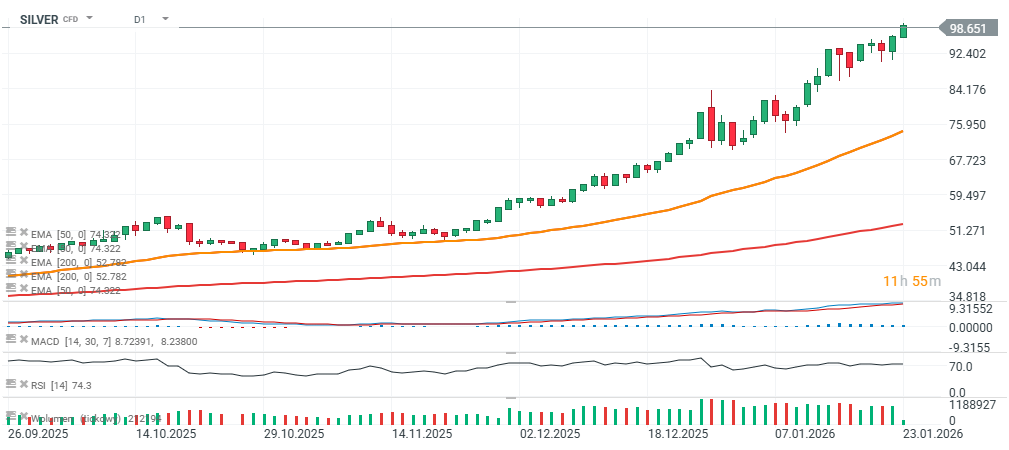

Metals – Silver.xag Surged 40% in January Moving Toward $100 Per Ounce

Silver has posted a gain of more than 40% in January and is pushing above $98.5 per ounce today, supported by a weaker US dollar and rising gold prices. In a special note, Bank of America said that $170 per ounce over a two-year horizon remains possible if retail investors start joining the rally – which is precisely what we appear to be seeing. The trend is particularly strong in China, where spot prices are reportedly nearly a dozen dollars higher per ounce than in the US.

Last weekend, the US Mint nearly doubled the sale prices of its silver coins to above $170 per ounce. While Bank of America estimates that the fundamentally justified level for silver today would be closer to $60 per ounce, gradual debasement of fiat currencies (including the dollar), persistent fiscal deficits, and rising frustration among individual investors suggest that increasing allocations to silver and other “hard assets” could be durable and strategic in nature.

Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.