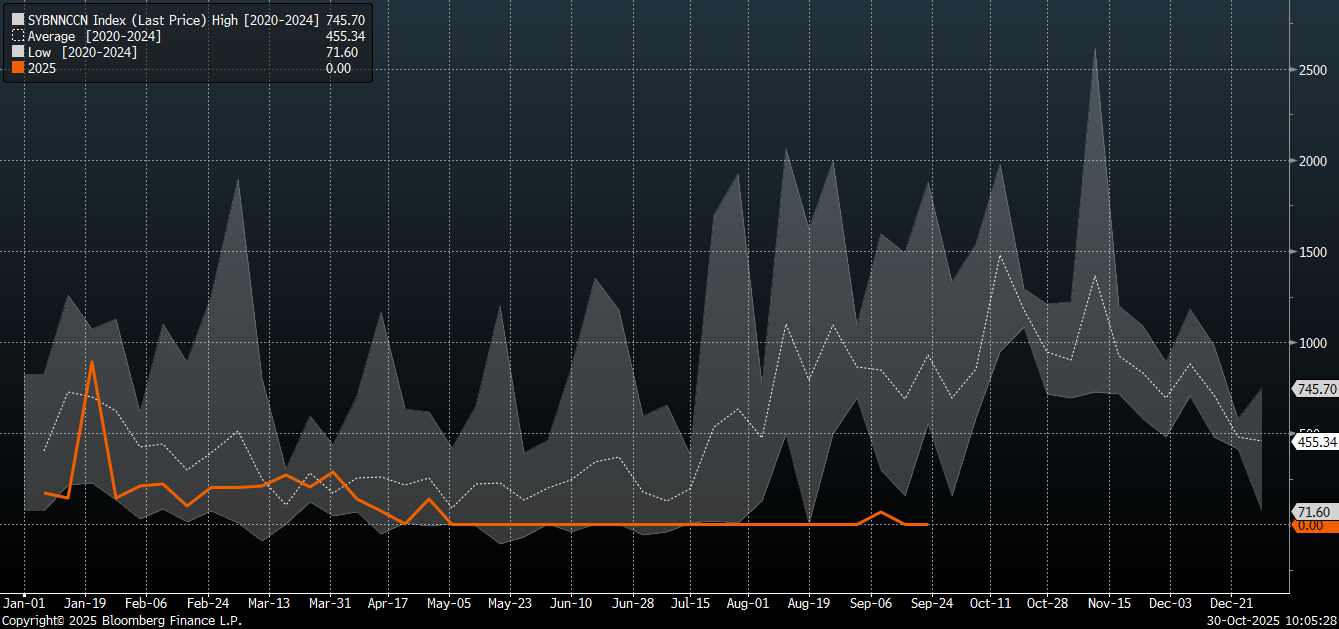

Chart of the Day – Soybean

Futures contracts for soybeans in Chicago dropped by over 1% following the conclusion of the Trump-Xi meeting in Busan, despite earlier dynamic price gains driven by hopes for a trade agreement and a resumption of Chinese soybean purchases. Ultimately, state-owned COFCO purchased three cargoes of soybeans for December and January delivery as a goodwill gesture immediately preceding the talks, marking a clear signal of change after a period of boycotting US supplies.

China has bought virtually no US soybeans since the trade war began in April. It is worth noting, however, that China has significantly diversified its sources of supply since the initial trade conflict. The current order may not indicate a total shift in procurement direction, as it coincides with the standard seasonal lull in supplies from South American countries. Source: Bloomberg Finance LP

Soybean prices have been rising since mid-October, and trading opened with a gap-up at the start of this week, reaching peaks near 1,100 cents per bushel—the highest level in 15 months. However, the price is reacting negatively following China’s declaration. It is worth recalling that the 2020 declaration of strong purchases of soybeans and other agricultural products was never fully fulfilled. Until the details of the agreement are released, such as a full purchase schedule, investors may choose to book more profits. The position of speculators is also unknown; immediately before the US government shutdown, speculative investors maintained a net short position in soybeans.

It must be emphasized that structurally, the majority of Chinese imports are still sourced from Brazil, which met over 70% of China’s demand in 2025 by exporting record volumes—an effect of the tariff war and political uncertainty. US farmers have borne the negative consequences of this policy, as historically, the peak selling season occurred in autumn. Some analysts stress that COFCO’s purchases are strictly political in dimension and do not alter Brazil’s position as the primary supplier. The 180,000 tonnes of soybeans bought by China are considered more of a gesture than a genuine reorientation of trade.

Technical Outlook

The price is currently rebounding from the 1,070 cents per bushel level, but a scenario where the gap created at the start of this week is closed cannot be ruled out. Key support is located at 1,058 at the 38.2% Fibonacci retracement of the last upward wave, and 1,042 at the 50.0% retracement.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.