Netflix’s 2026 Outlook Spooks Investors

Netflix earnings are considered the start of tech earnings season, and they came at a very interesting time for the market, in the middle of a global bout of risk aversion caused by a sell off in Japanese bonds and rising geopolitical angst due to the shifting foreign policy goals of Donald Trump.

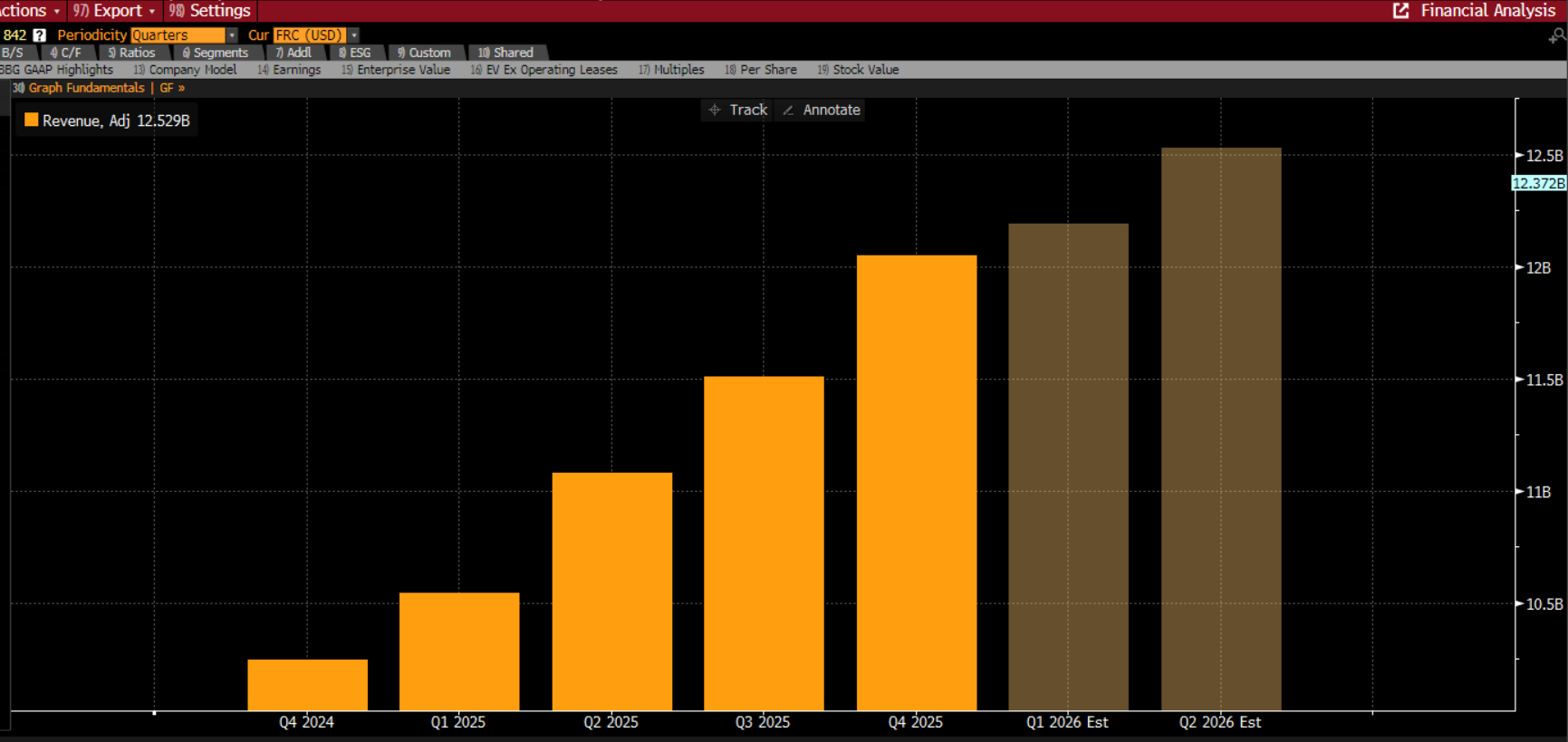

Overall, Netflix’s Q4 numbers were solid. Revenues and net income were above analyst expectations at $12.05bn and $2.55bn respectively. However, the focus was on the 2026 outlook and details about Netflix’s new and revised offer for Warner Brothers. The company may have posted 18% sales growth for Q4, but the outlook for Q1 was lacklustre and the bar was high. Concerns about operating margin strength and rising costs, including costs related to the Warner Brothers deal weighed on the stock in post-market trading on Tuesday, and it fell more than 5%.

The company expects Q1 revenue growth of 15.3%, and full year revenue growth of 13.3% for this year, which is the middle of its range. Even with its $27.75 a share all cash offer for Warner Brothers, Netflix is still predicting an increase in its operating margin to 31.5% for this year, and for free cash flow of $11bn, vs. $10.1bn in 2025. However, the operating margin increase was below expectations, and this could weigh on the stock price, especially when sentiment is shaky.

Advertising revenue is expected to rise sharply and could prove to be a headwind for Netflix. Added to this, the company is expecting to increase its prices this year to protect margins. However, Netflix’s strategy of finding new investment opportunities is expected to weigh on profitability, and earnings per share guidance was well below analyst expectations at $0.76, analysts had expected $0.82.

The company is planning on boosting spending on programming by 10% this year, along with $275mn of extra costs associated with the Warner Brothers deal, and this is causing some angst. The share price is down 25% in the past 6 months, which suggests that the market has not warmed to the deal. However, Netflix executives will not be swayed. They believe that having Warner Brothers’ back catalogue will provide them with a rich source of new content that will drive subscribers and advertisers to the streaming giant in the future.

Netflix’s latest move for Warner Brothers is a strategy for future revenue growth. After a period of slowing new users, this is a catalyst to bring people to the streaming giant. However, this move comes with uncertainty, and markets do not like uncertainty, so Netflix is getting punished. It could be a rough day for Netflix on Wednesday, but by solidifying itself as the world’s largest streaming platform with the Warner Brothers deal, there could be blue skies ahead.

Chart 1: Netflix quarterly revenue and forecasts.

Source: XTB and Bloomberg

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.