Earnings Q4 2025 – Netflix And Warner Bros in The Spotlight

Why the Results Matter

Today, Netflix is set to release its fourth-quarter 2025 results, and the media and investor world is holding its breath. This is not just a standard financial report — it is a key moment for the company to demonstrate that its subscription and hybrid model (ads + subscriptions) is sustainable, even amid global competition and major strategic deals.

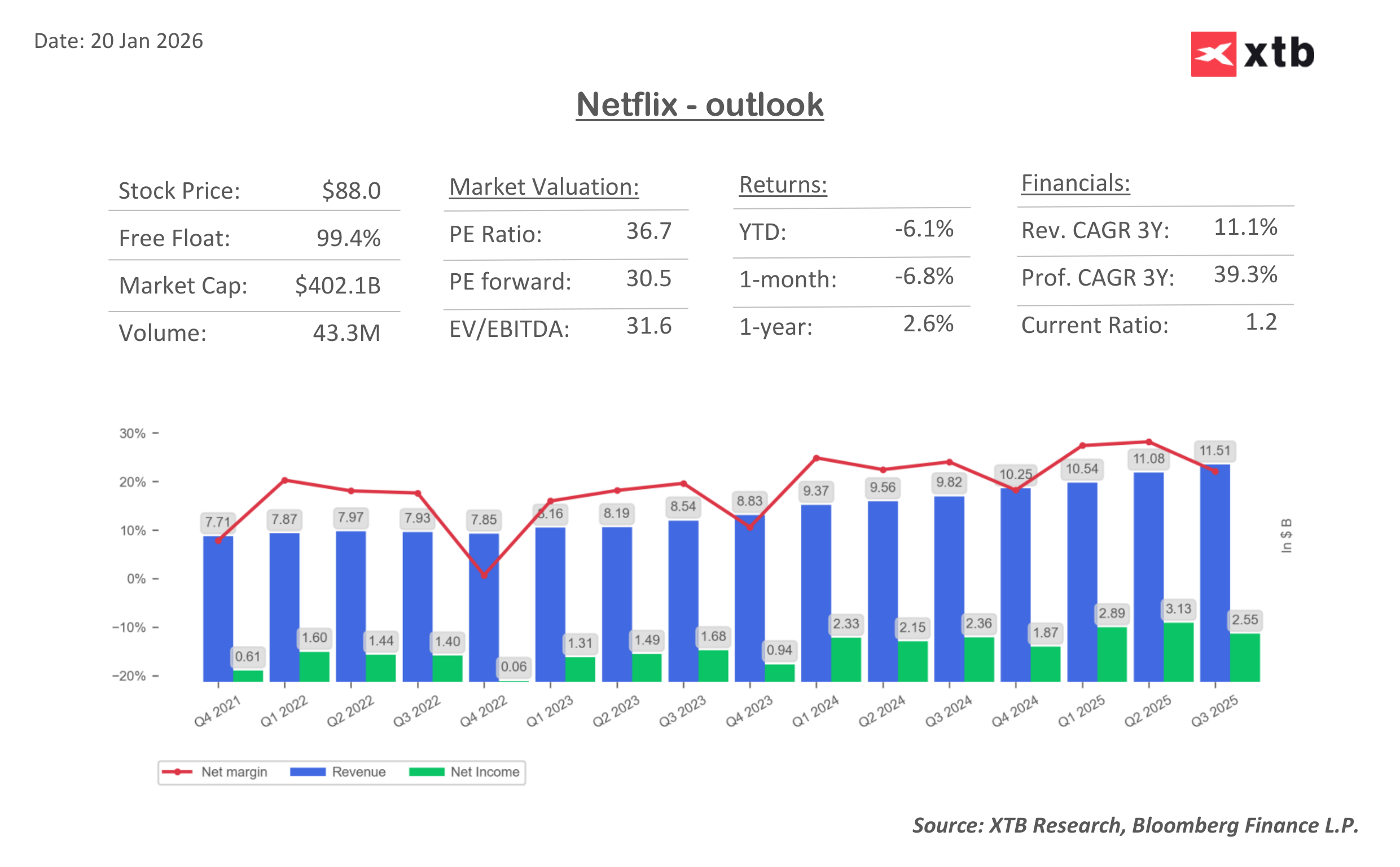

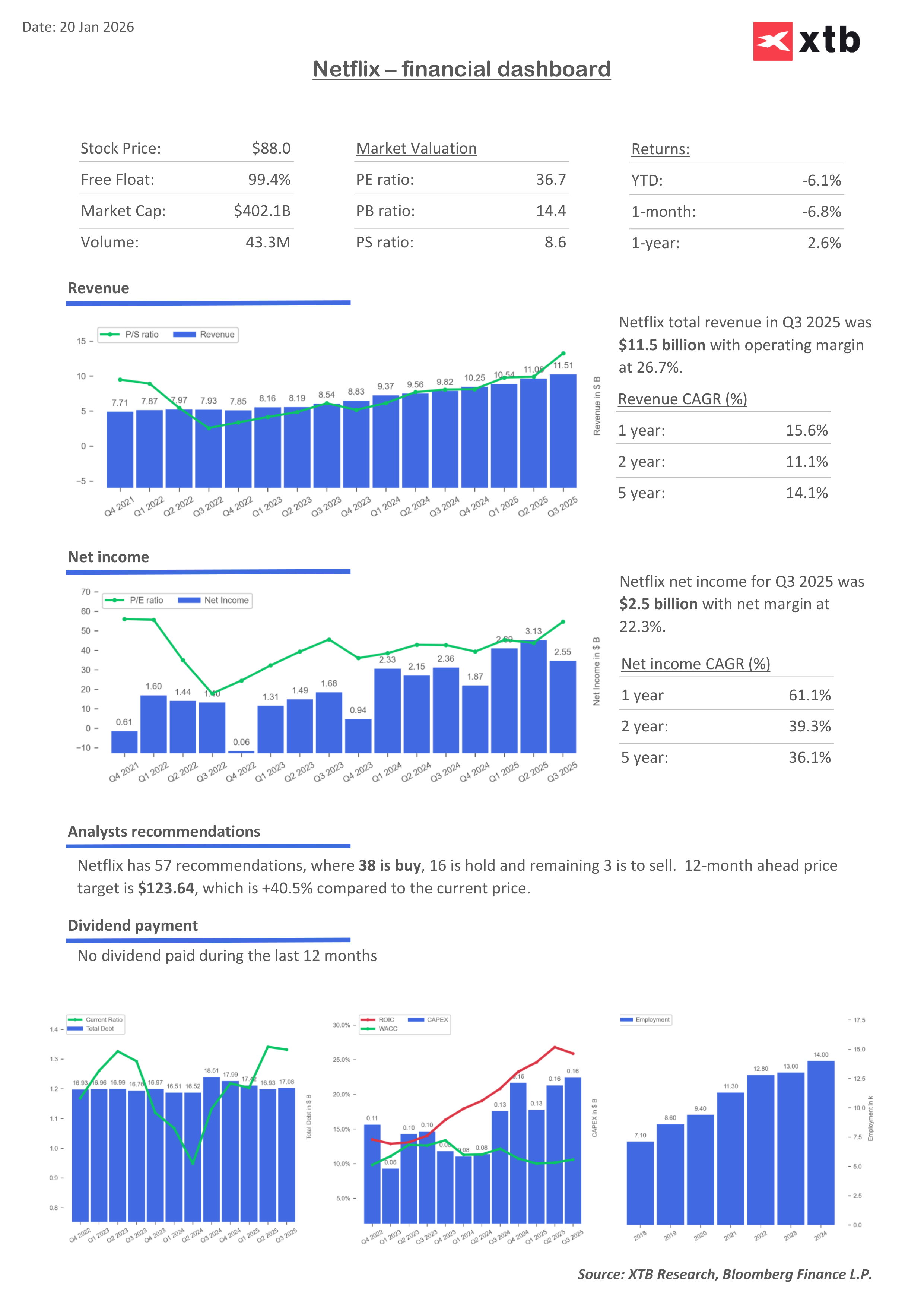

Forecasts point to revenue growth of around 16.7% year-on-year, driven by price increases, a growing advertising segment, and a blockbuster content lineup. Operating profit is expected to remain stable, and the streaming giant anticipates a 29% operating margin in 2025 and cash flows of $9 billion, compared to $6.9 billion in 2024.

