Crypto News – Bitcoin Stabilizes After Sell-off

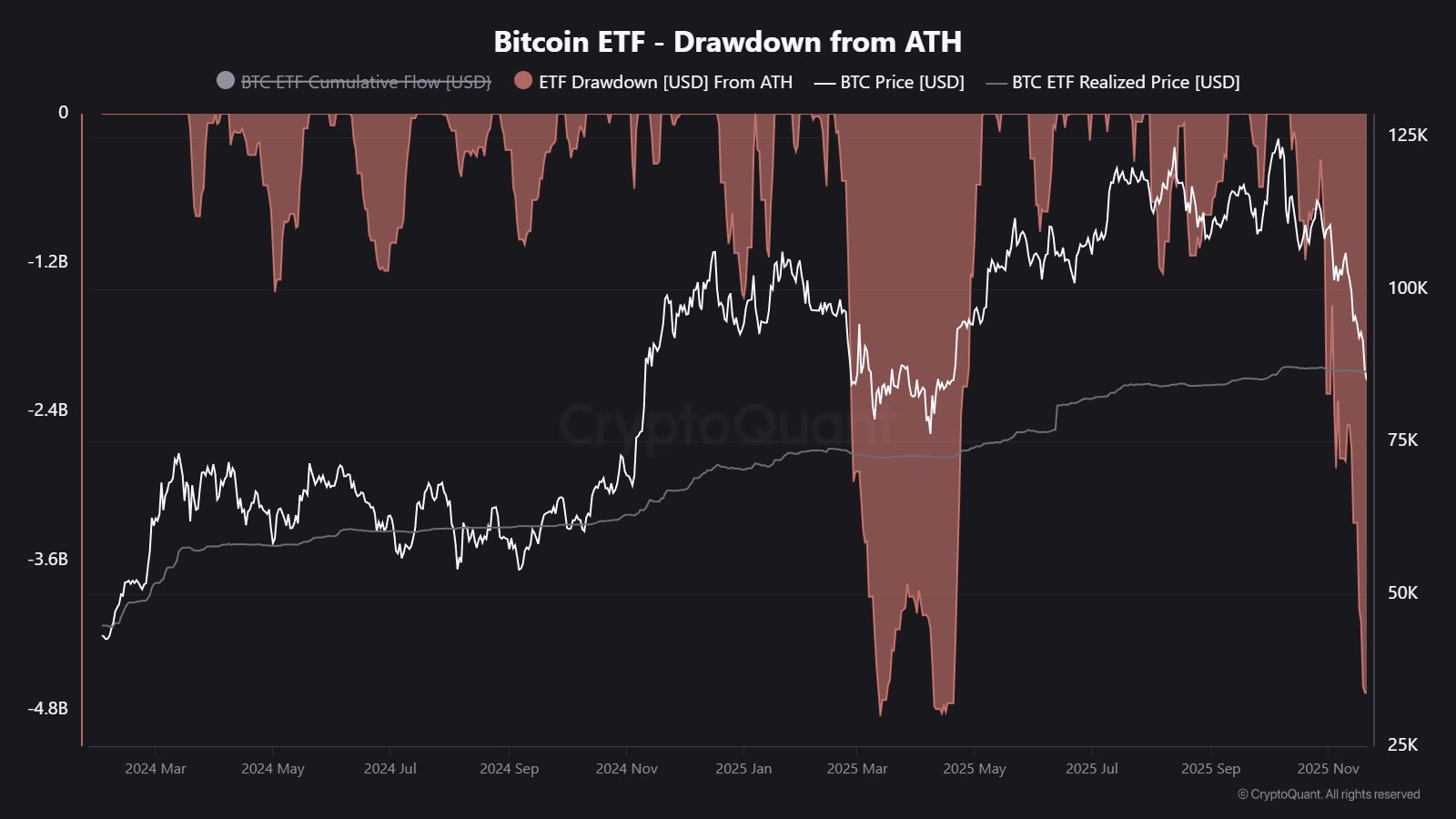

Cryptocurrencies are attempting to open the new week with modest, stabilizing gains after a very weak period during which BTC fell more than 30% from its recent highs. U.S. crypto ETFs remain the key monitoring tool for the market. Over the past four weeks, BTC-based funds have seen a record $4.35 billion in outflows. BlackRock’s IBIT alone recorded over $1.2 billion in net outflows last week, while the total trading volume of all funds exceeded $40 billion, suggesting significant institutional repositioning. A major driver for risk assets today is the sharp rise in expectations for a December rate cut—the market now assigns a 70% probability, compared with roughly 20% just a week ago.

