EURUSD Heads Towards 1.15 Amid Diminishing Chances of a December Fed Cut

The dollar is preparing for a positive close not only this week but also this month. The EURUSD pair is breaking local lows from mid-month today and is heading towards the 1.1500 level amid diminishing chances for interest rate cuts in the United States. The dollar is strengthening against every G10 currency today.

The probability of a rate cut in the US has decreased from around 90% before the last Fed decision to a level of nearly 60%. If next week’s data, such as the ISM indices or the ADP report, turn out positive, it could increase the Fed’s confidence regarding the state of the US economy and lead to further dollar strengthening. Moreover there are some signs that the EBC may be flexible in the near future which may mean that the interest rates may decrease in the next year.

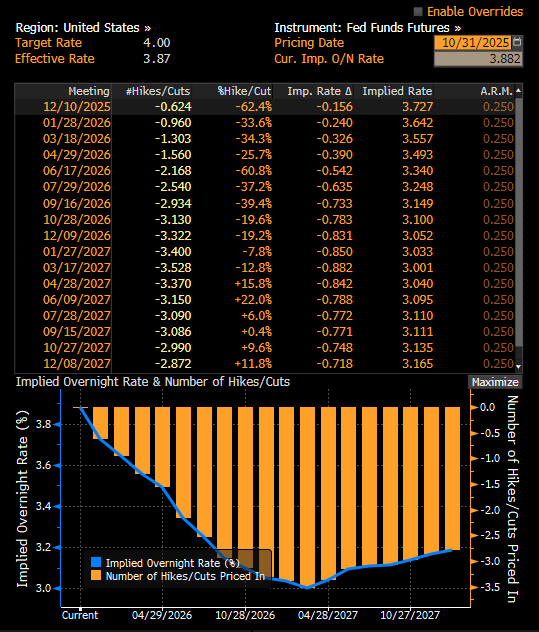

Expectations for Fed cuts have decreased. The market now sees interest rate declines to around 3.0% by the end of this cycle, considering the effective rate (3.25% for the upper bound). Source: Bloomberg Finance LP, XTB

EURUSD is falling below the 1.1530 level today, breaking through the mid-month support. Just 3 sessions ago, the pair was closer to the 1.17 level, but currently, it seems that the 1.1500 level is within reach. Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.