Metals – Gold Surges 2% With an Eye on $5,300 Amid Weak Dollar

Gold is up nearly 2% today and is testing levels close to USD 5,300 per ounce, lifting sentiment across the broader metals market as well as shares of mining companies such as Newmont Corp, Barrick Gold, and AngloGold Ashanti. The US Dollar is weakening ahead of the Fed meeting today, scheduled at 6 PM GMT and Fed chair Powell speech at 6:30 PM GMT.

Gold (D1 interval)

Looking at the GOLD chart on a daily interval, the RSI indicator has climbed to around 88, suggesting extreme overbought conditions. A sharp correction began from a similar level in October; back then, gold also reached an RSI reading of 90.

Source: xStation5

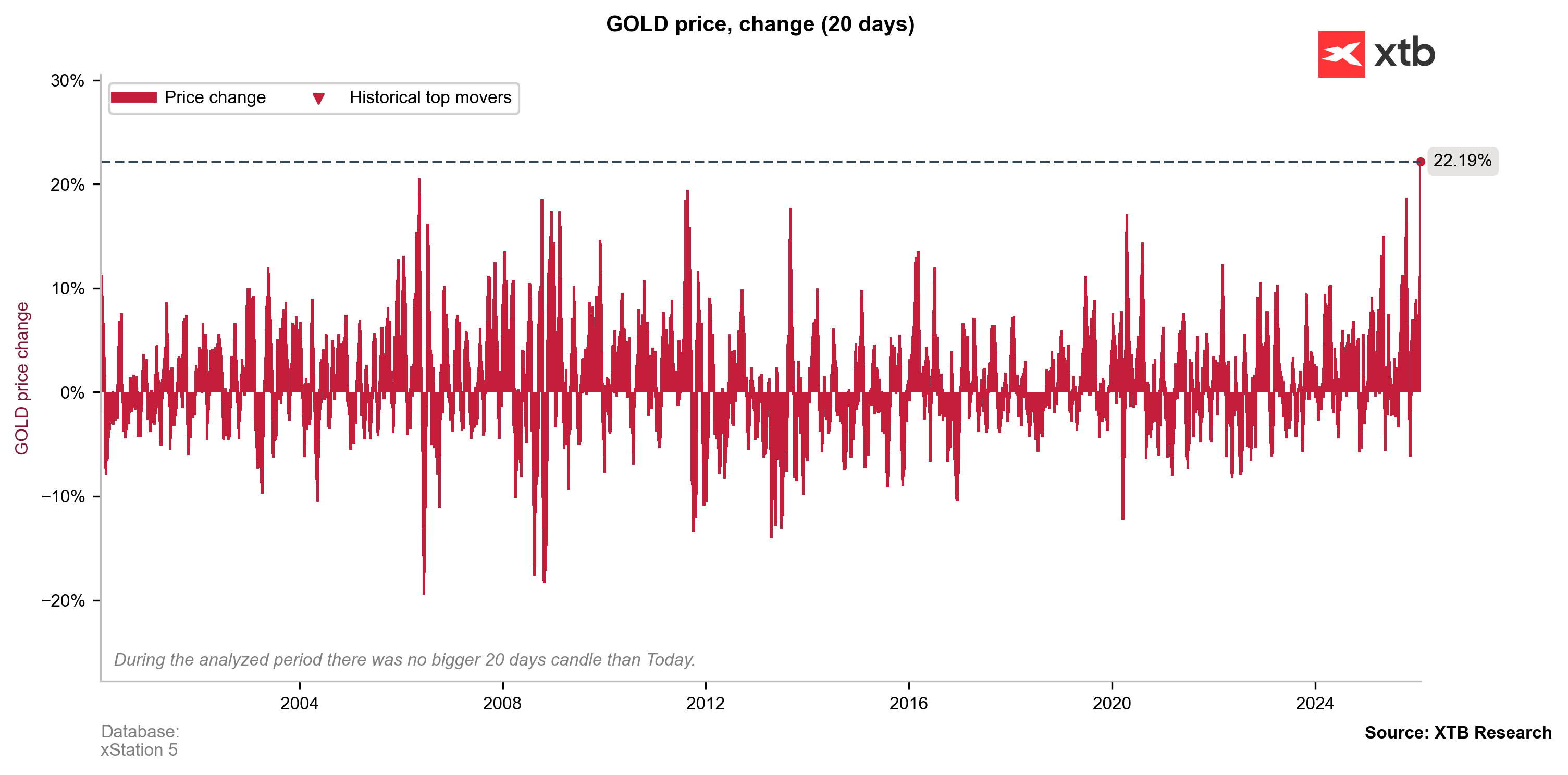

Data show that over the past 26 years, gold has not recorded stronger 20-session gains than the rally currently underway.