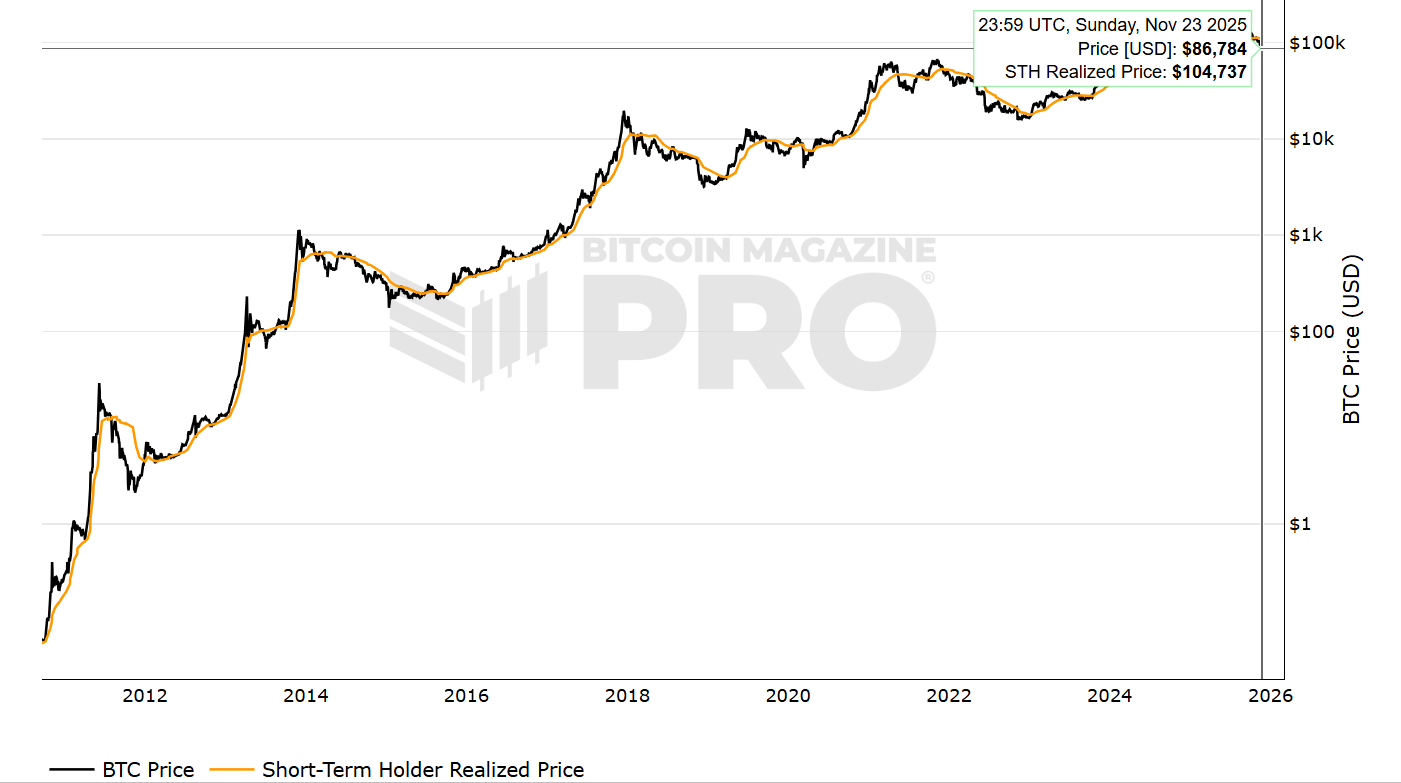

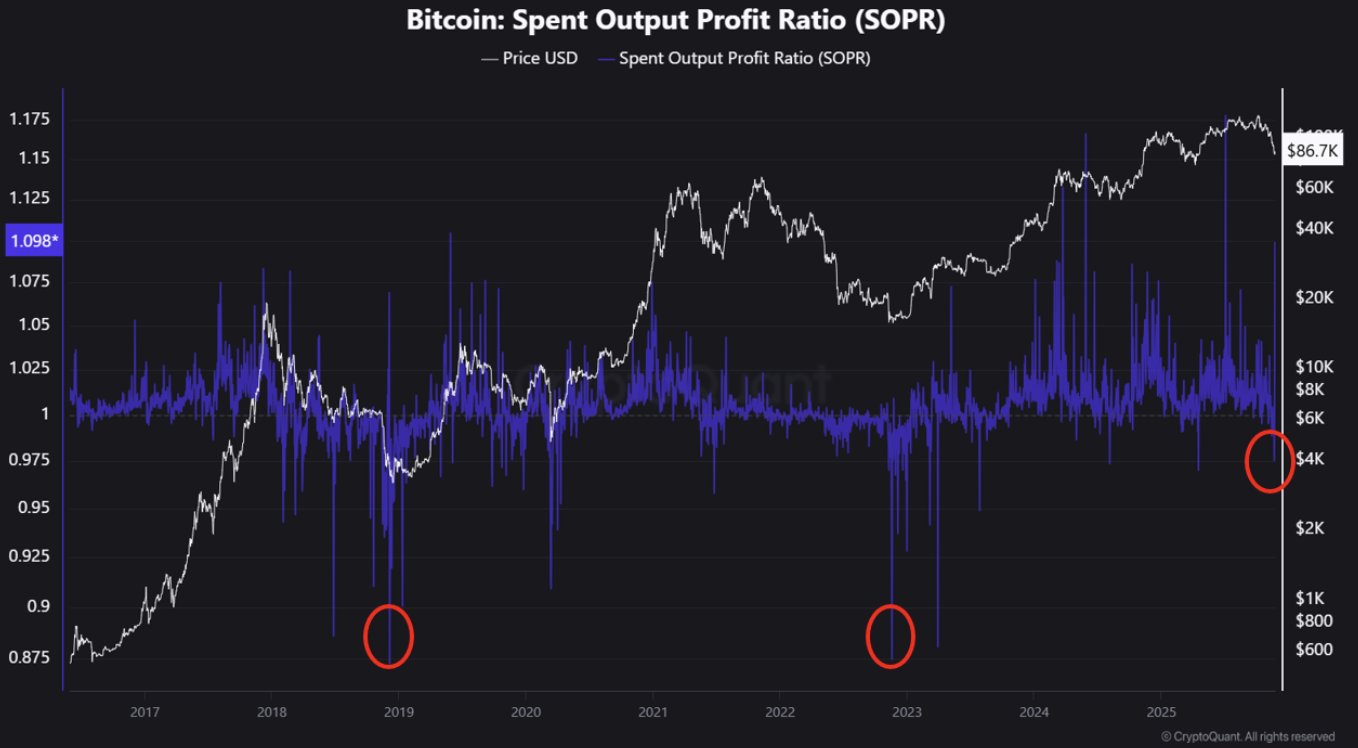

For now, as long as equity markets continue to rebound from recent declines, cryptocurrencies may follow a similar path. Similar-scale ETF outflows were seen in the spring during the Trump-tariff-driven sell-off. Source: CryptoQuant The average loss currently experienced by short-term investors is nearly 30%, a level historically associated either with Bitcoin entering a bear market or with bottom formations during deep corrections. Source: Bitcoin Magazine Pro

The average loss currently experienced by short-term investors is nearly 30%, a level historically associated either with Bitcoin entering a bear market or with bottom formations during deep corrections. Source: Bitcoin Magazine Pro

Bitcoin and Ethereum Charts

Looking back at the panic in April, Bitcoin’s peak-to-trough decline then—at its worst—was also around 30%, similar to now. However, that correction was less dramatic and more gradual. Today, BTC faces heavy profit-taking from the largest and oldest holders, while inflows from retail investors remain limited. Many retail traders lost capital during the October 10 crash, when hundreds of altcoins fell more than 50% within hours.

Source: xStation5

Ethereum still has a long way to go before reclaiming the $3,000 level. Both RSI and MACD point to extremely weak sentiment at the moment. Observing the EMA50 crossing below the EMA200 (“death cross”), we see that in the last four instances since 2021, this pattern twice marked a price bottom—but in the other two cases it preceded brief recoveries followed by another wave of declines.

Source: xStation5

A renewed drop below $80,000, according to CryptoQuant analysis, could increase the probability of a bear market and bring long-term pressure on Bitcoin’s Short-Term Holders, who have taken a significant hit in recent weeks.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.