Metals – Silver Breaking $100 Per Ounce, a Turning Point in Commodity Markets

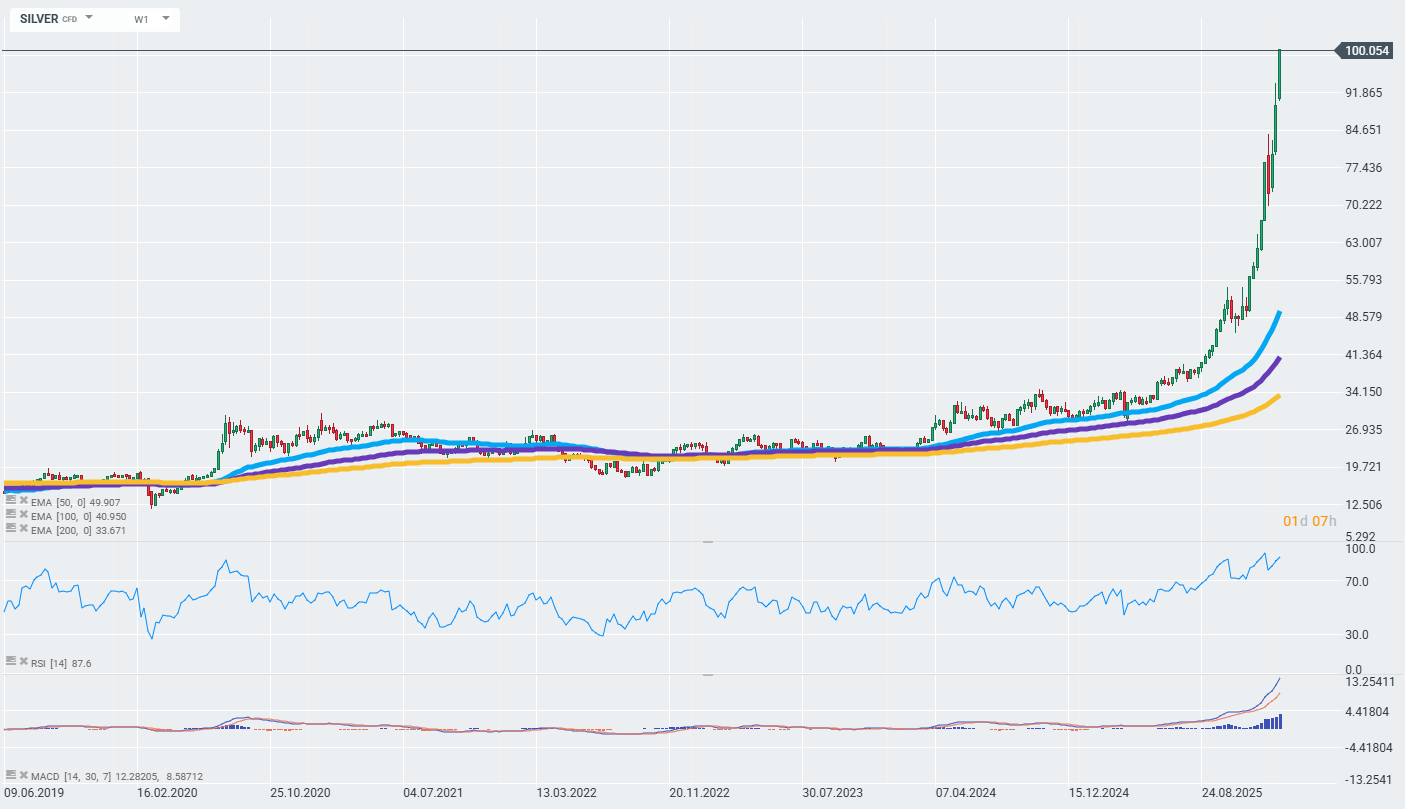

Silver has just crossed the psychological barrier of $100 per ounce, reaching an all-time high. This spectacular increase in the price of the metal—almost 226% year-on-year—is a market phenomenon that deserves closer analysis, as the reasons for this movement go much deeper than mere investor speculation.

