Silver Plumets 1.5%, Up-trend at Risk?

Silver (SILVER) is down more than 1.5% today after a massive rally that has delivered gains of over 100% from the latest local low on October 28, 2025. Looking at the chart, the long-, medium-, and short-term uptrends remain intact. That said, the metal has failed to push decisively above $93 per ounce, and today’s pullback is taking prices back toward the $90 area.

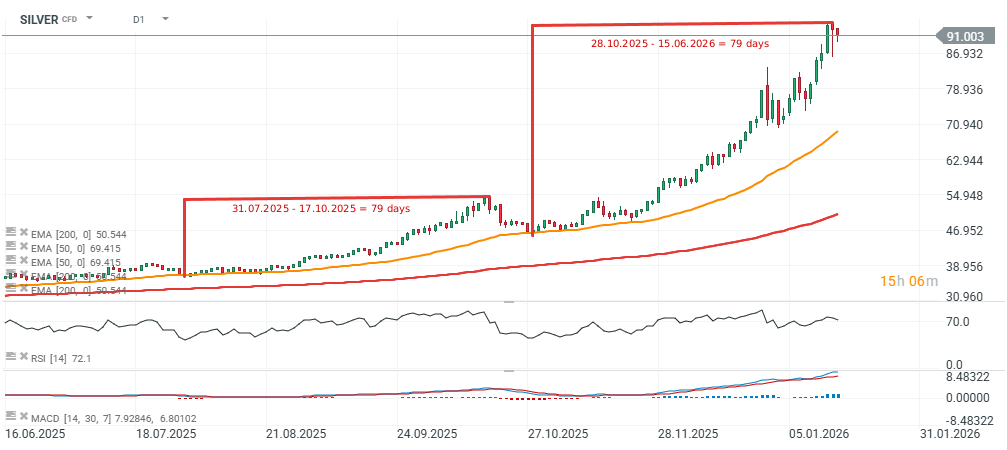

- On the chart, the previous upswing that began on July 31 lasted 79 days before a deeper correction set in, pulling prices down toward $45 per ounce and marking a peak on October 17. Now we can see that another strong leg higher started on October 28 and has lasted 79 days up to today—yet prices are now slipping. This second impulse delivered roughly twice the upside: during the summer–autumn 2025 move, silver rose by about 53%, whereas the autumn–winter leg produced a surge of more than 100%.

- If the technical picture weakens and prices fall below $90 per ounce, profit-taking pressure may weigh on the market and limit any potential acceleration in buying.

- Looking at the CFTC Commitment of Traders report for silver dated January 6, we can see that producers (Commercials) hold a large hedging short position (net short -25,545 contracts), while speculative funds (Managed Money) are net long +15,822 contracts.

- Bullish exposure increased as of January 6, but not because funds added longs—rather, it was driven mainly by short covering. Commercials also reduced shorts marginally, but the change was negligible: 529 contracts versus a still substantial net short position of more than 25.5k contracts.

- Long exposure is also held by Other Reportables and Nonreportables, pointing to strong bullish positioning among smaller-capital participants. Nonreportables are net long by more than 22.4k contracts.

After silver rebounded above $90 per ounce, the move was very dynamic—largely due to high concentration on the short side. The eight largest net short holders account for 37.6% of total net short positions. Momentum, however, is gradually fading and the rally is showing early signs of fatigue.

SILVER (D1)

A potentially important support area in a pullback scenario could be around $70, where a strong “base” formed around the turn of 2025 and 2026. On the other hand, if silver rebound above $93 again, we could see a pressure toward $100 level.

Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.