Fed Talk – Will The Fed be Late With Cuts Again?

Another exceptional publication from the United States lies ahead. Today we will see the somewhat delayed NFP report, which was originally due last Friday; however, due to the temporary US government shutdown and the subsequent rapid passing of the funding bill, the release was postponed by just a few days. Furthermore, the publication arrives at a uniquely “distorted” moment: the real condition of the labour market has weakened, despite the Fed’s recent assertion that it remains in a solid state. At the same time, a series of technical revisions may cause the January report to look almost recessionary, although this will largely be a statistical illusion rather than a sudden economic collapse. From the Fed’s perspective, the key takeaway is that once benchmarks and new models are accounted for, a clear slowdown in the labour market is visible dating back to mid-2024, which may bolster the narrative for further rate cuts in 2026.

The labour market situation

- The BLS is set to revise down total employment levels across the economy, erasing a total of nearly 1m jobs from the end-2025 level, which will roll back the historical image of labour market strength.

- Revisions and new seasonal factors will show that the labour market looked significantly worse than monthly data suggested, and we likely saw several negative readings in 2025.

- Alternative indicators (including Homebase and Bloomberg data) suggest that employment hit a floor in mid-2025, with a very slow, fragile recovery underway since then.

- The unemployment rate is hovering around 4.4%, with a slight increase in participation. The unemployment rate has also been influenced by new regulations introduced by the Donald Trump administration.

Key assumptions for today’s January NFP report

- Non-farm payroll (NFP) change: Bloomberg’s forecast is 0k jobs m/m (following 50k previously), against a consensus of around 70k, though the reading will be heavily distorted by revisions and seasonality. Such large discrepancies between consensus and forecasts in various previous readings show that the real situation on the labour market may differ significantly from what the data suggests.

- In non-seasonally adjusted terms, Bloomberg estimates an employment drop of approximately 3m jobs, corresponding to a typical January “reset,” while the final seasonally adjusted (SA) result depends largely on the newly estimated seasonal factor (with a risk of deviation of ±40k from the forecast).

- The unemployment rate forecast is approximately 4.4% with a slight increase in participation to around 62.4%, suggesting the economy can absorb a somewhat larger labour supply without further market tightening.

- The weak headline NFP figure itself is expected to be largely a methodological effect (revisions, birth-death, seasonality) rather than a sharp collapse in labour demand, which limits the “recessionary” significance of the report.