Source: XTB Research, xStation5

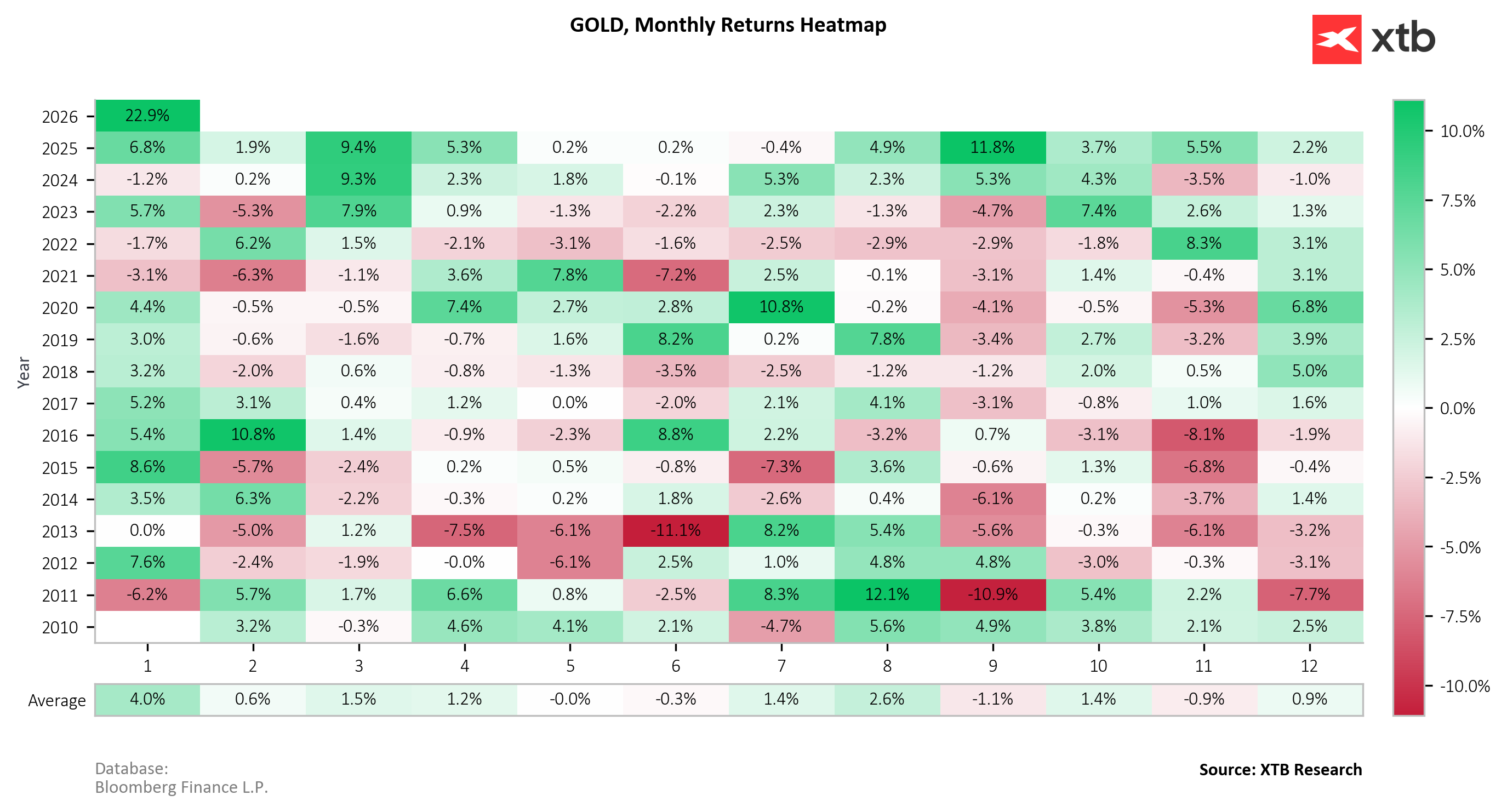

Source: XTB Research, Bloomberg Finance L.P.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.