Metals – Gold FOMO Amid Record After Record

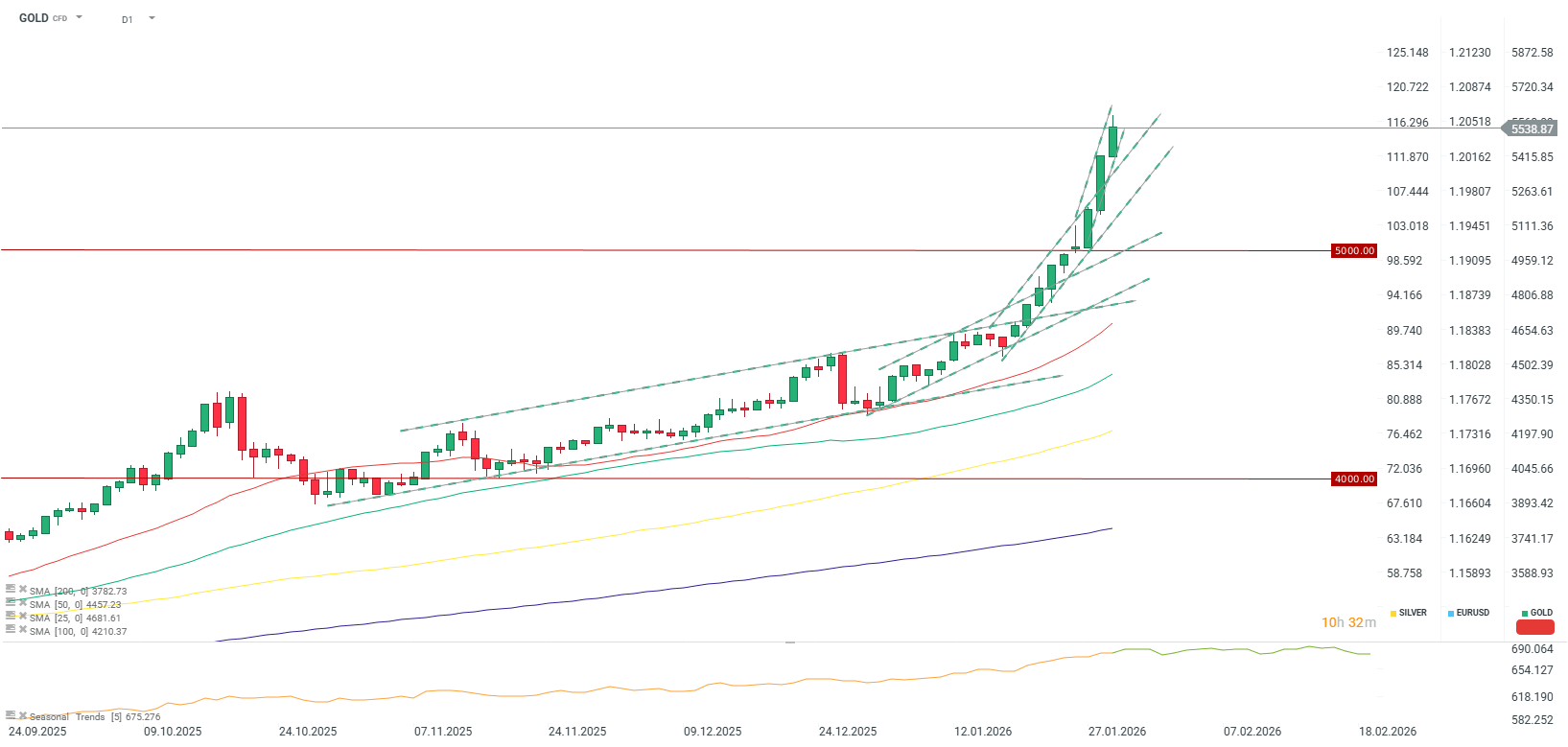

The year 2025 will be remembered as a watershed moment for precious metals. Gold notched a record 53 all-time highs over the course of the year, gaining more than 60%. Over the trailing 12 months, that return has surged past 100%. Having closed last year just above $4,000 per ounce, the current level of $5,500—reached less than a month into the new year—appears almost surreal. Yet these figures are merely the tip of the iceberg.

