Crypto – Will Ethereum Return to the $3,000 Zone

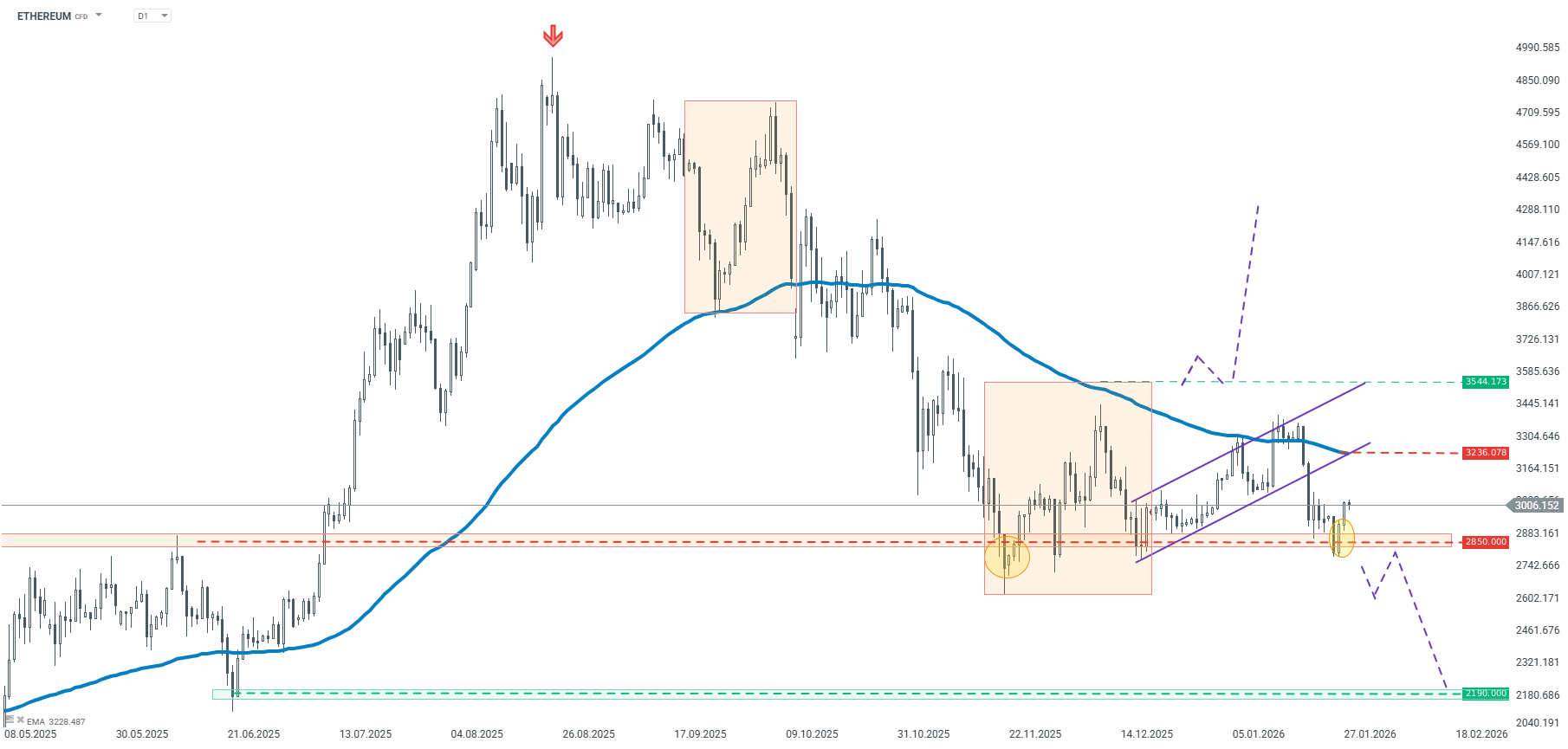

Ethereum quotes have been lacking a clear direction for some time now. Looking at the D1 interval, the key support remains the zone at $2,850, which has already been tested by the market several times. If yesterday’s rebound continues, the price may move towards resistance at $3,236, where the average of the last 100 periods runs, marked on the chart with a blue line.

However, in order for a clearer trend to develop, the market would have to break out of its current structure. A break below the support level at $2,850 would open the way towards $2,190, while a break above $3,540 would give a chance for a return to the uptrend. At this point, the direction remains undecided.

