HEICO Corporation (HEI.US) shares are near all-time high zone amid a new, announced acquisition that strengthens its presence in aerospace and defense manufacturing. HEICO’s Electronic Technologies Group has agreed to acquire Axillon Aerospace’s Fuel Containment Business for an undisclosed cash amount. The deal is expected to close in Q1 2026, pending customary conditions, including Hart-Scott-Rodino Antitrust clearance. HEICO expects the purchase to be accretive to earnings within one year after completion. HEICO focuses on advanced parts producing, niche electronics for both commercial and aerospace sectors working with private airlines, Department of Defense and NASA. Last acquisition came in July 2025 (Gables Engineering).

About Axillon Fuel Containment

- Based in Rockmart, Georgia, Axillon designs and produces military-specification fuel cells for U.S. military aircraft, select commercial aircraft, and ground vehicles.

- The company employs around 530 people at a 600,000-square-foot facility.

- Its fuel systems support platforms such as the F-16, F-15, F/A-18, CH-47 Chinook, and Bradley Fighting Vehicle.

- The business traces its roots back to Goodyear Tire & Rubber, which pioneered self-sealing fuel tanks during World War II.

Strategic Importance

- Co-CEOs Eric A. Mendelson and Victor H. Mendelson stated the acquisition adds a “storied and highly regarded business” to HEICO’s portfolio.

- The deal underscores HEICO’s strategy of acquiring niche, high-technology aerospace assets with strong defense ties.

- HEICO confirmed no major staff changes are expected — the current management team, will continue operations, and the facility will remain in Georgia.