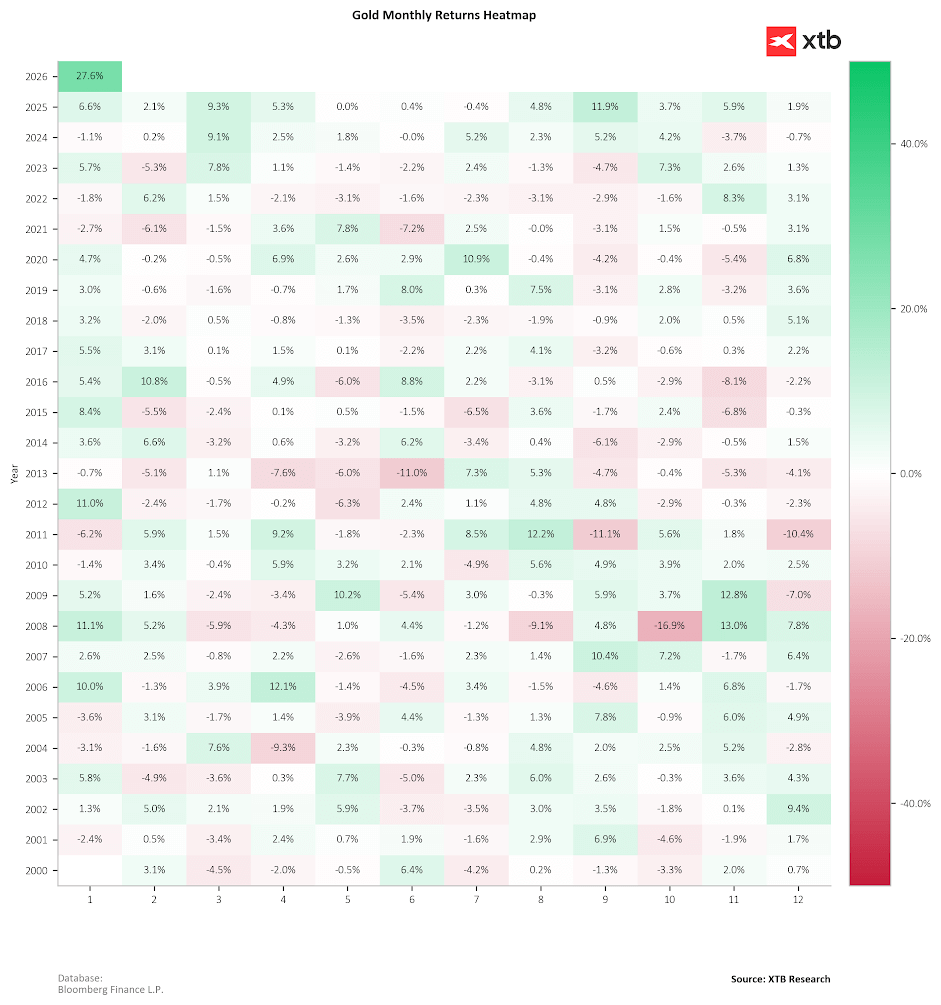

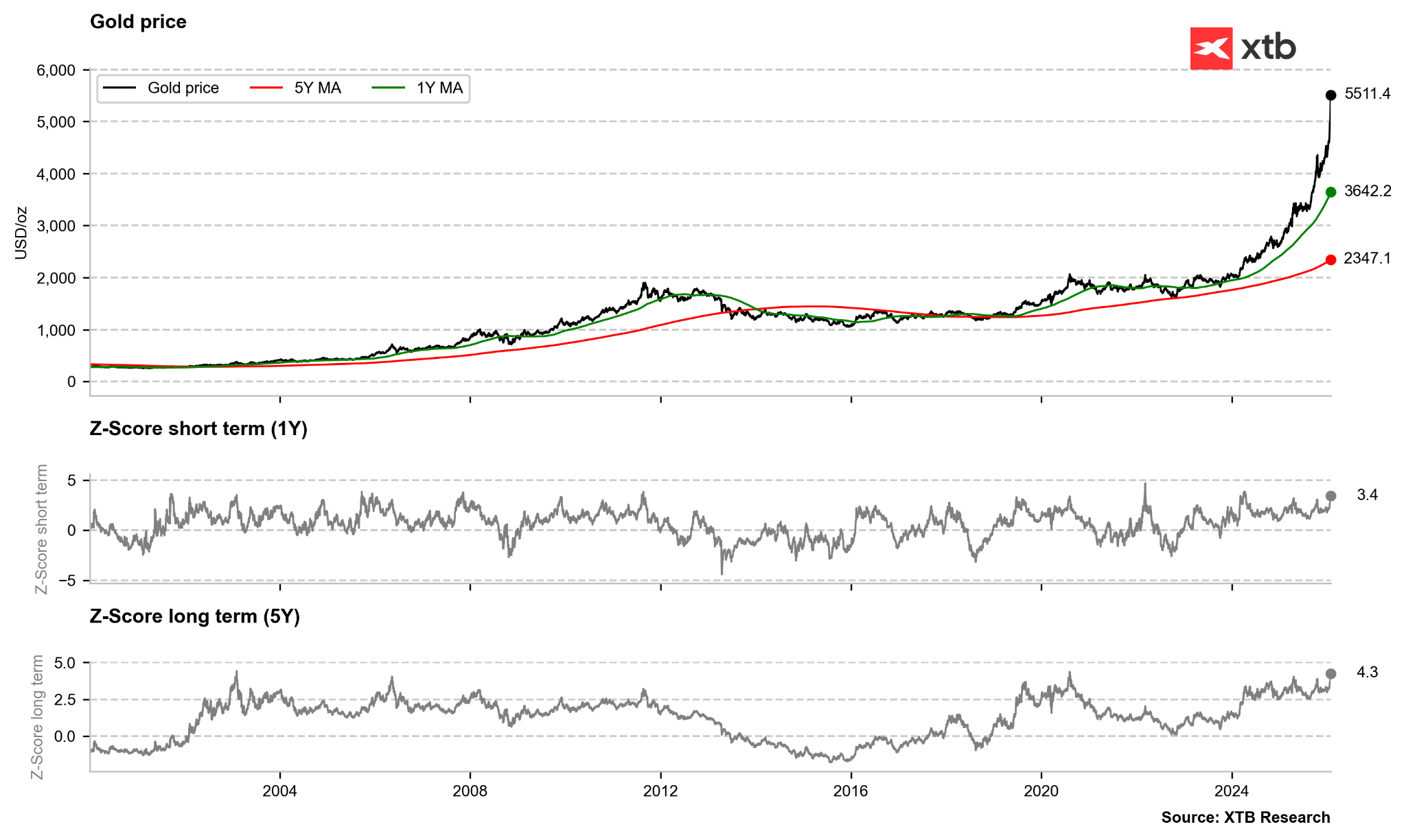

Growth in January 2026 reached nearly 30%. We have not witnessed such extreme market conditions in the last 20 years. Source: Bloomberg Finance LP, XTB

The catalysts driving gold markets extend far beyond geopolitical jitters or dollar weakness. At this juncture, one must question whether the very foundations of the global financial world are fracturing, as evidenced by the retreat from traditional safe-haven assets such as US and Japanese sovereign bonds. The current bull market reflects a structural re-evaluation of currency risk and a profound shift in investor loyalty from the global financial system toward “hard” assets.

