Trade of The Day – USD/JPY

Facts:

- The difference between BoJ and FED rates is currently between 3.25-3.5 percentage points.

- BoJ decided to maintain interest rates at 0.5% in October.

- The EMA100 (D1) average surpassed the EMA200 (D1) from below in October.

- The exchange rate is in a long-term upward trend.

- The price has bounced off the 140 JPY level three times over the past 12 months.

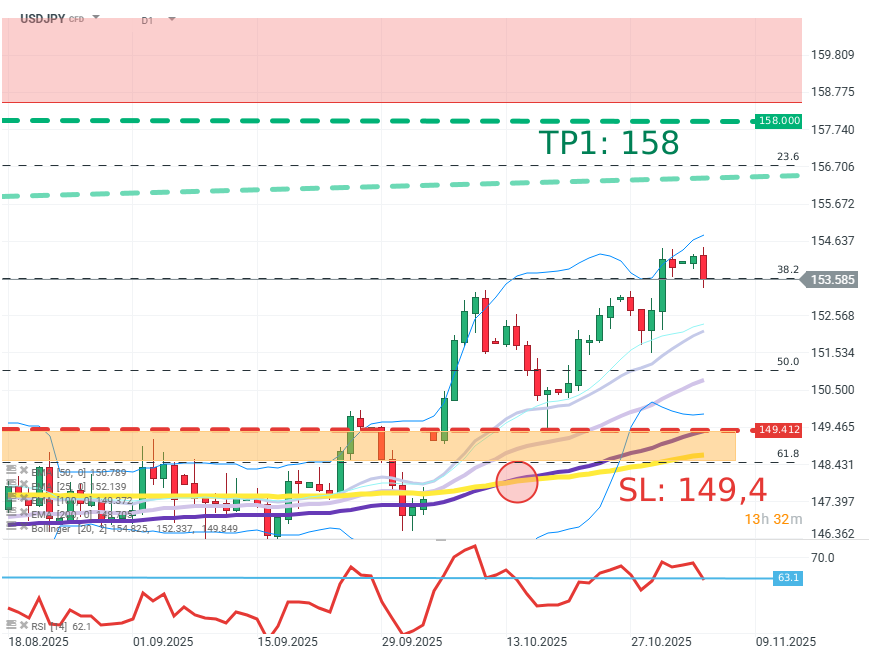

Recommendation: LONG position on USDJPY at market price.

- Target: TP1 – 158

- Stop: SL1 – 149.4

USDJPY (D1)

Source: xStation5

Opinion: There remains a significant discrepancy between interest rate levels in Japan and the USA, which will support the strength of the dollar against the Japanese yen. The structure of the EMA averages also favors the dollar, particularly the crossing of the EMA100 through the EMA200 from below. However, it is crucial to execute growth scenarios before exceeding the 160 level, around which BoJ has frequently intervened to stabilize the exchange rate and inflation prospects.

Methodology and assumptions: Fundamental analysis, particularly the difference in interest rate levels and monetary policy in Japan, and technical analysis based mainly on exponential average levels.

The target level has been set as the maximum USDJPY rate below which BoJ was not willing to intervene in the past.

The defensive stop loss order has been set below the FIBO 50 level of the last upward wave and the October price lows; falling below these levels would negate the growth scenario.