Novo Nordisk – Is it Time For Growth?

In recent months, Novo Nordisk has emerged as an example of a dramatic shift in market sentiment and company situation. It has been significantly devalued from its peak valuations, and investor behavior increasingly suggests that the market is inclined to write it off. But is this justified? The scale of this change is difficult to justify solely by fundamental factors.

There is no doubt that recent financial results have repeatedly disappointed, and the company’s market advantage has weakened. Competition has not remained passive, and the pace of sales growth has stopped meeting previous, very high expectations. Nevertheless, the depth of the devaluation seems greater than what would be expected from the mere scale of deteriorating prospects. It is worth remembering that Novo Nordisk still possesses significant assets that the market seems to be undervaluing at the moment.

The primary asset remains the structural growth in demand for anti-obesity and diabetes drugs. The problem of obesity is growing globally, and the use of measures to control it is becoming increasingly common. This market will grow regardless of short-term fluctuations in sentiment or results. Novo Nordisk still controls about half of this segment, which means it still holds a very strong position despite the deterioration of competitive advantage.

Also, noteworthy is the impressive gross margin, reaching over 30%, and the regularly paid generous dividends. Sales and profits continue to grow, just not at the pace the market, accustomed to spectacular dynamics in recent years, expected. From a fundamental perspective, the company remains a highly profitable enterprise with stable cash flows.

An important element of valuation also remains participation in the race for a drug for Alzheimer’s disease. In the context of aging societies, success in this area could become a real goldmine for the company.

Simultaneously, there is visible development in Asia, including the approval of drugs for sale in China, which opens access to one of the largest markets in the world.

External factors cannot be ignored either. The company has been more affected by extremely unfair market practices than by its own management. The flooding of the US market with illegal and often dangerous products emulating Novo Nordisk’s products is something the company finds hard to prepare for, yet it does not mean a permanent loss of market share.

At the same time, trade tensions are rising, and additional tariffs are being imposed on European products, including pharmaceuticals. It is worth remembering in this context that although the USA is more dependent than any other country on spending huge amounts on drugs, Europe leads in research, innovation, and drug exports. US companies cannot compete with the European industry on equal terms. This speaks to the strength and value of Novo Nordisk, not its weakness.

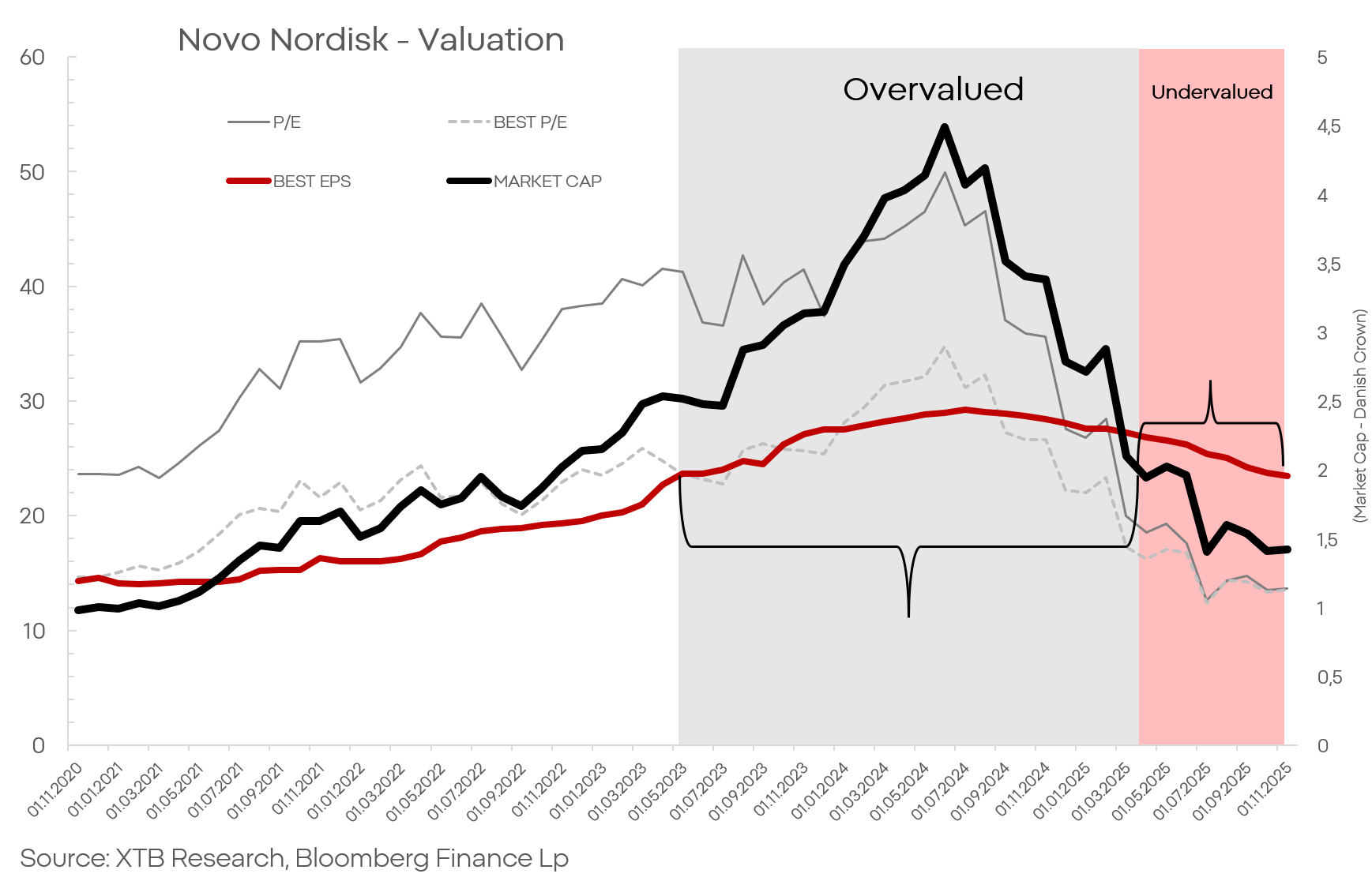

As seen in the chart, according to Bloomberg data, the Forward P/E ratio has equaled the P/E and is unusually low for the industry – 13. This is less than half the ratio of the company’s main competitor, Eli Lilly, whose profits and revenues are similar to Novo Nordisk. At the same time, EPS has clearly intersected with the company’s valuation and currently indicates a clear undervaluation.

Today’s valuation of Novo Nordisk seems to reflect more the disappointment with the growth rate than a real collapse of fundamentals. The market, as usual, reacts emotionally. Time will tell whether the current devaluation will prove to be a lasting trend change or merely a correction of excessive expectations.

NOVOB.DK (D1)

Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.