McDonald’s shares rise 3% after Reporting It’s Q3 Results

McDonald’s shares rise 3% after the company reported mixed results for its third quarter of 2025. Investors are viewing the comparable sales performance positively in an environment where the sector is struggling to grow.

Key figures from McDonald’s Q3 2025 results

- Total revenue: $7,078 million, +3% year-over-year and -0.36% compared to consensus

- EBIT: $3,357 million, +5% year-on-year

- Adjusted earnings per share: $3.22, 0% year-over-year and -3% compared to consensus

McDonald’s holds its own in a challenging market environment

McDonald’s shares rose at the start of trading after the company released its third-quarter results. McDonald’s reported revenue growth across all segments. Global comparable sales increased 3.6% year-over-year in the third quarter of 2025, primarily driven by a 4.7% increase in revenue from its international franchised business. It’s important to note that this metric excludes new store openings, making it a more accurate reflection of revenue growth per store. This demonstrates healthy growth for a mature company in a challenging competitive environment where many industry players are opting for price reductions. Furthermore, both company-owned and franchised international businesses saw growth of 2.4% and 4.3%, respectively. Meanwhile, total sales, including both company-owned and franchised locations, increased 6% at constant exchange rates.

What is McDonald’s doing?

As Chipotle noted in its earnings presentation, McDonald’s also points out a decline in traffic from lower-income consumers in the United States, falling by double digits according to the company. Meanwhile, traffic from higher-income consumers increased by double digits during the quarter, helping to offset the drop from lower-income consumers. In response, the company is launching special products at lower prices to try to maintain market share. Furthermore, it is also focusing on expanding its beverage segment, launching cold brew coffees and refreshing fruit drinks, directly targeting Starbucks, which is currently experiencing difficulties. It is a way to diversify revenue but also to compensate the weakness of the sector.

Profit growth has been slower than sales due to increased interest expenses and higher taxes, but operationally we can say that McDonald’s has had a solid quarter.

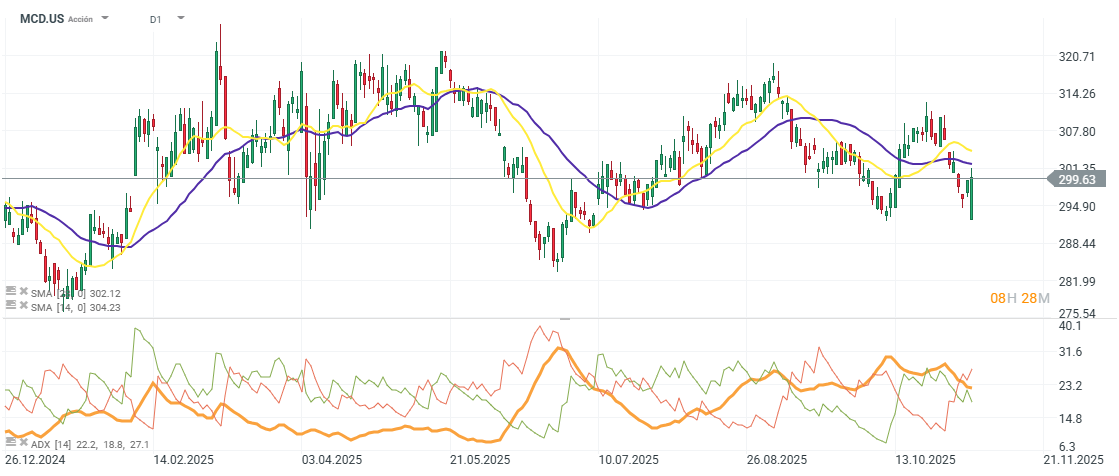

McDonald’s shares barely rise 3% in the year, but continue to trade at a multiple above 25 P/E.

Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.