Key Financial Estimates for Q4 2025:

- Revenue: $11.96 billion, up 16.7% YoY

- Earnings per share (EPS): $0.553, up 25.4% YoY

- Operating margin: 29.6%

- Net income: $2.36 billion, up 22.2% YoY

- Operating income: $2.89 billion, stable versus the prior period

- EBITDA: $3.03 billion, also stable

This shows that Netflix is not only growing but also generating strong cash flow, providing a foundation for investing in new content and potential acquisitions, including Warner Bros. Discovery.

What Investors Will Focus On

Investors will pay attention not only to revenue but also to the quality of growth and the potential for 2026. Key areas of focus are expected to include:

- Growth-driving content: Major Q4 hits such as the “Stranger Things” finale, the “Jake Paul vs. Anthony Joshua” fight, and NFL Christmas games increased engagement and attracted new users. Markets expect similar offerings in upcoming quarters.

- Advertising segment: Analyst estimates suggest ad revenue could reach $4–5 billion in 2026, after nearly doubling in 2025.

- Margins and profitability: Analysts project an operating margin of over 32% in 2026, continuing improvement from the 29% forecasted for 2025.

- Subscribers: Consensus anticipates 10.7 million new subscribers in Q4, although the company has stopped regularly disclosing subscriber numbers, focusing instead on revenue and ARPU.

All of this paints a picture of stable fundamentals, even as the market focuses on how Netflix plans to continue growing next year.

The Impact of Warner Bros.

Another important topic is the potential acquisition of Warner Bros. The $82.7 billion deal could dramatically change Netflix’s position in the market.

Even with relatively solid fundamentals in Q4, markets and investors will pay attention to:

- Regulatory risk: The deal is subject to antitrust review, which could lead to delays or additional restrictions.

- Concerns about core business growth: Some analysts question whether the company might be using this transaction as a “lifeline” amid slowing organic growth.

This shows that while quarterly results may be impressive, strategic decisions and M&A still dominate Netflix’s stock valuation.

Key Risks and Advantages for Netflix

Advantages:

- Global subscriber base: Estimates suggest around 330 million users worldwide, with further potential to monetize content through ads.

- Premium content: Original productions and live events, such as the “Stranger Things” finale or sports fights, increase engagement and help maintain user loyalty.

- Improving profitability: Rising operating margins and ad revenue strengthen financial fundamentals.

Risks:

- Competitive pressure: Disney+, Apple TV+, and Amazon Prime continue expanding content portfolios and investing in technology.

- M&A risk: Debt and regulatory complications related to Warner Bros. could limit Netflix’s financial flexibility.

- Macro and subscriber risk: Sensitivity to consumer sentiment and purchasing power across different regions worldwide.

Key Takeaways

Netflix is expected to show strong fundamentals in Q4 2025: revenue is growing, margins are improving, and cash flow is healthy. Despite concerns about slower core growth compared with previous quarters, the market expects Netflix to maintain revenue momentum and improve operational efficiency.

However, the strategic decision regarding the Warner Bros. acquisition remains a central issue, as it could reshape Netflix’s position in the global streaming market. Ongoing negotiations and the potential $82.7 billion deal continue to attract investor and analyst attention due to questions around financing, regulation, and the company’s long-term strategic direction.

Investors are therefore monitoring two parallel storylines: steady core growth in Q4 on one hand, and the risks and potential of a massive M&A transaction on the other. Success in one area without progress in the other may not be enough. 2026 is shaping up to be a year in which Netflix not only reports numbers but also actively shapes its future through strategic decisions and market expectations.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.