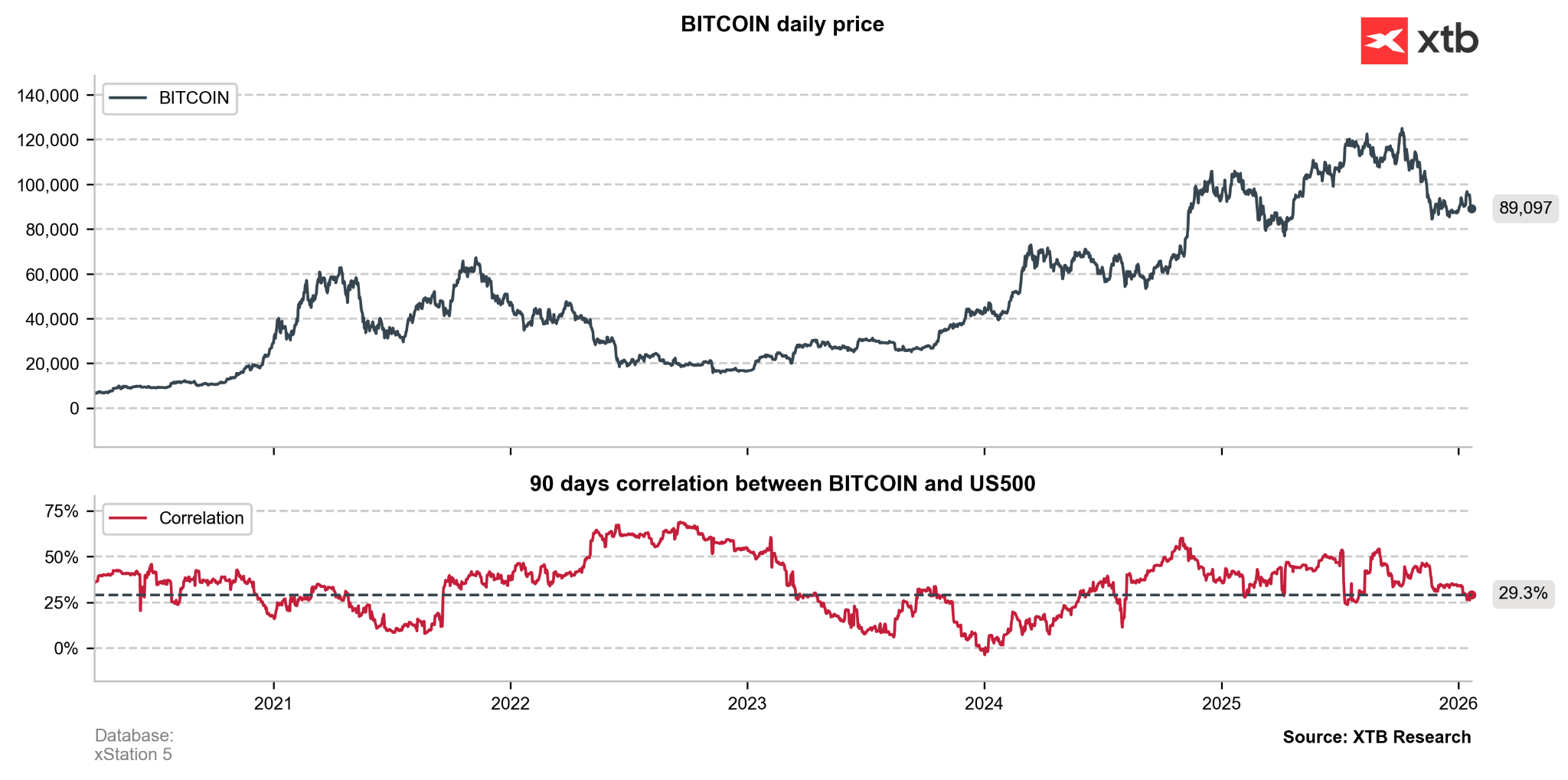

Bitcoin has been going through a difficult period recently. After a correction of more than 30% in Q4 2025, the world’s largest cryptocurrency has remained in consolidation. In recent weeks, Bitcoin even attempted to break higher from this range, but rising international tensions led to a reduction in investors’ risk appetite, pushing Bitcoin back below USD 90,000.

Bitcoin remains more strongly correlated with the US500 index than with gold. The decline in risk appetite is also weighing on demand for cryptocurrencies more broadly.

Market attention has now shifted to Davos, where cryptocurrency regulation—particularly the US CLARITY Act—has become one of the key topics of discussion among policymakers, banks, and leaders from the crypto industry.

Coinbase CEO Brian Armstrong used the opportunity to openly criticize the current version of the CLARITY Act (Crypto Market Structure Act), arguing that it overly favors the traditional financial sector and risks stifling innovation. Coinbase has withdrawn its support for the bill, as it expands the powers of the SEC, restricts DeFi, slows tokenization, and effectively bans interest payments on stablecoins. Armstrong’s stance—“no bill is better than a bad bill”—surprised lawmakers and parts of the industry, leading to delays in the Senate Banking Committee’s work and backlash from some policymakers. At the same time, Armstrong emphasized that discussions remain constructive, the White House is engaged, and a revised bill—more clearly delineating the responsibilities of the SEC and the CFTC—remains likely. Importantly, Davos also highlighted growing institutional acceptance of cryptocurrencies, with major banks and exchanges openly discussing asset tokenization and 24/7 blockchain-based markets, underscoring why clear regulation is now seen as urgent.

Estimated next steps for the CLARITY Act:

- The Senate Banking Committee is expected to review the bill after the legislative pause, addressing the scope of SEC authority, rules on stablecoin yields, and DeFi regulation.

- Continued bipartisan negotiations, with rising pressure from the industry to reach a compromise before legislative momentum fades.

- A possible reintroduction of a revised version of the bill later this month or early next month, featuring a clearer division of responsibilities between the SEC and the CFTC.

Bitcoin is rebounding today by 1.20% to USD 89,300 after yesterday’s nearly 5.00% correction to around USD 88,000.

Source: xStation 5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.