The relief rally in markets has spread to Europe. Markets are a sea of green, however, there has been some easing in the rally, particularly for the UK. The FTSE 100 opened higher by 6% earlier this morning and is now trading UP 4%. European markets are also fading earlier gains, the Eurostoxx index is higher by 5.4%. After an historic rally on Wednesday night for US stocks, US stock index futures are now in the red, suggesting that tailwinds from the tariff threat remain.

Trade wars remain a threat for markets

The trade war between China and the US is still in full swing, and tariff levels between the two largest global economies have never been higher. This is weighing on the oil price, which is lower once again on Thursday, and Brent crude is down 2.6% to $63.70 per barrel. Reports suggest that China could announce stimulus measures to boost its economy, however, they have not been forthcoming so far. Chinese and Hong Kong stocks also rallied today, although by less than European and US peers. Chinese stocks will benefit from the rest of the world avoiding recession if reciprocal tariffs from the US are moderated, which is why they are joining in the global equity market rally on Thursday.

Volatility levels: down, but still elevated

Volatility has been assuaged by the pause in tariffs, however, the Vix remains well above the average of 17 for the past 12 months, and it has started to turn higher as we move through this morning. This is worth watching. If the pause in tariffs does not placate markets, then what will?

Bond traders remain skeptical of Trump

Bond market volatility, as measured by BOA’s MOVE index has also backed away from recent highs, however, it remains elevated, which is one reason why bonds have not recovered fully from this week’s steep sell off. UK bonds are outperforming on Thursday, after yields surged sharply in the UK on Wednesday. 30-year UK Gilt yields are down 16bps today, erasing about half of Wednesday’s move. But the 30-year yield is still elevated and remains at January’s highs. The 10-year UK bond is also outperforming on Thursday. European yields are higher while US yields are only down slightly. Short term bond yields are higher in Europe, especially in Germany, as safe haven flows drain from the market and as emergency rate cuts are priced out. The bond market is worth watching closely today. A pause on tariffs is not a panacea. All imports to the US will still face a 10% tariff rate, China and the US have imposed laughable tariffs on each other and are engaged in a full-blown trade war that shows no signs of slowing down. There is no way of knowing how the next 90 days will go, and which countries will be able to negotiate ‘good’ tariff deals with team Trump. This complicates the outlook for markets and could limit the upside for equities.

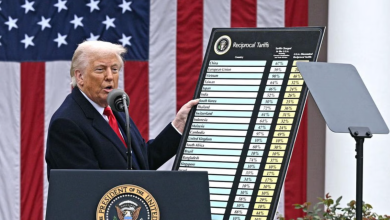

US tariffs are still sky high

After these tariffs, the US’s average tariff rate is still above 20%, which is bad news for growth, especially in the US. We also expect sectoral tariffs to hit the pharma sector in the coming days or weeks, which are unlikely to get reversed.

Today’s rally is one of relief, but the cloud of uncertainty remains in place. This is reflected in the FX market. The yen and the Swiss franc are up mote than 1% vs. the USD today, which is a sign that safe havens remain in demand, even if equities are clawing back some of the staggering losses from recent days.

From a stock perspective, these four companies stand out:

1, Nvidia: its stock price rose by 18% on Wednesday after the announcement of a pause on tariffs. The stock is down 3.5% in the pre-market today, which could weigh on the overall US blue chip index. However, we think that the pause is good news for Nvidia, since Taiwan, Nvidia’s manufacturing hub, is now less exposed to US tariffs in the medium term.

2, Amazon: The online retailer announced on Wednesday that it was pausing imports of Chinese goods due to the tariffs. Since many Amazon products originate in China, it remains caught in the cross hairs of the trade war between China and the US. However, Amazon has a strong, global business, which is why its stock price rallied by nearly 12% on Wednesday, as a lower chance of a global recession is positive for a consumer goods company like Amazon. Its share price is also lower in the pre-market.

3, Mercedez Benz Group: The German car marker is higher by 5.6% on Thursday, even though 25% tariff rates are still in place for car exports to the US. This is a relief rally after the 20% decline in Mercedez’s share price in the past month. We do not think that the stock will completely reverse all recent losses, as US tariffs remain a major threat to the earnings potential for European car makers.

4, Tesco: the UK grocer is bucking the global trend and is down by 6.3% on Thursday. The company issued a profit warning this morning, due to higher costs and more price conscious UK consumers. Not even a larger share buyback could protect the share price today. This tells us two things: 1, now that tariffs are paused, the focus will shift to company-specific factors that will also start to drive stock prices in the coming days and months. 2, earnings misses will be punished by investors, which makes Q1 earnings season crucial for the direction of markets.

This is not quite the calm after the storm, as investors are still affected by intense political policy risk in the US. Equity markets are discounting recession risks on Tuesday, however, there is still a risk premium associated with financial assets. This is why the US stock market recovery rally has stalled, the gold price is higher, and bond markets are treading a very cautious path. We expect this to continue for some time.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.