The third quarter of 2025 brought spectacular changes in hedge fund capital allocations, reversing the euphoria surrounding the “Magnificent Seven” stocks. Warren Buffett made an extraordinary move, increasing his position in Alphabet by 17.9 million shares (£4.9 billion), while reducing his stake in Apple by 15% and selling 37.2 million shares in Bank of America.

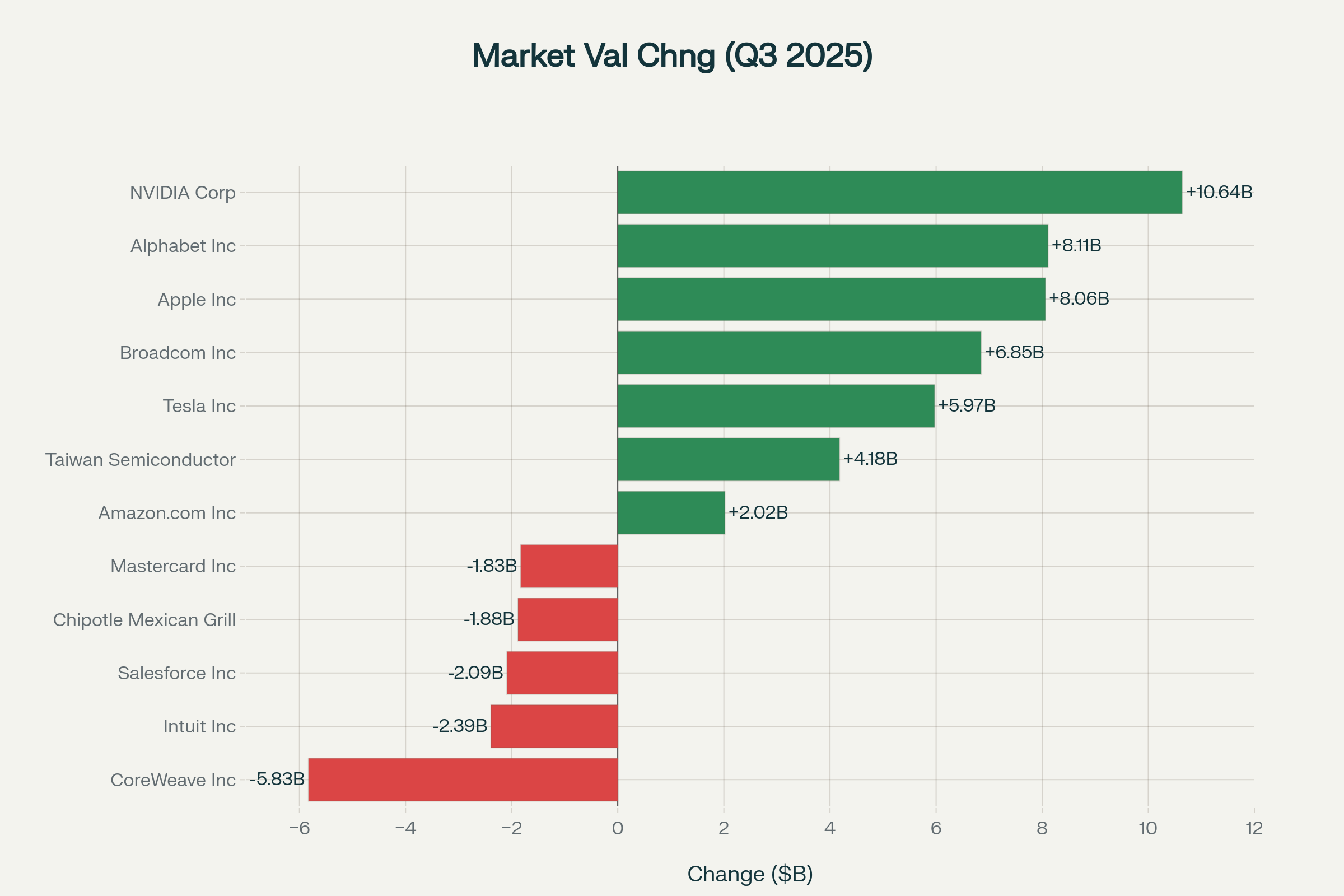

Based on data from nearly 909 hedge funds surveyed, the technology sector maintained its leading position (26% of portfolios) in terms of capital allocation. However, it is worth noting that as many as 145 funds reduced their positions in Apple, while only 118 increased them, and CoreWeave experienced a collapse in value of $5.83 billion – the largest decline in fund exposure across the entire market in terms of transaction value. NVIDIA remains a giant with a position worth $56.5 billion, and the $10.64 billion increase in value alone continues to confirm strong interest in the company, given its results and future projections.

CoreWeave, one of the state’s key AI infrastructure companies, has lowered its revenue forecast for 2025 from $5.35 billion to $5.05–5.15 billion, citing delays from third-party suppliers and energy constraints. CEO Michael Intrator acknowledged the industry’s frustration: the entire AI ecosystem is suffering from supply chain disruptions, computing power shortages and delays in connecting to the power grid. The rejection of the Core Scientific acquisition and the simultaneous decline in CoreWeave’s operating profit margin from an expected 6.5% to an actual 4% shows a dangerous combination and the risks that lie ahead.

Source: own study, XTB Research based on 13F data. Selected companies.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.