Mid-Morning Market Update

- Markets resume standard trading after the Easter break.

- US stock index futures are trading higher. The initial upward movement came before Tesla’s announcement that it is offering five-year zero-interest financing for its refreshed Model Y in China. Interestingly, the company’s results themselves will be released today after the close of the Wall Street session.

- However, we are seeing a slightly different mood in Europe, as the declines observed yesterday on Wall Street are taking hold here. Markets on the Old Continent are therefore trying to “catch up” on yesterday’s performance. Recall that the Nasdaq lost 2.55% yesterday.

- Shares of Chinese companies associated with cross-border trade and payments rose after the government began to seek to combat US tariffs, planning to promote the operation of free trade zones.

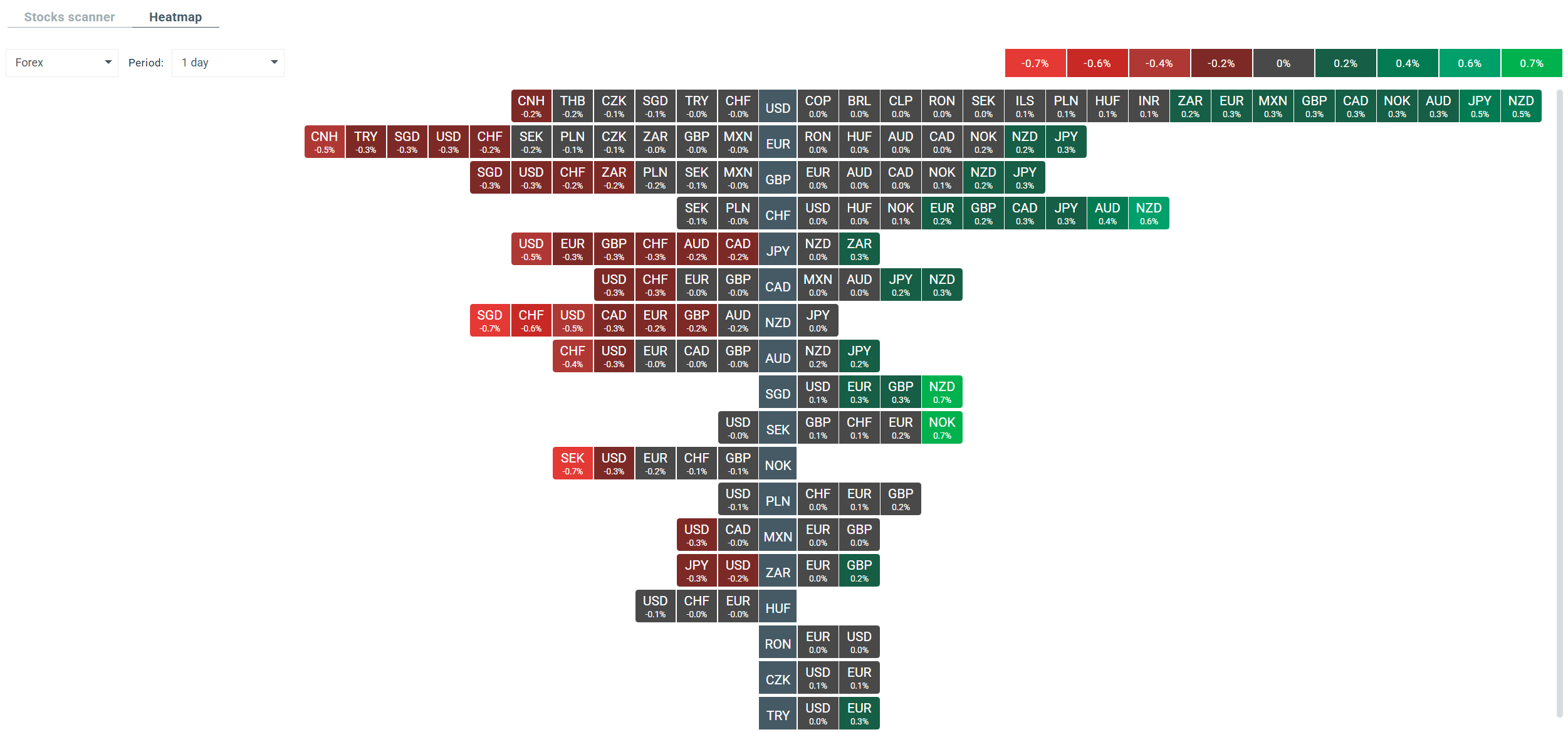

- On the broad FX market, the Japanese yen is currently the best performer, while the US dollar is proving to be the biggest loser. Antipodean currencies are doing relatively well, while the euro is also not doing so well.

- Gold continues its upward trend and is trading near $3,480 per ounce. Broad-market uncertainty supports this precious metal, which is gaining over 1.6% today alone.

- Bitcoin resumes its upward momentum and tests its 100-day exponential moving average. The cryptocurrency has increased by over 4% since yesterday.

- The most important events of the day will be Tesla’s and SAP’s quarterly results. Macro data from the Polish labor market, numerous speeches by FED and ECB bankers (including Lagarde) and the industrial price index from Canada.

Current volatility on the currency market. Source: xStation

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.