPMorgan analysts, who raised their recommendation from “underweight” to “neutral” and set a target price of €28.50, which is 5.5% higher than the current price. The change in rating reflects the easing of concerns about short-term risks and the stabilisation of results. The company is preparing for its next financial results, which will be published on 10 November.

Monte Paschi (BMPS.IT), the oldest operating bank, surprised investors positively by presenting a quarterly net profit of EUR 474 million, up 17% y/y, significantly exceeding analysts’ consensus. Revenues reached €999.7 million, largely due to strong growth in fee and commission income (+7.4% y/y) and an 18% decline in loan loss provisions. These results already reflect the effects of the consolidation with Mediobanca, while the full impact of this acquisition will be revealed in the Q4 results. The bank plans to announce a new strategy in the first quarter of 2026. The bank’s shares are up 2% today.

Daimler Truck (DTG.DE) had a weaker third quarter – adjusted EBIT amounted to EUR 716 million, down 40% year-on-year and below analysts’ forecasts. The decline is primarily due to significant difficulties in the North American market, where customers remain cautious due to the weak freight market and regulatory uncertainty. The only bright spot was the performance of the Mercedes-Benz segment, with EBIT up 12% y/y to €319 million. Revenues for the entire group fell by 14% y/y to €10.59 billion, although the bus segment recorded a 14% increase in revenues. The company is maintaining its financial targets for the whole year and forecasts sales of 410-440 thousand vehicles and free cash flow in the range of €1.5-2 billion.

What does the sell side say?

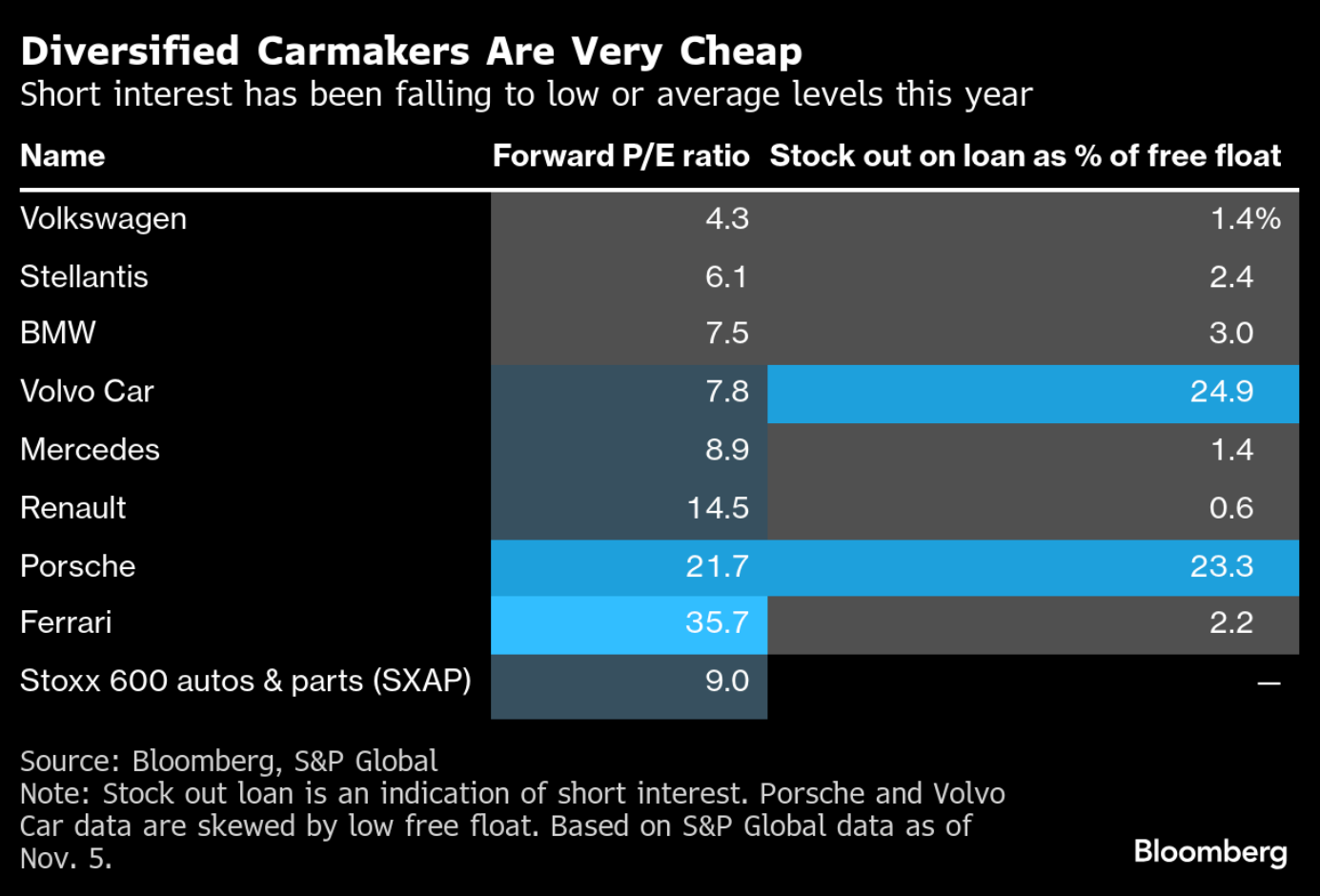

According to Bloomberg, shorting European car manufacturers has become risky, as pessimism about the industry has likely peaked. The Stoxx 600 autos & parts sub-index remains one of the weakest sectors this year, but since mid-October, the sector has risen by around 8%, while the broader market has gained only 0.6%. The sector has also proved relatively resilient to recent market volatility. Most car manufacturers have already reported their financial results with a satisfactory number of minor surprises in the form of earnings forecast cuts compared to the last two years, prompting investors to change their attitude, especially towards German brands.

Short interest values, i.e. the number of shares borrowed for short selling, are falling sharply, while the shares of these companies are rising. Investors are hopeful that capital expenditure (CAPEX) will return and that lower tariff burdens in 2026, along with the positive reception of new models such as the BMW iX3 and Mercedes GLC, will improve margins and free cash flow, which could increase distributions to shareholders.

Automotive remains the cheapest sector in terms of the European capital market. Source: Bloomberg Financial LP

Despite these positives, the industry faces several challenges, such as US tariffs, weakening demand in China and growing competition from Chinese manufacturers. The automotive industry remains the cheapest sector in Europe in terms of forward P/E ratio of around 9, and earnings forecasts have stopped falling, suggesting an end to the downward cycle. Subsidies for electric vehicles in Germany and cost-cutting programmes at companies such as Volkswagen and Volvo are expected to support a rebound next year. Another positive factor is that the German business climate and PMI indices in industry are showing improvement, indicating increased investor optimism. according to a Bank of America survey, the number of market participants with an underweight position in the automotive sector has decreased over the last three months, reaching its lowest level in two years, which may herald a further rebound in these manufacturers’ shares.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.