Gold nears record high as traders weigh US data and geopolitics

- Gold edges higher as a softer US Dollar supports prices.

- Easing tariff fears weigh on safe-haven demand, but broader fundamentals remain supportive.

- Technically, bulls are eyeing a break above $4,900.

Gold (XAU/USD) trims earlier losses on Thursday as traders digest a heavy slate of US economic data. At the time of writing, XAU/USD trades around $4,870, up nearly 0.80% after a short-lived dip below the $4,800 psychological level.

Bullion came under brief selling pressure, retreating from the record high of $4,888 set on Wednesday, as global risk appetite improved after US President Donald Trump backed away from his threat to impose tariffs on several European countries linked to the Greenland dispute.

However, traders are looking past the easing of immediate trade-war fears, as the broader macro backdrop remains supportive for Gold. Lingering concerns over Federal Reserve (Fed) independence, sustained expectations of lower US interest rates, the ongoing Russia-Ukraine conflict and continued strong central bank demand are keeping dip buyers engaged.

Meanwhile, a softer US Dollar (USD) is adding another layer of support. The US Dollar Index (DXY), which tracks the Greenback’s value against a basket of six major currencies, is trading around 99.50, down about 0.28%.

Market movers: Trump backs away from tariffs; markets weigh geopolitics and Fed risks

- Fresh US data showed steady inflation and resilient growth. Core Personal Consumption Expenditures (QoQ) for Q3 rose 2.9%, in line with expectations and unchanged from the previous quarter. Annualized Q3 Gross Domestic Product expanded 4.4%, beating forecasts of 4.3% and up from 3.8% in Q2. Meanwhile, Initial Jobless Claims fell to 200K, well below expectations of 212K, while the previous week was revised to 199K from 198K.

- Core PCE inflation rose 0.2% MoM in November, in line with expectations and unchanged from October, while the annual rate ticked up to 2.8% from 2.7%. Headline PCE also increased 0.2% on the month, matching forecasts, with the yearly pace rising to 2.8% from 2.7%. Personal Income climbed 0.3%, below expectations of 0.4% but stronger than October’s 0.1% gain, while Personal Spending held firm at 0.5%

- In a post on Truth Social late Wednesday, US President Donald Trump said he would not impose the tariffs scheduled to take effect on February 1 after a “very productive meeting” with NATO Secretary General Mark Rutte, adding that a “framework of a future deal” had been reached on Greenland and the Arctic region.

- Danish Prime Minister Mette Frederiksen struck a firmer tone, saying: “We can negotiate on everything — political issues, security, investments, the economy. But we cannot negotiate on our sovereignty.”

- US Supreme Court justices voiced skepticism on Wednesday over President Trump’s bid to fire Fed Governor Lisa Cook, raising concerns about the lack of due process. Justice Brett Kavanaugh warned that it could “weaken, if not shatter, the independence of the Federal Reserve.”

- On the monetary policy front, markets are pricing in around 50 basis points of easing by year-end, although the Fed is widely expected to remain on hold at the January 27-28 meeting. A Reuters poll published on Wednesday showed that 58% of economists forecast no change in rates during the first quarter. Looking further ahead, 55 out of 100 respondents expect rate cuts to resume in June or later, once Jerome Powell’s tenure as Fed Chair ends in May.

