Gold Plunges 5% – Precious Metals Slide Into Correction

Mass profit-taking and mounting pressure on leveraged long positions are weighing on precious metals today. Gold is down nearly 5%, and the pullback from its all-time high is now around 10%. Silver is also sliding sharply, down almost 8%. Palladium is off nearly 9%, while platinum is retreating by as much as 10%.

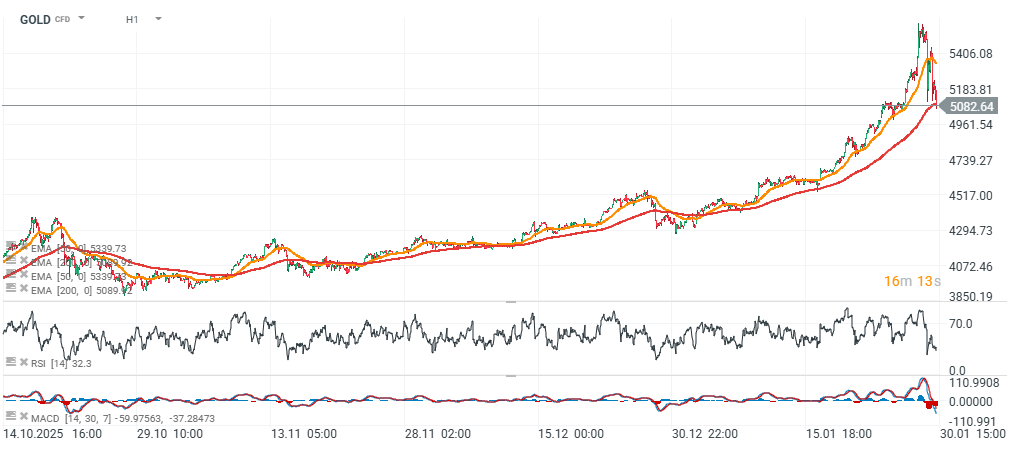

The move comes despite major banks such as JPMorgan and UBS raising their forecasts, suggesting that short-term momentum has turned against precious metals. Gold’s RSI plunged yesterday from around 89 to just under 28, during one of the largest precious-metals sell-offs in modern market history.

Gold is currently testing the EMA200 (red line) near $5,100 per ounce. Volatility remains elevated and bulls may attempt to reverse the move quickly. A potentially solid support zone appears around $4,600–$4,700 per ounce (one standard deviation).

GOLD (H1)

Source: xStation5

On the daily timeframe, the current correction range looks roughly 1:1 compared with the October decline, although it’s worth noting that the latest pullback followed a much stronger prior upswing, which naturally increases the likelihood of a larger deviation.

Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.