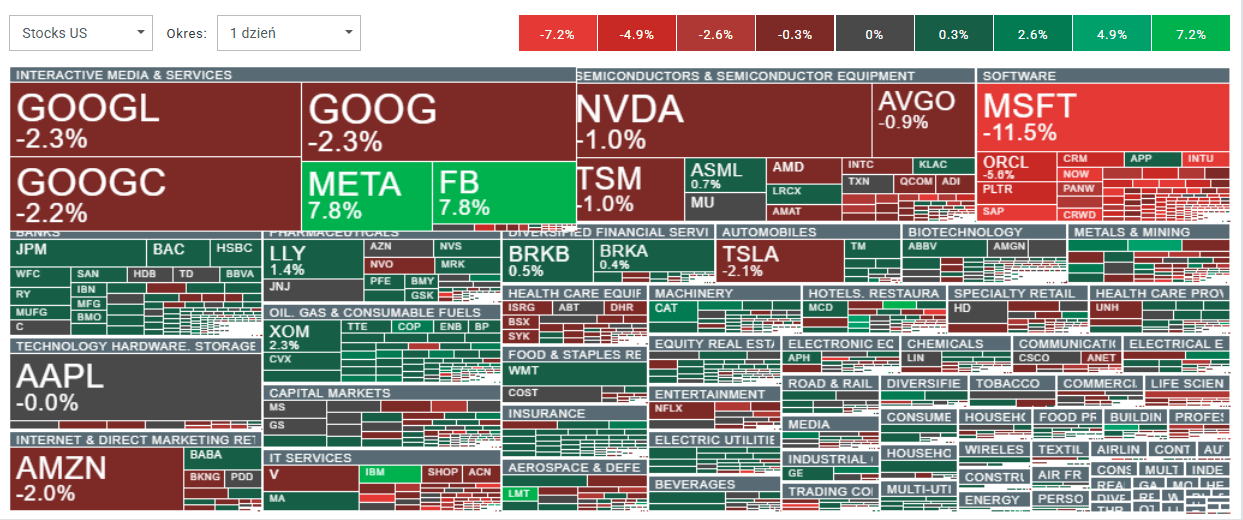

Nasdaq Sildes While Microsoft Shares Crash 11%

U.S. index futures opened the session in a sharply risk-off mood. A drop of more than 10% in Microsoft (MSFT.US) following its earnings is weighing heavily on sentiment and dragging major benchmarks lower — especially the US100, which is down close to 2%.

- Declines in the U.S. equity market are also weighing on cryptocurrencies. Bitcoin has fallen to around $86,000, while Strategy shares are down more than 6%.

- Analysts at Switzerland’s UBS raised their price target for Meta Platforms to $872 per share, up from $830 previously. Meanwhile, JPMorgan lowered its price target for Tesla to $145 per share, from $150 previously.

- Large losses are also visible across the software sector, where Microsoft’s sell-off is putting pressure on names such as Oracle, Palantir, Intuit, Salesforce, and ServiceNow. Big Tech is broadly weaker as well, with the exception of Meta Platforms: Amazon, Alphabet, and Tesla are down nearly 2%, while Nvidia is off about 1%. Apple (AAPL.US) is scheduled to report after today’s U.S. close; its shares are trading flat ahead of the release.

- On the macro side, U.S. factory orders rose 2.7% m/m, beating expectations of 1.3% and rebounding from -1.3% previously. December 2025 wholesale sales also increased by 1.3%, versus expectations for just a 0.1% rebound after -0.4% previously.

US100 (H1 interval)

Source: xStation5

The only notable gainers today are essentially Meta Platforms (META.US), IBM (IBM.US), and Lockheed Martin (LMT.US).

Source: xStation5

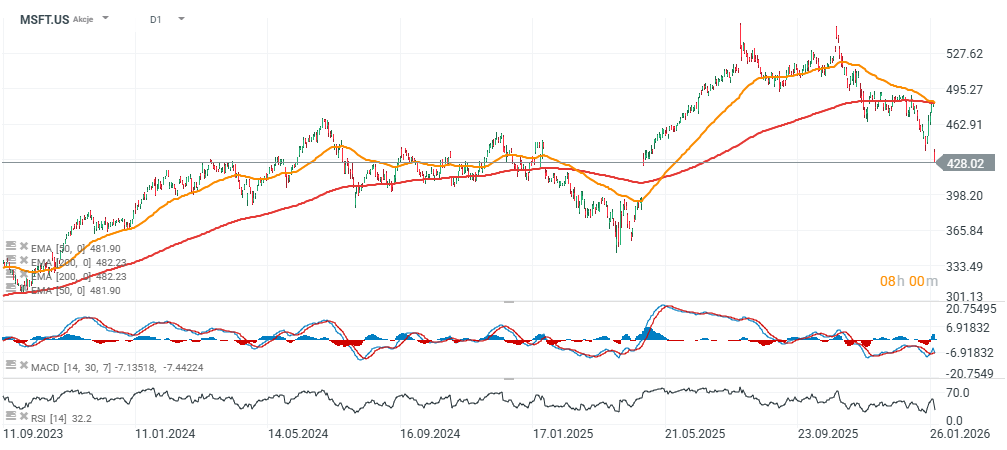

MSFT.US (D1)

Microsoft shares – the third-largest U.S.-listed company by market capitalization are down more than 10%. The current discount versus the EMA200 (red line) is now close to 15%.

Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.