Jefferies downgrades Tobacco Giant’s Shares

Jefferies downgraded its recommendation for Philip Morris International (PM.US) from Buy to Hold, while lowering its target price from $220 to $180. The new valuation implies an increase of only 3.7% from the last closing price. The analyst’s decision is justified by intense competition in key growth segments – the nicotine pouch segment is dominated by British American Tobacco, while Japan Tobacco is increasing competitive pressure in heated tobacco. These two categories were the main drivers of PE re-rating for PM, and their loss threatens to limit the potential for valuation growth over the next 12 months.

* Philip Morris International is one of the world’s largest tobacco companies, best known for its iconic brand Marlboro – the best-selling cigarette globally, which generates a significant portion of the group’s revenue. In addition to Marlboro, the company’s portfolio includes other well-known cigarette brands such as Chesterfield, L&M, and Parliament, which maintain strong positions in international markets. In recent years, PM has been actively diversifying its business towards alternative products, especially IQOS (electronic tobacco heating system) and modern nicotine products (pouches), focusing on the transition from traditional cigarettes to less harmful alternatives.

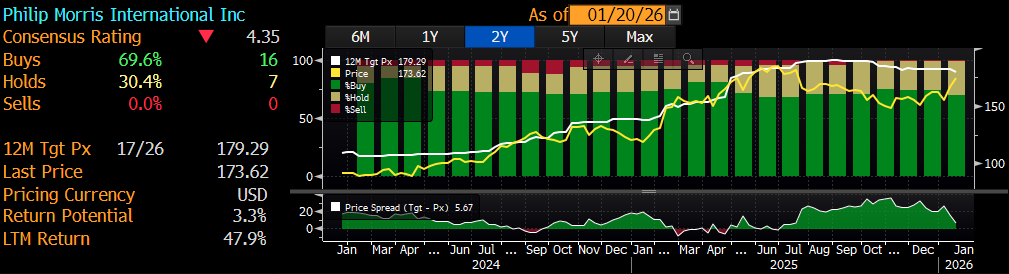

As shown by Bloomberg Terminal, none of the analysts covering Philip Morris currently assign a “sell” rating to the company. Source: Bloomberg Financial Lp

Structure of the Decline in Cigarette Volumes in the US

Barclays research indicates a multidimensional decline in traditional cigarette volumes in the United States. A breakdown of volumes reveals four main downward factors:

- Demographic decline: -2.5% per year (younger generations smoke less)

- Price elasticity: -2.1% (a 6% increase in cigarette prices reduces volumes by ~2%)

- Cross-category cannibalization: -3.9% (switch to e-cigarettes, pouches, illicit vape)

- Total: estimated decline of -8.5% in 2025 and -8.0% expected in 2026

Fuel Price Effect – Insignificant Assistance

Statistical data show an inverse relationship between gasoline prices and cigarette volumes (elasticity: -0.1). Historically, between 2014 and 2016, when oil prices fell from $3.44 to $2.25 per gallon, the decline in volumes slowed to -2.5% over two years (compared to the normal rate of -4.6% per year). Current gasoline prices are 6% below the 2025 average, which could potentially add 0.5% growth in cigarette volumes. However, this is a marginal effect, insufficient to change structural trends.

