ARM Holdings Plc shares are rising in pre-market trading after the company reported record quarterly results, driven by strong demand for processors in data centers, artificial intelligence (AI), and mobile devices.

Key figures for ARM’s Q3 2025 results:

- Total revenue: $1.14 billion, up 34% year-on-year, beating estimates of $1.06 billion.

- Earnings per share (EPS): $0.39, above the expected $0.33.

Results and business model

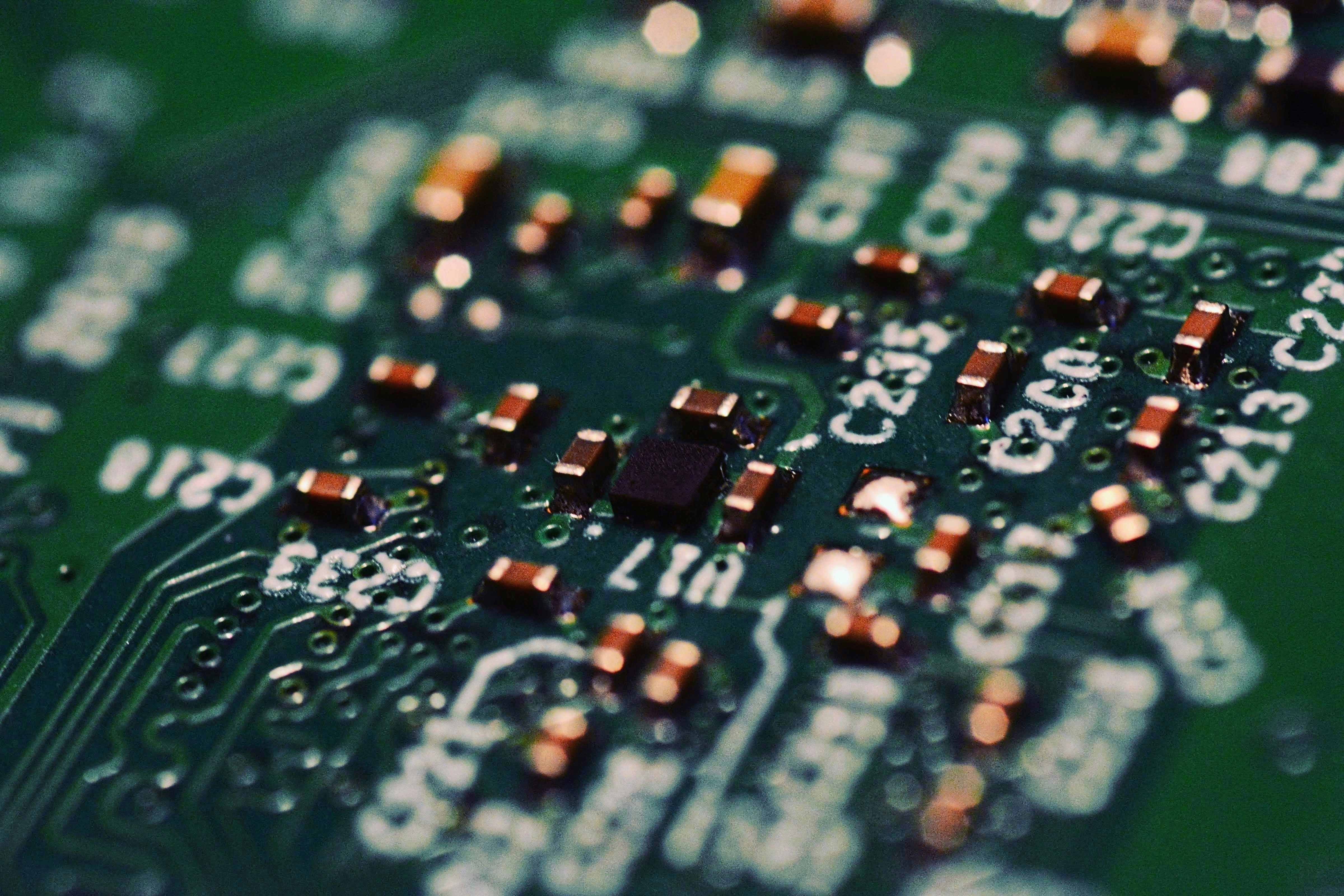

The company’s latest report, together with recent statements from management, highlights a period of strong growth and transformation for Arm Holdings, the global leader in processor design. In general terms, Arm occupies a middle ground between companies that design and manufacture chips (such as Nvidia or Intel) and those that use Arm’s designs (such as Qualcomm or Samsung).

Arm designs the architecture—the “brain” or set of instructions—that other manufacturers use to build their own processors. When a company such as Qualcomm, Apple, Samsung, or Nvidia wants to use this technology, it must purchase a license from Arm. In this segment, the company generated $525 million, a 56% year-on-year increase, boosted by new high-value licensing agreements and the recognition of revenue from previously signed contracts.

Once chips based on Arm technology are manufactured and sold, the company receives a royalty payment per chip. This segment also exceeded expectations, generating $620 million in revenue. Arm continues to expand into high-growth markets beyond mobile, which still accounts for 45% of total royalties. The cloud and networking segment contributes 10%, automotive 7%, and IoT/embedded systems 18%, reflecting a clear diversification away from the company’s historic dependence on smartphones.

Overall, total quarterly revenue reached $1.14 billion, up 34% year-on-year, with earnings per share of $0.39. The company maintained solid margins despite higher operating expenses linked to the development of increasingly complex products. Free cash flow over the past twelve months exceeded $1 billion, highlighting a healthy balance sheet with low leverage and ample capacity to continue investing in innovation.

Outlook and strategic position

For the next quarter, Arm issued an optimistic forecast, projecting revenue of around $1.23 billion. This outlook reflects the positive impact of growing demand for data-center chips designed for AI workloads.

Expansion in data centers and artificial intelligence

The data-center segment has become one of Arm’s main growth drivers. Its Neoverse product line, designed for server and supercomputing workloads, doubled its revenue, fueled by adoption from companies such as Amazon (AWS) and Google (Alphabet), which seek greater energy efficiency in their AI infrastructures. Arm expects its market share in data centers to exceed 50% by 2025, as AWS, Google, Microsoft, and Meta increasingly deploy Arm-based processors—an expansion that could become a key driver of the company’s stock performance.

Arm-based chips consume significantly less power per unit of computation than those built on traditional x86 architectures (such as Intel or AMD). This is crucial, since AI data centers consume vast amounts of electricity, and every gain in efficiency translates into multi-million-dollar energy savings.

This growth underscores how Arm’s architecture—originally developed for mobile devices—has successfully adapted to the demands of data centers and AI systems, where performance-per-watt and power efficiency are critical.

Among current challenges, Arm faces rising costs tied to larger-scale and more complex projects, which have temporarily reduced operating margins. Nevertheless, these investments are positioning the company as a key player in the AI era, even taking part indirectly in strategic initiatives such as Project Stargate, led by OpenAI and SoftBank, Arm’s majority shareholder.

Although Arm’s stock has risen about 30% year-to-date, its performance remains more moderate than that of other semiconductor manufacturers. Still, its licensing-and-royalty-based model, characterized by low operational risk and high profitability, gives it strong fundamentals and substantial room for expansion.

In summary, Arm combines a diversified and highly profitable business model with a strategy focused on leadership in artificial intelligence. Its transformation into a comprehensive provider of chip designs for data centers and connected devices places it in a privileged position to capture value from the next wave of technological innovation.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.