Cryptocurrencies Gain Amid Improving Sentiments on Wall Street

Cryptocurrencies attempt a rebound on Monday after sharp declines, during which BTC fell about 20% from its all-time high, while Ethereum pulled back to around $3,000 from $4,900 seen in the summer. Today, both of the largest cryptocurrencies are gaining along with U.S. stock indices, where improving sentiment may signal higher inflows into ETF funds. Hopes for a U.S. government reopening have increased, as Republicans continue to negotiate details with Democrats. Importantly, reopening the government would also boost market liquidity, which—beyond improved sentiment about the economy—could serve as a more structural driver for the trend.

CryptoQuant noted that spot order size data suggests the return of institutional investors to the Ethereum market, which, if it holds the $3,000–$3,400 support zone, may be entering a low-volatility accumulation phase.

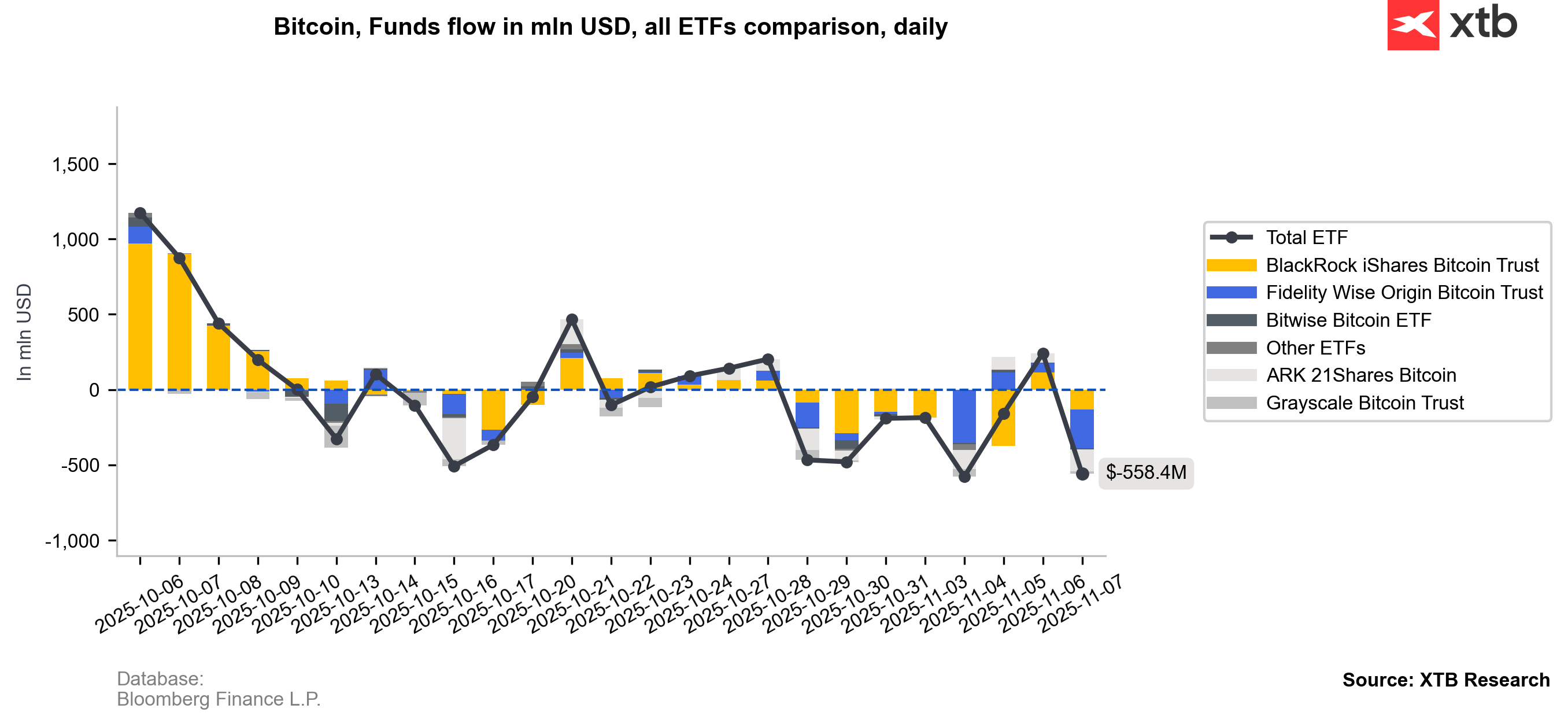

Meanwhile, older Bitcoin wallets have recently been transferring their crypto reserves to Binance at the largest scale since July, indicating strong selling pressure among that group of investors. Bitcoin ETF inflows have fallen by about $2.3 billion from their peak, marking the biggest outflow since May 2025.