Gold hits record demand

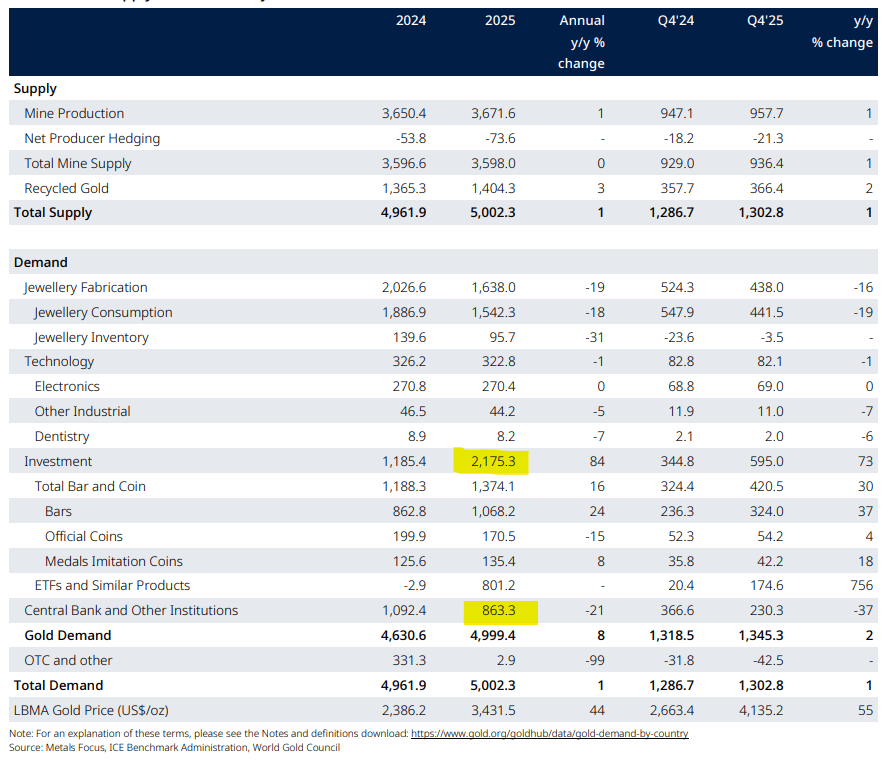

The recent surge in gold prices coincided with the release of the latest World Gold Council report. While a rise in demand was widely anticipated, the data revealed new milestones. Including over-the-counter (OTC) transactions, gold demand surpassed 5,000 tonnes in 2025 for the first time in history, with a total value exceeding $500 billion. This is not a fleeting spike, but a coordinated, systemic increase in appetite across almost every market segment.

Key pillars of demand:

- ETFs: Inflows reached 801 tonnes in 2025 (the second-best year on record).

- Retail Investors: Purchases of bars and coins hit 1,374 tonnes—a 12-year high.

- Central Banks: While purchases (863 tonnes) were lower than the outlier years of 2022–2024, they remain nearly double the previous decade’s average of 473 tonnes.

Notably, 95% of central banks expect global gold reserves to increase over the coming year, with a record 43% planning to expand their own holdings. The National Bank of Poland (NBP) stands out as a leader in this trend, having been the largest buyer in 2025 with 102 tonnes added to its vaults. NBP Governor Adam Glapiński has signaled an ambition to increase reserves to 700 tonnes, citing national security—a motive that is becoming the new standard for global financial decision-makers.

Fundamental structure of the gold market according to the latest World Gold Council report. Investment demand has surged to record levels, surpassing peaks from over a decade ago and significantly outstripping demand from the jewelry sector. Source: World Gold Council

Mechanisms of the bull run: Why capital is fleeing to gold

The appreciation of gold is not merely a reaction to isolated shocks, but a response to structural shifts:

- Erosion of trust in fiat currencies: Massive US budget deficits and the perceived politicization of the Federal Reserve are undermining the dollar’s status. Threats from the Trump administration against Fed Chair Jerome Powell in January sparked significant market movements.

