Trump’s Venezuela blockade and Russian sanction threats jolt markets

The Venezuelan gambit: Naval blockade or political posturing?

Oil prices found a floor on Tuesday after U.S. President-elect Donald Trump announced a “total blockade of all sanctioned tankers” transporting Venezuelan crude. The move, disclosed via Truth Social on December 16, aims to sever the financial lifeline of the Nicolás Maduro administration. The White House alleges these oil revenues fund terrorism and human trafficking.

The directive follows the high-profile seizure of a tanker off the Venezuelan coast last week and suggests the deployment of what could be the largest naval armada ever seen in South American waters. While the U.S. has been repositioning military assets to the region for months, questions remain regarding the feasibility of a sustained physical blockade.

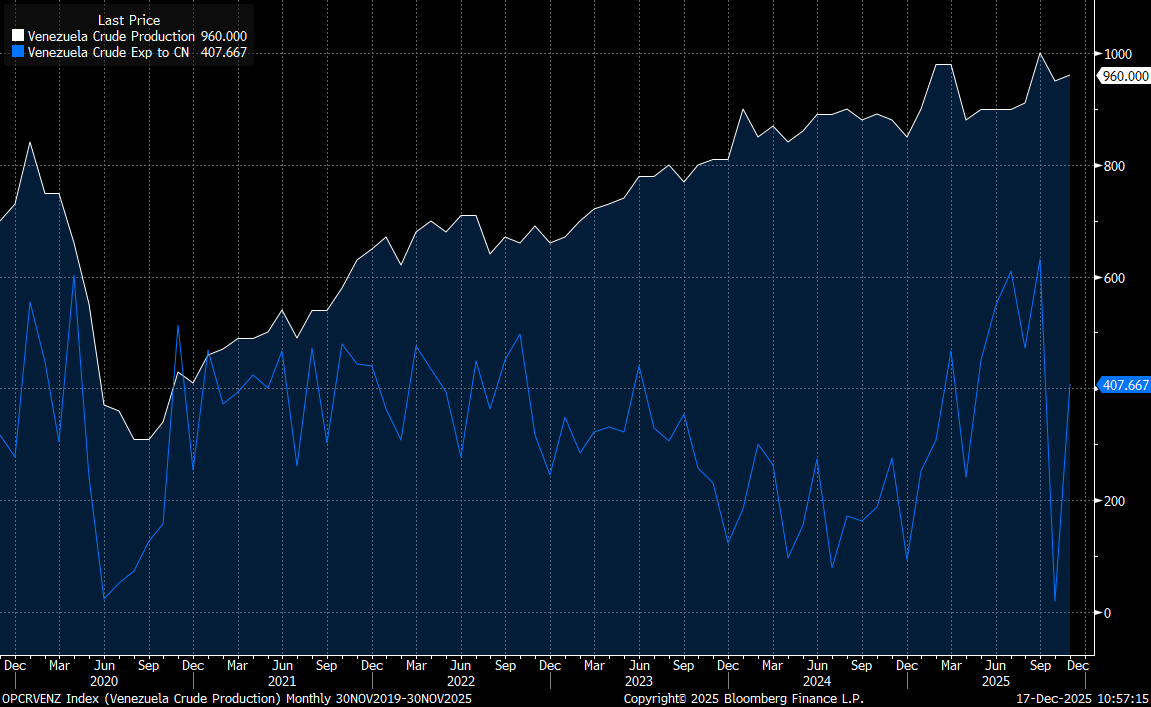

Venezuela’s oil industry is a shadow of its former self. Production, which stood at 3m barrels per day (bpd) in 2000, plummeted to 300,000 bpd in 2020 due to systemic underinvestment and sanctions. While output has recently recovered to nearly 1m bpd, approximately half of these exports are destined for China, often via Chinese-owned tankers. Any physical interference by the U.S. Navy would directly challenge Beijing’s energy security. While a successful blockade would tighten a market currently grappling with a massive supply overhang, its impact on global fundamentals may be tempered by these geopolitical frictions.

Venezuela produces nearly 1 million barrels of crude oil per day and has dropped out of the top 10 oil producers. Nearly half of this amount is exported to China. Source: Bloomberg Finance LP, XTB

Trump’s ultimatum to Moscow

Simultaneously, Washington is preparing a draconian suite of sanctions targeting the Russian energy sector. The measures, which focus on the “shadow fleet” of tankers and third-party traders, are reportedly contingent on Vladimir Putin’s response to a proposed peace plan for Ukraine.

Diplomatic efforts intensified following two days of high-stakes negotiations in Berlin (December 14-15), involving President Volodymyr Zelenskyy and Trump envoys Steve Witkoff and Jared Kushner. While preliminary security guarantees for Ukraine—modelled on NATO standards—were discussed, the Kremlin remains recalcitrant, demanding a comprehensive settlement rather than a temporary truce.