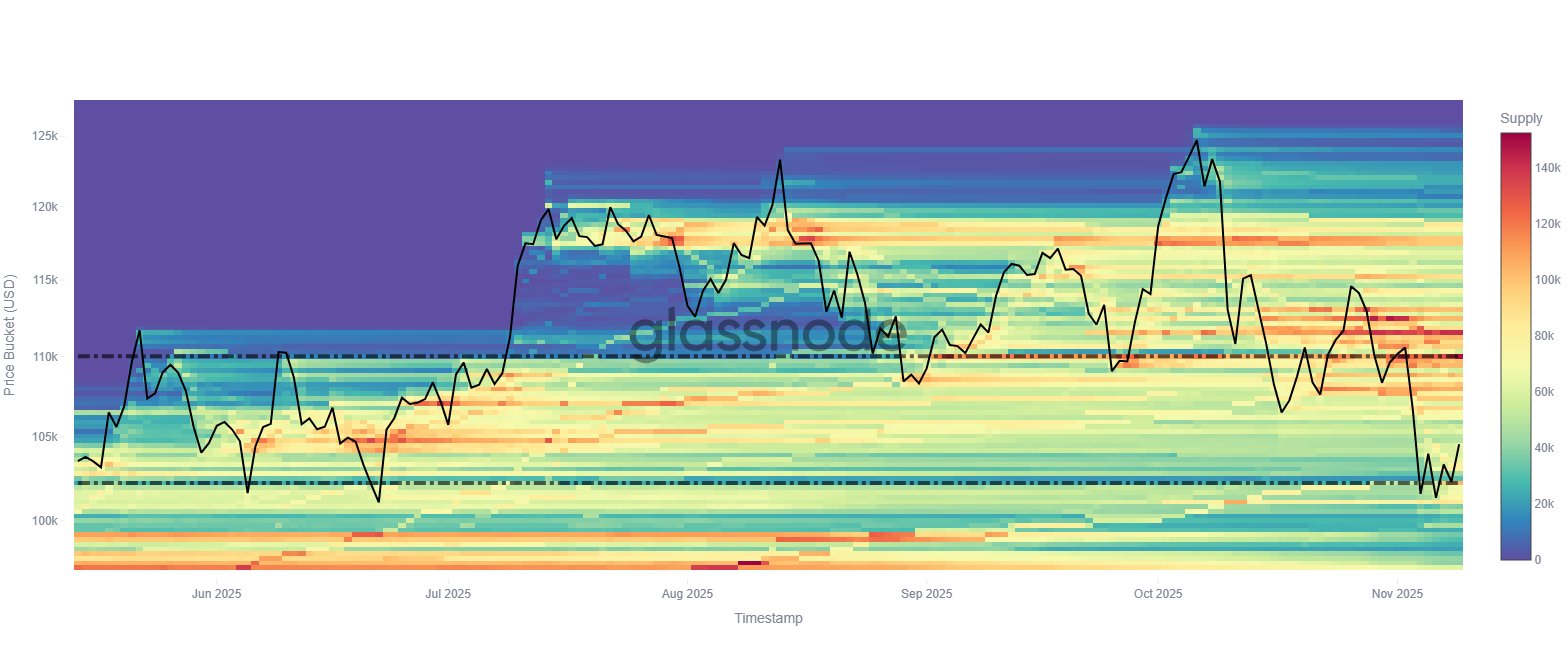

Since October, long-term investors (LTHs) have resumed selling, but this time demand has weakened, preventing the market from absorbing their supply at higher prices. For instance, during January–March and November–December 2024, increased selling from LTHs was offset by rising demand. The market is now clearly in a correction phase, which is also evident in on-chain flows. Analysis of Glassnode’s on-chain Cost Basis Distribution indicator shows the key price levels where Bitcoin positions are being built or closed on a large scale. Two levels currently stand out:

- $110,000 – a zone showing high supply concentration, where many market participants have been eager to sell BTC

- $102,000 – where accumulation is starting to appear, though still relatively weak

It will be crucial to watch whether selling around $110,000 remains strong and if demand near $102,000–$105,000 continues to develop.