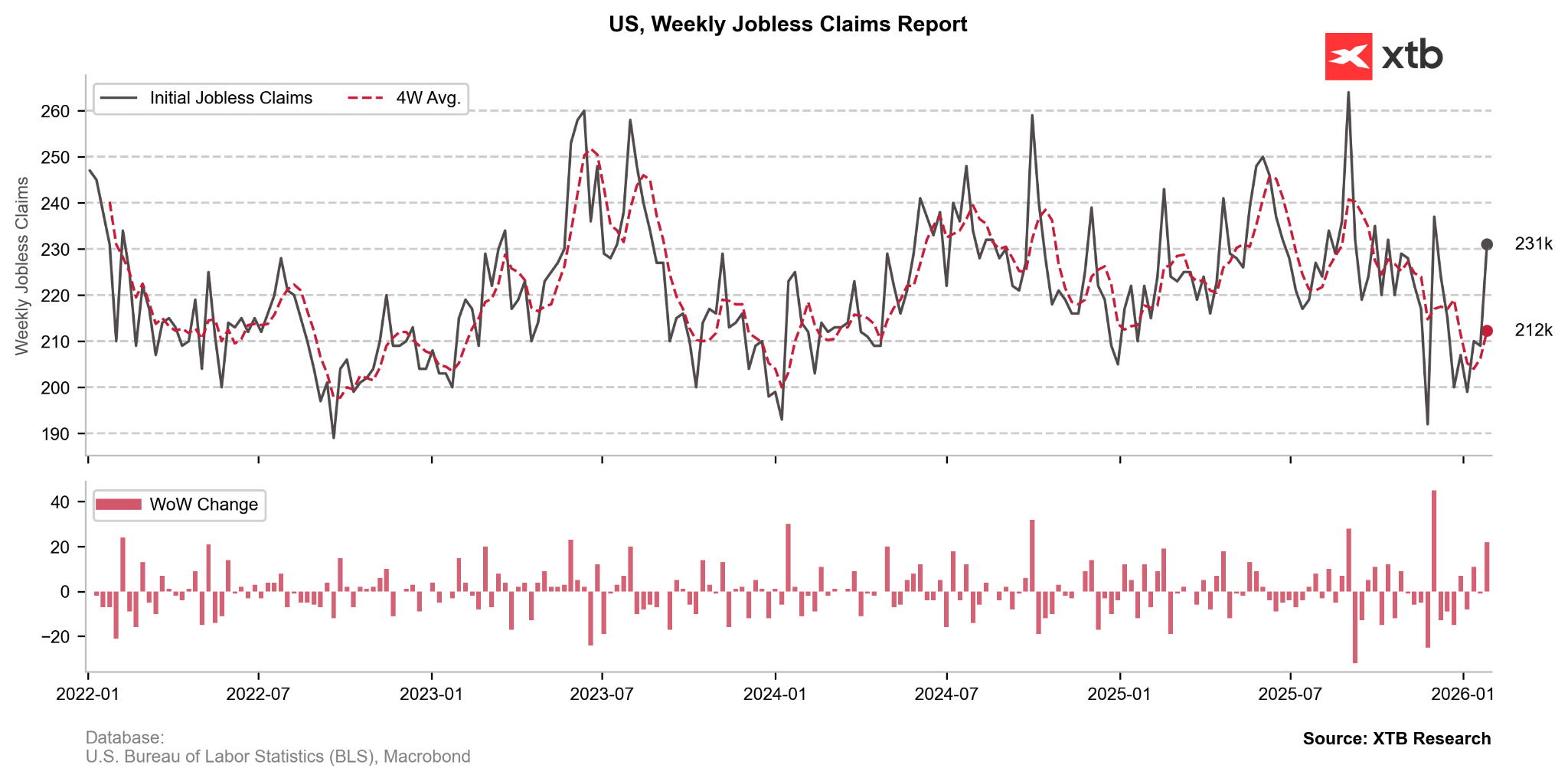

Jobless claims remained at very low levels throughout January, which should offer a chance for a strong NFP report. On the other hand, the latest reading showed a clear increase, though it will not impact today’s NFP report. Source: Bloomberg Finance LP, XTB

Jobless claims remained at very low levels throughout January, which should offer a chance for a strong NFP report. On the other hand, the latest reading showed a clear increase, though it will not impact today’s NFP report. Source: Bloomberg Finance LP, XTB