Ethereum – D1 interval | Source: xStation5

Ethereum – D1 interval | Source: xStation5

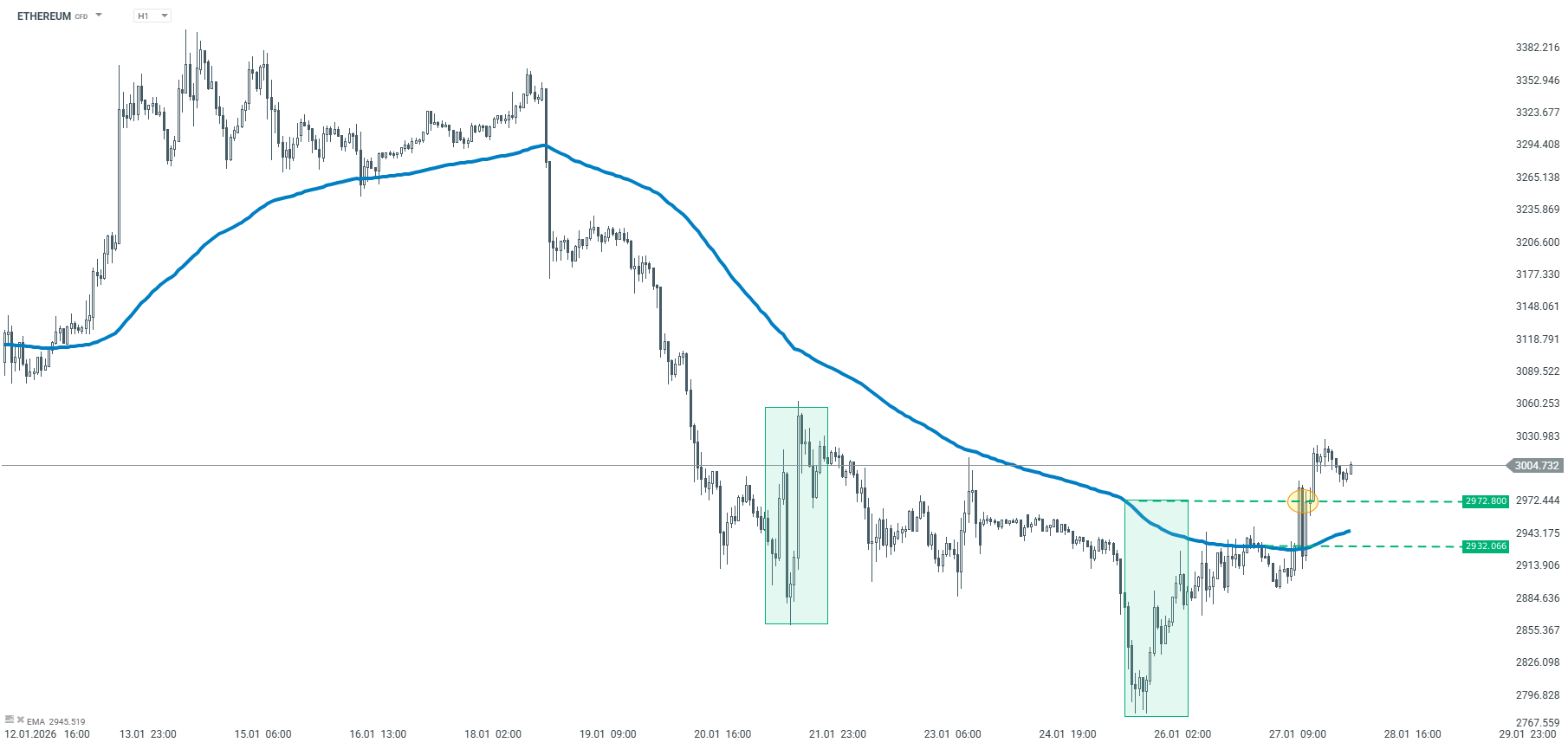

On the lower H1 time interval, we drew attention to the average and 1:1 geometry. Despite the initial supply reaction, the price managed to break through both significant resistances – $2,932 and $2,972. In the short term, this pattern increases the chances on the demand side and may support a scenario of further upward movement, provided that the broken levels are maintained.

Ethereum – H1 interval | Source: xStation5

Ethereum – H1 interval | Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.