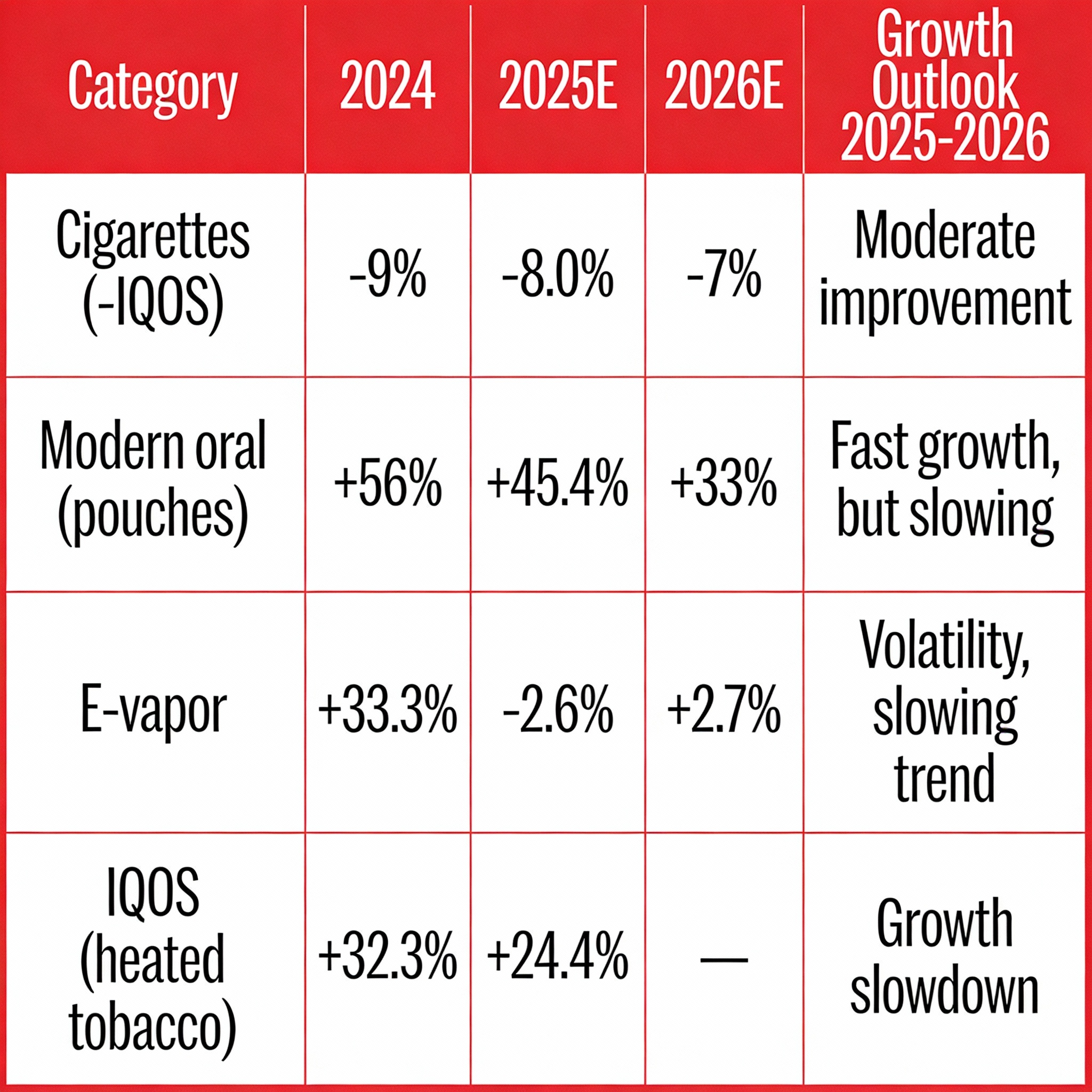

The Dynamics of Alternative Categories

The modern oral segment shows the fastest growth (+45.4% in 2026E), but the pace of growth is steadily declining. IQOS, key to PM’s strategy, is slowing down (+24.4% in 2026E vs. +32.3% in 2024). Source: XTB Research

