L’Oreal, and Adidas Earnings in Focus

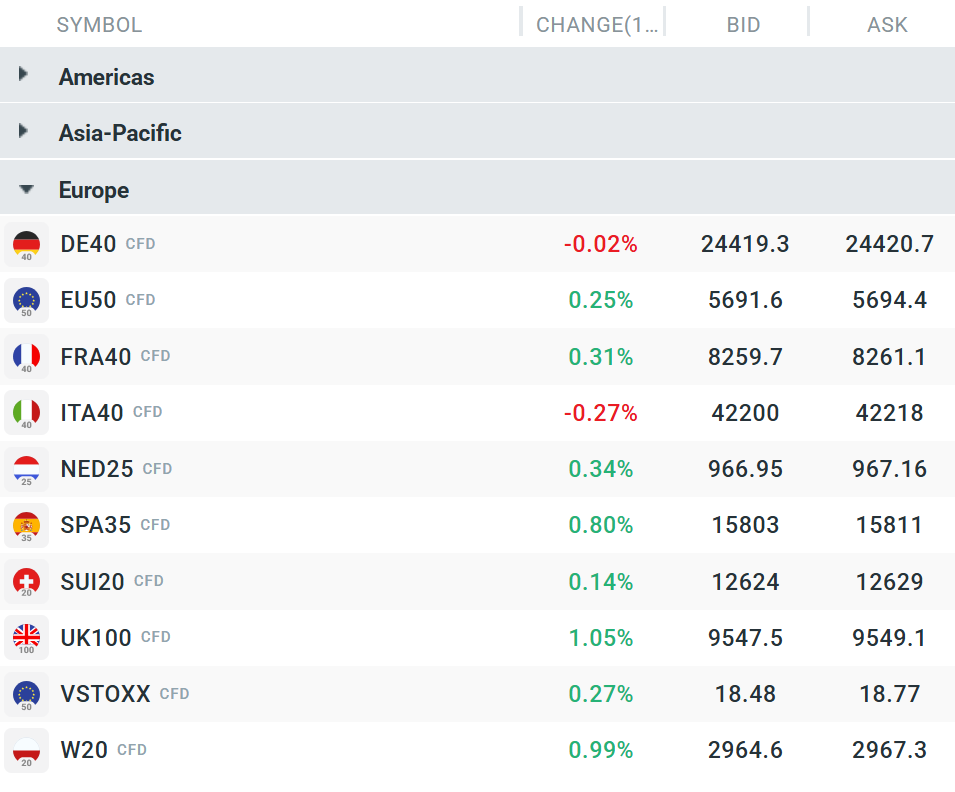

European stock indices remain close to record highs, with the EU 50 up 0.25%. At the same time, Germany’s DE40 is down 0.02%. Despite the initial weakness of the indices, sentiment began to improve over time, although this was not preceded by any fundamental information. Investors are focusing today on companies’ quarterly results. In Europe, these included Hermes, L’Oreal, and Adidas.

