Trade of The Day – US2000

Facts:

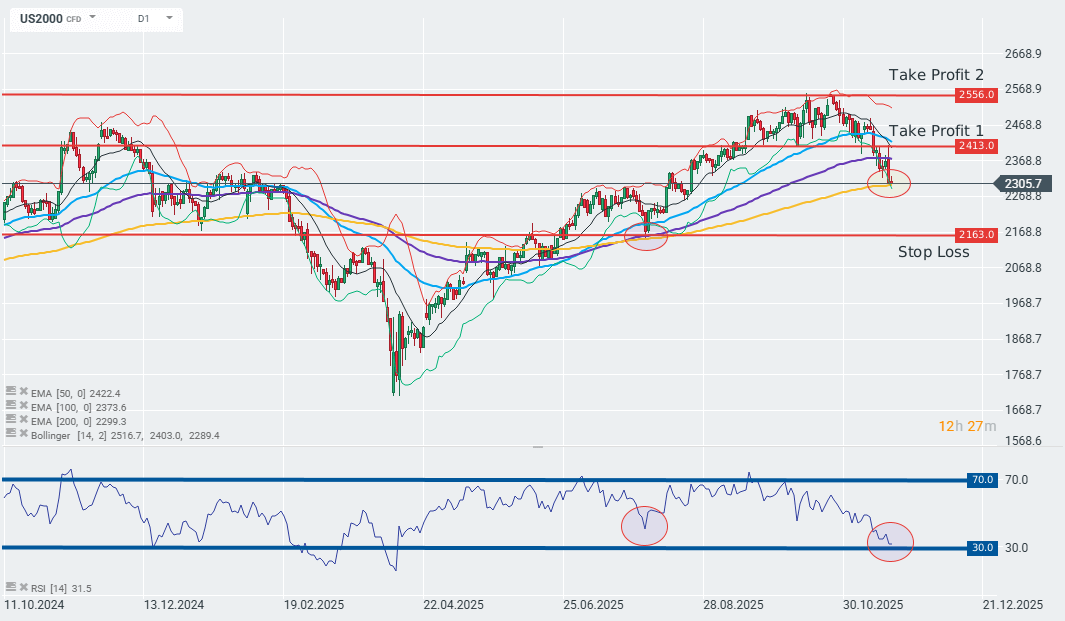

- The US2000 is currently testing its 200-day exponential moving average.

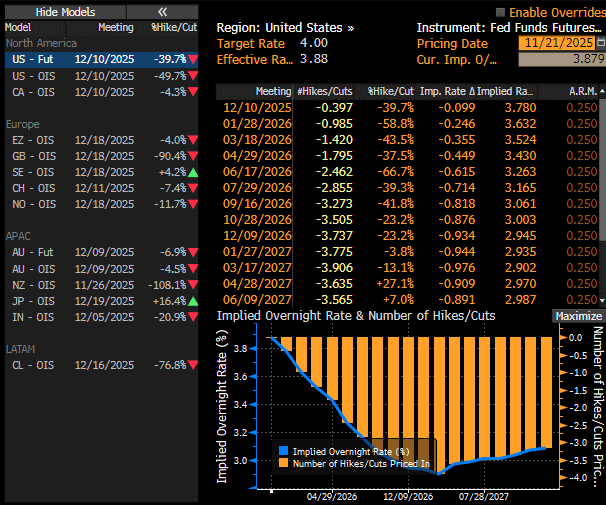

- Swaps estimate a 60% chance of a pause in the Fed’s cycle of interest rate cuts in December.

Recommendation:

Long position on US2000 at market price

- SL: 2163

- TP1: 2413

- TP1: 2556

Opinion:

The LONG recommendation for Russell 2000 futures is based on the outlook for the Federal Reserve, which is currently in a cycle of interest rate cuts, regardless of a potential pause in December 2025.

Although the market initially discounted the possibility of a pause in rate cuts in the coming month due to rising macroeconomic risks, the structure of the cycle remains clear—cuts will continue in the medium term. This fundamental change in monetary policy is crucial for the small and medium-sized companies that make up the Russell 2000, as these entities are much more sensitive to access to capital and financing costs than large corporations.

The resumption of the cycle of cuts after a possible pause may provide support that could drive the Russell 2000 upward after the current correction period. A LONG position on US2000 futures positions the portfolio to capture this scenario, providing exposure to the sectors and companies most sensitive to improved financing conditions. However, it is worth bearing in mind that US2000 is a highly volatile instrument, so we recommend exercising particular caution when making any decisions.

The first target level was set at the level of the last local maximum on November 20, and the second in the zone of recent historical peaks. The technical stop loss point is the lowest price point from August this year.

Source: xStation

Appendix 1: Swap market indicating possible Fed decisions on interest rates. Source: Bloomberg Financial No.