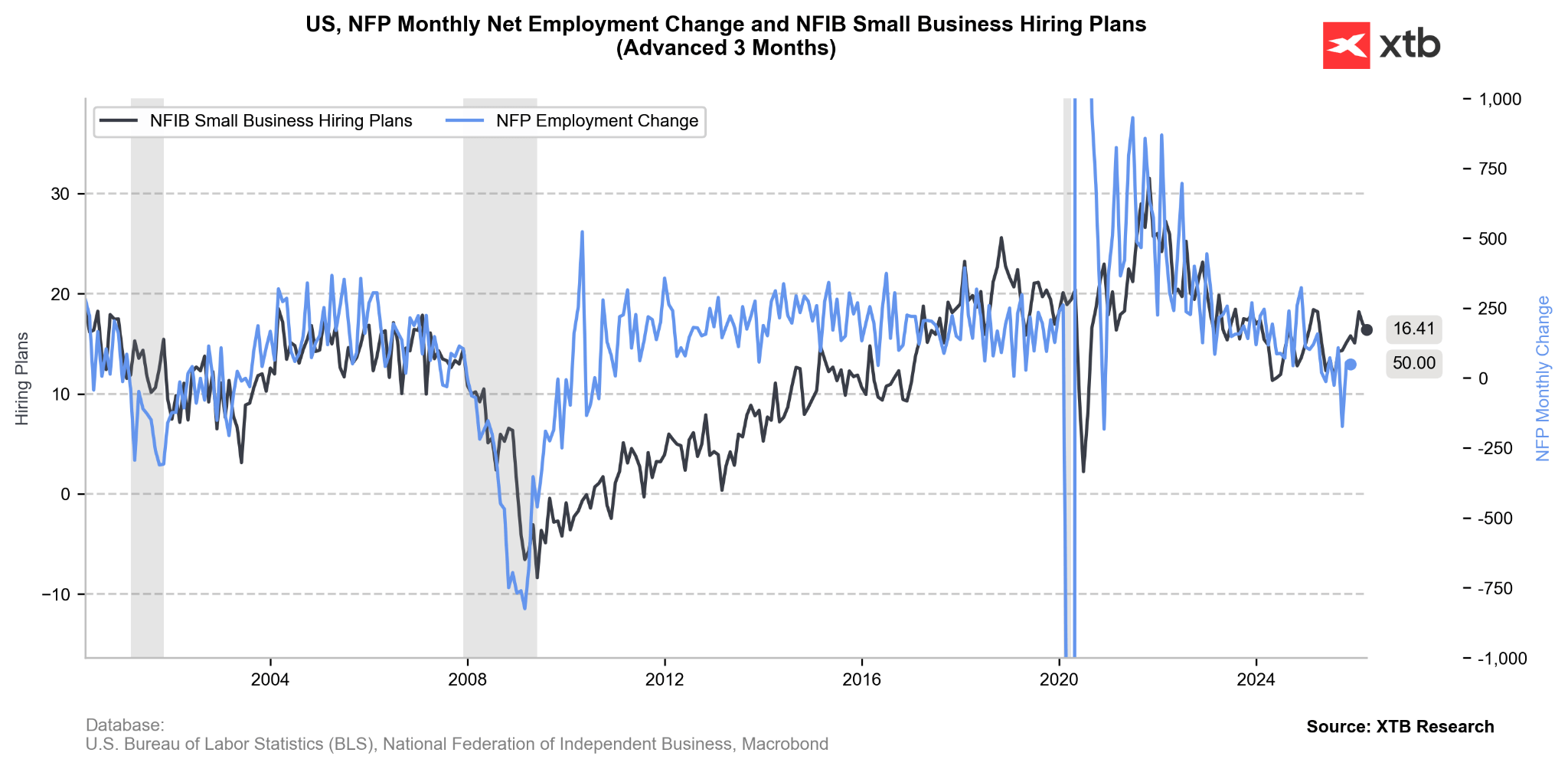

A leading indicator in the form of the NFIB report suggests that NFP could be higher. However, it is worth noting that the hiring plans index concerns small firms, not the entire economy. Source: Bloomberg Finance LP, XTB

A leading indicator in the form of the NFIB report suggests that NFP could be higher. However, it is worth noting that the hiring plans index concerns small firms, not the entire economy. Source: Bloomberg Finance LP, XTB