PRICING

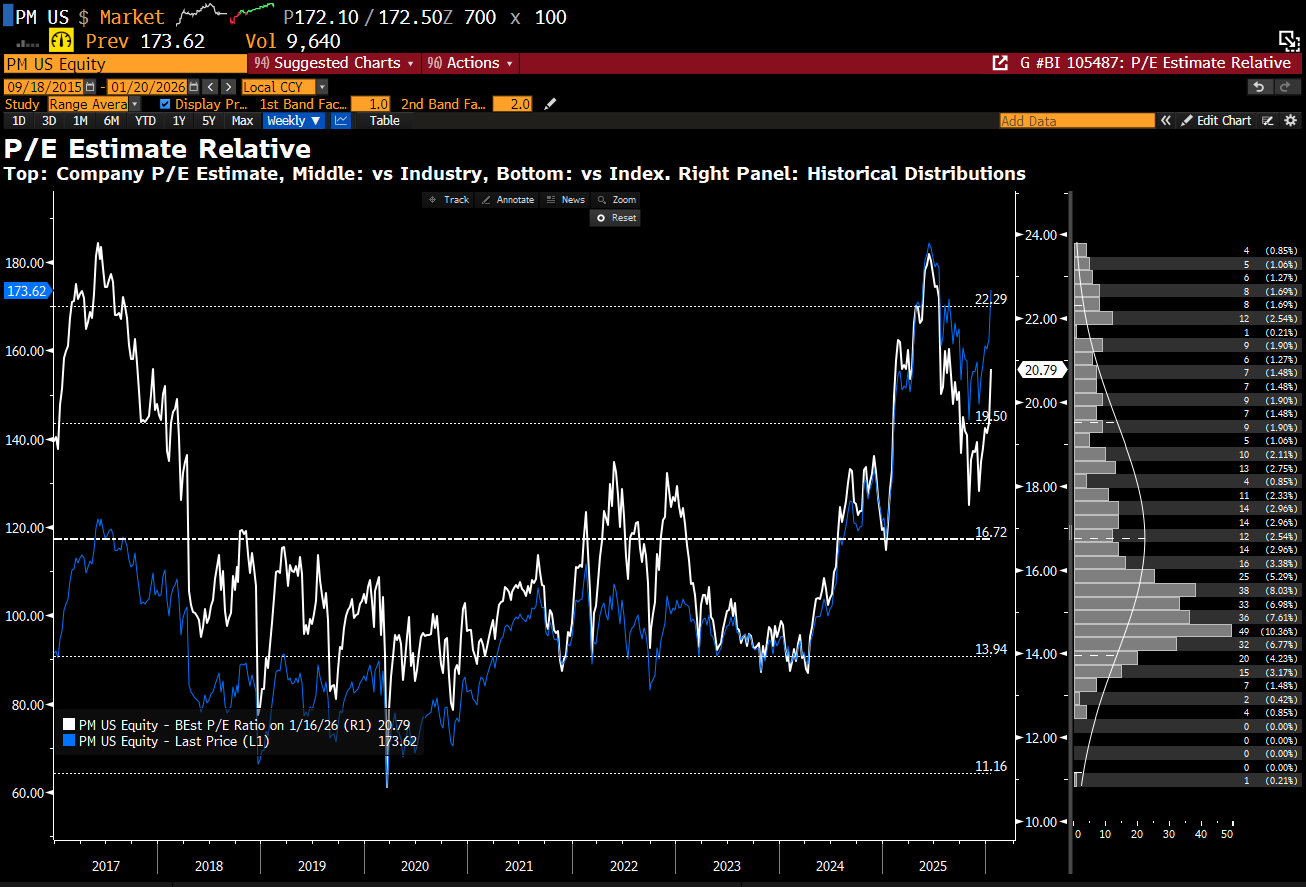

The company’s valuation currently remains significantly elevated. Based on the average since 2017, the estimated P/E ratio for the next 12 months is above 1.5 standard deviations. Source: Bloomberg Financial Lp

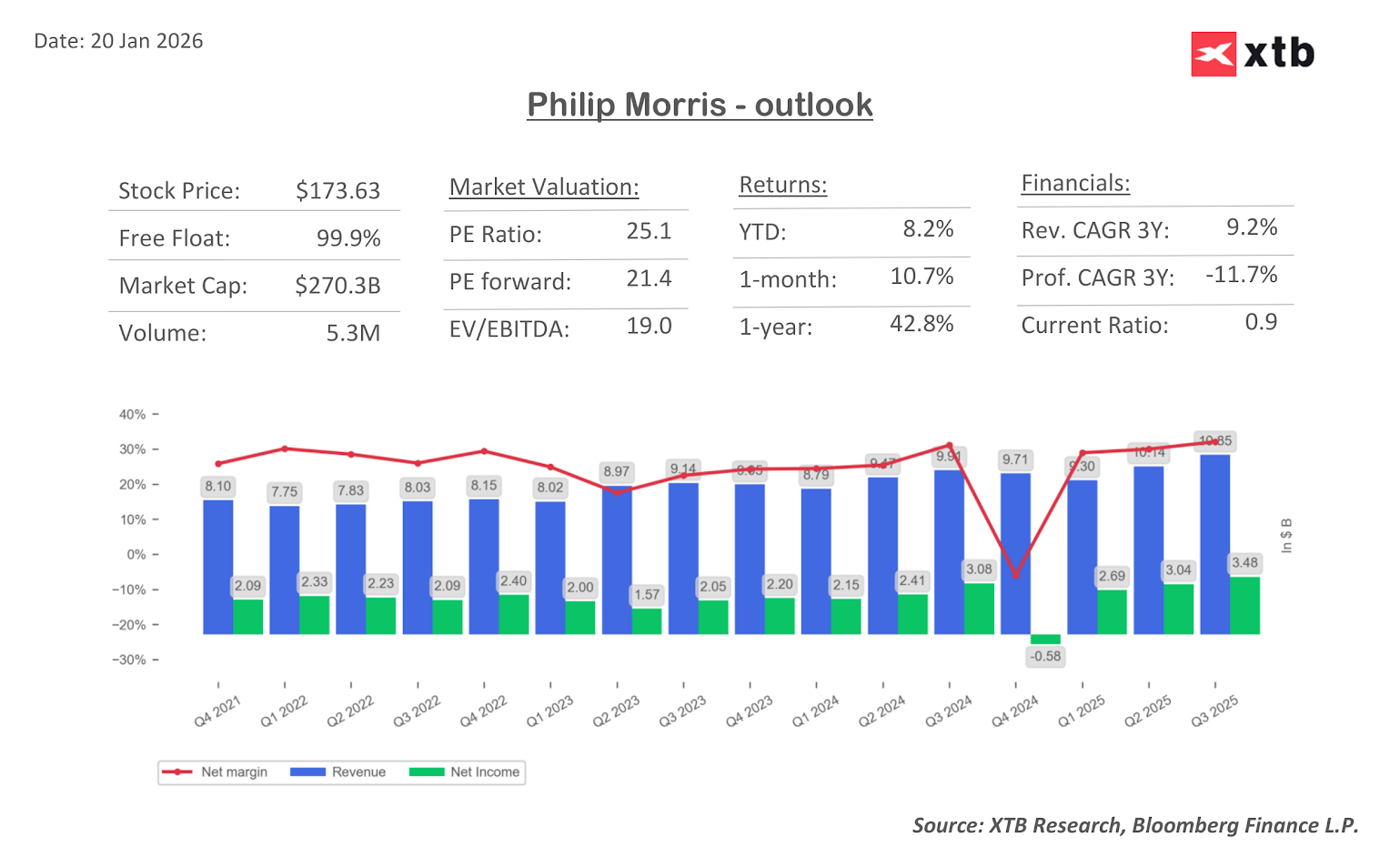

Company dashboard showing key financial metrics. Source: XTB

Philip Morris shares are now trading at their highest levels since August 2025. The RSI for the 14-day average is above 70 points. Source: xStation

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.