Technical analysis: Gold consolidates near highs as momentum cools

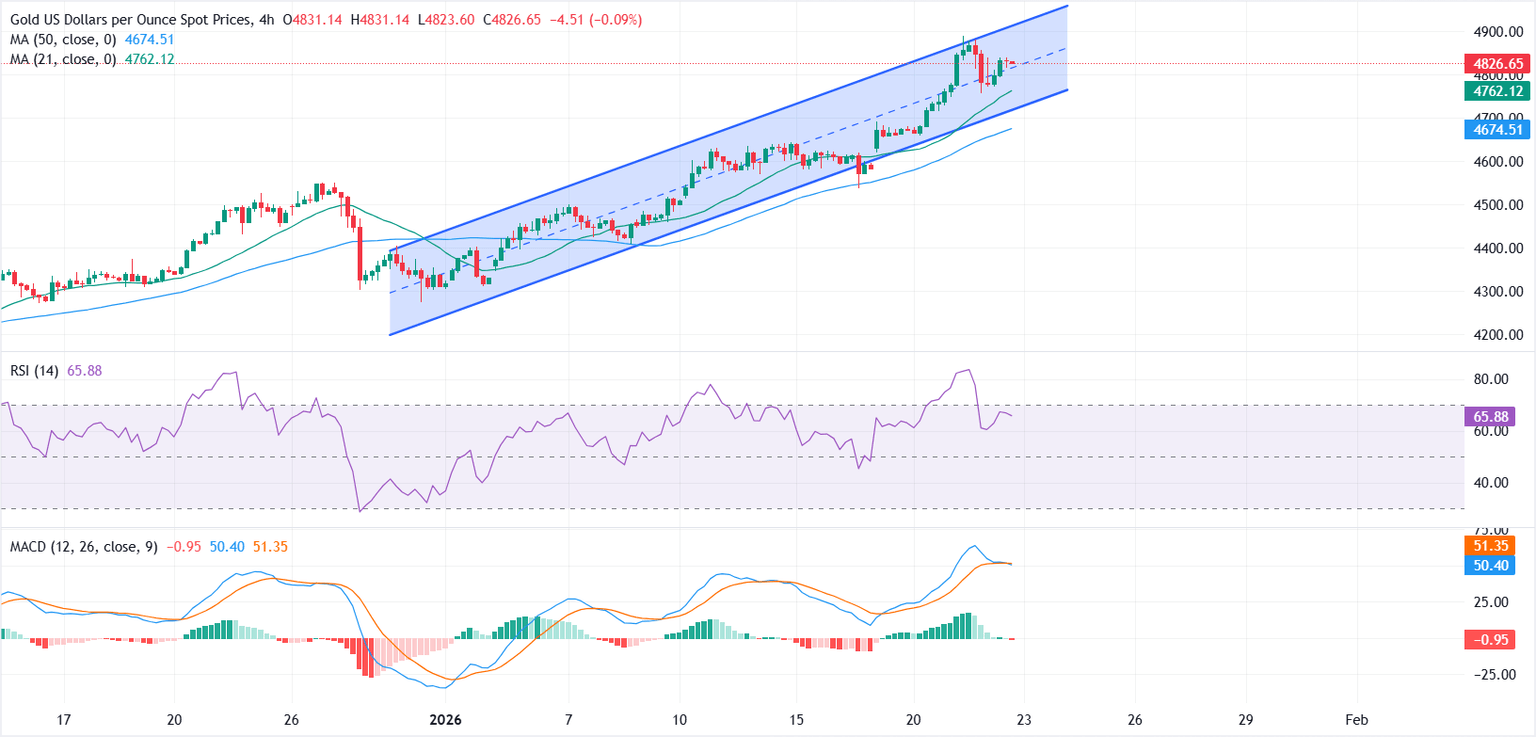

XAU/USD remains in a strong uptrend, with prices up nearly 11% so far this month after surging about 64% in 2025. On the 4-hour chart, Gold is trading within a well-defined ascending parallel channel, marked by a clear sequence of higher highs and higher lows. Prices remain comfortably above the 21-period and 50-period Simple Moving Averages (SMAs), reinforcing the view that buyers are firmly in control.

On the upside, bulls are eyeing a sustained break above the $4,900 mark, which would open the door for a fresh extension of the broader uptrend.

On the downside, the $4,800 psychological zone is the first line of support. A sustained break below this area would expose the 21-period SMA near $4,762, followed by the 50-period SMA around $4,674.50.

The Moving Average Convergence Divergence (MACD) has crossed below its signal line near the zero level, and the histogram has turned slightly negative, pointing to fading upside momentum. Meanwhile, the Relative Strength Index (RSI) near 66 keeps a neutral-to-bullish tone, but has eased from overbought levels.