European equities are slightly lower at the start of the week. The EUROSTOXX index is down 0.15%. The selloff is not significant and remains limited to a 0.10–0.60% range. The German DAX is down 0.10%, the French FRA40 drops 0.52%, and the British UK100 loses 0.15%. EURUSD gains 0.30% thanks to slight declines in the dollar and gains in the euro.

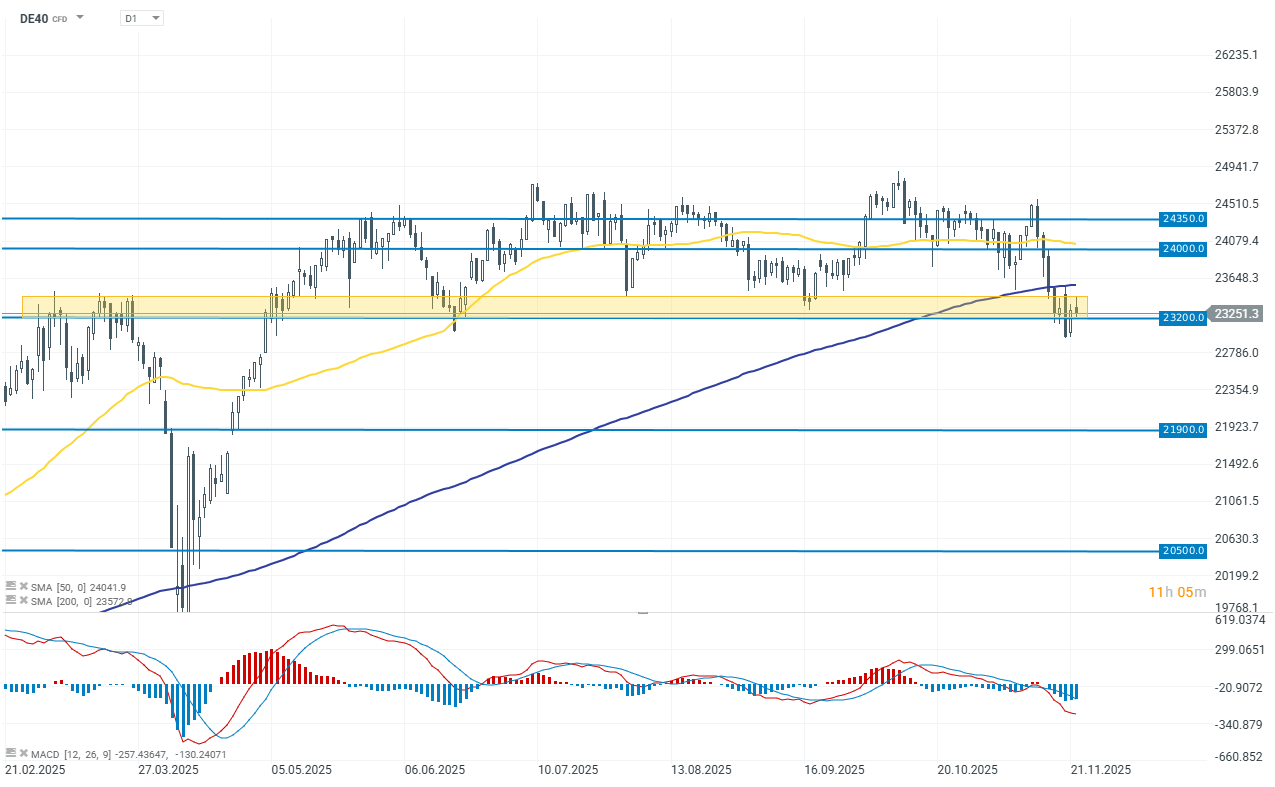

DE40

The German index is currently testing the lower boundary of the consolidation channel in place since the end of April this year. This is the longest period so far spent around the 23,200-point zone. If the bulls fail to hold this support, the selloff could deepen rapidly from a technical perspective.

Company news

- European defense companies are seeing sharp declines amid the possibility of a peace settlement in Ukraine. By Thursday, both sides are expected to accept the terms of the agreement supported by the U.S. Rheinmetall (RHM.DE) is down nearly 5.00% today.

- Bayer (BAYN.DE) rises over 11.00% after its experimental anti-stroke drug asundexian delivered strong results in late-stage trials — reducing the risk of recurrent stroke. This gives the company new momentum amid declining blockbuster sales.

- Leonardo (LDO.IT) falls 2.30% after seven Italian organizations filed a lawsuit seeking to annul a defense contract with Israel, alleging violations of the constitution and international law. The company said it will defend the agreement in court and emphasized that it is not linked to operations in Gaza.

- Commerzbank (CBK.DE) and the European Investment Bank (EIB) announced a new 1.2 billion euro risk-sharing program under the EU’s G4E initiative, aimed at supporting local German energy infrastructure. The EIB will cover up to 50% of Commerzbank’s exposure to municipal energy loans, boosting lending capacity and supporting small projects in electricity, heating, and grid modernization — all crucial for Germany’s long-term energy transition.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.