S&P 500 at All Time High Ahead of The Fed, Will Big-Tech Support The Momentum

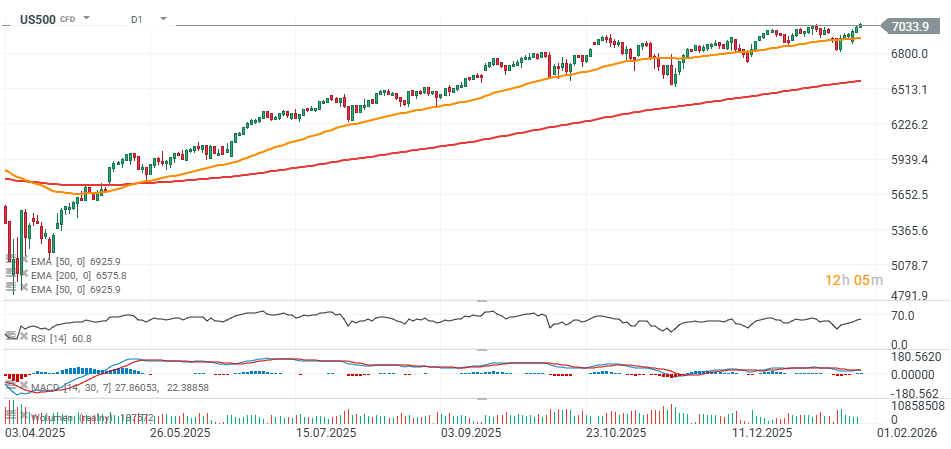

The S&P 500 contract (US500) hit a record high today around the 7,040 mark as markets brace for the Fed decision scheduled for 6 PM GMT. This week, four “Magnificent 7” companies are set to report Q4 results: Meta Platforms and Microsoft (both after the US session today), as well as Apple and Tesla. That setup suggests US500 could see elevated volatility – in both directions.

Source: xStation5

What about Big Tech earnings?

After today’s US close, two leading US tech giants — Microsoft and Meta Platforms — will report earnings. Market expectations are high.

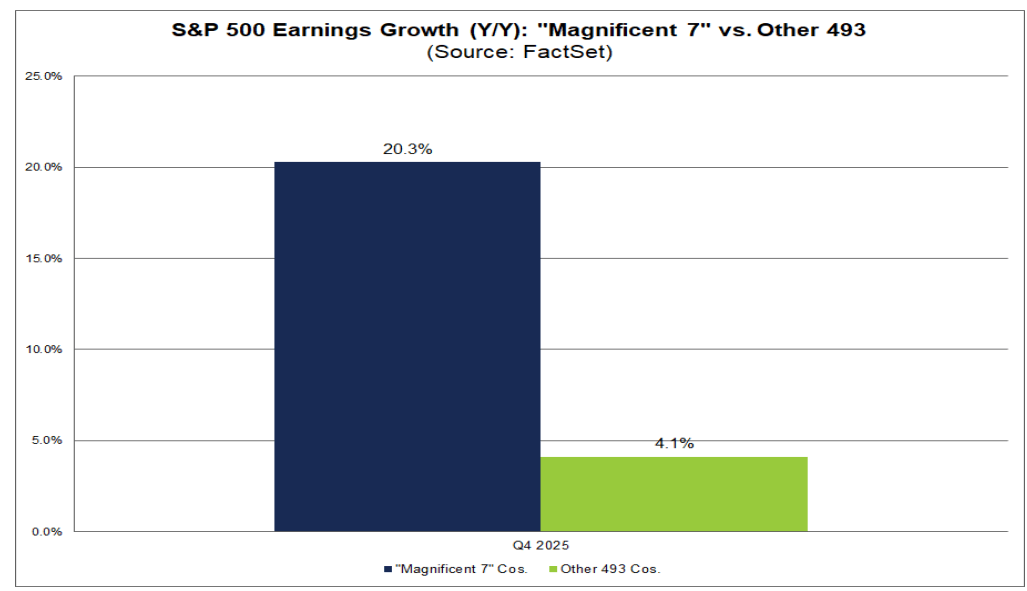

- In recent quarters, the so-called “Magnificent 7” have often been among the strongest drivers of year-over-year earnings growth for the entire S&P 500. The question is: how many of them are expected to rank among the top five contributors to earnings growth in Q4 2025?

