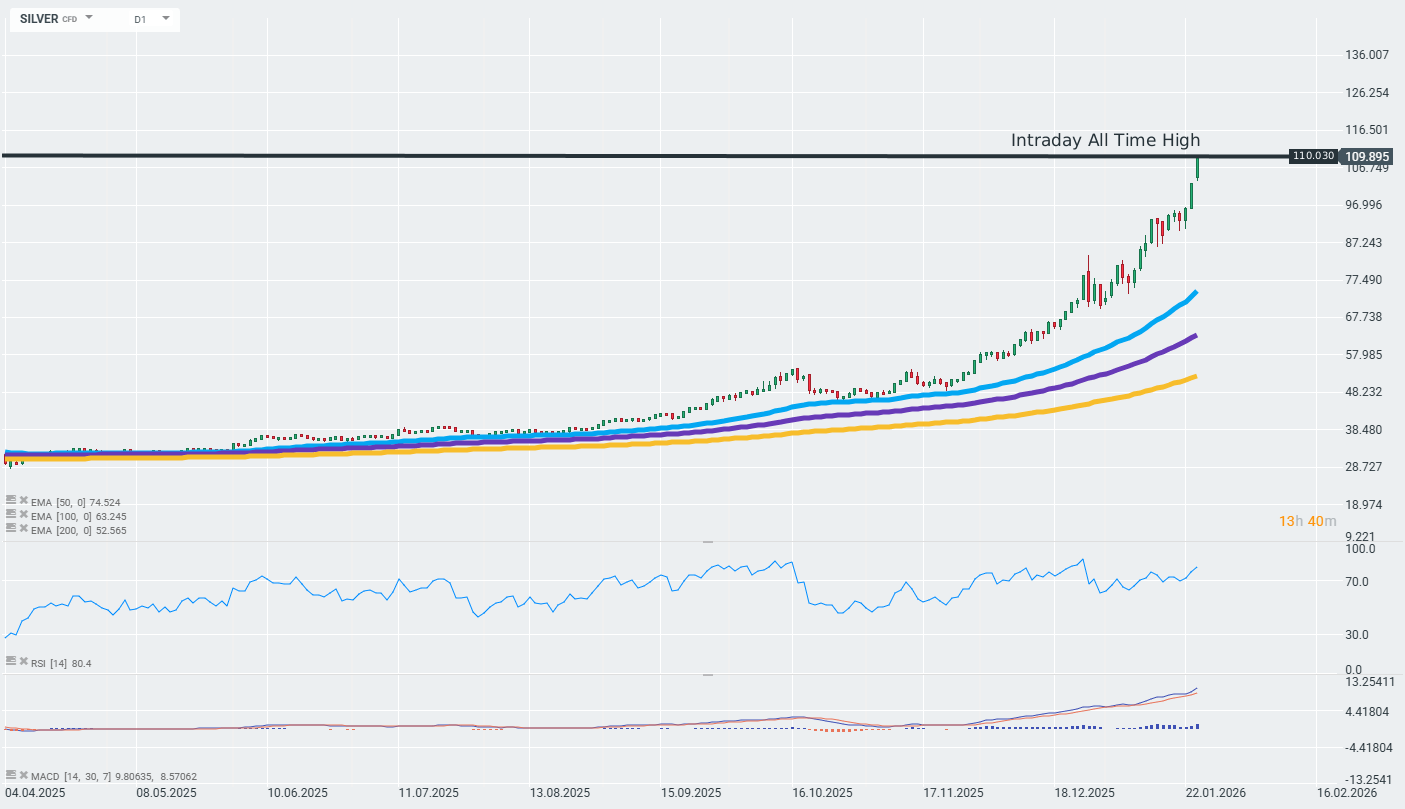

Chart of The Day – Silver.XAG

This morning, the precious metals market made history in a way that investors will remember for decades to come. Silver reached an unprecedented high of $110 per ounce, rising another 7% in just one session, while gold broke through the $5,100 barrier, recording its sixth consecutive day of gains. These figures are not the result of speculative frenzy. This is a structural change in the way the world perceives money, financial security, and the role of reserves.

The rise in silver in just one month (54% since January 1) is virtually unprecedented in the long history of this metal. If we compare this to the whole of 2025—when silver rose by 150%—what we are seeing in January 2026 is truly spectacular. A year ago, in January 2025, silver cost around $31 per ounce. Today, we are seeing an increase of 280%.

Three Pillars of Growth

The first and most obvious catalyst is the confluence of tragedy and political disorganization in Minneapolis. Over the past two weeks, ICE agents under federal supervision have shot and killed two people in Minneapolis. These incidents have ignited protests not seen in America for decades. When Democrats in the Senate began blocking the government spending package until January 30, federal agencies had to choose between funding ICE operations and conceding to demands for changes in immigration policy. In normal times, this would have been a tactical negotiating aid. But in a world where voters and investors are already weary of uncertainty, the risk of an actual government shutdown has skyrocketed. Every government shutdown historically generates an “uncertainty premium” in defensive assets—and silver and gold are the ultimate refuge from such uncertainty.

The second pillar is the drastic weakening of the US dollar. The dollar index has fallen to a three-and-a-half-month low, and the main reasons are deep and structural. The market is currently pricing in at least 50 basis points of interest rate cuts by the Federal Reserve in 2026. At the same time, the European Union is expected to remain unchanged, while the Bank of Japan plans to raise rates. In such an environment, currencies with a more conservative stance become more attractive relative to the dollar, even though nominal rates in the US remain higher, which should support the USD. This point highlights the decline in confidence in the world’s reserve currency, which marginalizes this aspect of relatively higher nominal rates.

The answer lies in the fundamental shortage of silver supply. Seventy-five percent of all silver production is a by-product of copper, lead, and zinc mining. In other words, you cannot suddenly increase silver production by deciding to mine more silver. You have to mine more copper, lead, and zinc—and that happens with a certain delay and with its own limitations. At the same time, silver inventories on the COMEX and London Metal Exchange are at their lowest levels in decades. At the same time, China, which controls a significant portion of global trade, has classified silver as a strategic material and imposed export restrictions. What’s more, on the CME in New York, speculators must purchase silver futures contracts subject to margin requirements. In the last three months, the CME has raised its minimum margin requirements twice. Silver now requires margins of around 9-10% of the contract’s face value, or about $25,000 per contract. This makes speculative betting on increases much more expensive. At the same time, in the East—in Shanghai, Mumbai, and Tokyo—investors are paying premiums of $8-20 above the New York price.

SILVER resumes its long-term upward trend and widens the spread between the price and moving averages The RSI for the 14-day average remains in the 81-point zone. Source: xStation

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.