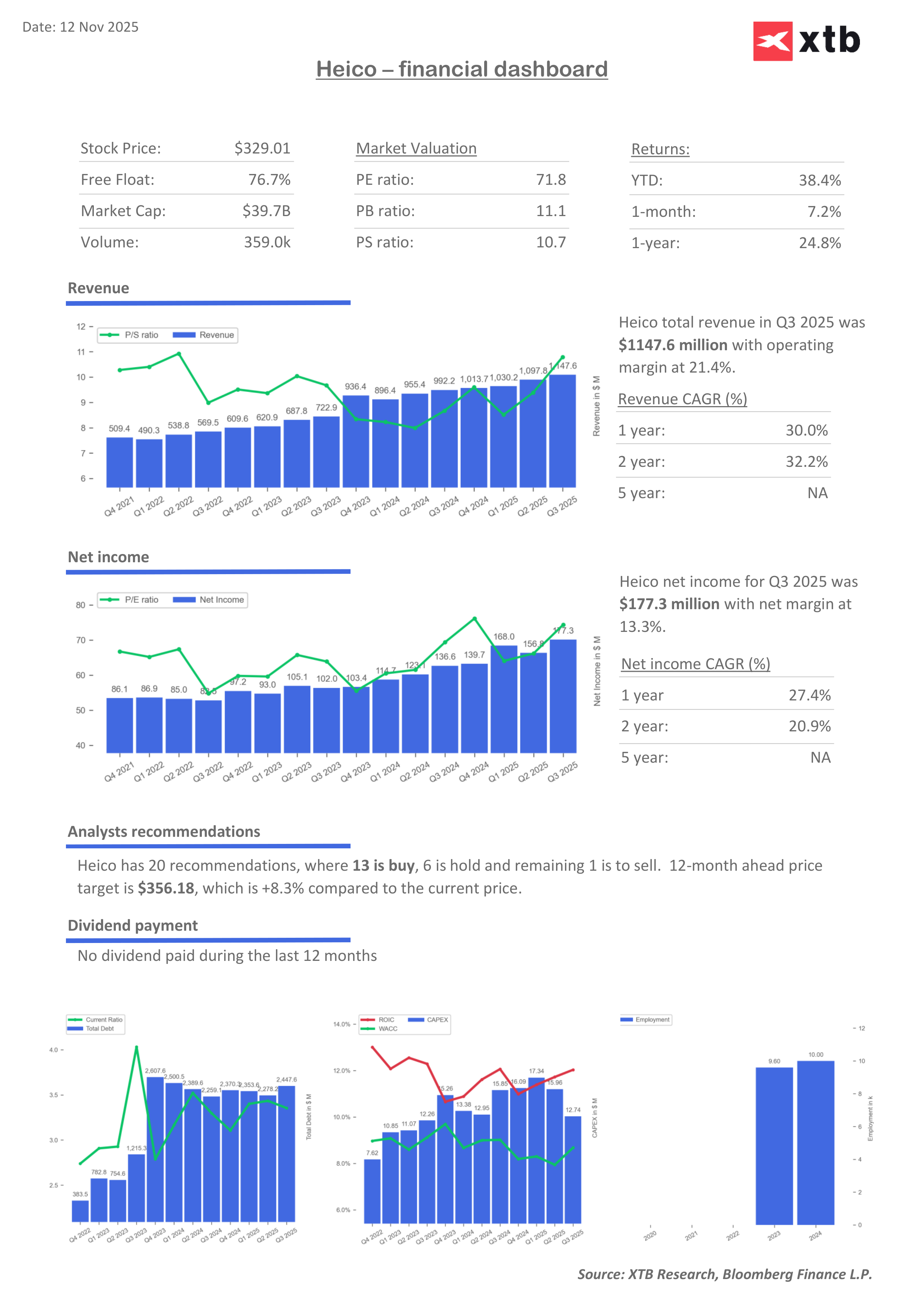

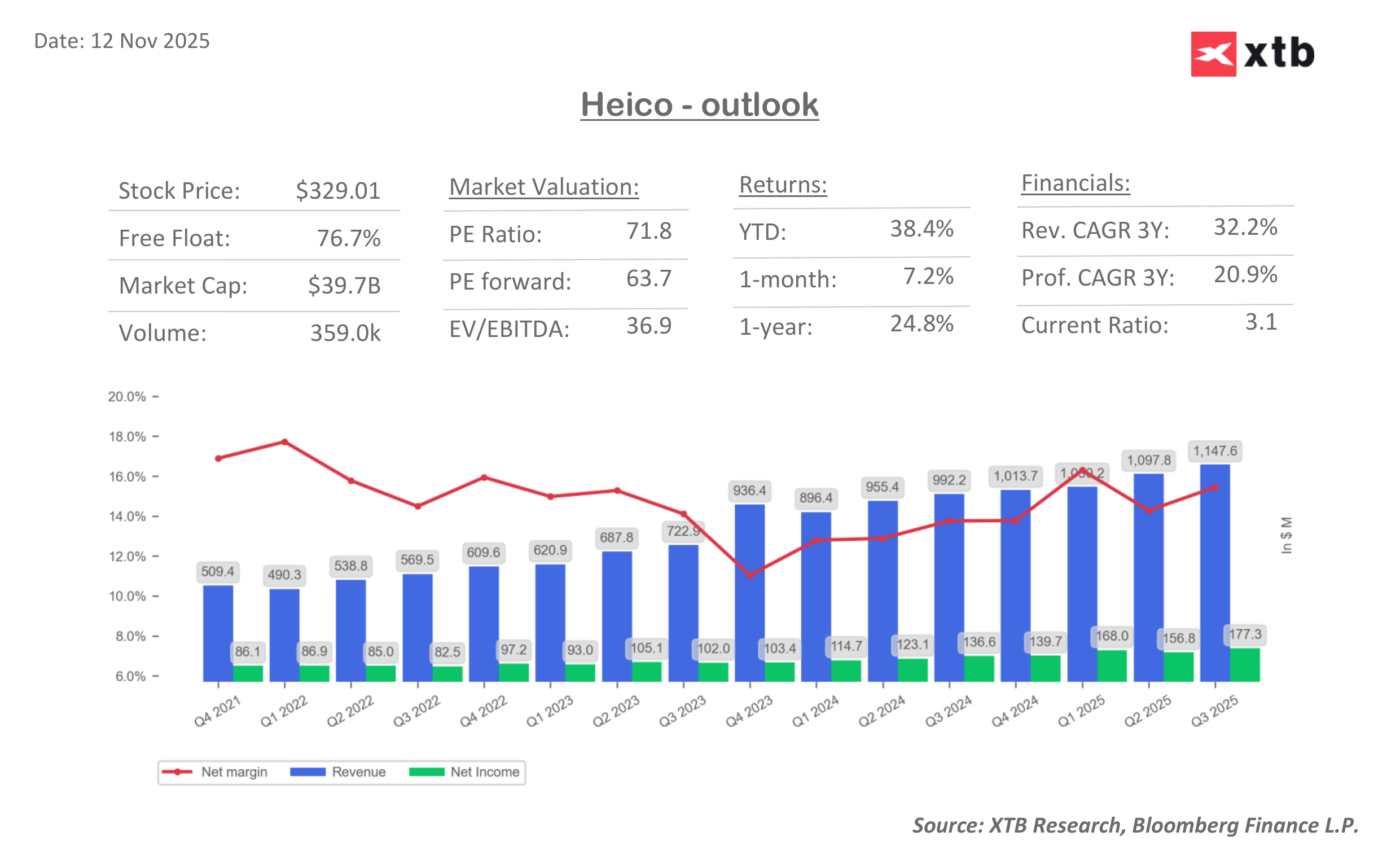

HEICO’s Financial Strength

- Market value: $38.95 billion

- YTD return: +35%

- Revenue growth: +13.46% YoY

- Current assets exceed short-term obligations; debt remains moderate.

- HEICO has paid dividends for 50 consecutive years.

Recent Earnings & Analyst Reactions

- Q3 2025 earnings: EPS of $1.26, beating forecasts of $1.12.

- Revenue: $1.15 billion vs. $1.11 billion expected (+16% YoY growth).

- Following the results, analysts adjusted their price targets:

- BofA Securities: Raised to $400, citing market share gains and efficient operations.

- Truist Securities: Up to $366, highlighting organic growth in the Flight Support Group.

- Stifel: Increased to $360, noting strong earnings performance.

- RBC Capital: Lowered to $350, citing margin pressure but maintained Outperform.

Heico (D1 interval)

Heico shares hit all-time high zone near $230 per share, however the company valuation is coming more and more expensive since 2021. The investors will focus on profitability rise next quarters.

Source: xStation5

Source: XTB Research

Source: XTB Research

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.