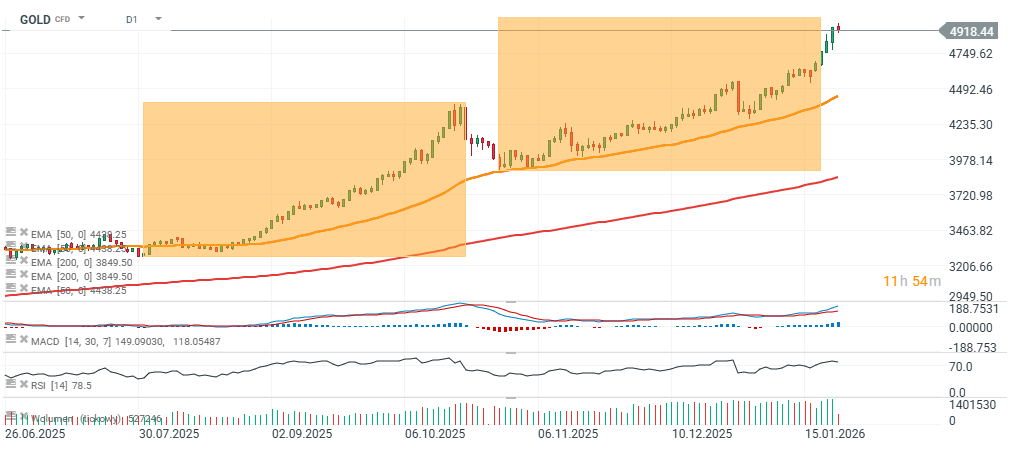

Gold.xau – Correction Risk Rising ? Golman Lifts 2026 Target

Precious metals are benefiting from a broader destabilization in global financial markets, which is weighing on the US dollar and potentially on demand for US Treasuries. The diversification trend away from Treasuries appears strategic and long-term in nature, supporting the fundamental backdrop for gold in particular. Goldman Sachs has raised its 2026 gold price target to $5,400 per ounce, up from $4,900 previously.

- If we assume the next leg in gold follows a 1:1 pattern similar to the two prior impulses—and that the corrective phases also respect a 1:1 structure—this would imply a potential pullback toward $4,400 before a new upside impulse. In that scenario, the next move could be roughly $1,000 higher, taking gold toward $5,400 per ounce, broadly in line with Goldman’s projection.

- The two previous upward impulses (July–October, and mid-October–January 2026) each delivered gains of around $1,000 per ounce. If the corrections were to be comparable as well, a pullback of roughly $500 would be consistent—pointing to a potential test of the $4,400 area. That said, there is no certainty that gold will continue to follow this pattern, or that a 1:1 correction must occur at this stage.

The biggest risk for gold and the broader metals complex appears to be Jerome Powell remaining in charge of the Fed—an outcome that would likely reduce the chances of implementing a “Trump model,” in which the Federal Reserve cuts rates aggressively while tolerating inflation near target. Even so, such a scenario would not necessarily prevent foreign central banks and large funds from deciding to reduce exposure to Treasuries. Against the backdrop of escalating tensions around Greenland, this is a debate that could increasingly matter for Nordic countries and pension funds in Northern Europe, not only for BRICS nations.

GOLD (D1 timeframe)

Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.