Source: xStation

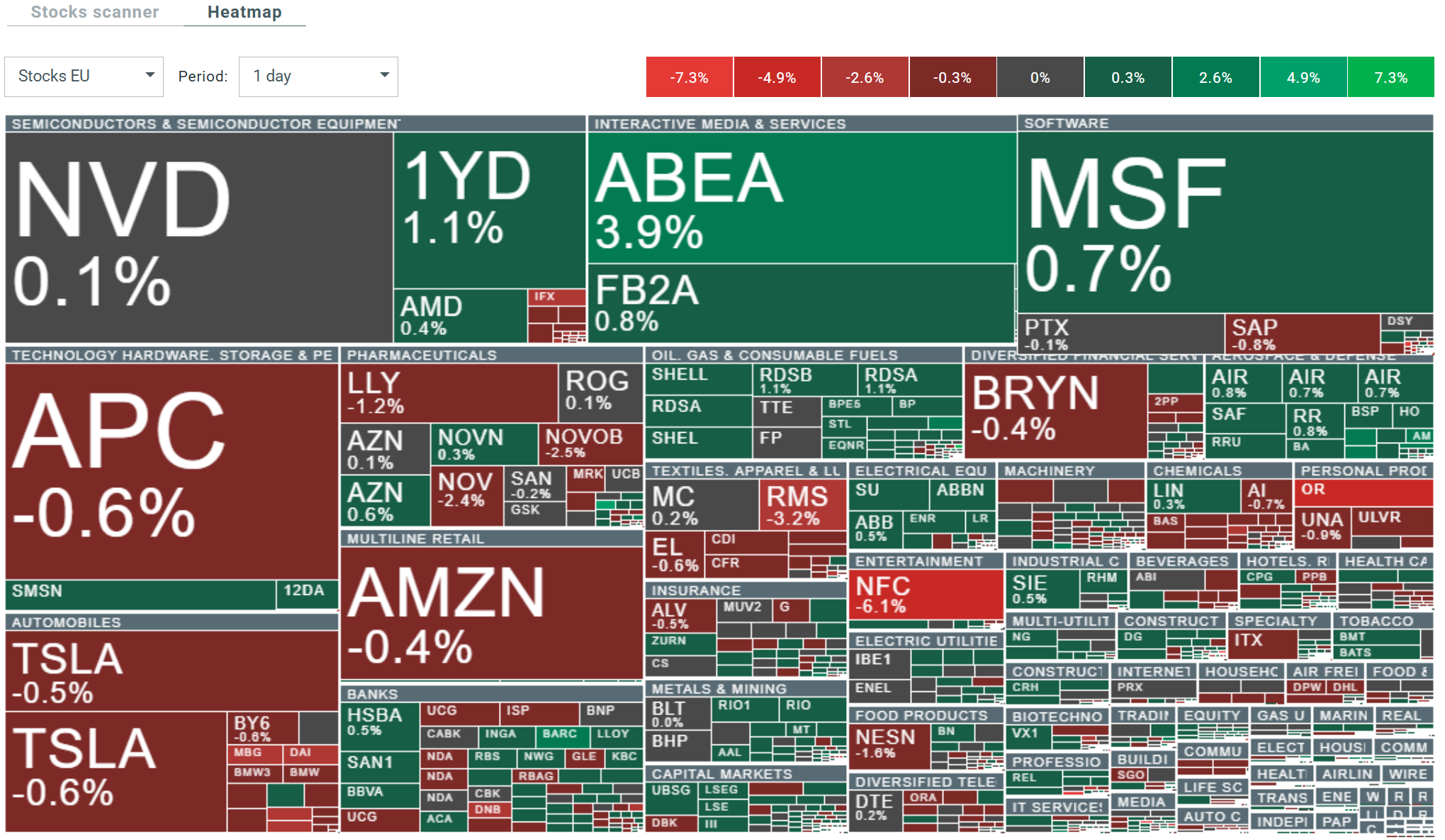

Currently observed volatility on the broader European market. Source: xStation

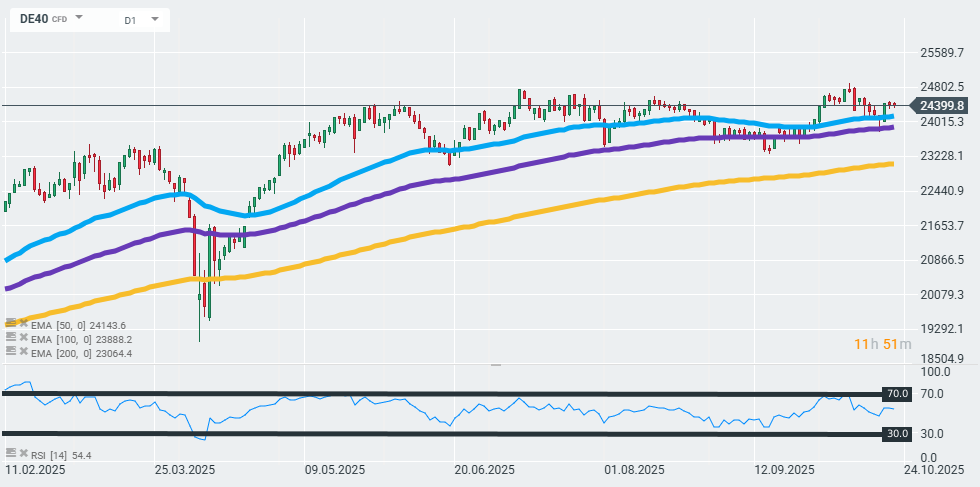

The DAX is falling slightly during Wednesday’s session and is potentially opening the way once again to test the key support level set by the 50-day exponential moving average (blue curve on the chart), which shows that despite “warmer” messages on the US-China front, investors are still concerned about geopolitical uncertainty or are resuming closing long positions after a series of long and dynamic rallies. At the moment, however, the index is still maintaining a technical uptrend, looking at the price pattern above the 50- and 100-day EMA. Source: xStation

News

Adidas (ADS.DE) posted a record third quarter for 2025, while raising its full-year operating profit forecast. Adjusted for currency effects, the brand’s sales grew by 12% y/y, with consolidated revenues reaching €6.63 billion (up from €6.44 billion a year ago, but below the analyst consensus of €6.71 billion). The company’s operating profit rose to €736 million (previously €598 million), clearly exceeding market expectations (€694 million), with a higher operating margin of 11.1% compared to 9.3% a year earlier. The gross margin improved to 51.8%, despite unfavorable exchange rate movements and higher tariffs in the US. For the full year, Adidas currently forecasts currency-neutral revenue growth of around 9%, compared to the consensus of 10%. Operating profit is expected to reach around €2.0 billion (up from the previous range of €1.7-1.8 billion), reflecting the brand’s continued momentum, better-than-expected results, and measures to mitigate the impact of higher import costs to the US. The company sees no signs of weakening demand for its products in key categories and regions and is preparing for 2026, which will be an intense year in terms of sporting events (the Winter Olympics and a record-breaking World Cup).