Source: Glassnode

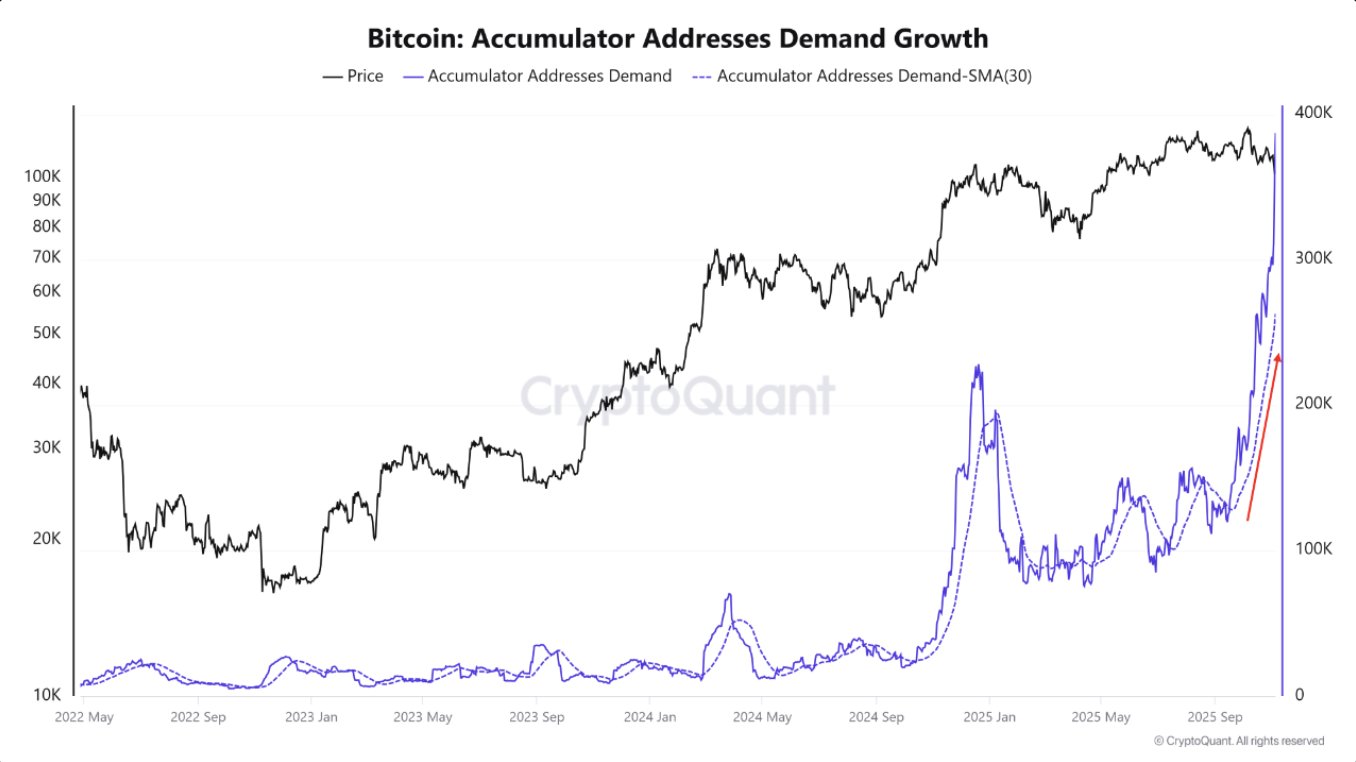

CryptoQuant’s on-chain indicators still point to solid accumulation among broad investor groups, despite intense BTC selling from long-term addresses and falling prices.

Source: CryptoQuant

Bitcoin and Ethereum Charts (D1)

Looking at the charts of the two largest cryptocurrencies, we can see that both are currently attempting to reclaim the 200-day EMA (red line), with Ethereum showing a stronger rebound. The token is trading roughly around the key moving average near $3,600. The RSI indicator for both cryptocurrencies is gradually rising toward 50, suggesting a significant easing of selling pressure.

