CD Projekt (CDR.PL) – Quarterly Earnings Beat Market Consensus

In the third quarter of 2025, CD Projekt (CDR.PL) presented results that clearly confirm the thesis of Cyberpunk’s “second life”. The company not only beat market consensus on every key level (revenue, EBIT, net profit), but also demonstrated its ability to generate strong cash flow at a time when most of its development resources are committed to producing new games rather than supporting existing ones.

The company’s shares reacted to this news with an increase of nearly 3% at the opening of Thursday’s session, reflecting investors’ relief – the market had been concerned that the “fuel” from the sale of the back catalogue would run out before the release of The Witcher 4.

Below is a detailed analysis of the results and operating situation.

Financial results: “Beat” across the board

CD Projekt “broke the bank” in the third quarter, showing that Cyberpunk 2077 has become a product with an extremely long sales tail, reminiscent of the phenomenon of GTA V or Skyrim, rather than a typical single-player game.

| Revenue | PLN 349.1 million | PLN 325 million | +7,4% | +53% |

| EBIT (Operating profit) | PLN 194.6 million | PLN 168 million | +15,8% | +141% |

| Net profit | PLN 193.5 million | PLN 159 million | +21,7% | +148% |

| Cyberpunk 2077 sales | > 35 million copies | — | — | — |

Key financial conclusions:

- Cyberpunk’s dominance: As much as PLN 252.7 million (72% of product sales) came from the Cyberpunk franchise (base game + Phantom Liberty expansion). By comparison, The Witcher series generated PLN 26.2 million in this quarter.

- Cost efficiency: Despite intensive work on new projects (The Witcher 4, Cyberpunk 2), the company maintained cost discipline. Selling and general administrative expenses (SG&A) grew more slowly than revenues, pushing net profitability up to an impressive 55.4%.

- Cash is King: The company generated PLN 221 million in cash from operating activities in the quarter. After paying for investments in new games (PLN 118 million) and other expenses, cash reserves (including deposits and bonds) amount to a secure PLN 1.408 billion.

Production scale: Acceleration of the Orion project (Cyberpunk 2)

The Polaris project (The Witcher 4) has already achieved full “commitment” on the part of the developers, while the Orion project (Cyberpunk 2) is entering a phase of dynamic growth.

Here is a summary of changes in team sizes (July vs October 2025):

| The Witcher 4 (Polaris) | 444 | 447 | +3 | Full production |

| Cyberpunk 2 (Orion) | 116 | 135 | +19 | Start-up phase (Boston) |

| Projekt Sirius (The Molasses Flood) | 51 | 56 | +5 | Pre-production |

| Hadar Project (new IP) | 22 | 29 | +7 | Conceptual phase |

| Shared services | 149 | 162 | +13 | Support (QA, AI, Localisation) |

| Inne | 17 | 22 | +5 | – |

| TOTAL | 799 | 851 | +52 |

Source: Own study based on CD Projekt’s Q3 2025 report.

It is clear that the centre of gravity for recruitment is shifting towards North America. The team in Boston (responsible for Cyberpunk 2) is set to grow to 300-400 people by the end of 2027, confirming that the sequel is a strategic priority for the second half of the decade.

Market reaction:

The nearly 3% increase in the share price at the opening, amid generally neutral sentiment in the broader market, is due to three factors:

- Financial security: The market feared a “revenue gap” between Phantom Liberty and The Witcher 4. The Q3 2025 results show that this gap is being filled by organic sales of Cyberpunk. The company is financing the production of new hits from current profits, without “burning through” its cash reserves.

- Cyberpunk momentum: The news that it has surpassed 35 million copies sold is psychologically important. Cyberpunk 2077 is currently selling faster than The Witcher 3 in the same period after its release (The Witcher took 5 years to sell 28 million copies). This gives analysts grounds to raise their long-term forecasts for the sequel.

- No negative surprises: The report does not mention any delays or production issues with Polaris. The stable number of developers (447 people) suggests that work is progressing according to schedule, bringing us closer to a potential release in 2026/2027.

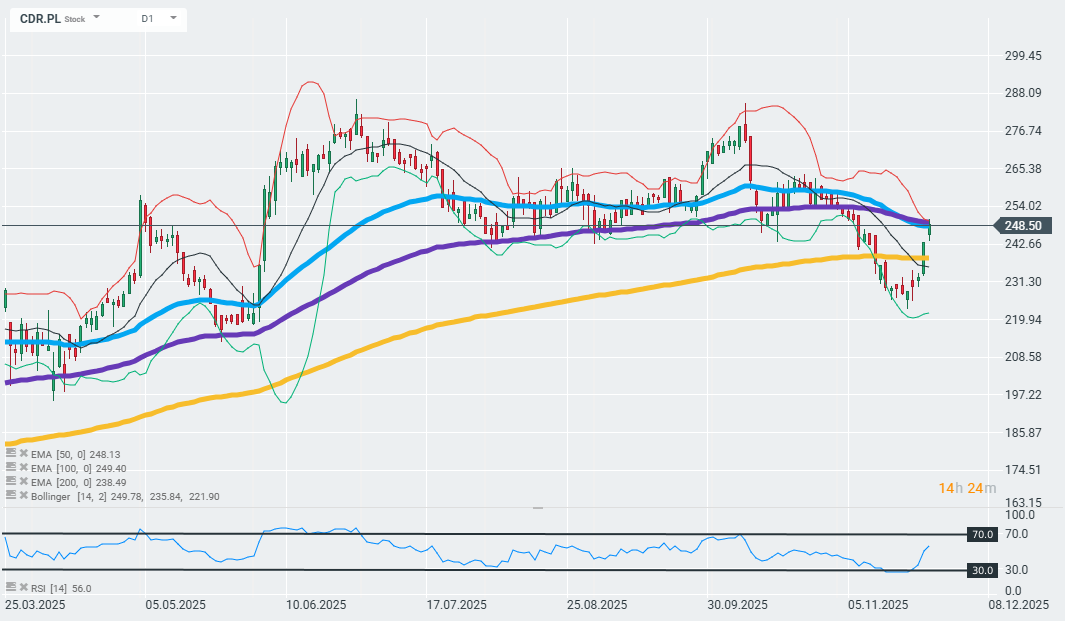

The company’s shares are reacting optimistically to the publication of quarterly results. The price itself is currently testing the 50- and 100-day exponential moving averages, which may be considered key control zones in the short and medium term, indicating the dominance of buyers or sellers. Source: xStation

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.