Monday Blues in European Indices

The first half of the European session is behind us, dominated by slight declines in the main indices. The broad Euro Stoxx 50 index of companies from the Old Continent is currently down 0.11%. At the same time, the German DAX is up 0.1% and the French CAC40 is down 0.25%.

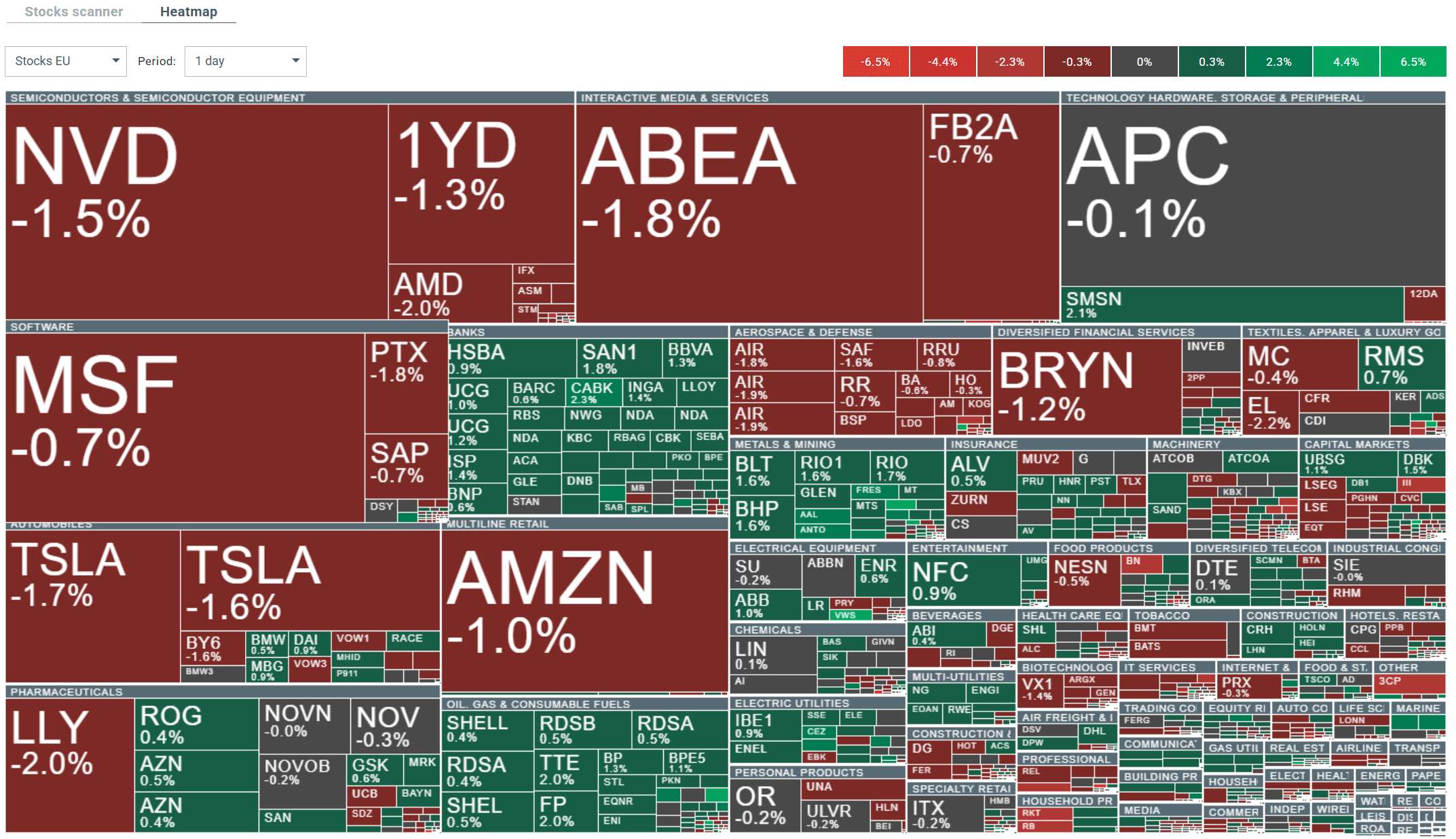

Banks and mining companies are currently the green islands in terms of share prices in individual sectors. The volatility heat map on the stock exchange below…

Ryanair posted strong results for Q3 of the 2025 financial year, with revenues of EUR 3.21 billion above the consensus of EUR 3.18 billion and passenger numbers of 47.5 million, higher than the expected 47.08 million. The load factor was slightly weaker than forecast (92% vs. 92.6%), but the company announced an interim dividend payment of EUR 0.193 per share, underscoring its confidence in its performance and cash generation. Management raised its full-year customer forecast to 208 million (previously 207 million) and expects profit after tax before one-off items to be in the range of EUR 2.13-2.23 billion, indicating continued strong profitability. The CFO highlighted very solid consumer demand and record booking weeks recently, and the company is considering further extending its USD hedging until the 2028 financial year to better protect itself against exchange rate fluctuations.

