Trade of The Day – Silver XAG/USD

Facts:

- China announced that starting January 1, refined silver exports will require export licenses, covering around 121 million ounces of net exports.

- Year-end positioning is driven by tax-motivated profit-taking.

- Silver has surged a record ~80% over the past two months.

Recommendation:

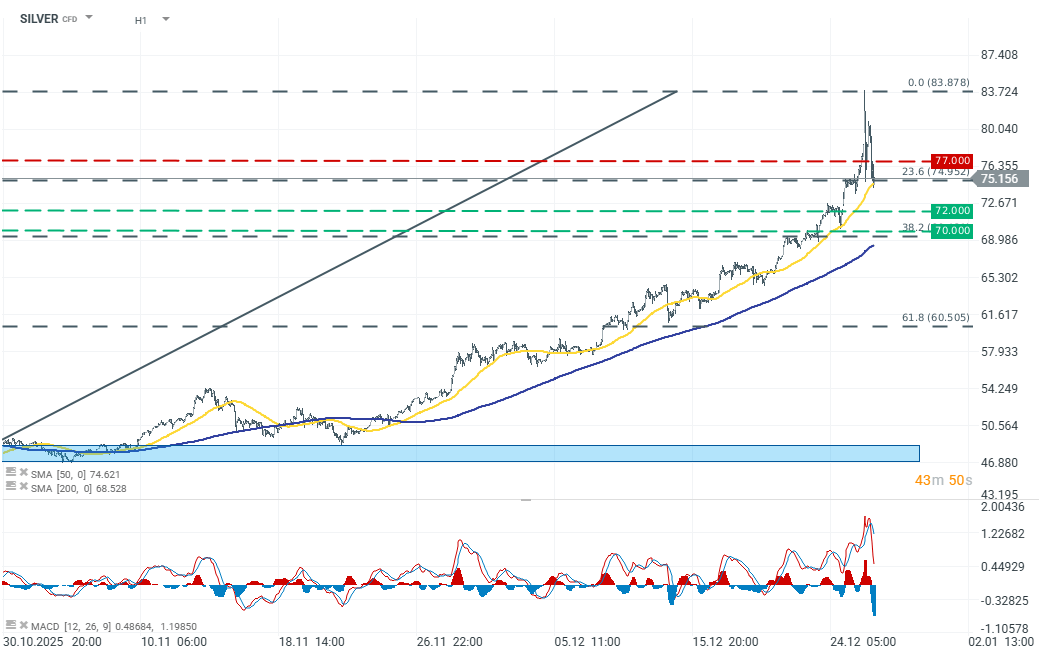

Short position at market price

- TP1: 72.00

- TP2: 70.00

- SL: 77.00

Opinion:

In the short term, the balance of risks favors a tactical bearish scenario for silver, even though the long-term structural outlook remains constructive. Several short-dated factors cluster around the turn of the year: investors are inclined to take profits on highly profitable positions for tax reasons, CME margin hikes constrain capital for hedgers, and a stronger USD combined with rates repricing after firm U.S. data may pressure USD-denominated metals. On top of that, there is a risk of technical selling from overbought territory, where minor pullbacks can cascade into deeper corrections.

At the same time, it is important to note that the current selling pressure is technical rather than structural. Physical demand remains strong and continues to pay significant premiums, London backwardation signals a genuine inventory shortage, and the industrial component of demand remains relatively inelastic even at current price levels.

Taking the above factors into account, we recommend opening a short position at market price, with a stop-loss in place to minimize potential downside risk. The recommendation is short-term in nature, following the recent sharp rally.