The diplomatic calendar is now tightly packed. Following Trump’s assertion that a deal is “closer than ever,” the peace proposal is expected to be formally presented to Moscow by December 20. Should Putin reject the terms, the threat of escalated sanctions could provide a short-term floor for prices. However, with India and China still firmly entrenched as buyers of Russian Urals, market participants remain sceptical that Russian supply can be fully sidelined in 2026.

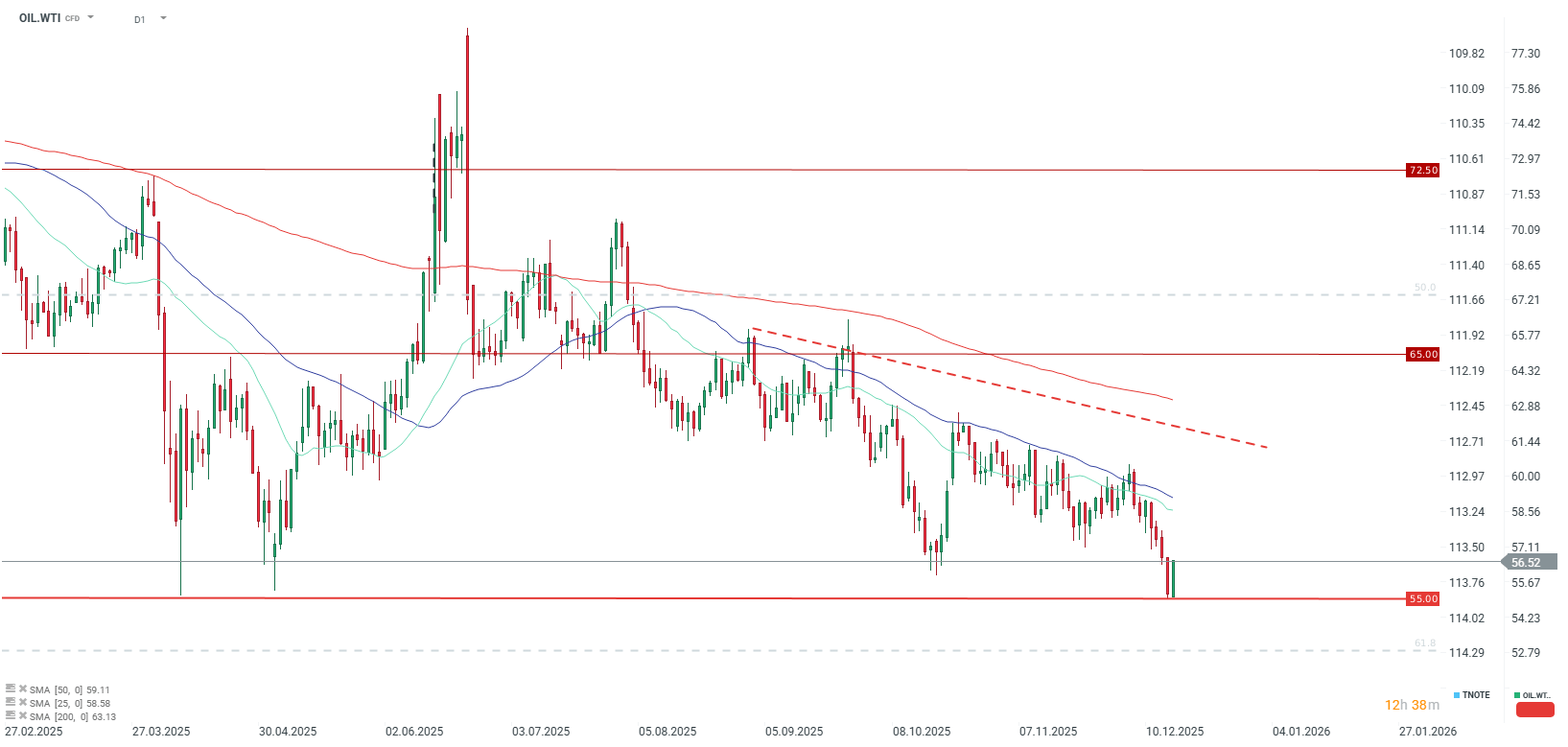

Technical Outlook: A test of the lows

WTI crude recently collapsed toward $55 per barrel, marking a near five-year nadir, before staging today’s recovery. Technical analysts note that a close above $56.50 could signal a “bullish engulfing” pattern, potentially opening the door for a corrective rally toward the 25 and 50-day Simple Moving Averages (SMA) near $58.

Conversely, should Russia signal compliance with the Western coalition’s demands, the “peace dividend” would likely see prices breach the $55 support level. This would bring the 61.8% Fibonacci retracement of the 2020–2022 rally—situated just below $53—into play. Notably, the Energy Information Administration (EIA) maintains a bearish outlook for the coming year, forecasting prices to average below $52 per barrel in 2026.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.