When are the German/ Eurozone flash HCOB PMIs and how could they affect EUR/USD?

German/ Eurozone flash PMIs Overview

The preliminary German and Eurozone flash HCOB Purchasing Managers’ Index (PMI) data for January is due for release today at 08:30 and 09:00 GMT, respectively.

Amongst the Euro area economies, the German and the composite Eurozone PMI reports hold more relevance, in terms of their impact on the European currency and the related markets as well.

The flash Composite PMI for Germany is expected to come in higher due to an improvement in both manufacturing and the service sector activity. In December, the Composite PMI came in at 51.3.

Preliminary Services PMI is seen at 53, higher than 52.7 in December. The Manufacturing PMI is expected to have contracted again, but at a slower pace, to 48.0 from the prior reading of 47.0. A figure below the 50.0 threshold is considered a contraction in the business activity.

The forecast for the Eurozone flash Composite PMI also shows that overall private sector output increased at a faster pace in January, driven by improvements in both manufacturing and the services sector. The Services PMI is seen at 52.8, up from 52.4 in December. Like the German Manufacturing PMI, the manufacturing activity in the old continent has contracted too, but at a moderate pace to 49 from the previous release of 48.8.

How could German/ Eurozone flash PMIs affect EUR/USD?

Signs of strength in overall business sector activity from the German/ Eurozone flash PMI prints would be favorable for the Euro (EUR), while weak numbers would act as a drag on the shared currency.

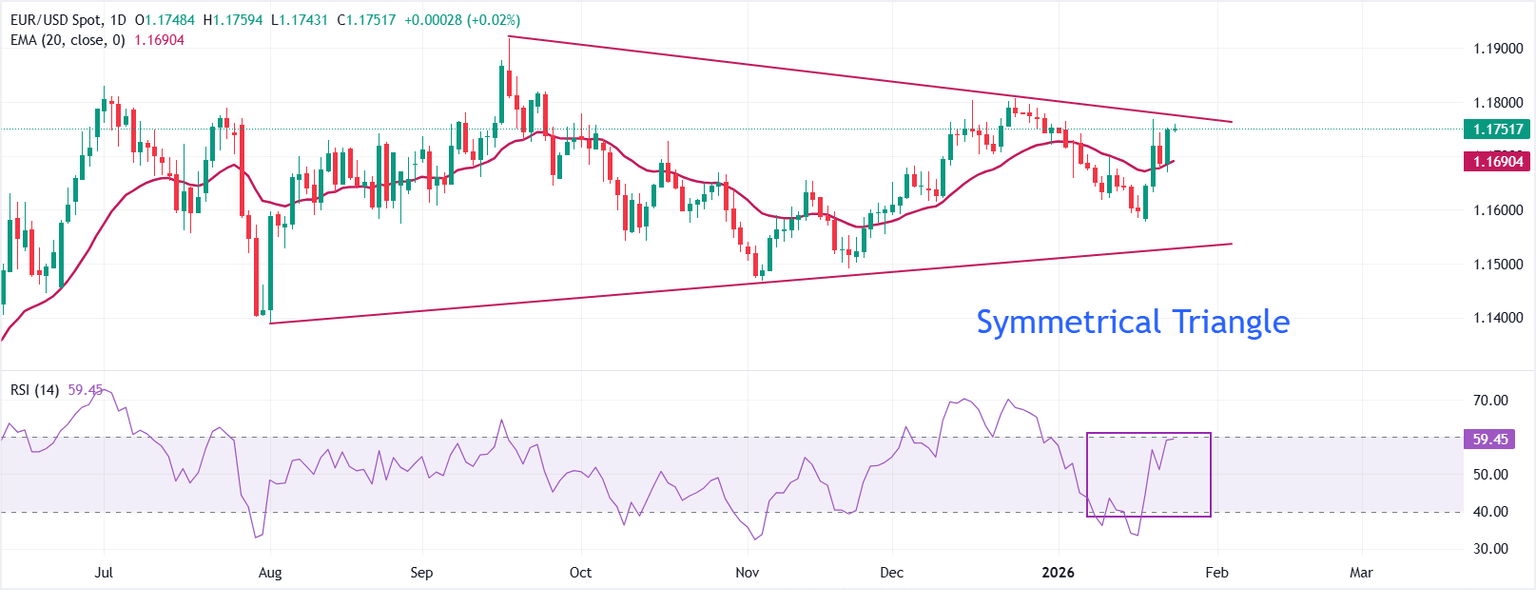

EUR/USD trades close to the three-week high of 1.1769 as of writing. The major currency pair trades within a Symmetrical Triangle on the daily chart, indicating broader volatility contraction. The price is close to the upper boundary of the volatility contraction pattern around 1.1770, which is plotted from the multi-year high of 1.1919 posted on September 17.

The 20-day Exponential Moving Average (EMA) at 1.1690 turns higher, and price holds above it, keeping the short-term recovery in place. A close above the 20-day EMA would preserve the bullish bias. The 14-day Relative Strength Index (RSI) at 59.44 signals firm momentum.

Looking up, the pair could advance towards 1.1800 and 1.1900 following a decisive breakout of