Source: xStation5

Source: xStation5

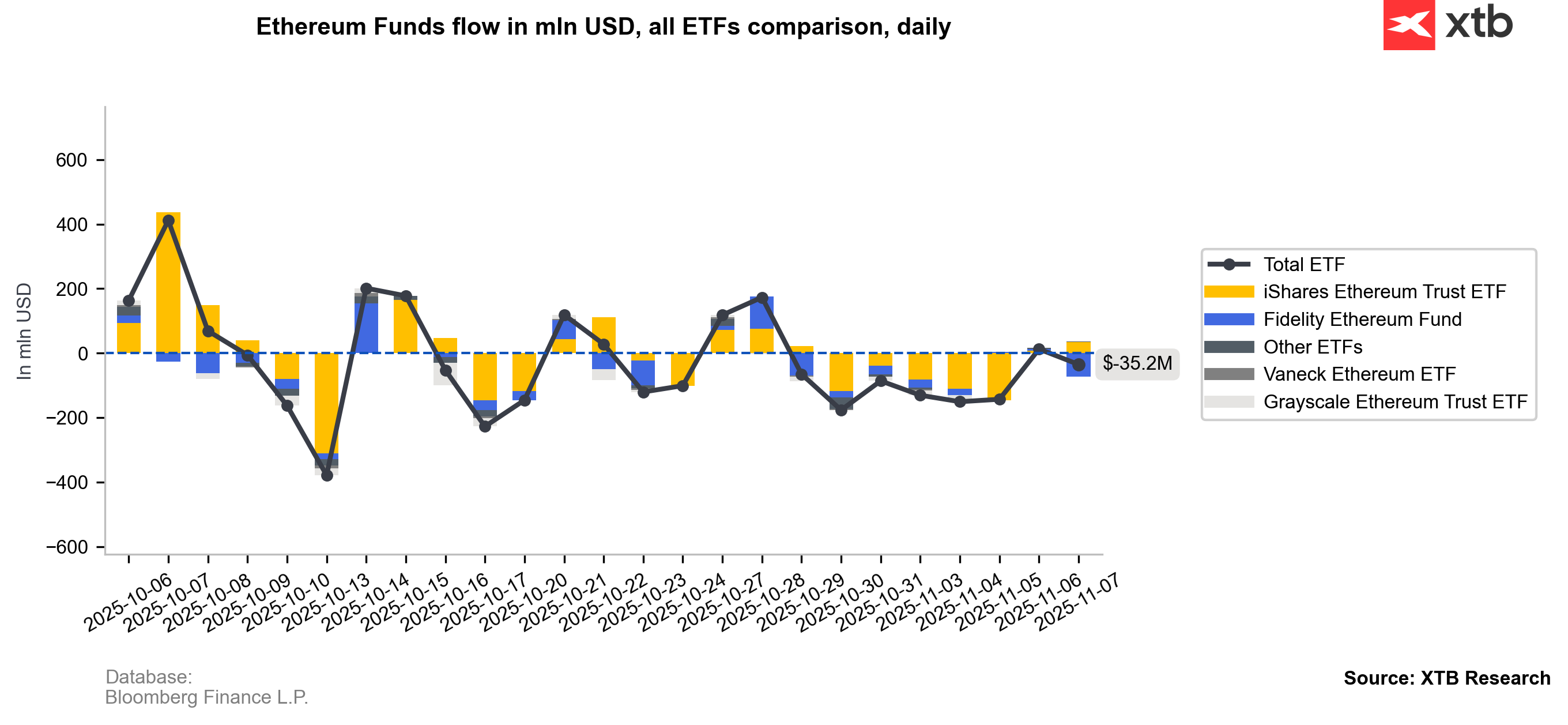

ETFs Are Selling (for Now)

Recent days have seen outflows from crypto ETFs, but the long-term trend appears intact—especially if the U.S. government reopens and stocks resume their upward trend. ETFs remain a key measure of buying momentum in the crypto market, closely monitored by hedge funds and dealers. Renewed demand from this group could serve as a key signal of a potential trend reversal.

Source: Bloomberg Finance L.P., XTB Research

Source: Bloomberg Finance L.P., XTB Research

Source: Bloomberg Finance L.P., XTB Research

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.