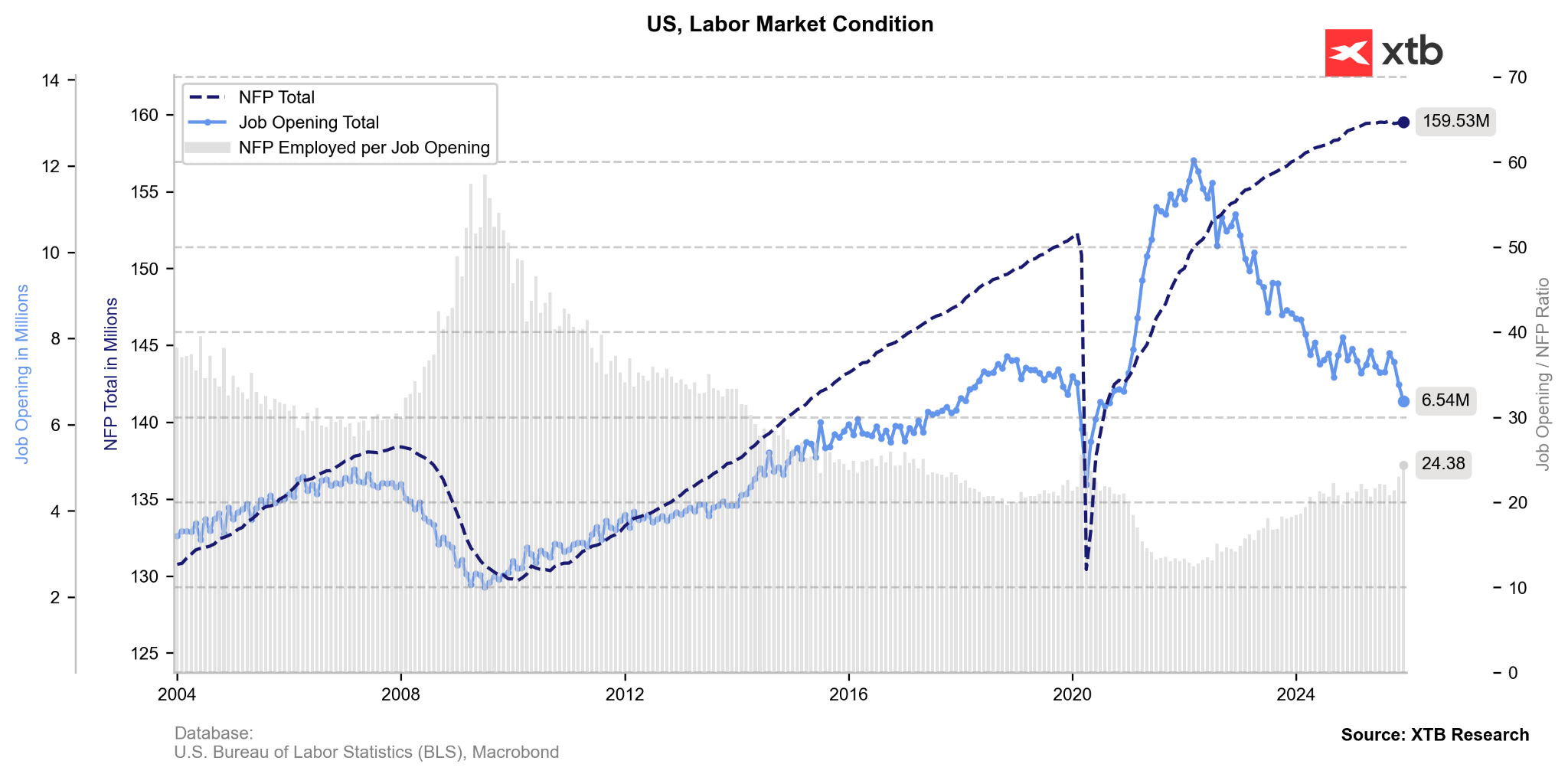

The figure indicating total NFP and the massive drop in JOLTS suggest that the labour market is not in great shape at all. While a typical collapse is not yet visible, NFP itself will be revised down by approx. 1m for 2025, and the number of job openings is at levels recorded in 2020, or previously in 2017. Source: Bloomberg Finance LP, XTB

Revisions, structure, and data noise

- The BLS annual re-benchmarking to the QCEW is set to lower the employment level in March 2025 by approx. 666k jobs, while updates to the birth-death model and seasonality for the April–December 2025 period are expected to subtract another approx. 270k.

- In total, revisions may lower the payrolls level at the end of 2025 by nearly 1m spots, breaking the previous narrative of a “surprisingly resilient” labour market. It is worth noting, however, that these revisions have been occurring for a long time and consistently indicate that the labour market is in much worse condition than initial data suggest.

- Volatility in participation, largely among African Americans, was a significant source of fluctuations in activity and unemployment rates in 2025; part of this movement is linked to the tightening of work requirements in transfer programmes (e.g., SNAP) following the implementation of the OBBBA.

- The BLS is delaying this year’s standard January population control adjustment until the February report, meaning part of the population and labour force adjustment will only “hit” in the following month, without changing the unemployment rate itself.

Implications for the Fed

- The combination of a weak, downwardly revised labour market picture and more subdued January CPI (due February 13) creates an environment conducive to an earlier start of the next round of rate cuts.

- Bloomberg Economics assumes a total of approx. 100 bps of cuts in 2026, arguing that the labour market has long been balancing below the pace required to keep unemployment in check.