- Strategic De-dollarization: Emerging economies (Brazil, Kazakhstan, India) are consistently building alternative reserves. While China’s purchases slowed in the final quarter, its long-term strategy points toward a steady departure from dollar hegemony. Many central banks now target a 20% gold share in total reserves; China currently holds less than 10%, suggesting significant upside potential for future buying.

- Inflation Fears: While high inflation historically creates headwinds for gold via higher rates, the fear of an inflationary resurgence is generating fresh interest—particularly as real interest rates in several jurisdictions have plunged into negative territory.

- Geopolitical Premium and Systemic Uncertainty: The rise in “term premiums” on bonds indicates that investors are demanding higher compensation for holding long-term debt amid chaos. In Japan, 40-year bond yields recently crossed 4% for the first time, reflecting unease over extraordinary fiscal spending.

- Preference for Physical over Paper: While ETF inflows are robust, commercial banks increasingly prefer physical holdings. Under Basel III regulations, physical gold is assigned 100% value for capital reserves, whereas “paper gold” carries only 85%. Gold is now effectively treated on par with cash or high-quality sovereign bonds.

A bubble or a new reality?

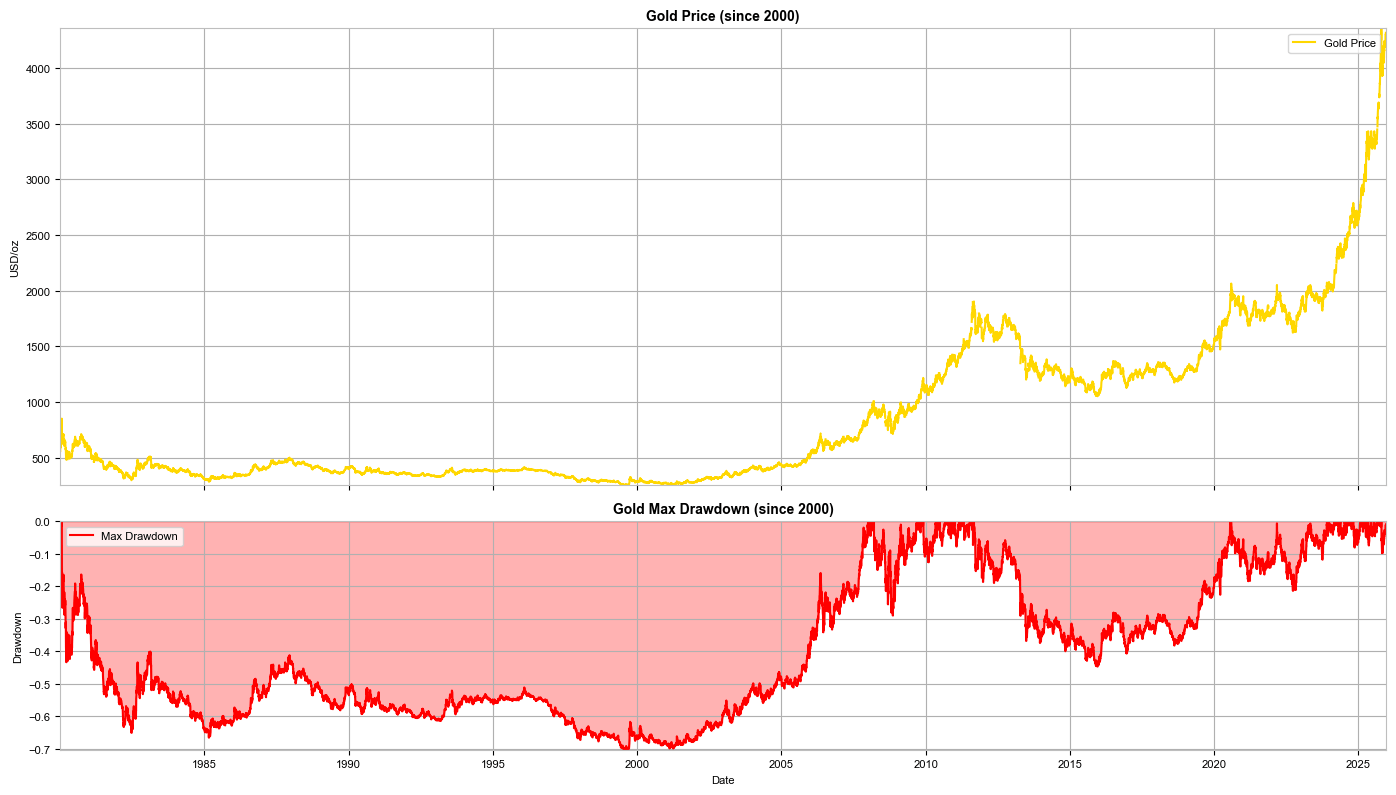

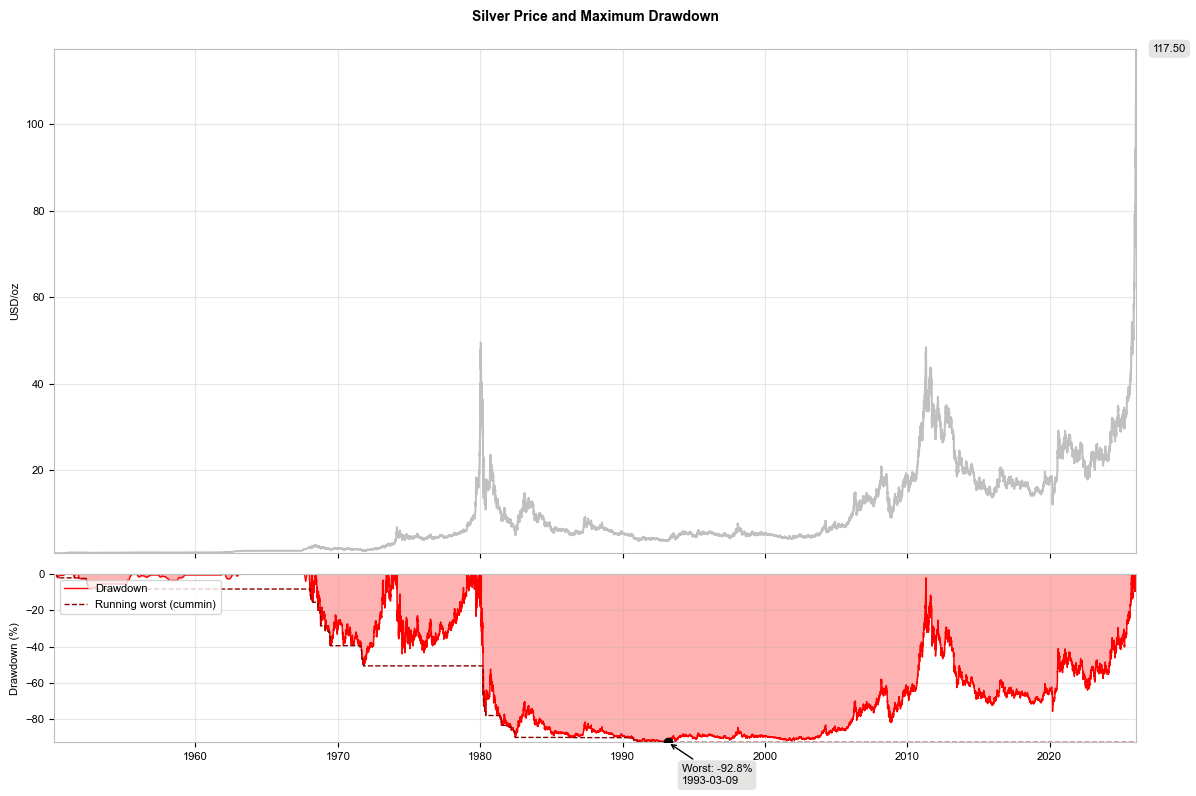

