Trade of The Day – EUR/USD

Facts:

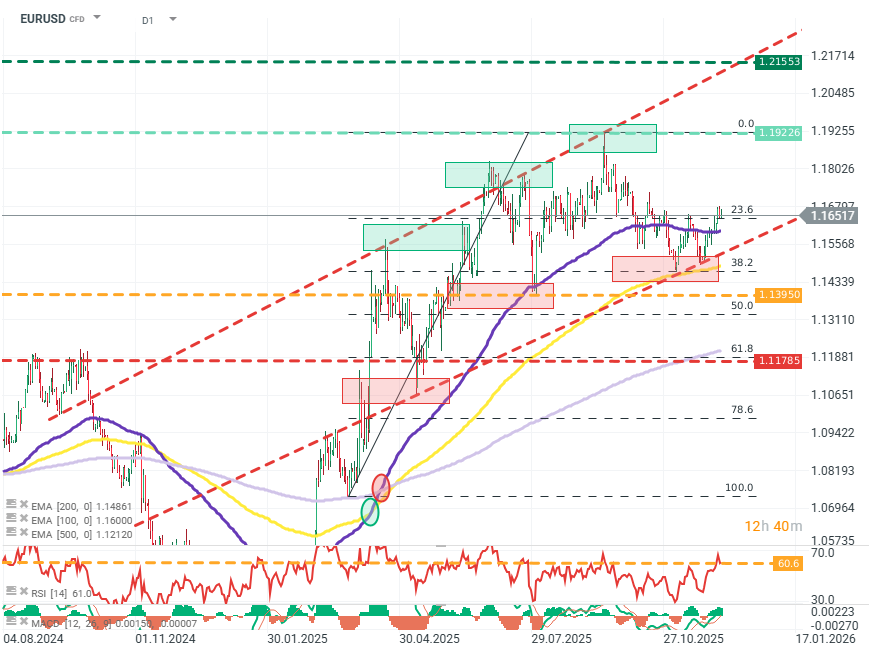

- The rate maintains an upward dynamic according to the structure of the EMA100 and EMA200 averages.

- The MACD line has crossed the signal line and maintains a “spread” over the past few days.

- The rate remains in the upward trend channel (red line).

- The rate defended the FIBO 38.2 level and exceeded EMA100.

- Interest rate contracts according to Bloomberg indicate that the market currently prices an aggressive path of rate cuts by the FED (3 cuts with a 100% probability and a 40% probability of 4 cuts by the end of 2026) – at the same time, the market does not foresee any certain cuts from the ECB.

Trade: LONG EURUSD at market price

- Target: 1.215

- Stop: 1.117

EURUSD (D1)

Source: xStation5

Opinion: The Euro has strengthened against the dollar over the past year. This is a culmination of the dovish policy of the FED compared to the ECB. The market has already priced in at least 2-3 cuts of 25 basis points, but investors may underestimate the degree of change in U.S. monetary policy. In May, Jerome Powell’s term as FED chairman ends. He may be replaced by one of Donald Trump’s loyalists. This would mean a change in the imperative of FED/FOMC operations, and the new committee composition will focus monetary policy on short-term growth, financing critical U.S. debt levels, and maintaining the “AI Bull Market,” which is critically dependent on cheap credit. At the same time, Europe’s competitiveness favors it, as the U.S. increasingly desperately tries to defend its market against European products, but the U.S. trade deficit with Europe is enormous — according to Census.gov, by August 2025, the U.S. has already reached a $165 billion trade deficit.

Methodology and assumptions:

- The recommendation is based on technical analysis of the EURUSD chart, particularly the MACD indicator, Fibonacci levels, and EMA, as well as fundamental analysis, including trade balance and implied interest rate differences based on Bloomberg Finance Lp data.

- The target level was determined based on the upward trend line (red line) and previous peaks from 2020, which may prove to be a strong resistance zone.

- The stop-loss order is based on the FIBO 61.8 level of the last upward wave, the breach of which threatens the realization of the upward scenario.