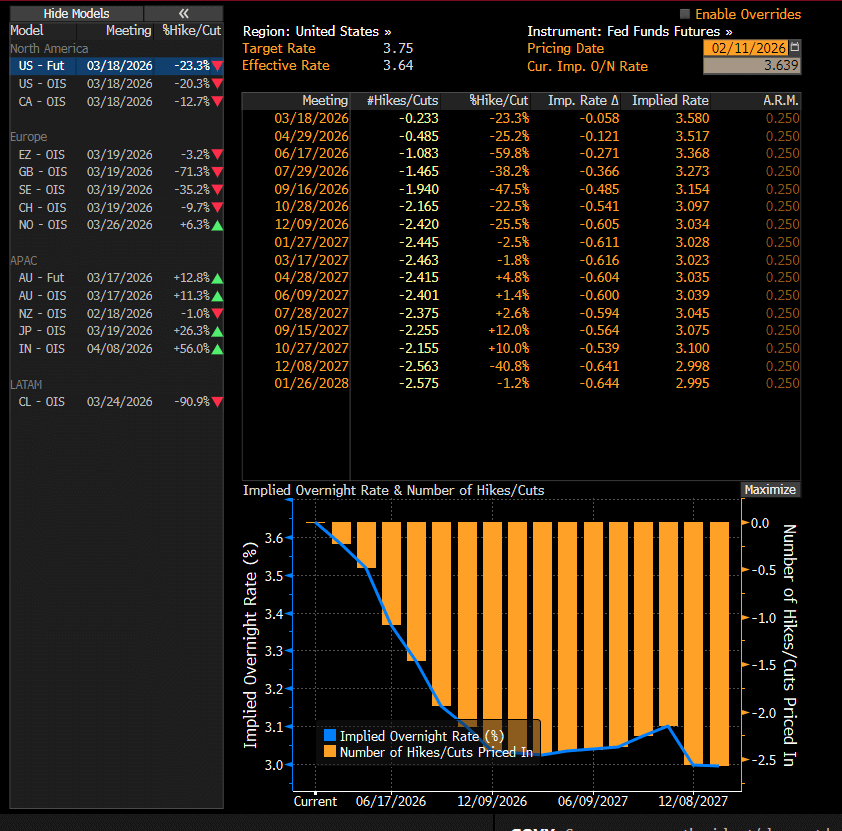

- At the same time, the market is pricing in approx. 2 cuts in 2025. It is worth remembering that April will be the final meeting with Jerome Powell as Fed Chair, as he departs his post in May. Theoretically, Warsh may attempt to build a consensus for the entire path of cuts if the labour market is indeed doing worse than data suggest.

- For the Fed, a weak NFP—even if partially “technical”—combined with softer inflation will confirm that the risk of “over-tightening” outweighs the risk of inflation re-accelerating.

- For the market, this means that “bad” NFP data (weak payrolls, stable or slightly higher unemployment) will be read in the short term as a dovish signal for rates, even if analyst commentary emphasises the technical nature of the revisions.

- A weak reading could lead to dollar weakness and lower yields in anticipation of a more dovish Fed stance on future interest rates. Simultaneously, this could reawaken precious metals, primarily gold, to continue recovering losses.

The market is pricing in just over 2 cuts this year, with the first not until June—the point at which new Fed Chair Kevin Warsh will be in power. Including June, there will be 5 meetings remaining, allowing interest rates to be cut significantly more than market expectations suggest. Source: Bloomberg Finance LP, XTB

What does this mean for the dollar?

Expectations point to a solid NFP report with a consensus of 70k, maintaining the unemployment rate at 4.4% and a drop in wage growth to 3.6% y/y. The market also expects a downward revision to employment of 1m for 2025. As can be seen, short-term forecasts are solid, but from a long-term market perspective, they are quite weak.

Bond yields are falling clearly, which should suggest further dollar weakness. An NFP reading closer to 0k, as Bloomberg suggests, along with a massive revision of total employment for 2025, could lead to a test of the 1.20 area. However, the consensus consistently shows a solid reading of 70k, and expectations regarding the full-year NFP revision are already known. Claims suggest a solid NFP, even despite a relatively low ADP reading. If the NFP reading is higher than 50-60k, and particularly if the unemployment rate falls or wages come in higher, there will be a chance to return to the 1.1770 level, which even with rising yields could lead to a closing of the divergence. Nonetheless, it is worth remembering that any sign of weakness from the labour market could contribute to a shift in stance from the Fed.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.