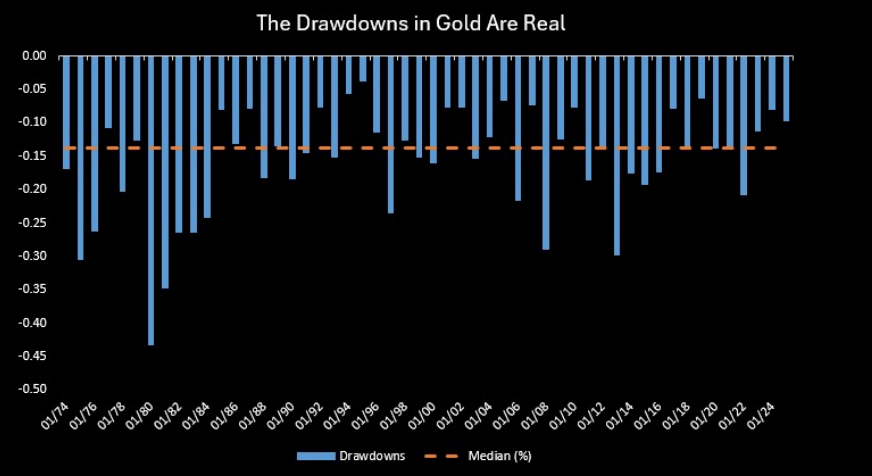

Exponential price growth inevitably raises questions about sustainability. Gold is currently trading at an extreme deviation from long-term averages. Historically, gold “crashes” have seen drawdowns of approximately 20%, with a maximum decline since 2000 of roughly 40%. Silver remains significantly more volatile, with the potential for corrections of 50-70%.

Maximum drawdowns in gold since the early 1980s. When considering the period from 1990 onwards, the maximum drawdown falls within the 40-50% range. Source: Bloomberg Finance LP, XTB

Silver is markedly more volatile, with corrections often reaching 50-70%. This is due to a demand structure distinct from gold, characterized by a smaller institutional share but benefitting from its precious metal status. Source: Bloomberg Finance LP, XTB

The deviation from the 5-year moving average now exceeds 4 standard deviations, signaling that gold is in an extremely overbought state. Source: Bloomberg Finance LP, XTB

Based on drawdowns from local peaks rather than historical highs, the median decline for gold stands at approximately 15%. Source: Bloomberg Finance LP

Despite these technical warnings, fundamentals remain exceptionally strong. While institutions like JPMorgan and Goldman Sachs previously forecasted prices in the $4,900–$5,300 range—levels already surpassed—the key will be whether these targets are revised upward. Institutional gold allocation remains at historical lows; even a marginal reallocation of capital could trigger a massive new wave of demand.

Outlook for 2026

The World Gold Council anticipates a continuation of the bull market, albeit with heightened volatility. Supporting factors include:

- Tensions in the Middle East and US-China rivalry.

- Persistent inflationary pressure and negative real rates.

- Speculative spillover into silver, which surged over 150% in 2025.

The gold rally of 2025–2026 does not appear to be a classic speculative bubble. Rather, it represents a reorganization of a financial system that, faced with systemic uncertainty, is pivoting toward tangible security. Even without a total collapse of the existing order, gold may continue to appreciate as a hedge against the changing perception of the system’s durability.

Gold serves today as a “systemic thermometer.” Its price is rising because global policymakers and investors are underwriting insurance against scenarios that were considered impossible a decade ago. We are witnessing a global repricing of trust. In a world where institutional confidence is waning, gold is reclaiming its role as the ultimate store of value.

Gold has seen a series of trend accelerations. In the event of a correction, support will be found at the lower boundaries of previous ascending channels. Currently, a potential downside target lies in the $5,100-$5,200 range per ounce. Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.