L’Oréal (OR.FR) z reported disappointing sales growth in the third quarter of 2025, triggering the biggest drop in its share price this year – as much as 8%. Organic growth of 4.2% fell short of high market and consensus expectations (4.9%), with three of the four main product segments, except for Professional, failing to meet analysts’ forecasts. The weakness of the US market and milder results in Latin America outweighed growing demand in China, which the company’s CFO explains, among other things, by the less than optimal dynamics of the makeup category in the US and the continuing weakness of sales in the travel retail channel.

Despite weakness in the US, Europe and North Asia performed better than expected, while Africa, the Middle East, and South Asia showed strong double-digit growth. CEO Nicolas Hieronimus emphasized caution about the future outlook in China and announced that the company would maintain its leading position in the cosmetics market and continue to grow profits in the coming quarters. L’Oréal is energizing its portfolio by strengthening its luxury segment with the acquisition of the Creed brand and securing long-term licenses to develop beauty products for Gucci, Bottega Veneta, and Balenciaga, while preparing for further investments, including potential capital actions in Giorgio Armani.

L’Oréal’s key quarterly metrics and consensus estimates:

- Organic sales growth: +4.2% y/y, consensus: +4.85%

- Professional products: +9.3% (forecast: +4.86%)

- Consumer products: +3.8% (forecast: +4.84%)

- L’Oreal Luxe segment: +2.5% (forecast: +4.11%)

- Dermatological products: +5.1% (forecast: +6.56%)

- Sales in North America: +1.4% (forecast: +4.41%)

- Sales in Europe: +4.1% (forecast: +3.02%)

- Sales in North Asia: +4.7% (forecast: +3.22%)

- Sales in Africa, the Middle East, and South Asia: +12.2% (forecast: +10.6%)

- Sales in Latin America: +4.4% (forecast: +8.95%)

- Total sales: EUR 10.33 billion (+0.5% y/y), consensus: EUR 10.44 billion

What does the sell-side say?

