S&P500 Earning Season Highlights

The third-quarter 2025 earnings season for the S&P 500 is underway, and early results show a mixed picture. While most companies are beating expectations, the size of these beats is smaller than usual. Still, the index continues to post strong growth, marking its ninth consecutive quarter of rising earnings. Here, we will analyse the earnings season data up to 17 October, using FactSet Research data.

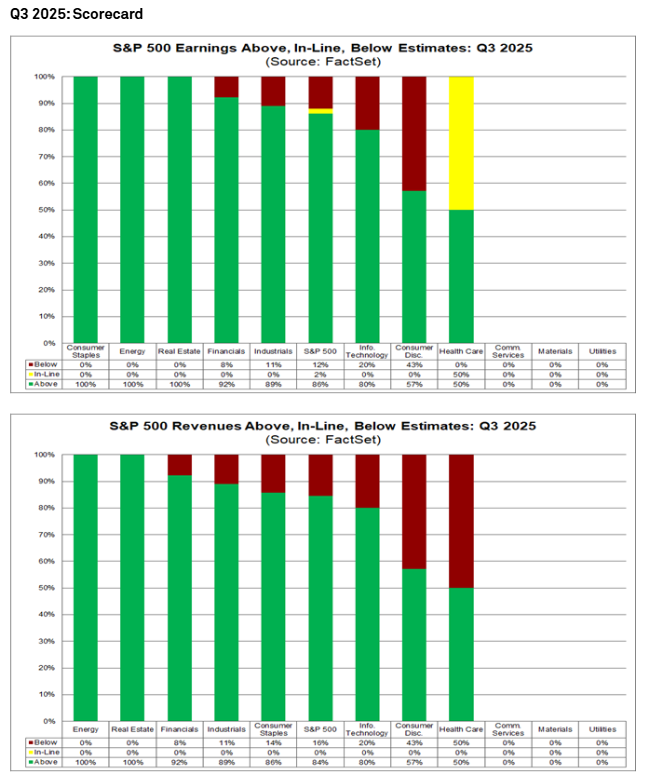

- Around 12% of S&P 500 companies have reported their Q3 results until 17 October.

- 86% have reported earnings per share (EPS) above analysts’ estimates — higher than both the five-year (78%) and ten-year (75%) averages.

- However, earnings have exceeded estimates by an average of 5.9%, which is below the five-year average of 8.4%.

This suggests that while companies continue to outperform, the overall strength of the surprises is fading compared to previous quarters. Of course, the early stages of the Q3 2025 earnings season show resilience in U.S. corporate profits. Strong results from the Financials and Technology sectors continue to drive growth, even as some industries — particularly Energy and Consumer Staples — face headwinds. With robust revenue trends and improving projections for 2026, the outlook for S&P 500 earnings remains positive, but valuations suggest expectations are already high.

Financials Lift the Index

Financial sector companies have been the main drivers of the earnings momentum. Their strong results have helped lift the overall earnings growth rate for the S&P 500.

- Positive surprises in Financials outweighed weaker results and estimate cuts in the Health Care sector.

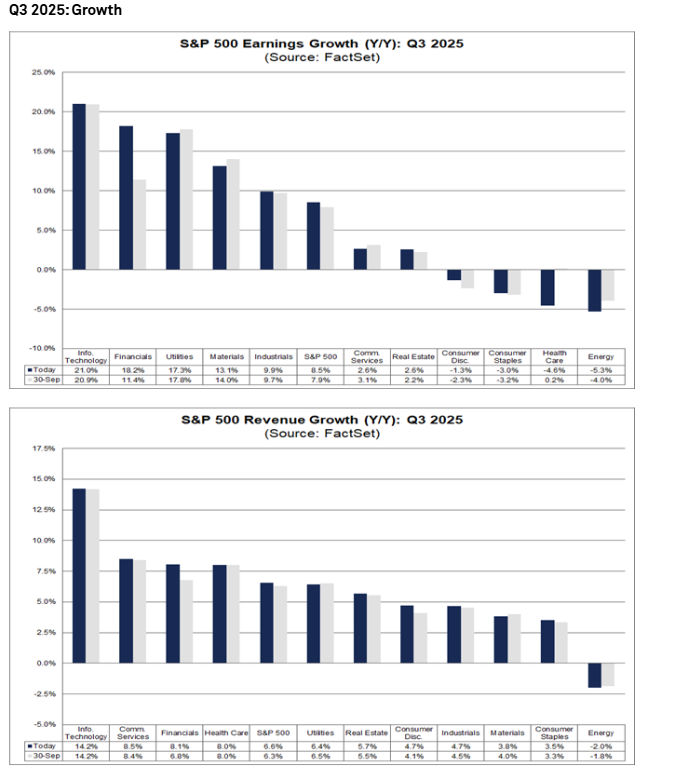

- The blended earnings growth rate — which combines actual and projected results — now stands at 8.5%, up from 7.7% last week and 7.9% at the end of September.

If this rate holds, it will mark nine consecutive quarters of year-over-year earnings growth.

Sector Breakdown

- Sectors with Growth: 7 out of 11 sectors are expected to post higher earnings year over year.

- Leaders: Information Technology, Financials, Utilities, and Materials.

- Sectors with Declines: 4 sectors are expected to see drops in earnings.

- Laggards: Energy and Consumer Staples are seeing the largest declines.

Revenue Trends

Revenue growth remains solid across the index, continuing an impressive streak of expansion.

- 84% of reporting companies have posted revenues above expectations — well above long-term averages.

- Reported revenues are 1.5% above estimates, slightly lower than the five-year average (2.1%) but still healthy.

- The blended revenue growth rate is now 6.6%, compared to 6.3% at the end of Q3.

This marks the second-highest revenue growth since Q3 2022 and the 20th consecutive quarter of revenue expansion.

- Information Technology continues to lead in revenue growth.

- Energy remains the only sector showing a year-over-year revenue decline.

Looking Ahead: Analyst Expectations

Analysts are optimistic about the upcoming quarters. Forecasts for earnings growth are as follows:

- Q4 2025: 7.5%

- Q1 2026: 11.9%

- Q2 2026: 12.8%

- Full Year 2025: 11.0%

These projections indicate expectations for steady acceleration in corporate profitability through mid-2026. The S&P 500’s forward 12-month price-to-earnings (P/E) ratio stands at 22.4 — elevated compared to its five-year average (19.9) and ten-year average (18.6). However, it has edged slightly lower from 22.8 recorded at the end of September. This valuation suggests that the market remains expensive relative to historical norms.

Source: FactSet Research

Source: FactSet Research

Looking on the US500 (futures on S&P 500) we can see the short-term weakness. Despite the solid start of the Q3 Earnings Season, sentiment on Wall Street lags. Both Netflix and Tesla didn’t surprise investors positively this week.

Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.