The fundamentals behind the galloping prices of silver are solid and multi-layered. First and foremost, the market is struggling with a chronic supply deficit – in 2024, demand for silver amounted to 1.17 billion ounces, while mining production lagged behind by 500 million ounces. This structural shortage persists, and experts predict that it will continue into 2026. At the same time, industrial demand remains extremely strong – silver is the metal with the highest electrical conductivity and is used in three key sectors of the future: solar cells, AI data centers, and electric vehicles. What is more, in 2025, the United States placed silver on its list of critical minerals, giving it the status of a strategic resource.

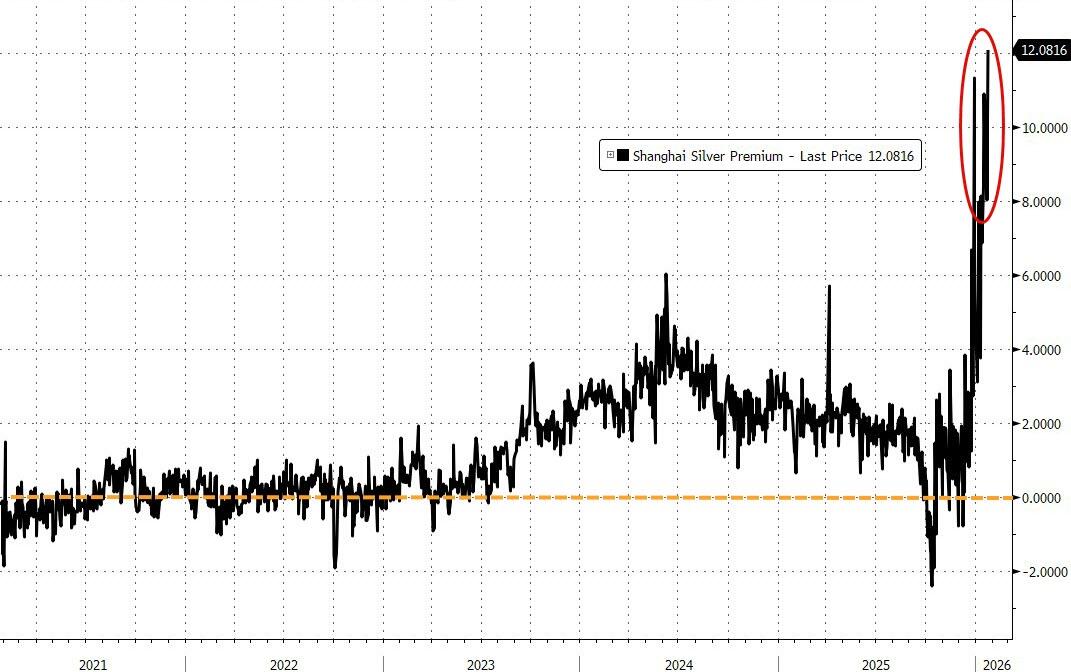

The silver shortage is most evident in the Chinese market. Above is a chart showing the price premium of silver available on the Shanghai Stock Exchange vs. that available on Western markets. Source: Bloomberg Financial Lp via ZeroHedge

However, macroeconomic and geopolitical factors are the main drivers of price increases. The weakening of the US dollar, declining expectations for Federal Reserve interest rates, and growing geopolitical tensions—in particular, Donald Trump’s tariff escalation against European countries and the threat of tariffs on countries that do not sell Greenland—are fueling investor appetite for safe assets. In addition, uncertainty about the Fed’s independence and accelerating efforts to demonetize the dollar are strengthening silver’s position as a store of value, similar to gold.

Is this increase justified? The answer seems to be yes, but with reservations. The supply deficit is real and structural, as evidenced by significant premiums on physical markets and spikes in silver leasing rates, which indicate the genuine scarcity of the metal. However, technically, silver has moved 47% away from its 200-day moving average. Overall, this shows that the growth rate of this metal’s price is above average from a statistical perspective, which creates the risk of deep and sudden corrections.

What next? Many analysts believe that even if prices eventually fall from their current historic highs, they will not return to the averages of 2022–2025, when silver fluctuated between $21 and $28 per ounce. The new equilibrium level will be significantly higher, which would create a permanent rebalancing in the silver market caused by both structural changes (accelerating energy transition) and a long-term reorientation of investor portfolios towards real assets in the face of weakening confidence in currencies such as the dollar and the euro.

A historic moment on the SILVER market. For the first time ever, the instrument has broken through the $100 per ounce mark❗Source: xStation

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.