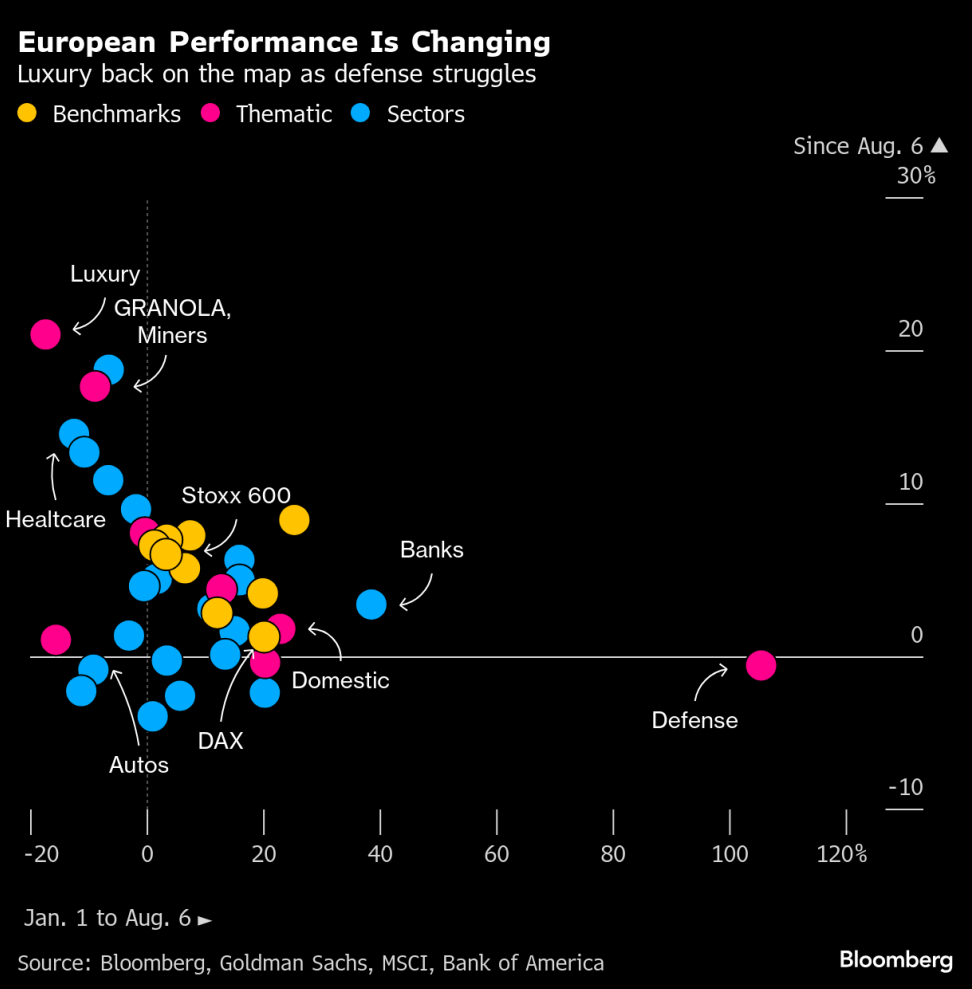

Investors in the European market are returning to highly rated, quality companies after more than a year of dominance by domestic and defensive stocks. Since the summer low, we have seen a noticeable change in leaders — large international blue chips are back in favor, especially the GRANOLAS basket (GSK, Roche, ASML, Nestle, Novartis, Novo Nordisk, L’Oreal, LVMH, AstraZeneca, SAP, Sanofi), which combine competitive advantage, a defensive profile, and solid EPS growth prospects. This change is linked to a slowdown in the momentum of winning sectors such as financials and industrials, and is supported by the stabilization of the dollar and hopes for new trade agreements.

Source: Bloomberg Financial Lp

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.