- Consensus for the full S&P 500 points to +8.2% y/y blended earnings growth in Q4 2025. If this figure holds, it would mark the 10th consecutive quarter of earnings growth for the index.

- At present, the top five companies contributing the most to year-over-year earnings growth for the index in Q4 (ranked by contribution) are: Nvidia, Boeing, Alphabet (Google), Micron Technology, and Microsoft.

- This means three out of the five largest contributors to Q4 earnings growth are expected to be “Magnificent 7” names: Nvidia, Alphabet, and Microsoft, which reports today.

- Boeing (outside the “Magnificent 7”) is benefiting mainly from an easy base effect: a year ago the company posted a large loss (including charges and other expenses reflected in non-GAAP EPS).

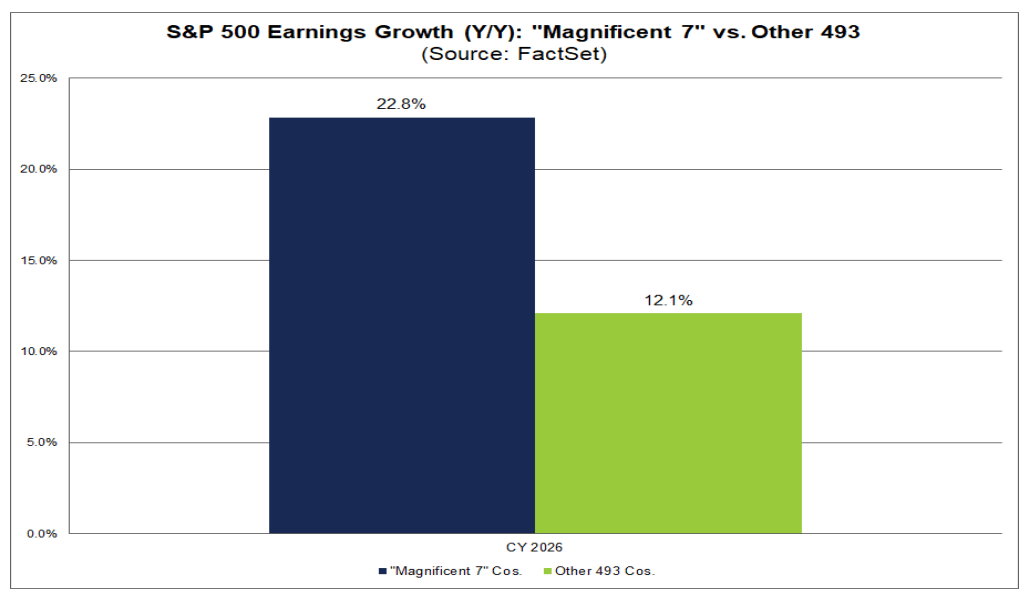

- Looking ahead, analysts expect double-digit earnings growth in 2026 for both the “Magnificent 7” and the rest of the index. Moreover, growth for the Mag7 is projected to accelerate to nearly +23% y/y, versus +12.1% for the remaining S&P 500 companies. If these estimates prove accurate — or even slightly conservative — the index could deliver solid performance this year.

The market is pricing in at least ~20% EPS growth for the Mag7 in Q4 2025, compared with only ~4% for the other 493 S&P 500 companies.

Source: FactSet Research

According to FactSet data as of January 23, about 13% of S&P 500 companies have reported results so far. 75% beat EPS expectations (positive surprise), while 69% beat revenue expectations.

- Estimate revisions: as of December 31, the market expected +8.3% y/y earnings growth for Q4; it is now marginally lower at +8.2%.

- Four sectors currently have lower earnings expectations than at the end of December, due to downward EPS revisions and negative earnings surprises.

- Guidance (Q1 2026): so far, six S&P 500 companies have issued negative EPS guidance for Q1, while four have issued positive guidance.

- Valuation: the S&P 500’s forward 12-month P/E stands at 22.1. That is above both the 5-year average (20.0) and the 10-year average (18.8). The market is relatively expensive versus history, but double-digit y/y earnings growth expected in 2026 provides a meaningful argument for an earnings “premium” in valuations.

Source: FactSet Research

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.