HSBC and NatWest plan to raise their target profitability (profit) ratios in their upcoming annual reports, following in the footsteps of their European competitors, who have already announced such increases. The move reflects improved profitability prospects for the banking industry, driven by higher interest rates and a tougher approach to operational efficiency.

January data from the Ifo Institute for Germany fell slightly short of expectations, but essentially confirm the picture of an economy stuck in stagnation rather than in a clear recovery. The business climate index remained at 87.6 points, below the forecast of 88.2 points, with a slightly weaker assessment of the current situation (85.7 vs 86.0) and lower expectations for the coming months (89.5 vs 90.3). The reading suggests that businesses are still struggling with weak demand and uncertainty, which limits their willingness to invest and hire, while at the same time giving the ECB no strong argument to rush into interest rate hikes.

Futures contracts on US indices continue to trade under moderate downward pressure. The US100 is currently down 0.2%, while the US500 is down 0.1%.

Trump is threatening to impose 100% tariffs on Canadian goods if Ottawa concludes any trade agreement with China, although Prime Minister Carney has rejected this possibility for now. At the same time, Beijing assures that its preliminary agreement with Canada is not directed against any third party, suggesting a pragmatic approach to possible escalations. On the geopolitical front, the deployment of a US aircraft carrier in the Middle East is once again raising fears of a potential conflict with Iran, adding uncertainty to an already tense global situation.

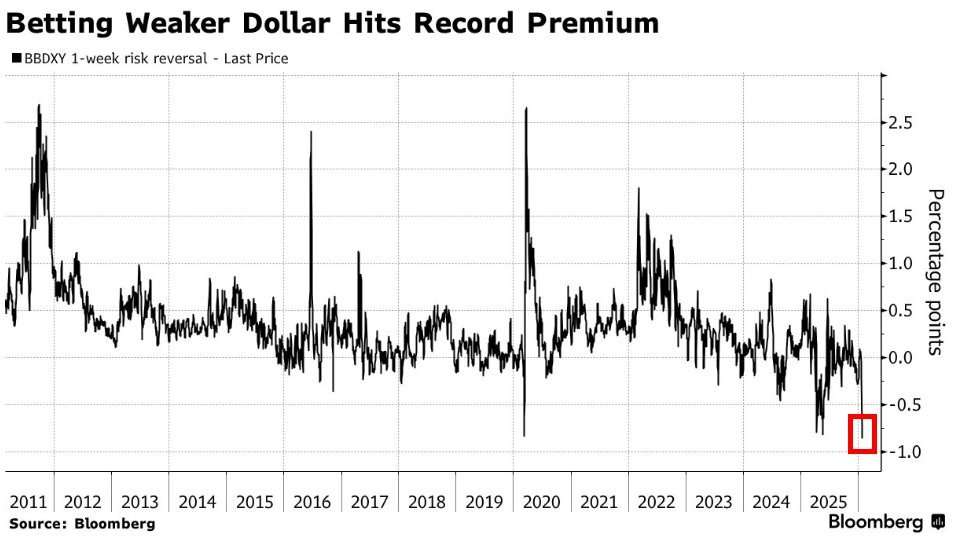

The Japanese yen continues to dominate the Forex market. The dollar is losing value, with only the Swiss franc performing worse. Interestingly, positioning on the BBDXY dollar index for the week ahead has reached record lows not seen since the Covid panic. See chart below:

Source: Bloomberg Financial Lp

OPEC+ delegates indicate that at its March meeting, the cartel will most likely maintain current oil supply restrictions, without additional cuts or increases in production. This “pause” scenario is intended to allow time to assess the effects of the reductions to date and the response of demand before decisions are made on possible further adjustments.

The precious metals market is dominated by buying pressure. The significant upward trends/dynamics of recent weeks are clearly continuing today. GOLD is trading close to USD 5,100 per ounce for the first time, adding nearly 2.2% intraday. At the same time, SILVER prices are up as much as 7.6%, exceeding £110.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.